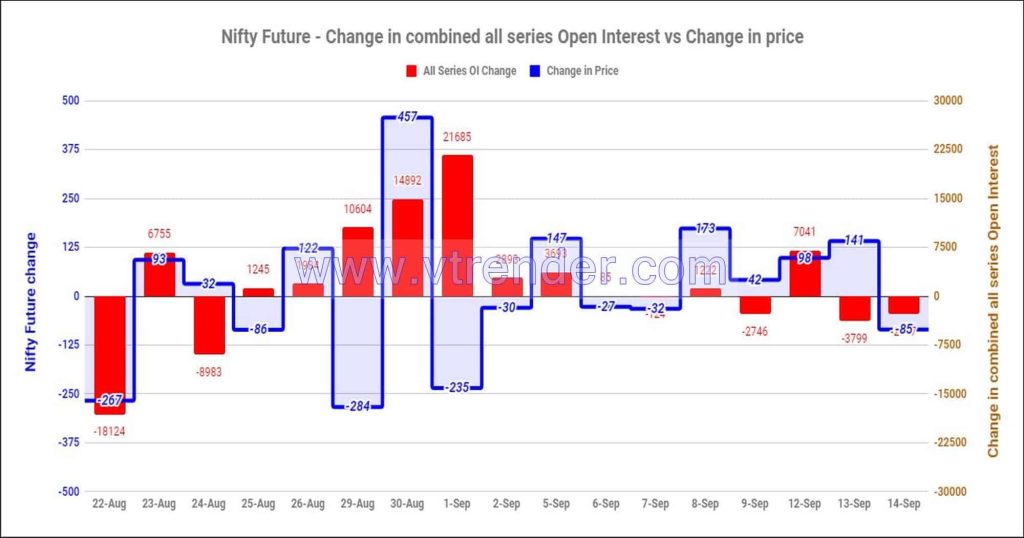

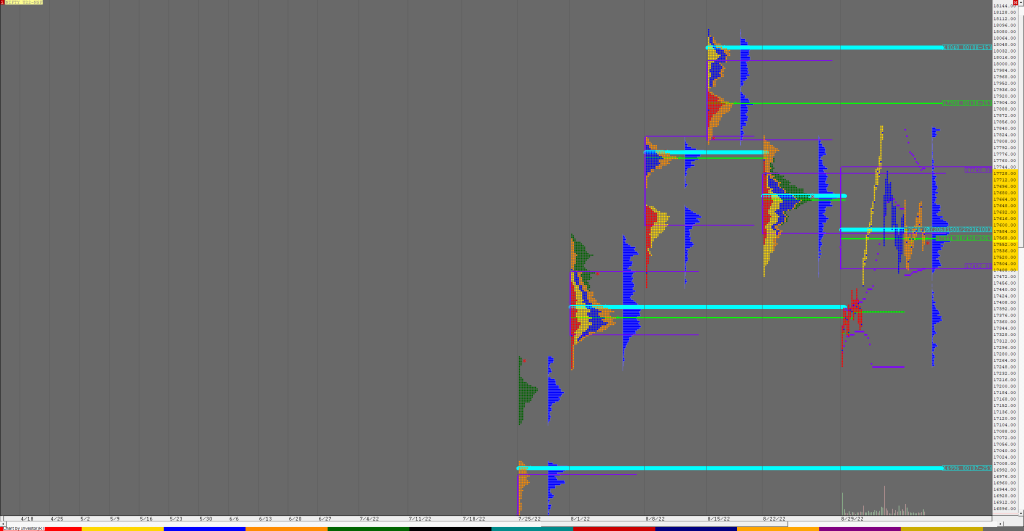

Nifty and Banknifty Futures with all series combined Open Interest – 14th SEP 2022

Total Nifty/Banknifty OI and daily OI changes Nifty Futures have added shed 2747 contracts in Open Interest today but traded volumes climbed up sharply. Banknifty Futures have added 8035 contracts with heavy volumes.

