Today’s charts

Nifty : Bank Nifty : SBI : RIL : LT :

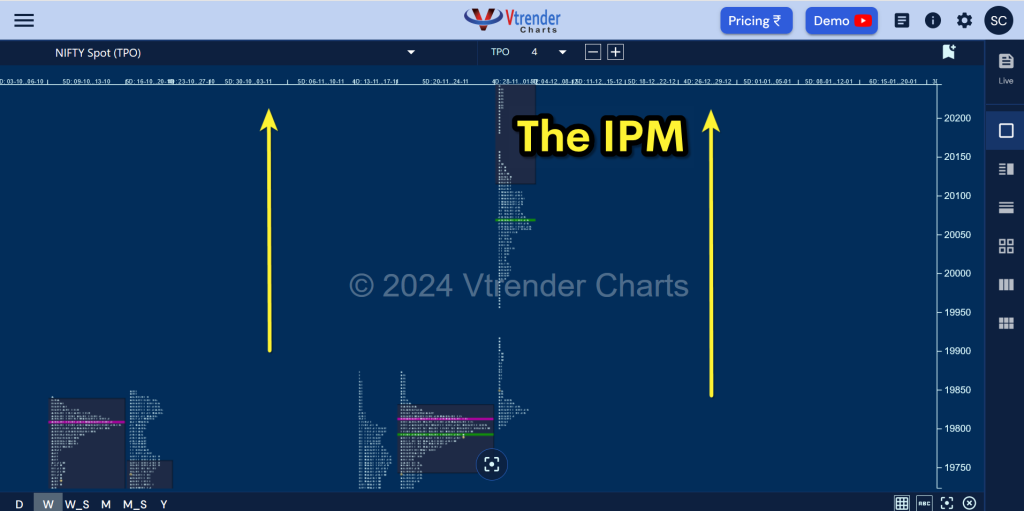

Steidlmayer Distribution

Navigating Market Movements through Steidlmayer Distribution In the complex world of trading, the markets serve a fundamental role: facilitating trade across various time frames. This continuous exchange is akin to a vast, ever-evolving auction where understanding the dominant time frame can be pivotal in navigating price movements effectively. Enter the concept of Steidlmayer Distribution, a […]

Profile charts for 20th april

The Italics are the comments from yesterday and the previous days. Broader market of Tuesday :some short covering at 5718 and late buying above poc at 5735 helped the NF remain unchanged. Bank Nifty : ——————– BN closed above the pull back low of 11755– selling prints at the top at 11990 levels.——-– strength seen […]

Trade Alerts : 18th apr

*** INTRA-DAY TRADES *** * Buy BankNifty 11855, sl 11825, tgt 11905/11950tgt 1 done+ 50 * Sell Nifty 5796, sl 5817, tgt 5764/5735booked at 5762+ 34 *** OPEN TRADES *** ***Total points for the Day : Mini Nifty :Nifty :34Bank Nifty :50Option : ***Cumulative points for the Apr Series ( so far) : Mini Nifty […]

Profile charts for 19th april

The Italics are the comments from yesterday and the previous days. Broader market of Monday :A responsive seller in the H period from 5910 levels took the markets swiftly towards the 5760 levels, where recovery efforts were snuffed out. A NV day. Bank Nifty : ————- – Bank Nifty showed a small buying tail near […]

Profile charts for 18th april

The Italics are the comments from yesterday and the previous days. Broader market of Friday :The market broke through the pull back low of 5866 thus negating the rally of the day before.The broader trend continues to be sideways above 5730. Bank Nifty : ————- – Bank Nifty showed a small buying tail near 11590.———-– […]

OrderFlow at 1.00 pm.

In Market profile, the auction theory is all about the buying and the selling of the market. Fortunately in our trading room, we keep a record of this through our OrderFlow indicators. The orderflow measures the buying and selling of the market and puts us ahead of some great trades through it’s uniqueness. It is […]

Profile charts for 15th april

The Italics are the comments from yesterday and the previous days. Broader market of Wednesday :The market found initiative buyers near the 5730-70 zone who triggered short covering later in the day above 5850 levels to take the markets to 5945 levels. Bank Nifty : ————-– Bank Nifty showed a small buying tail near 11590.– […]

Trade Alerts : 14th apr

*** INTRA-DAY TRADES *** * Buy Nifty 5770, sl 5750, tgt 5800/5851booked at 5834+ 64 * Buy BankNifty 11800, sl 11720, tgt 11900/ 11925booked at 11895+ 95 *** OPEN TRADES *** * Buy 5900 CE at 65, sl 49, tgt 90.Part booked at 89 + 24 ***Total points for the Day : Mini Nifty :Nifty […]

Profile at noon.

We have seen a strong buyer off the open this morning, more as a response to the lower prices near the 5730 levels we had marked out as borderline in Monday’s post. In profile a gap is considered a splendid risk-reward opportunity as it points to the presence of a longer time frame player in […]