Market Profile Analysis dated 16th May 2022

Nifty May F: 15842 [ 15780 / 15752 ] NF opened higher negating the first of the previous session’s extension handle of 15827 but was swiftly rejected as it went back into the NeuX (Neutral Extreme) zone of 15827 to 15744 and tested the mini tail of 15756 to 15744. The auction then made a vertical […]

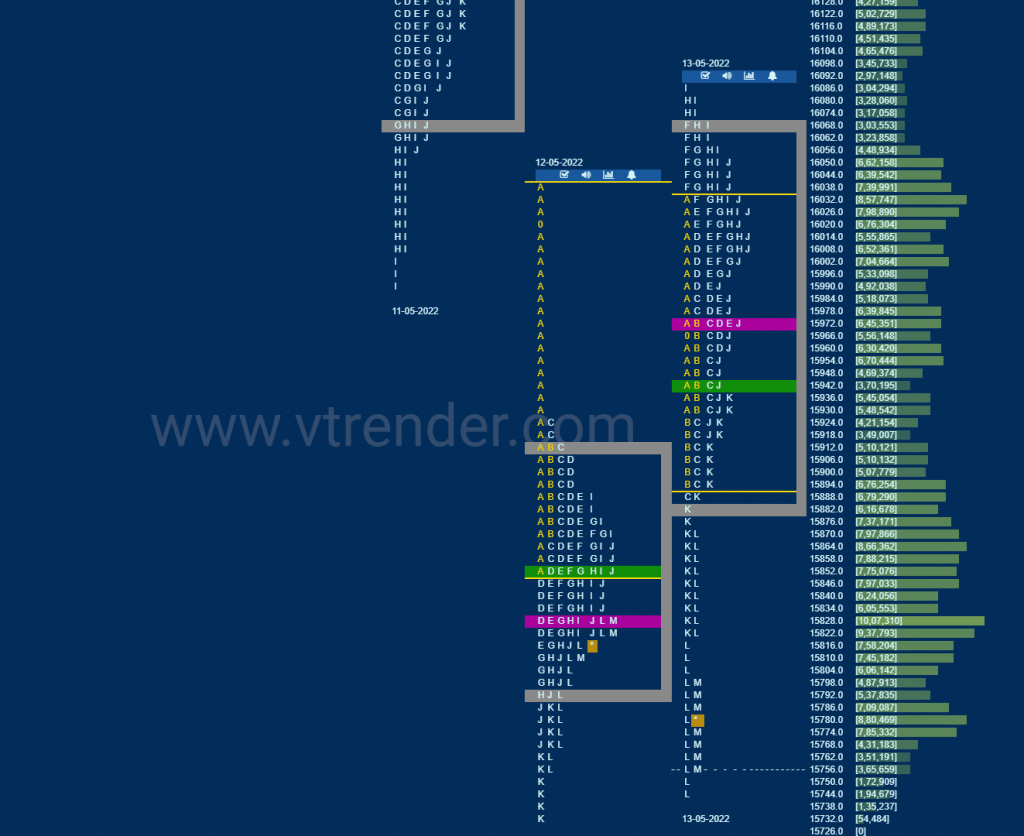

Market Profile Analysis dated 13th May 2022

Nifty May F: 15786 [ 16091 / 15744 ] NF opened with a gap up of 160 points and got accepted in previous day’s Selling Singles in the A period but probed lower in the B and left a typical C side extension down which was swiftly rejected resulting in a FA (Failed Auction) being confirmed […]

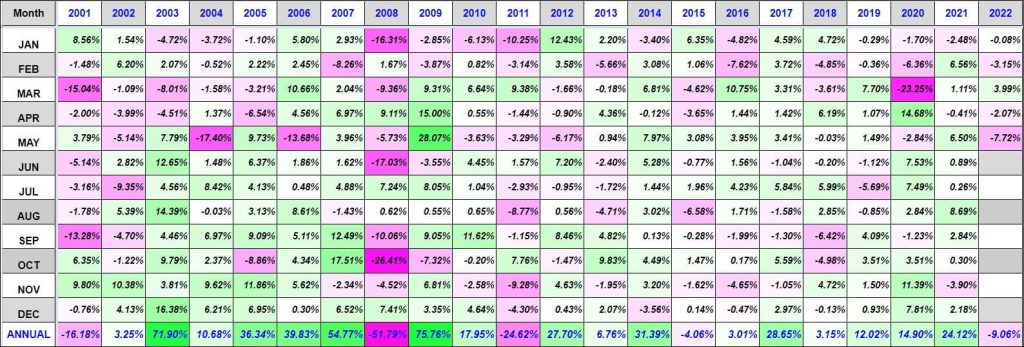

Nifty 50 returns (since 1991)

