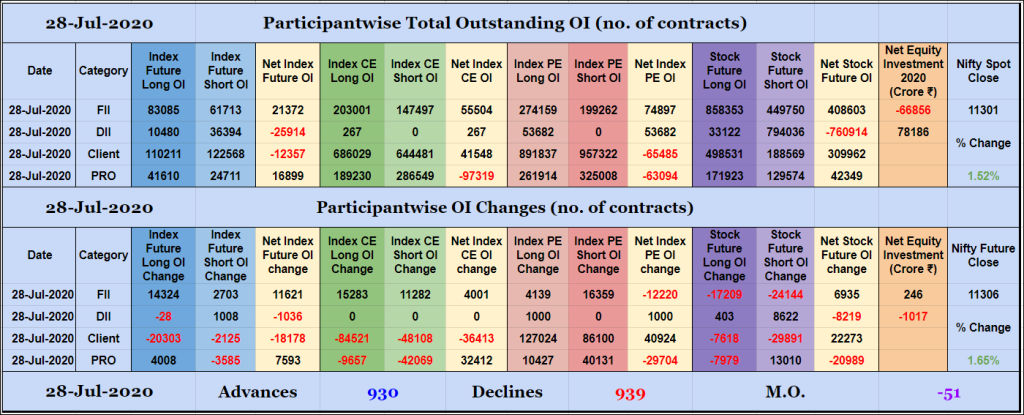

Participantwise Open Interest – 28th JUL 2020

FIIs have added net 11K long Index Futures, net 4K long Index CE and net 12K short Index PE contracts today while reducing exposure in Stocks Futures. They were net buyers in equity segment for ₹246 crore. Clients have added net 40K long Index PE contracts today while reducing exposure in Index Futures, Index CE […]

