Market Profile Analysis dated 12th Oct 2022

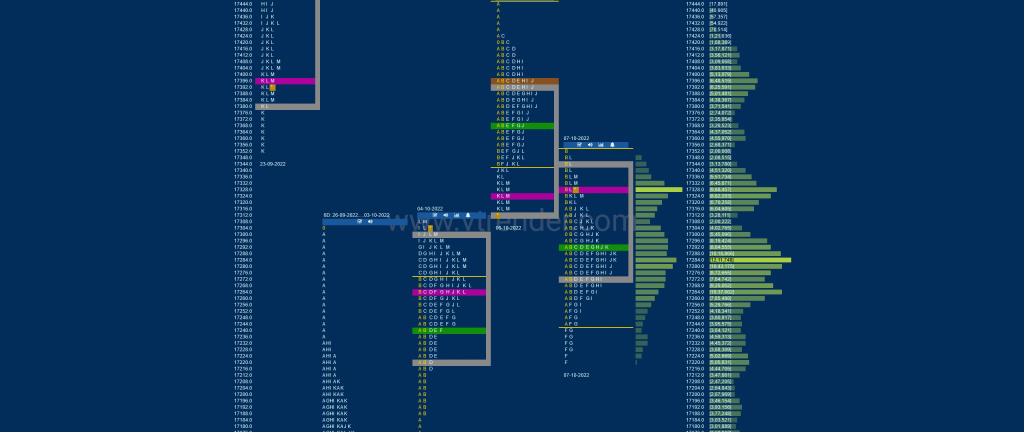

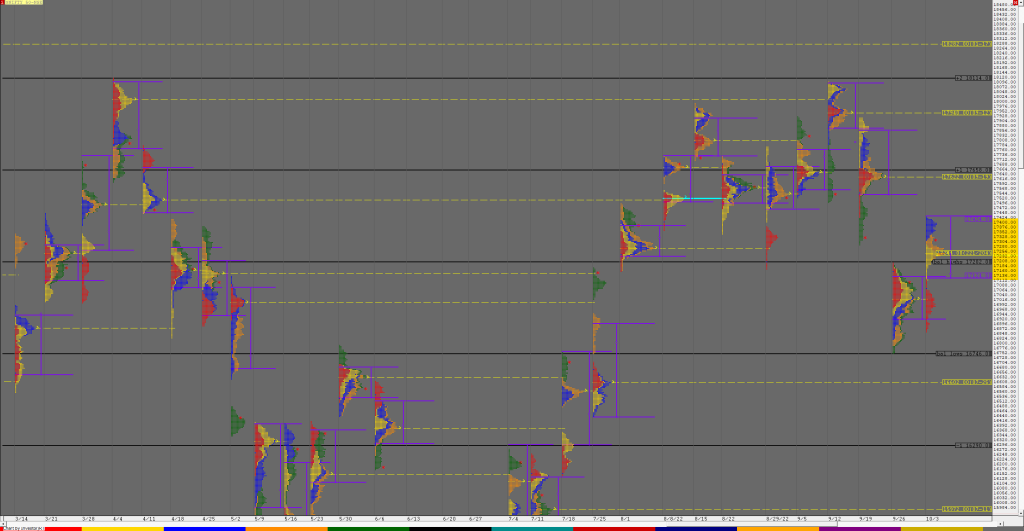

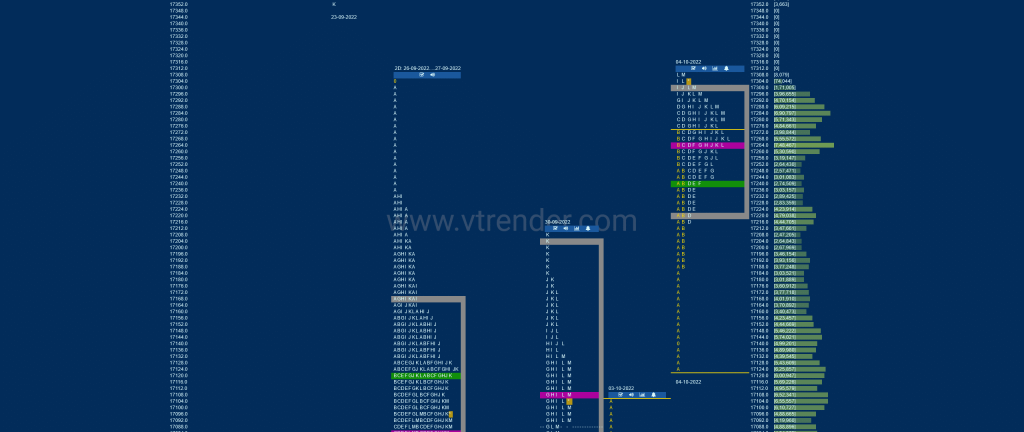

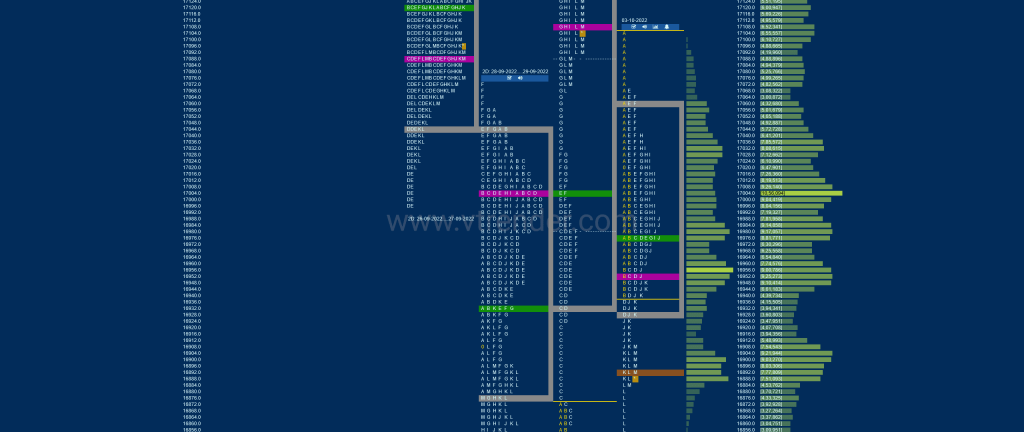

Nifty Oct F: 17114 [ 17134 / 16951 ] NF made an OAIR in previous day’s spike zone and formed the Initial Balance (IB) between 16966 & 17063 after which it made an attempt to extend the IB lower in the D period as it tagged the closing HVN of 16956 but could only match PDL […]