Nifty 50 returns (1991-2000)

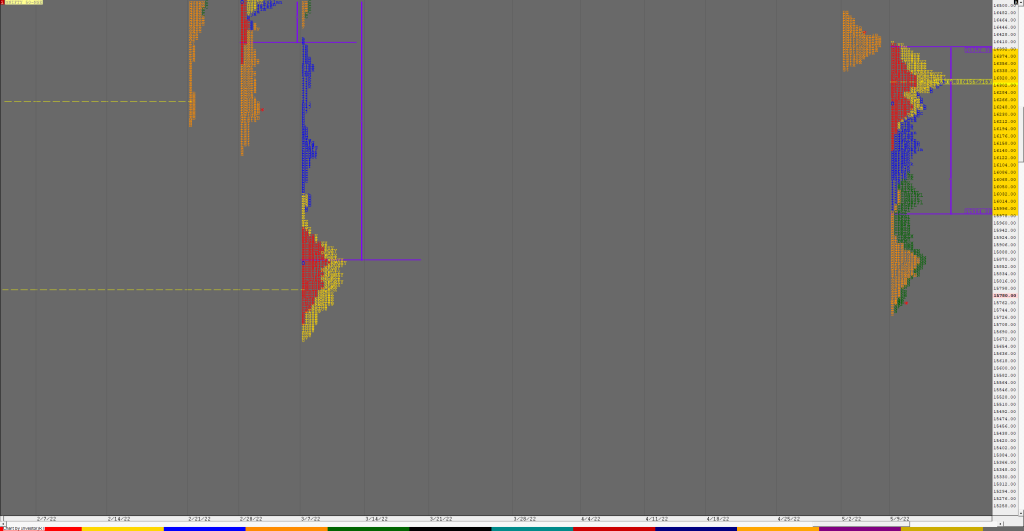

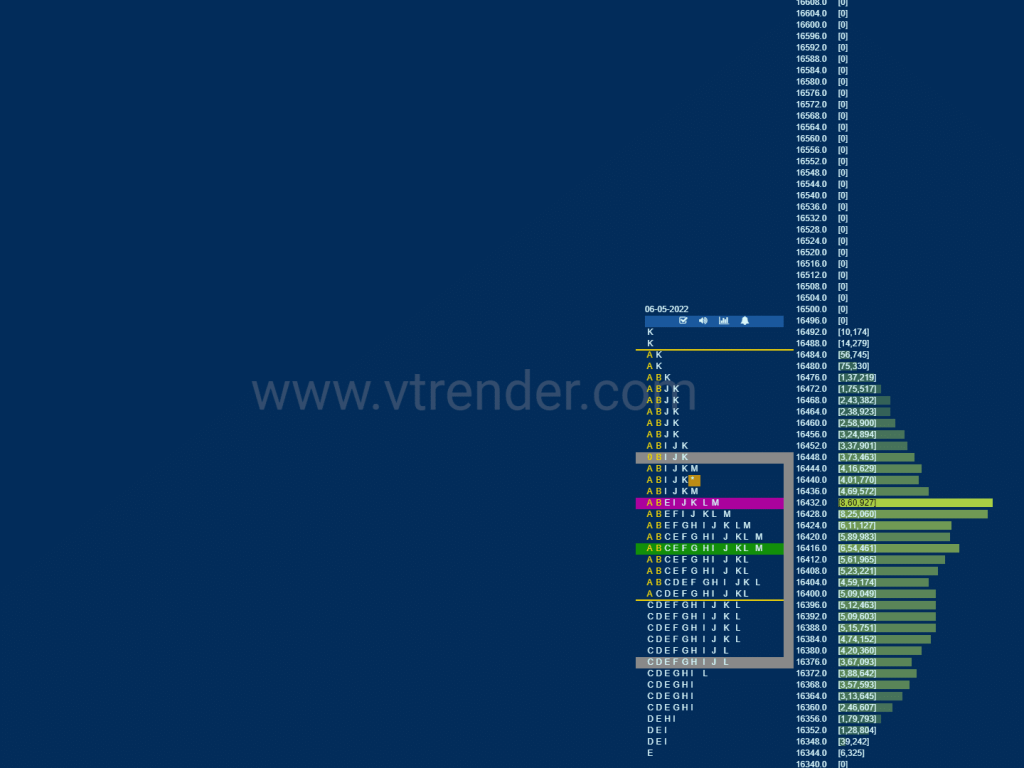

Weekly Charts (09th to 13th May 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (09th to 13th May 2022) 15782 [ 16404 / 15735 ] Previous week’s report ended with this ‘The weekly profile as expected has given a move away from the 2-week balance & is a Neutral Extreme one to the downside with overlapping to lower Value at 16674-16998-17070 with a big zone of […]