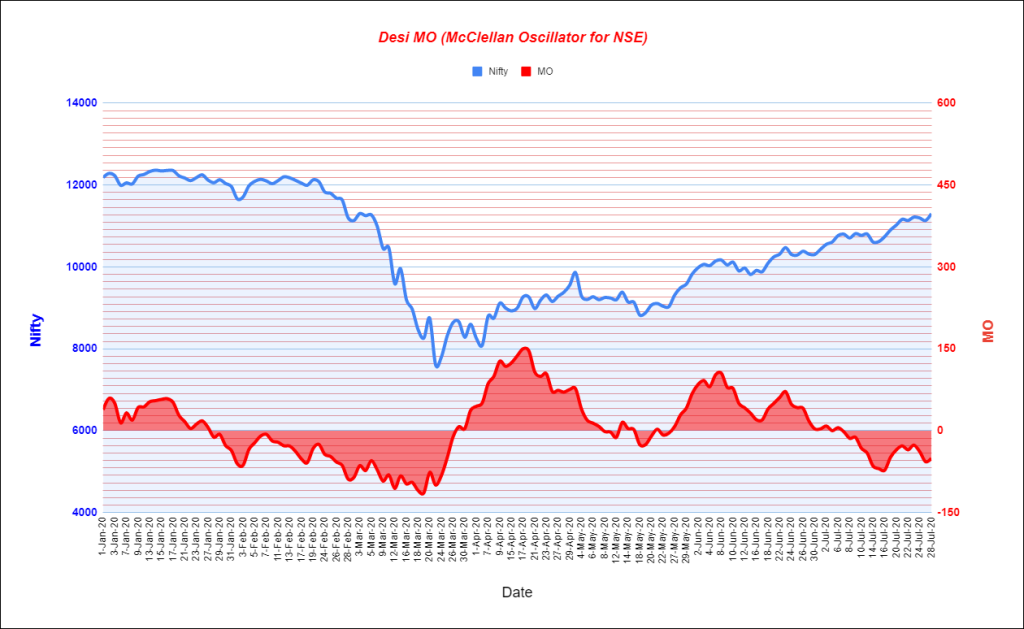

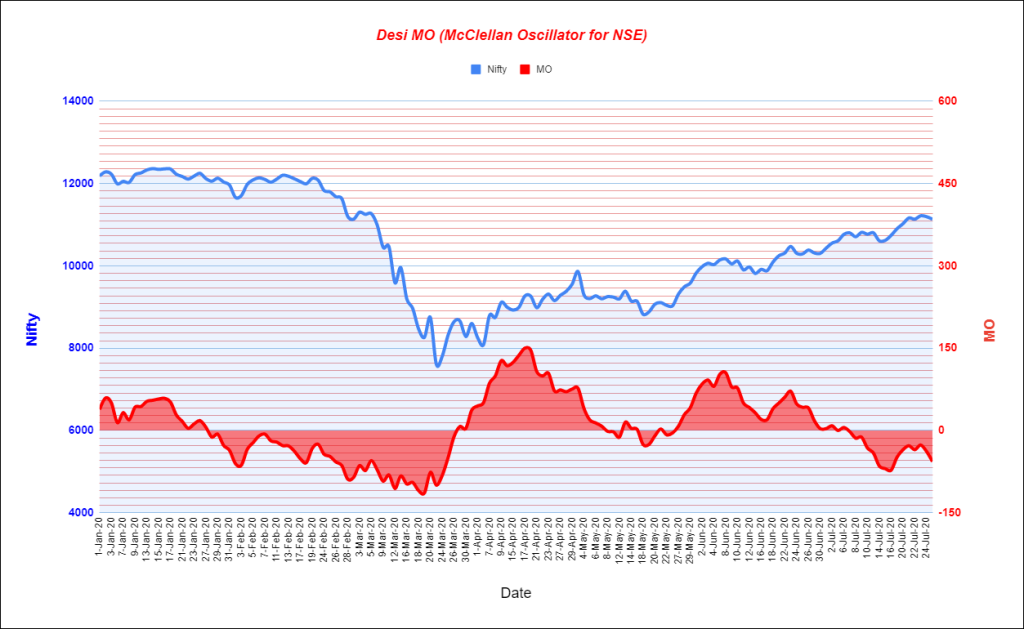

Desi MO (McClellans Oscillator For NSE) – 28th JUL 2020

MO at -51

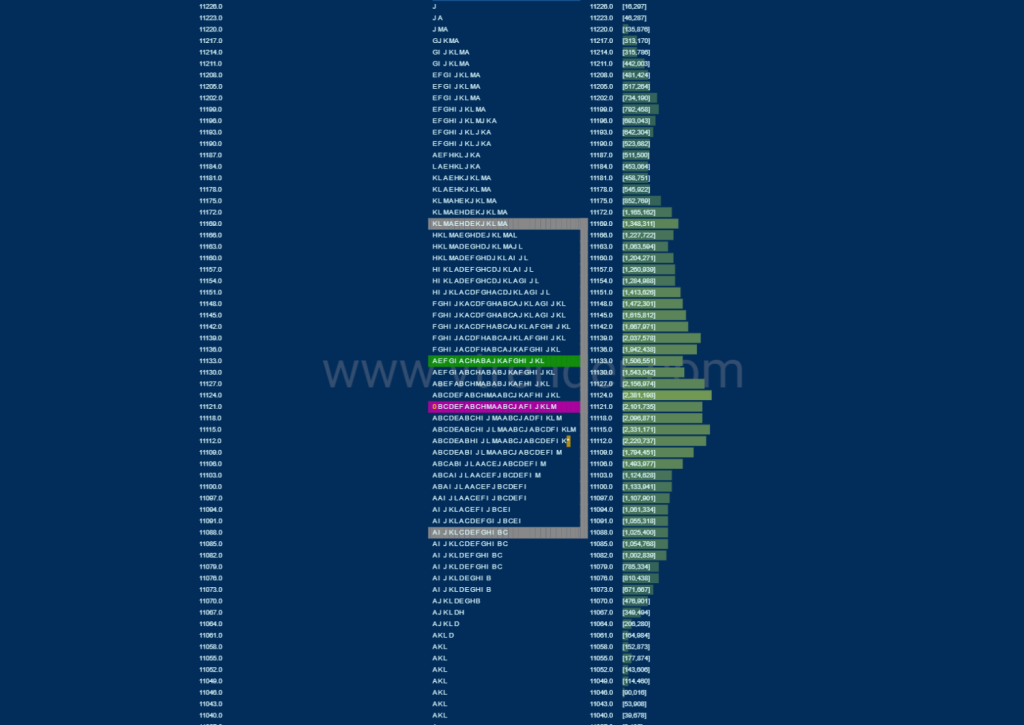

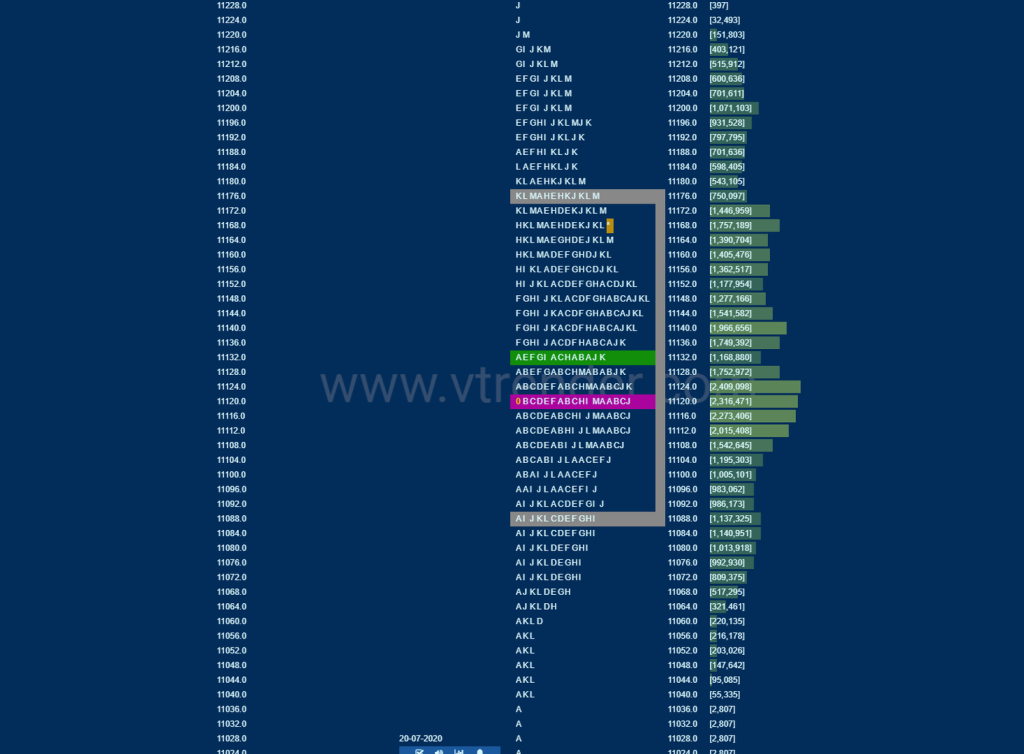

Order Flow charts dated 28th July 2020

Trading Order Flow allows a trader to see the specific price where a trade has hit the market, along with the volume of that trade. This information is extremely valuable and allows a trader to generate substantial revenue by using this information to trade. The way we see it is that Order Flow trading is […]

Market Profile Analysis dated 27th July 2020

Nifty Jul F: 11122 [ 11225 / 11070 ] HVNs – 10190 / 10293 / 10475 / 10570 / 10728 / 10764 / 11112 Previous day’s report ended with this ‘Value for the day was completely lower though the close was way above the VAH as NF has been forming a balance over the last […]