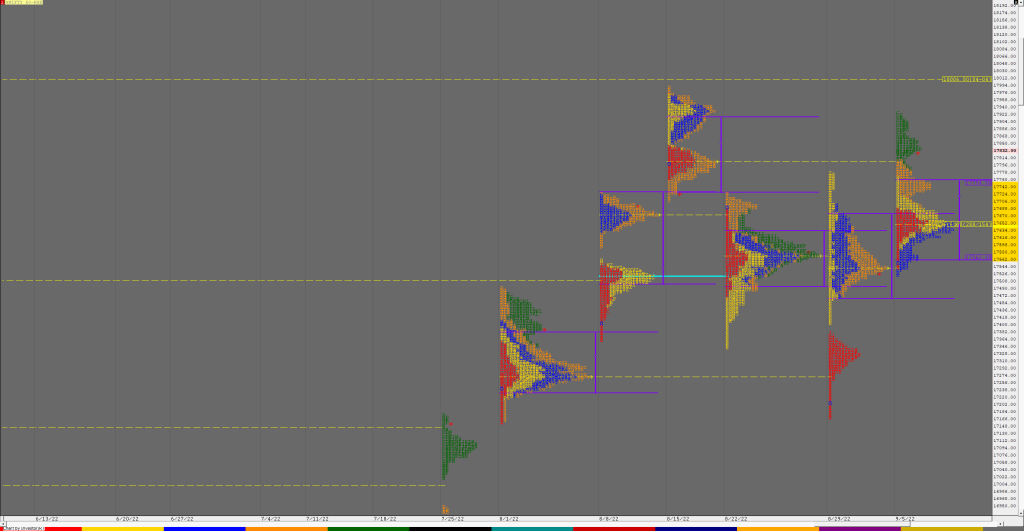

Market Profile Analysis dated 14th Sep 2022

Nifty Sep F: 18020 [ 18110 / 17819 ] NF opened with a big 279 point gap down but took support in this week’s buying tail of 17841 to 17805 from last Friday as it made a low of 17819 and confirmed an ORR (Open Rejection Reverse) start to the upside resulting in a good IB […]

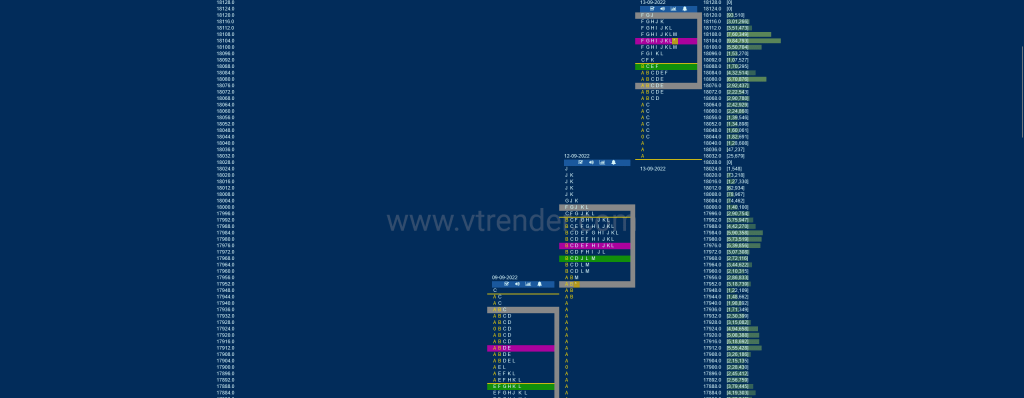

Market Profile Analysis dated 13th Sep 2022

Nifty Sep F: 18105 [ 18123 / 18032 ] NF made the 4th consecutive gap up open and took out the 19th Aug VPOC of 18041 but settled down into an OAOR (Open Auction Out of Range) forming a narrow range of just 58 points in the IB (Initial Balance) between 18091 to 18032 and followed […]

Market Profile Analysis dated 12th Sep 2022

Nifty Sep F: 17964 [ 18024 / 17872 ] NF made a low volumes OAIR (Open Auction In Range) start but gave an initiative move away from previous Value in form of an initaitive buying tail from 17944 to 17872 after which it went on to negate the FA of 17949 & stayed above it all […]