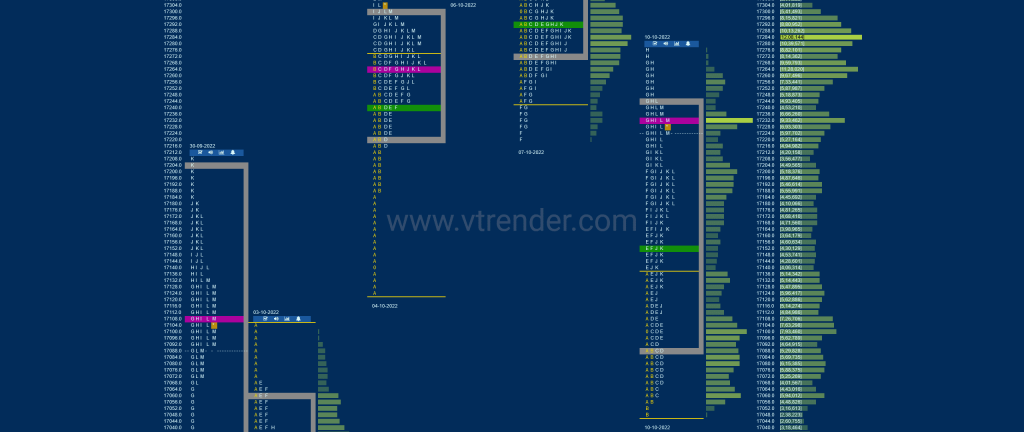

Market Profile Analysis dated 11th Oct 2022

Nifty Oct F: 16978 [ 17239 / 16951 ] NF made an OAIR start on pretty low volumes but left an initiative selling tail from 17179 to 17239 in the IB indicating rejection from yPOC but made the dreaded C side extension lower to the HVN of 17100 where it took support triggering a bounce back […]