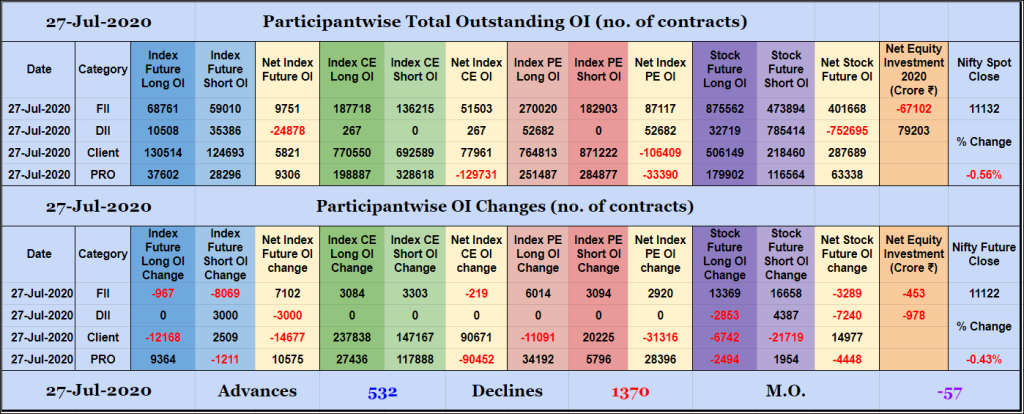

Participantwise Open Interest – 27th JUL 2020

FIIs have added net 2K long Index PE and net 3K short Stocks Futures contracts today while covering 8K short Index Future contracts. They were net sellers in equity segment for ₹453 crore. Clients have added 2K short Index Futures, net 90K long Index CE and 20K short Index PE contracts today besides liquidating 12K […]

Desi MO (McClellans Oscillator For NSE) – 27th JUL 2020

MO at -57

Order Flow charts dated 27th July 2020

Many traders are used to viewing volume as a histogram beneath a price chart. This approach shows the amount of volume traded below the price Bar. The Order Flow approach is to see the Volume traded inside or within the price bar, an important distinction. Order Flow trading is thinking about what order market participants […]

Market Profile Analysis dated 24th July 2020

Nifty Jul F: 11170 [ 11199 / 11062 ] HVNs – 10190 / 10293 / 10475 / 10570 / 10728 / 10764 / 11135 Previous day’s report ended with this ‘Volumes for the day were the lowest of the series which means the demand is drying up and NF would need fresh buying to come […]

Change of Prices – Vtrender Trading Room

A message to the community. Dear Traders, We’re writing to inform you that on Aug 1, 2020, the list price of the Vtrender Trading Room (VTR) to all new members joining will increase to NR 19999/- for the Monthly Plan, to INR 49999/- for the quarterly Plan & INR 149999/- for the Annual Plan. These rates are inclusive of taxes […]

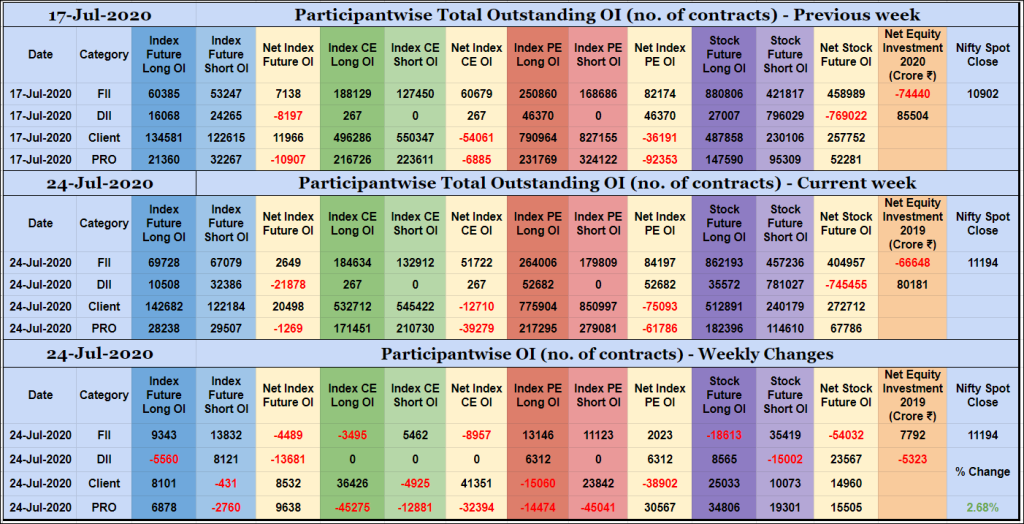

Participantwise Open Interest – 24th JUL 2020

Weekly view FIIs have added net 4K short Index Futures, 5K short Index CE, net 2K long Index PE and 35K short Stocks Futures contracts this week while liquidating 3K long Index CE and 18K long Stocks Futures contracts. They were net buyers in equity segment for ₹7792 crore. Clients have added 8K long Index Futures, […]