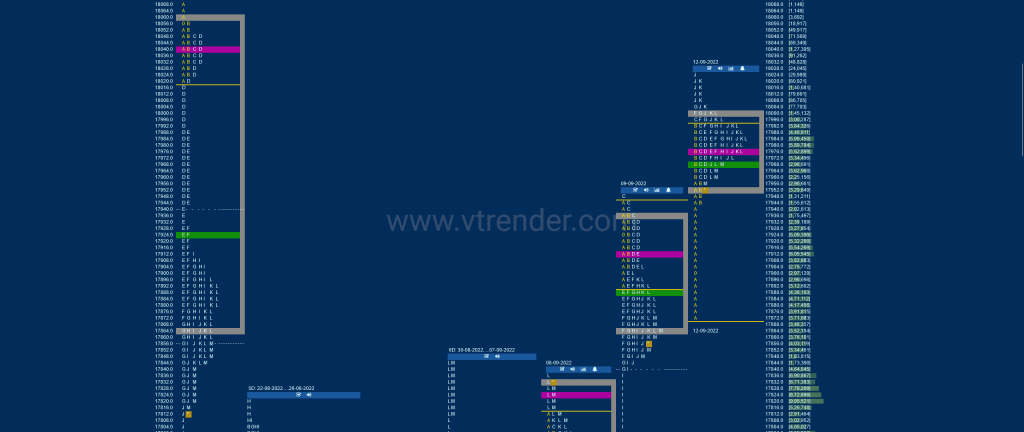

Market Profile Analysis dated 09th Sep 2022

Nifty Sep F: 17866 [ 17949 / 17805 ] NF gave a rare follow up to a NeuX (Neutral Extreme) profile with a gap up of 103 points but settled down into an OAOR (Open Auction Out of Range) as it could not find fresh demand above the 19th Aug extension handle of 17945 and made […]

