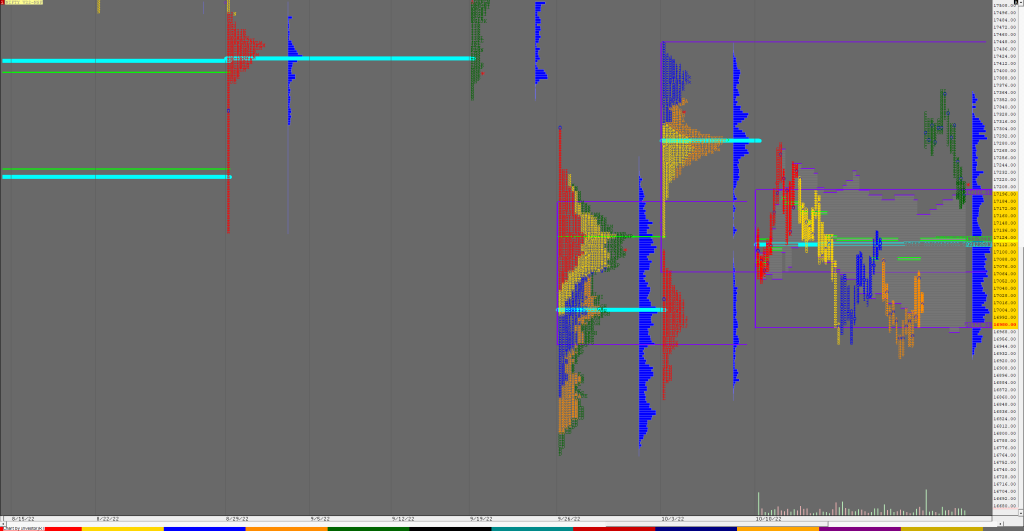

Weekly Settlement Charts (14th to 20th Oct 2022) and Market Profile Analysis for NF & BNF

