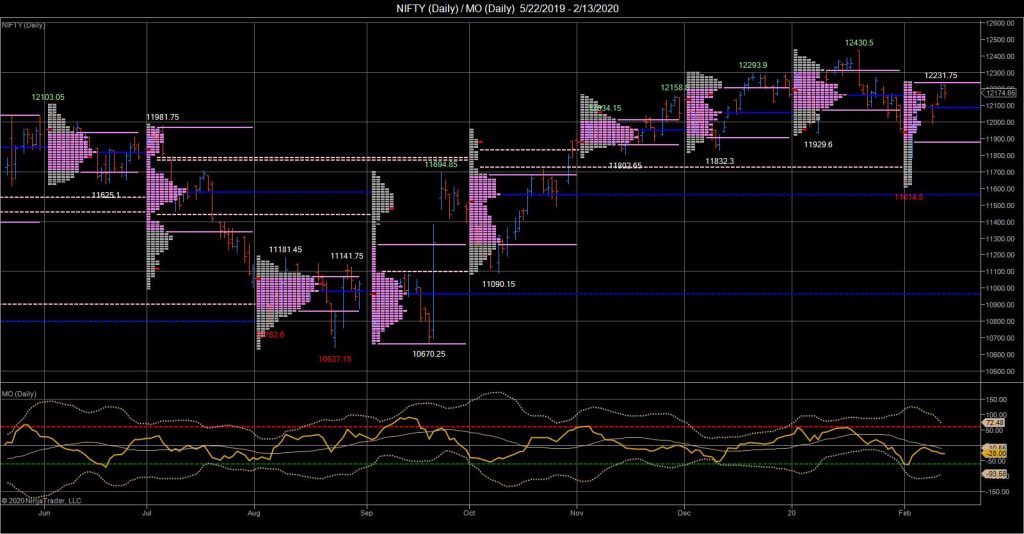

Desi MO (McClellans Oscillator For NSE) – 13th FEB 2020

MO at -28

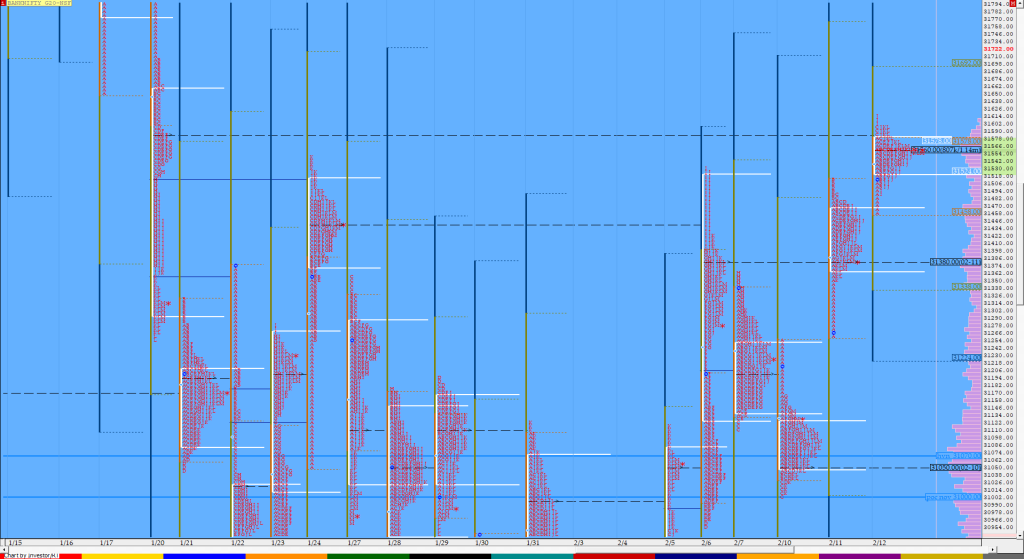

Order Flow charts dated 13th Feb 2020 (5 mins)

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. NF BNF

Order Flow charts dated 13th Feb 2020

The key to using Order Flow trading is to determine market depth. This describes the places where Market participants have taken positions or the zone they have transacted. The Order Flow is like a list of trades and helps to know how other traders are placed in the market. Vtrender helps you to stay on […]