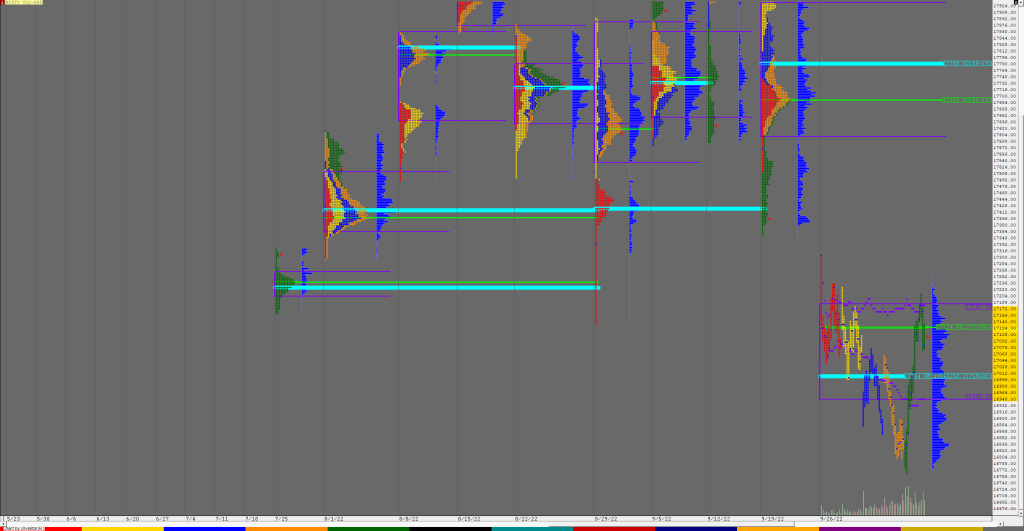

Market Profile Analysis dated 10th Oct 2022

Nifty Oct F: 17227 [ 17278 / 17050 ] NF opened with a big 229 point gap down and made an attempt to enter the 6-day composite Value from 26th Sep to 03rd Oct but formed similar lows of 17056 & 17050 in the LVZ (low volume zone) of 17064 to 17044 as the buyers came […]

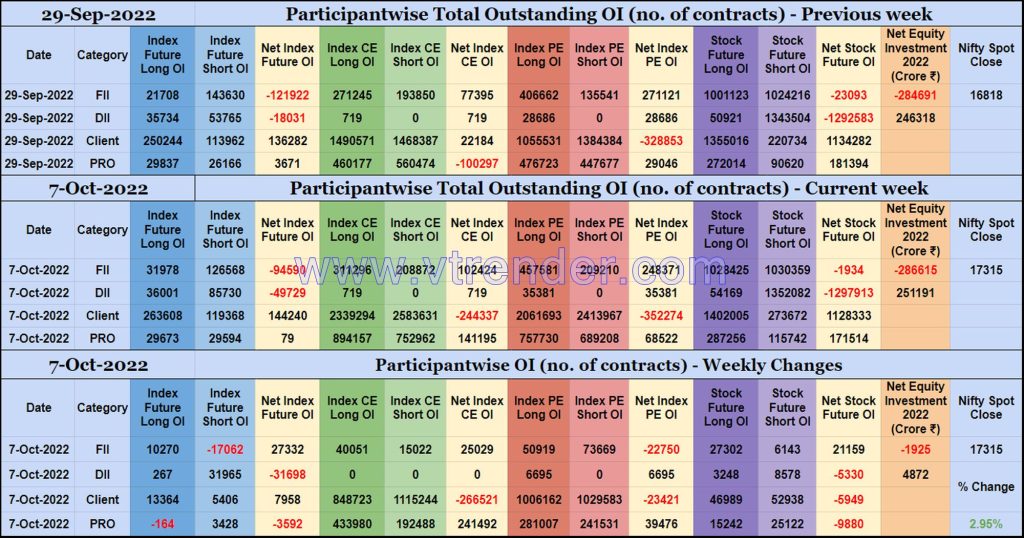

Participantwise Open Interest (Weekly changes) – 7th OCT 2022

Weekly changes in Participantwise Open Interest FIIs have added 10K long Index Futures, net 25K long Index CE, net 22K short Index PE and net 21K long Stocks Futures contracts this week besides covering 17K short Index Futures contracts. FIIs have been net sellers in equity segment for ₹1925 crore during the week. Clients have […]