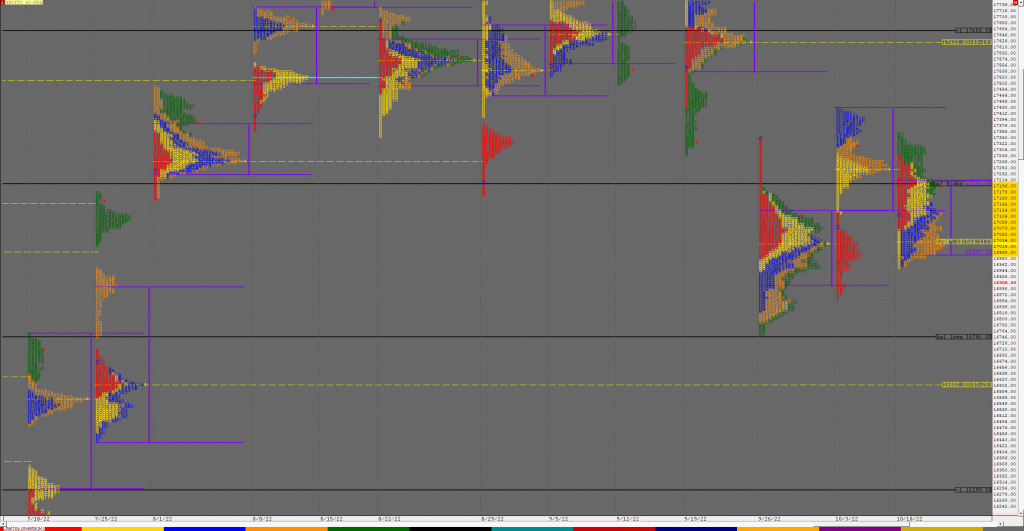

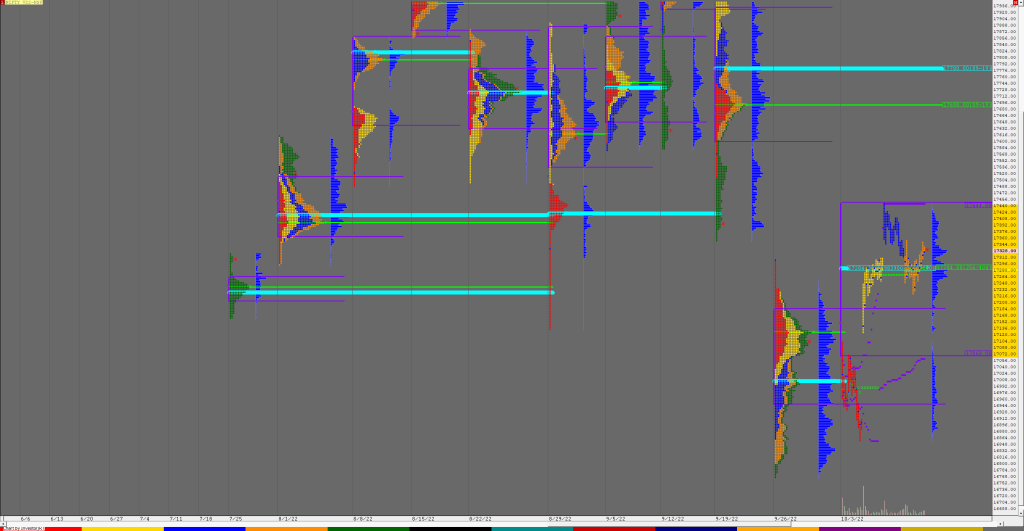

NF Weekly Profile (14th to 20th Oct 2022) 17540 [ 17599 / 17100 ] Friday: NF opened the week with a big gap up of 290 points and tagged the 07th Oct VPOC of 17329 in the IB and even made couple of REs (Range Extension) to the upside but could only manage similar highs near […]