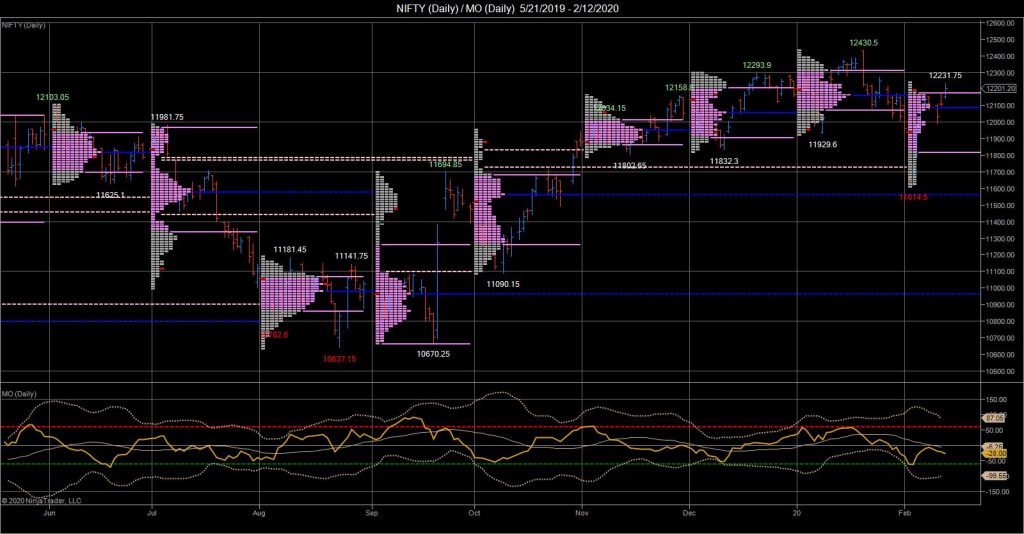

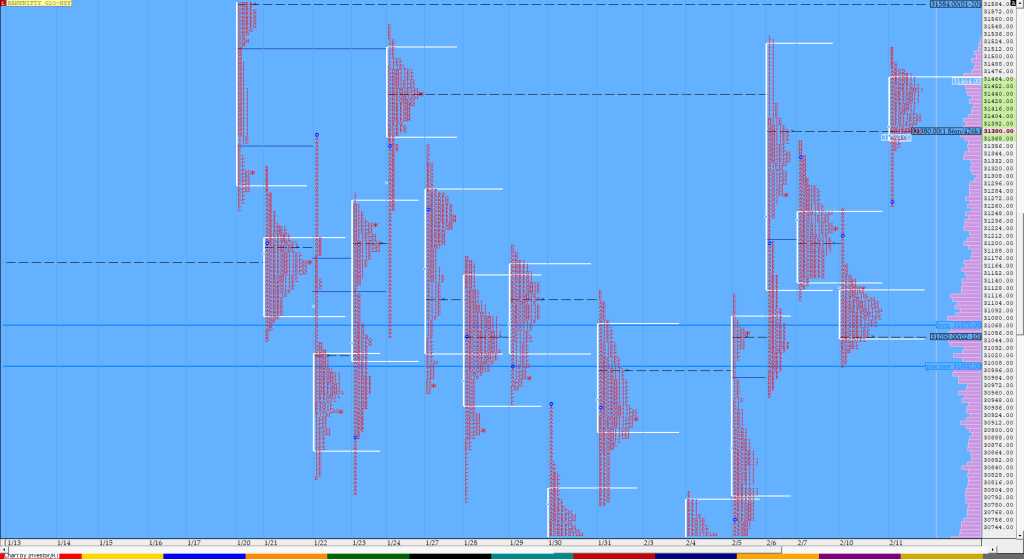

Market Profile Analysis dated 12th Feb 2020

Nifty Feb F: 12228 [ 12248 / 12158 ] HVNs – 11922 / 11965 / 12012 / 12095 / 12130 / 12165 / 12218 Previous day’s report ended with this ‘Value for the day was completely higher but the inability to tag the VPOC of 12189 suggests that the supply is back and NF would […]