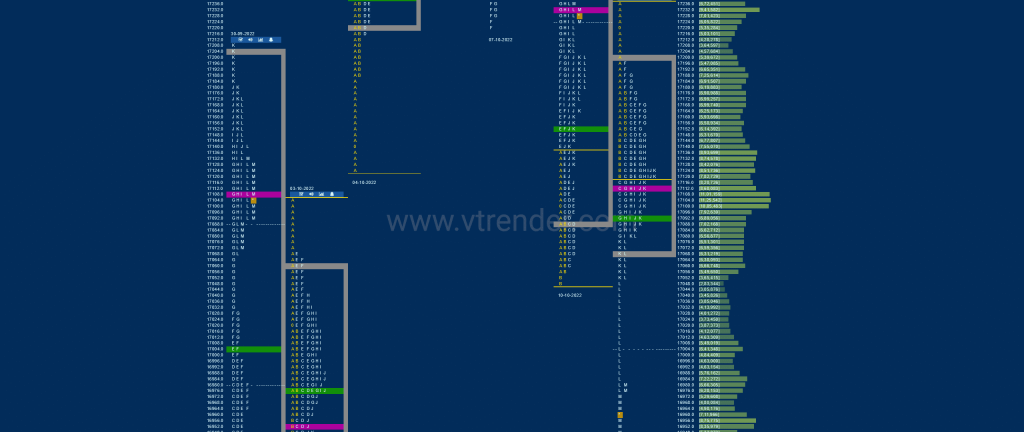

Market Profile Analysis dated 07th Oct 2022

Nifty Oct F: 17328 [ 17354 / 17220 ] NF made an OAOR (Open Auction Out of Range) start and went on to break below 04th Oct’s VPOC of 17267 while making a low of 17247 where it took support just above that day’s VWAP of 17243 triggering a quick short covering bounce to 17354 in […]

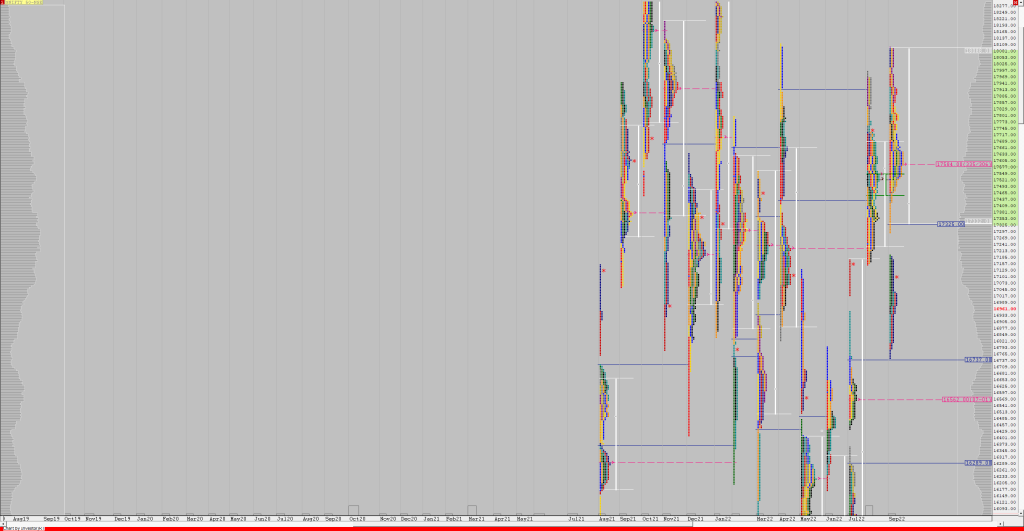

Weekly Charts (03rd to 07th Oct 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (03rd to 07th Oct 2022) 17314 [ 17428 / 16855 ] Previous week’s report ended with this ‘The weekly profile is a well balanced one inside a narrow range of 449 points with completely lower Value at 16920-17016-17124 with a bit of filling needed in the zone of 16854 to 17087 […]

Weekly Settlement Charts (30th Sep to 06th Oct 2022) and Market Profile Analysis for NF & BNF