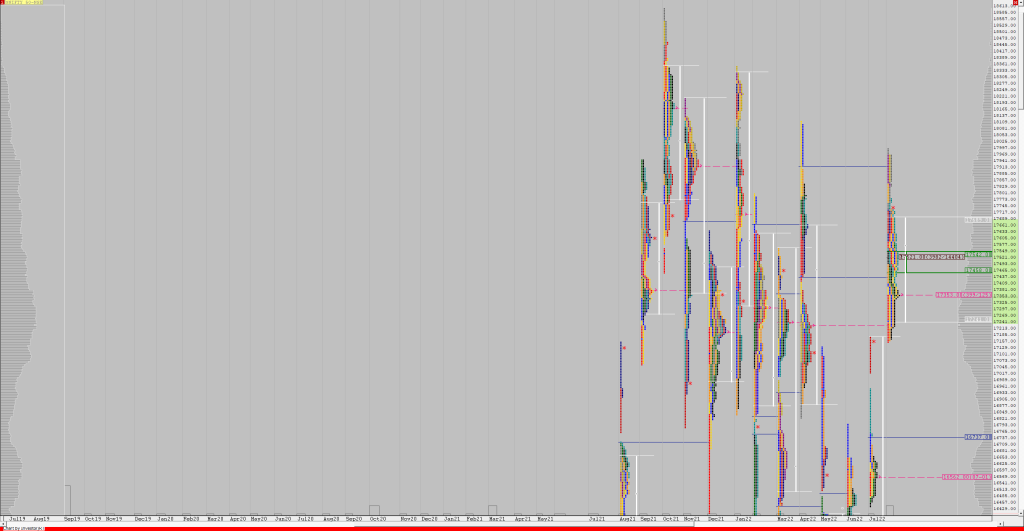

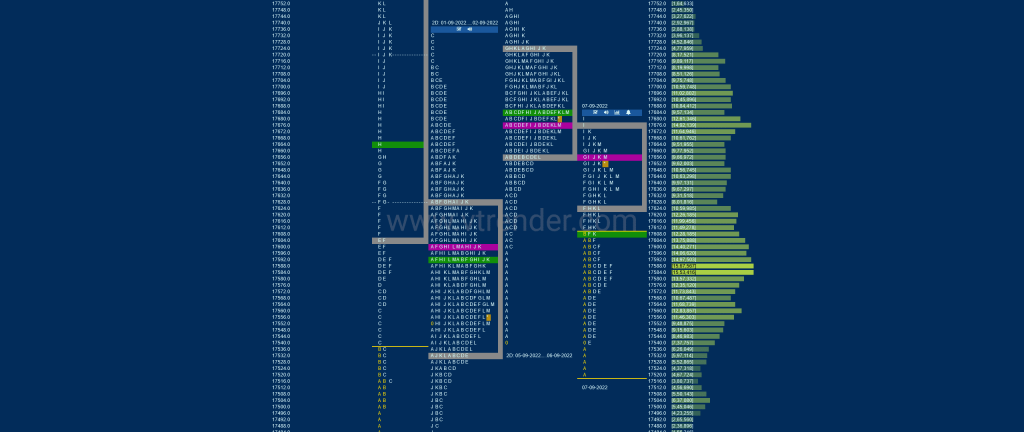

Weekly Charts (05th to 09th Sep 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (05th to 09th Sep 2022) 17833 [ 17926 / 17484 ] Previous week’s report ended with this ‘The weekly profile resembles a Double Distribution (DD) one to the upside with a buying tail at lows from 17267 to 17166 and the lower distribution HVN at 17309 above which it has the […]