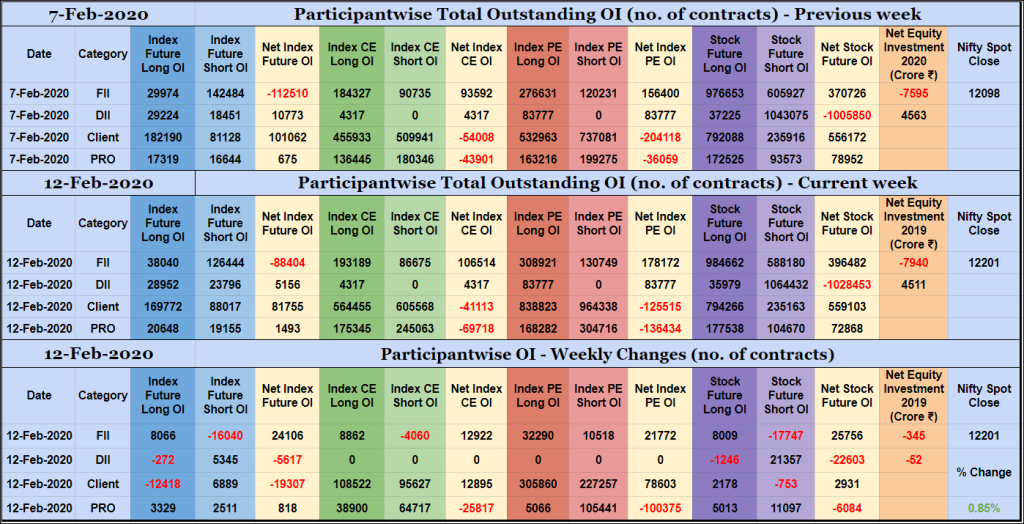

Participantwise Open Interest – 12th FEB 2020

Mid-week view FIIs have added 8K long Index Futures, 8K long Index CE, net 21K long Index PE and 8K long Stocks Futures contracts while covering 16K short Index Futures, 4K short Index CE and 17K short Stocks Futures contracts this week. They have been net sellers in equity segment for ₹345 crore during the […]

Desi MO (McClellans Oscillator For NSE) – 12th FEB 2020

MO at -28

Order Flow charts dated 12th Feb 2020

Order Flow trading is thinking about what order market participants do and when you think along this, you can anticipate what kind of action they will be taking in the market. This is a very important concept in Order Flow. Market participants always look for the weaker side of the market, so both buy and […]

Order Flow charts dated 12th Feb 2020 (5 mins)

Order Flow can show how a collection of market participates has acted in the past and this helps to create profit by knowing if these traders are profitable or caught upside down. NF BNF

Market Profile Analysis dated 11th Feb 2020

Nifty Feb F: 12127 [ 12185 / 12095 ] HVNs – 11922 / (11965-978) / 12012-20 / 12090-95 / 12125-130 / 12165 NF opened with a big gap up of 66 points as it negated the previous day’s selling tail of 12050 to 12096 and made a low right at 12095 and drove higher to […]

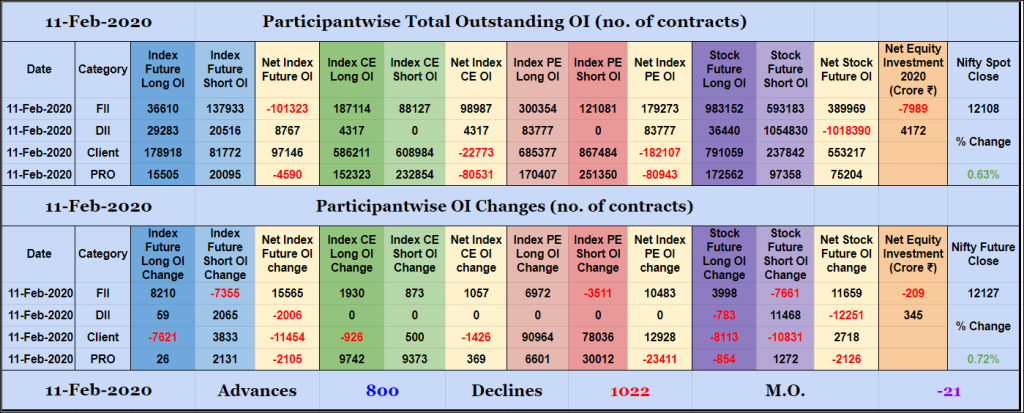

Participantwise Open Interest – 11th FEB 2020

FIIs added 8K long Index Futures, net 1K long Index CE, 6K long Index PE and 3K long Stocks Futures contracts while covering 7K short Index Futures and 7K short Stocks Futures contracts. They were net sellers in equity segment for ₹209 crore. Clients added 3K short Index Futures and net 12K long Index PE […]