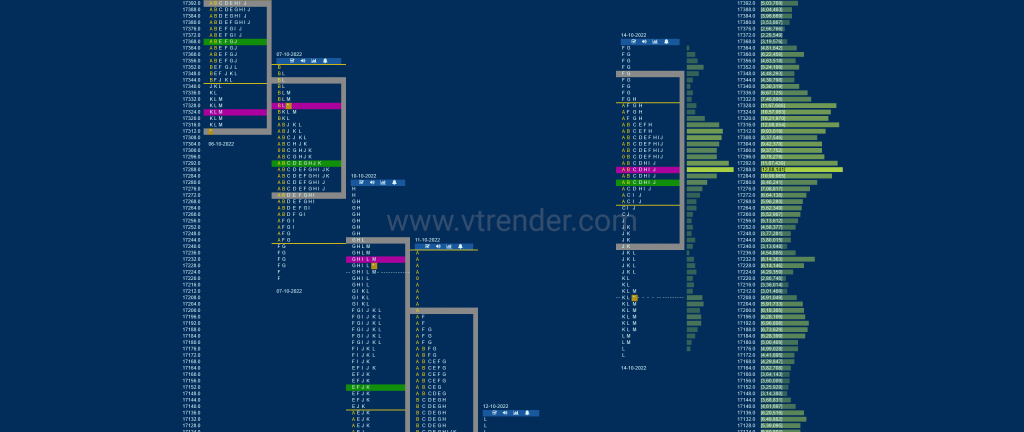

Market Profile Analysis dated 19th Oct 2022

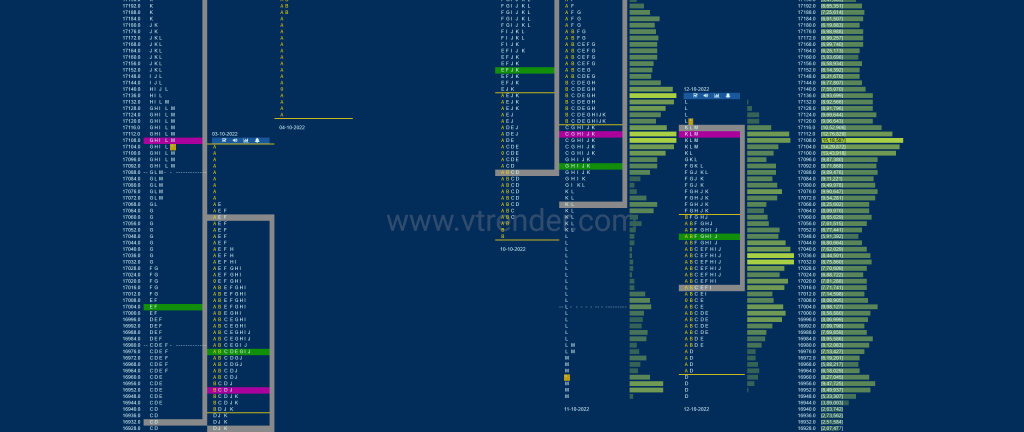

Nifty Oct F: 17494 [ 17599 / 17457 ] NF opened slightly higher giving a move away from the prominent yPOC of 17496 & probing into the selling singles of 23rd Sep as it made new highs for the week at 17585 but could only form a very narrow 55 point range IB indicating the continutation […]

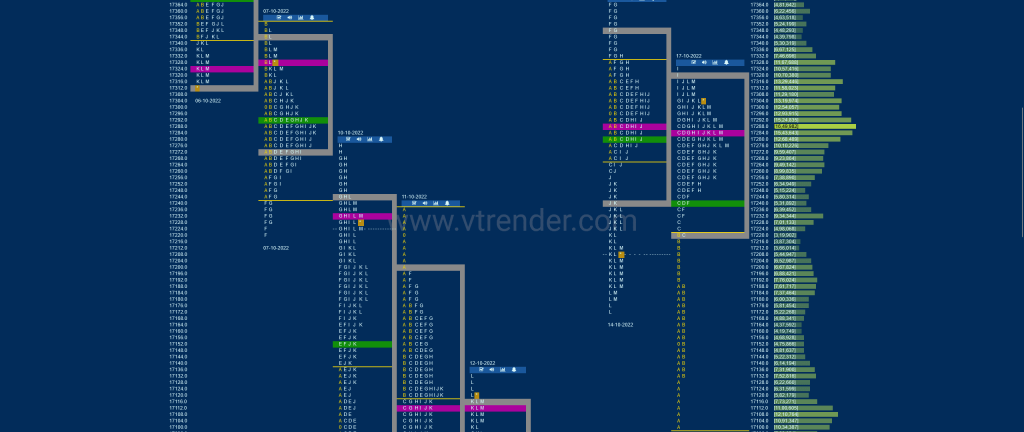

Market Profile Analysis dated 18th Oct 2022

Nifty Oct F: 17502 [ 17538 / 17432 ] NF moved away from the overlapping POC of 17285 with a gap up open of 143 points and even left an A period buying tail as it formed a narrow IB range between 17432 & 17526 and made the dreaded C side extension to 17538 stalling the […]