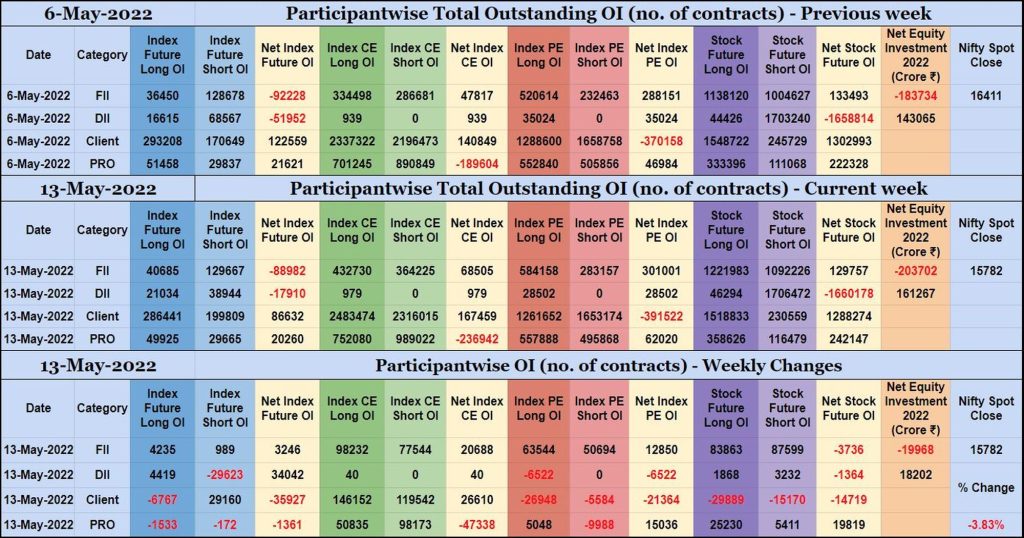

Participantwise Open Interest (Weekly changes) – 13th MAY 2022

Weekly changes in Participantwise Open Interest FIIs have added net 3K long Index Futures, net 20K long Index CE, net 12K long Index PE and net 3K short Stocks Futures contracts this week. FIIs have been net sellers in equity segment for ₹19968 crore during the week. Clients have added 29K short Index Futures and […]

Market Profile Analysis dated 12th May 2022

Nifty May F: 15811 [ 16039 / 15733 ] NF not only gave a gap down open of 158 points but confirmed an ORR (Open Rejection Reverse) start to the downside as it made a big drop of 182 points in the A period where it completed the Weekly 2 IB objective of 15888 while making […]