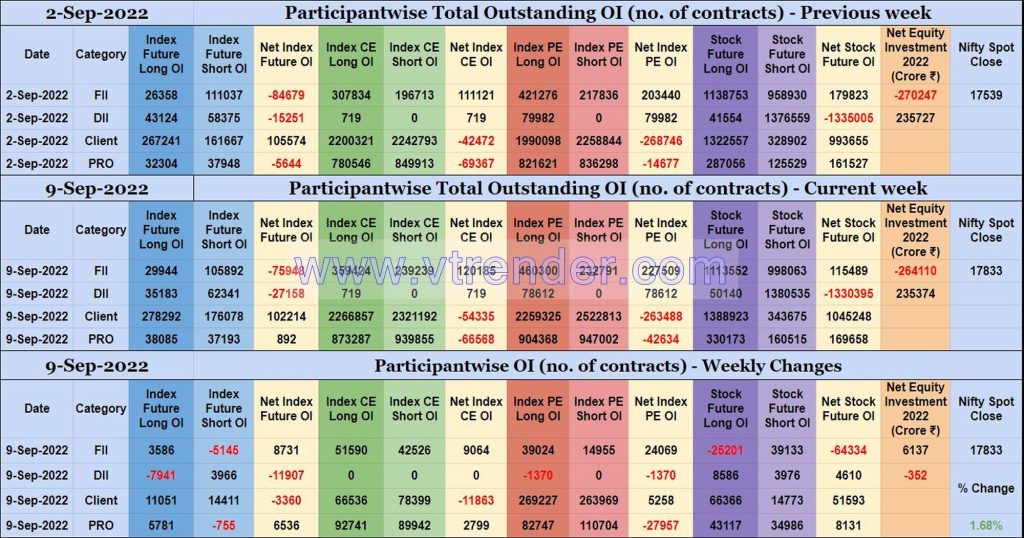

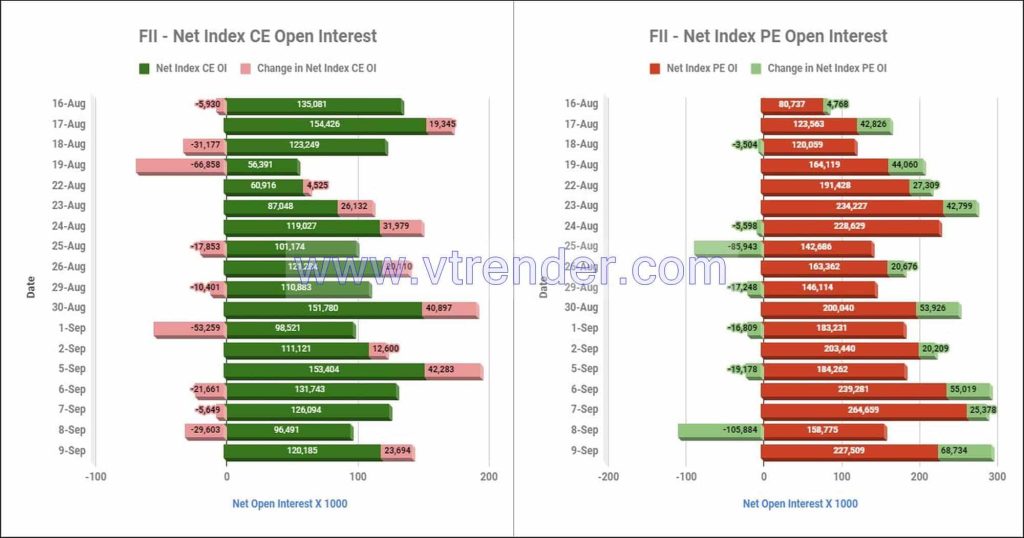

Participantwise Open Interest (Weekly changes) – 9th SEP 2022

Weekly changes in Participantwise Open Interest FIIs have added 3K long Index Futures, net 9K long Index CE, net 24K long Index PE and 39K short Stocks Futures contracts this week besides covering 5K short Index Futures contracts and liquidating 25K long Stocks Futures contracts. FIIs have been net buyers in equity segment for ₹6137 […]

Participantwise net Open Interest and net equity investments – 9th SEP 2022

Participantwise total outstanding Open Interest & Daily changes

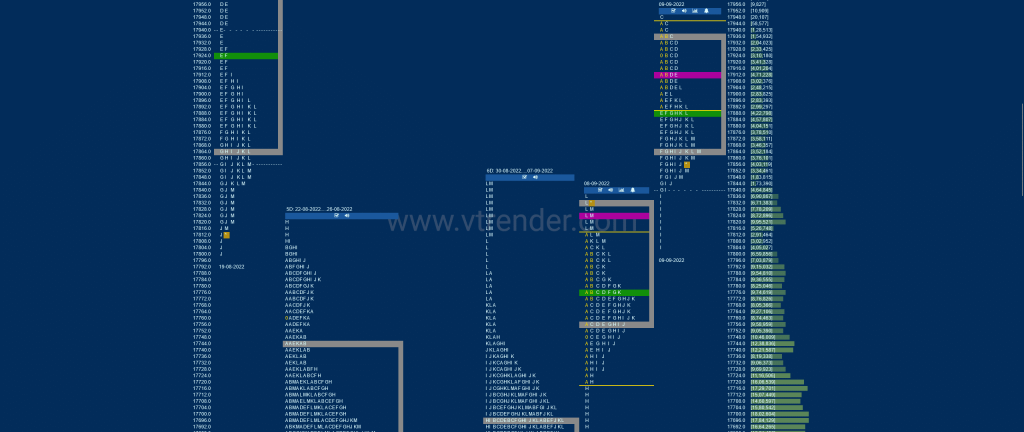

Market Profile Analysis dated 08th Sep 2022

Nifty Sep F: 17824 [ 17837 / 17695 ] NF opened with a gap up of 99 points and scaled above the 06th Sep Swing High of 17788 as it went on to make a high of 17813 in the IB where it failed to get fresh demand and settled down into a low volume grind […]

Weekly Charts (02nd to 08th Sep 2022) and Market Profile Analysis for NF & BNF

NF Weekly Profile (02nd to 08th Sep 2022) 17824 [ 17837 / 17491 ] Friday: NF started the week with a Normal Day as it stayed below the weekly POC of 17670 & filled up the lower part of previous week’s profile and left an important C side extension at 17491 which turned out to […]