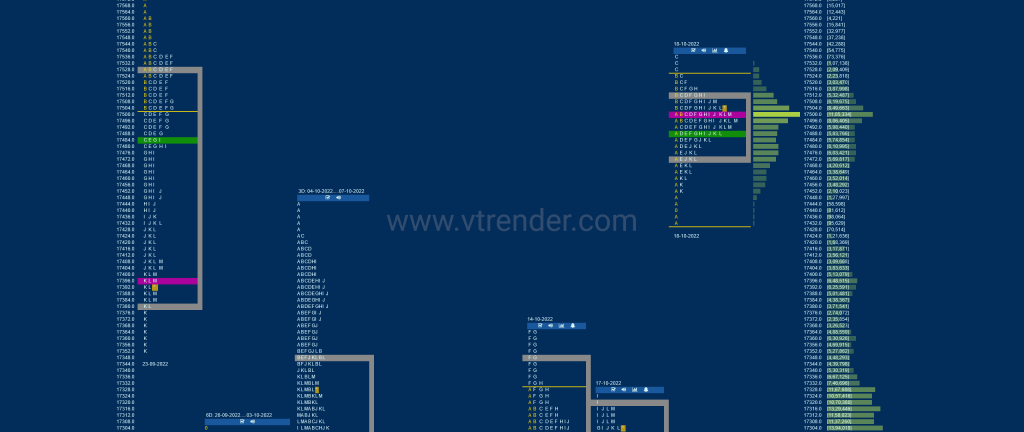

Market Profile Analysis dated 17th Oct 2022

Nifty Oct F: 17300 [ 17324 / 17100 ] NF gave a rare follow through to a NeuX (Neutral Extreme) with a lower open right at 14th Oct’s Gap mid-point of 17155 and continued to probe to the downside making a low of 17100 & tagging the HVN of this series where it left an initiative […]

Market Profile Analysis dated 14th Oct 2022

Nifty Oct F: 17195 [ 17367 / 17175 ] NF opened with a huge gap up of 289 points and went on to tag the 07th Oct VPOC of 17329 as it made a high of 17331 but settled down into an OAOR forming a very narrow 61 point range IB after which it made a […]

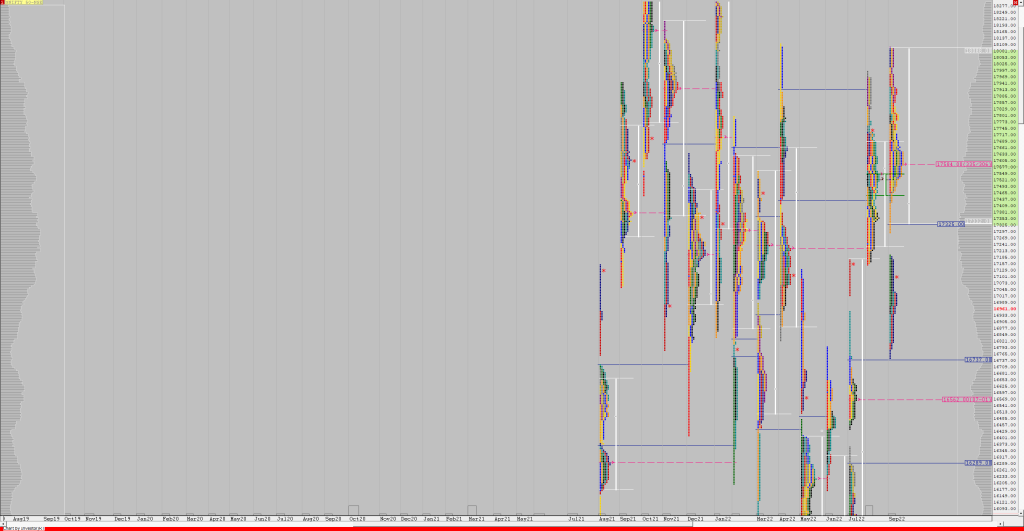

Weekly Charts (10th to 14th Oct 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (10th to 14th Oct 2022) 17185 [ 17348 / 16950 ] Previous week’s report ended with this ‘The weekly profile is a Neutral Extreme one to the upside with a FA at 16855 & a zone of singles from 17059 to 17175 along with a daily VPOC at 17024 and has […]