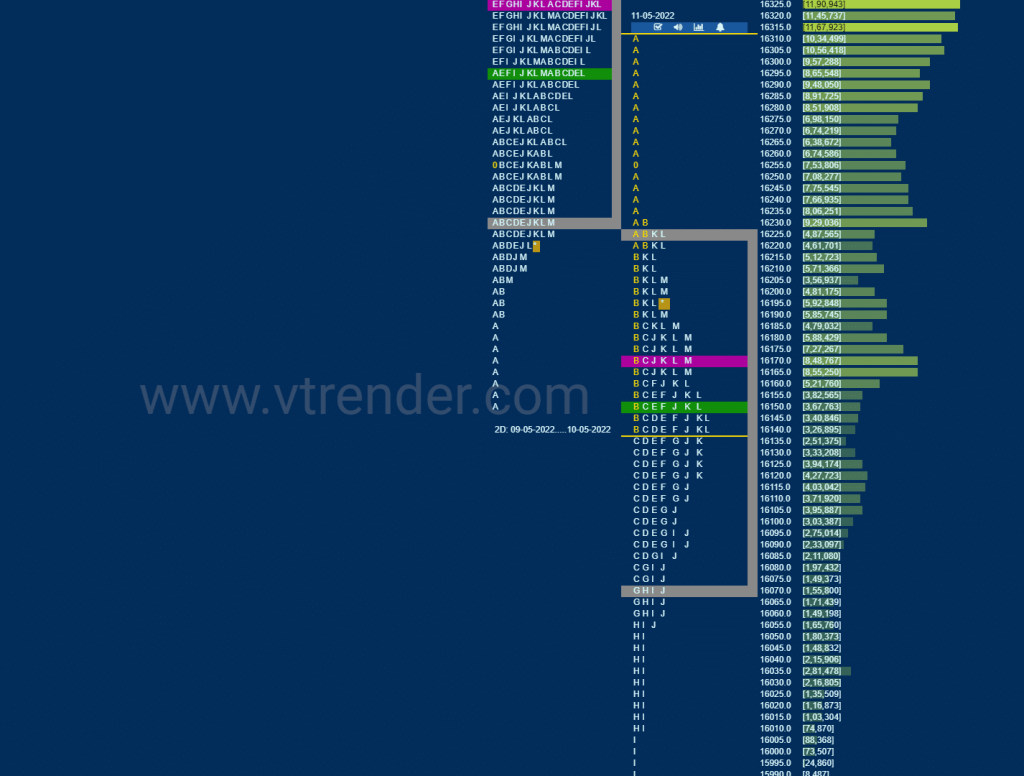

Market Profile Analysis dated 11th May 2022

Nifty May F: 16178 [ 16315 / 15993 ] NF gave yet another OAIR (Open Auction In Range) start right in the middle of the 2-day balance but got rejected right from yesterday’s NeuX VWAP of 16315 in the A period after which it left an extension handle at 16220 in the IB (Initial Balance) along […]

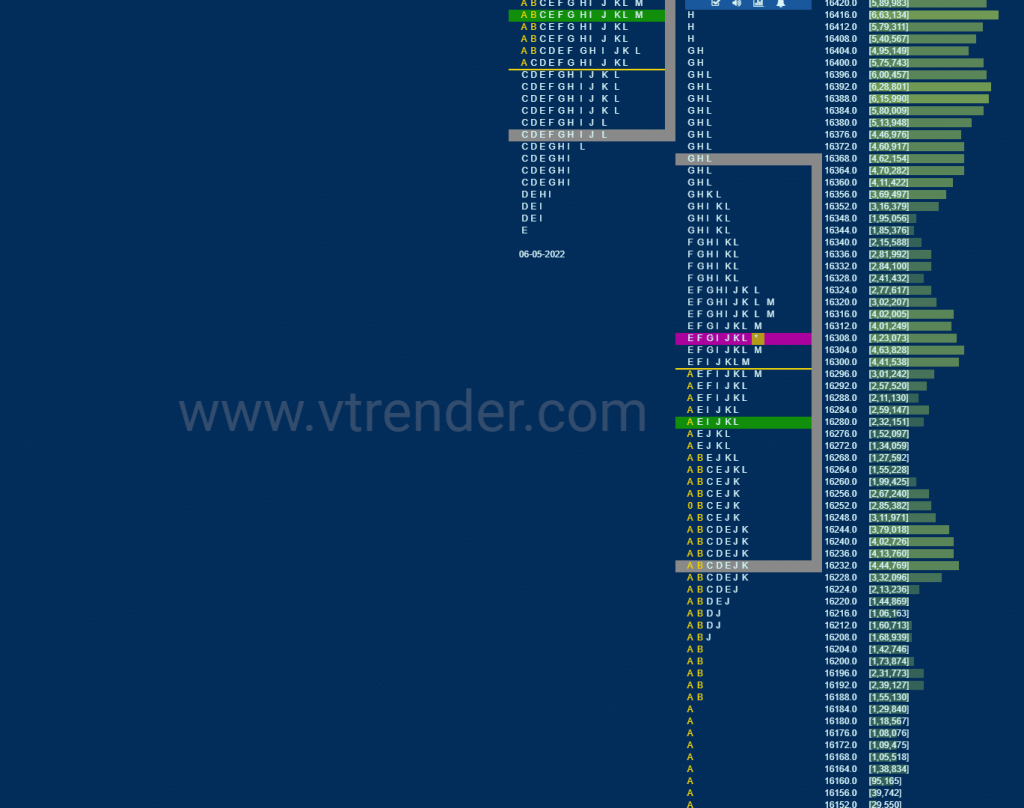

Market Profile Analysis dated 10th May 2022

Nifty May F: 16247 [ 16410 / 16209 ] NF made an OAIR (Open Auction In Range) start and remained in previous Value for the first half of the day before making multiple REs (Range Extension) to the upside in the F / G & H periods but could only manage similar highs of 16401 / […]