NF Weekly Profile (30th Sep to 06th Oct 2022) 17325 [ 17444 / 16764 ] Friday: NF began the week by looking below previous poor lows of 16800 as it hit 16764 but got rejected and swiped through previous Value with a huge Trend Day Up of 445 points as it left couple of extension handles […]

Market Profile Analysis dated 06th Oct 2022

Nifty Oct F: 17325 [ 17444 / 17313 ] NF opened with another gap up of 128 points and tagged the 23rd Sep LVN of 17444 to the dot after which it settled down into an OAOR (Open Auction of Range) leaving a small selling tail till 17426 and forming a narrow 98 point range IB […]

Market Profile Analysis dated 04th Oct 2022

Nifty Oct F: 17293 [ 17309 / 17125 ] NF not only opened with a big gap up of 244 points but continued to drive higher in the IB forming a large range of 148 points as it left an initiative buying tail from 17191 to 17125 and made a high of 17273 testing the 26th […]

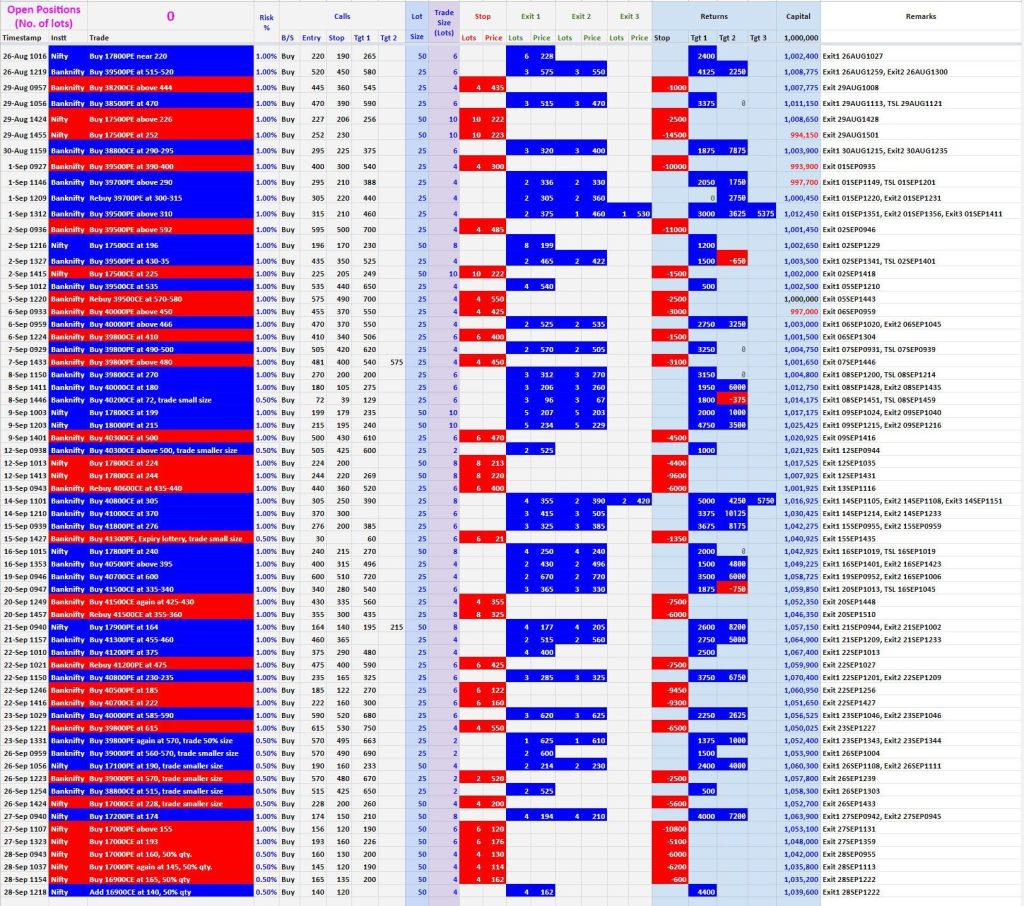

Making sense Sept 2022

Sept was a volatile month and nifty dropped 4% in Sept in 2 way swings. We started sept well but lost on some trades and could finish at 3.9% Here is a breakdown of all the trades we took in Sept. as the market got volatile we reduced allocation to trade and set it at […]