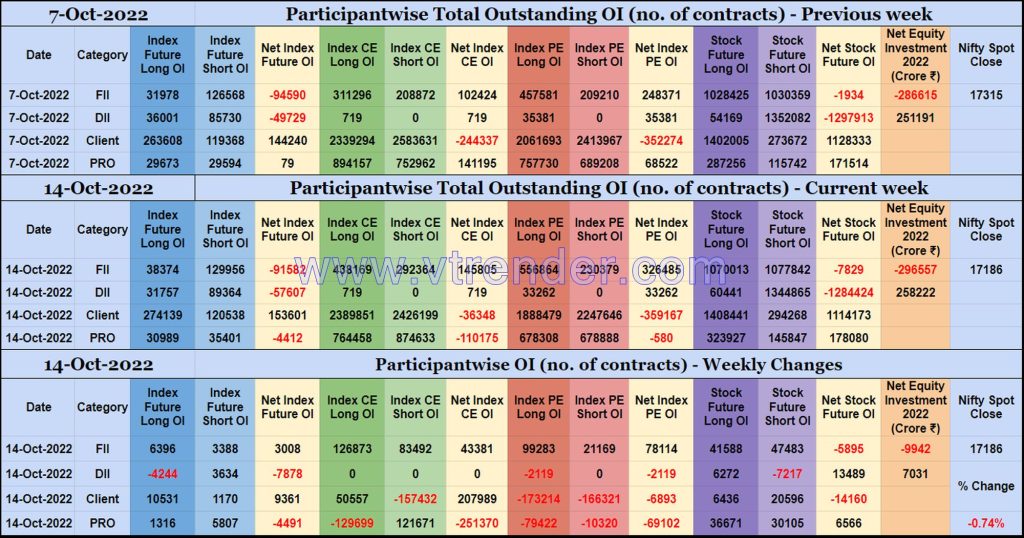

Participantwise Open Interest (Weekly changes) – 14th OCT 2022

Weekly changes in Participantwise Open Interest FIIs have added net 3K long Index Futures, net 43K long Index CE, net 78K long Index PE and net 5K short Stocks Futures contracts this week. FIIs have been net sellers in equity segment for ₹9942 crore during the week. Clients have added net 9K long Index Futures, […]

Market Profile Analysis dated 13th Oct 2022

Nifty Oct F: 17010 [ 17086 / 16927 ] NF once again failed to give a follow up after a NeuX Day as it not only opened lower but made an almost OH (Open=High) at 17086 forming an OTF (One Time Frame) lower till the F period where it negated previous day’s FA of 16951 while […]

Weekly Settlement Charts (07th to 13th Oct 2022) and Market Profile Analysis for NF & BNF

NF Weekly Profile (07th to 13th Oct 2022) 17010 [ 17354 / 16927 ] Friday: NF opened the week with a nice Gaussian Curve as it remained below the higher HVN of 17388 and remained in a narrow range of just 134 points all day between 17354 & 17220 forming a prominent TPO POC at 17288 […]

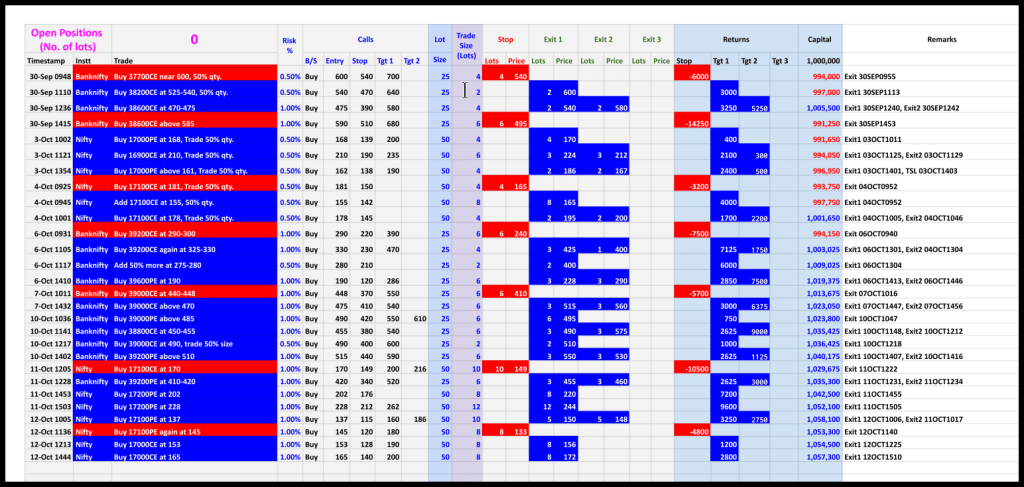

Mid Month report

We are on trac We are on track for a good October series. Our trades and setups have worked fine and we should be able to finish October on a very strong note The Market Volatility got to us in the last week of September and we surrendered some gains to the market A running […]