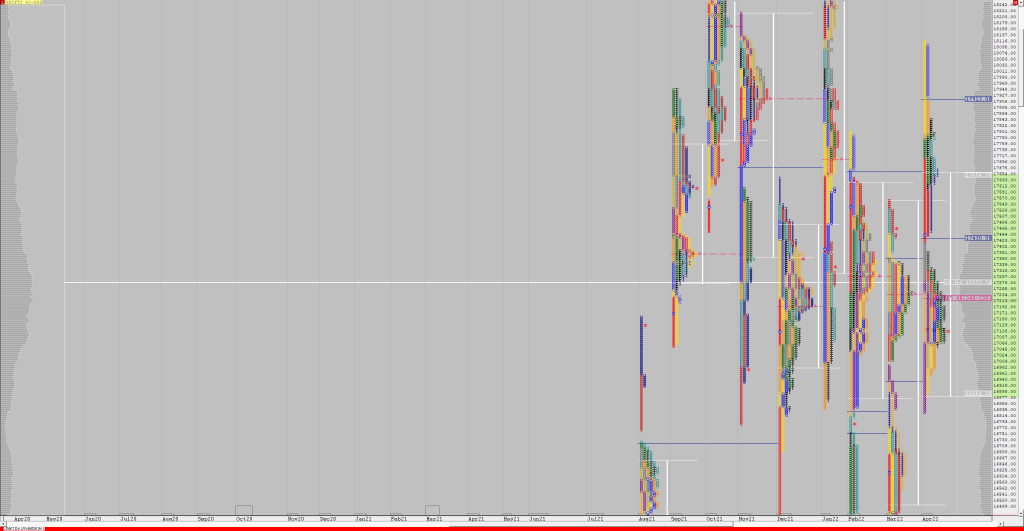

Order Flow charts dated 10th May 2022

Many traders are looking for information on how to use market conditions to find good trades. Order Flow is best understood as a way to see existing bias in the markets. Order Flow helps us understand who is in control of the market and who is ‘upside down’ and likely to make exits from that […]

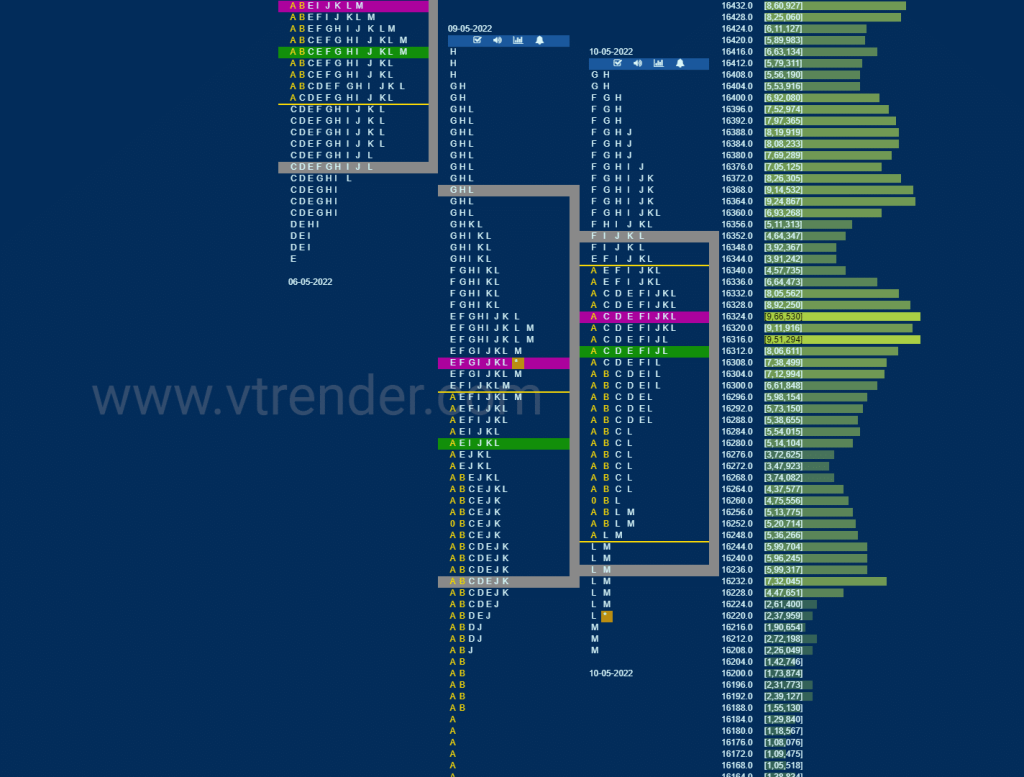

Market Profile Analysis dated 09th May 2022

Nifty May F: 16299 [ 16418 / 16153 ] NF opened with another gap down of 164 points as it tagged the 1 ATR objective of 16249 from last Friday’s FA of 16495 and continued to probe lower in the A period breaking below the 09th Mar HVN of 16210 and testing the PBL of 16175 […]