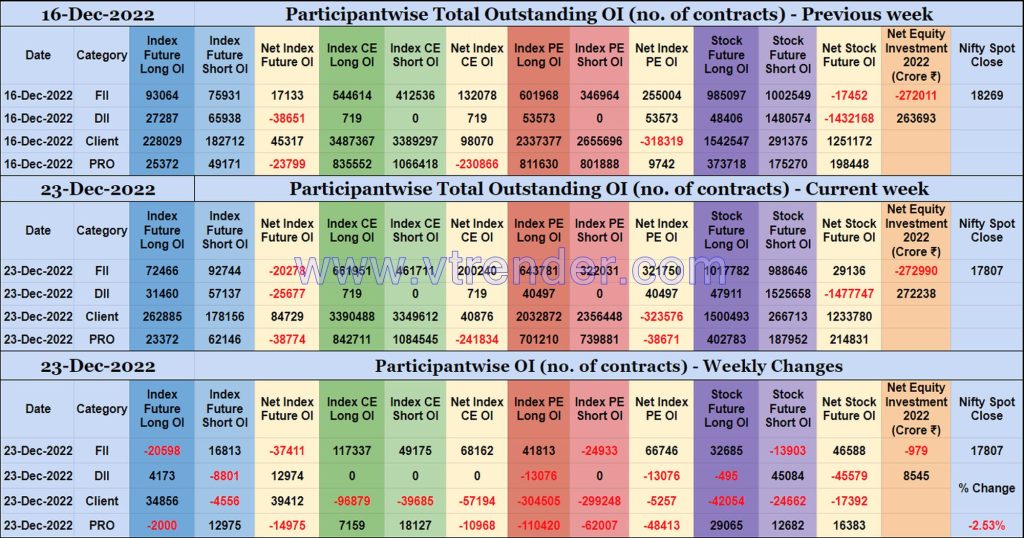

Participantwise Open Interest (Weekly changes) – 23rd DEC 2022

Weekly changes in Participantwise Open Interest FIIs have added 16K short Index Futures, net 68K long Index CE, 41K long Index PE and 32K long Stocks Futures contracts this week besides liquidating 20K long Index Futures contracts and covering 24K short Index PE and 13K short Stocks Futures contracts. FIIs have been net sellers in […]

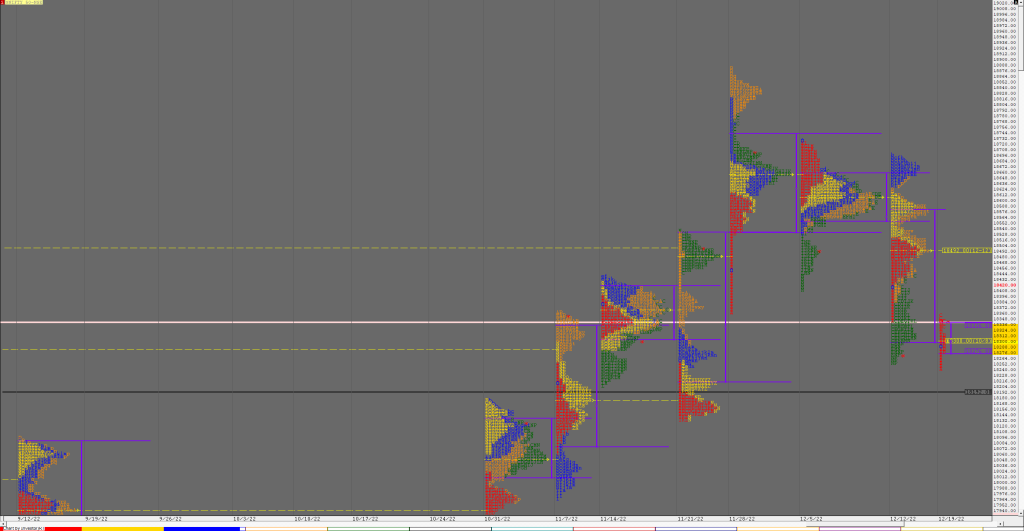

Market Profile Analysis dated 23rd Dec 2022

Nifty Dec F: 17864 [ 18115 / 17831 ] NF opened lower and made an attempt to get back into previous day’s range in the A period but was swiftly rejected from 18115 as it left an initiative selling tail & along an extension handle at 18036 in the IB (Initial Balance) after which it left […]

Market Profile Analysis dated 22nd Dec 2022

Nifty Dec F: 18170 [ 18357 / 18112 ] NF made a higher open and as expected got rejected from yVWAP of 18350 as it left another initiative selling tail from 18323 to 18357 along with an extension handle at 18235 and made a OTF (One Time Frame) probe lower for the first half of the […]

Market Profile Analysis dated 21st Dec 2022

Nifty Dec F: 18276 [ 18515 / 18223 ] NF continued previous session’s imbalance close with a higher open & a tag of the 19th Dec’s VPOC of 18497 along with an entry into that day’s selling tail from 18504 to 18519 but it could only make a high of 18515 signalling the return of OTF […]

Market Profile Analysis dated 20th Dec 2022

Nifty Dec F: 18424 [ 18449 / 18231 ] NF not only opened lower but got rejected from yVWAP of 18428 confirming a Drive Down on huge volumes resulting in a big IB range of 197 points as it left a long selling tail from 18303 to 18440 and tested the 21st Nov Swing Low of […]

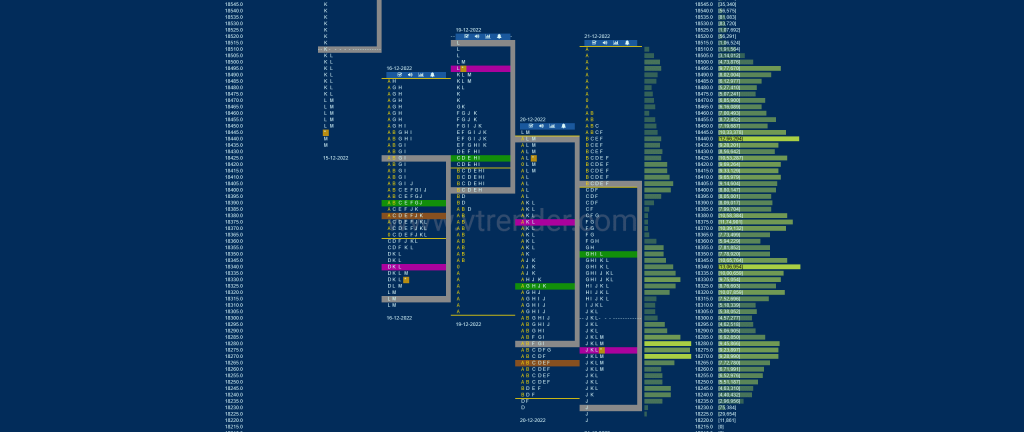

Market Profile Analysis dated 19th Dec 2022

Nifty Dec F: 18499 [ 18519 / 18308 ] NF opened with a look down below the poor lows of previous session but could only manage 18308 as it got swiftly rejected signalling some aggressive buying coming in which was further confirmed as it left an A period buying tail from 18345 to 18308 along with […]

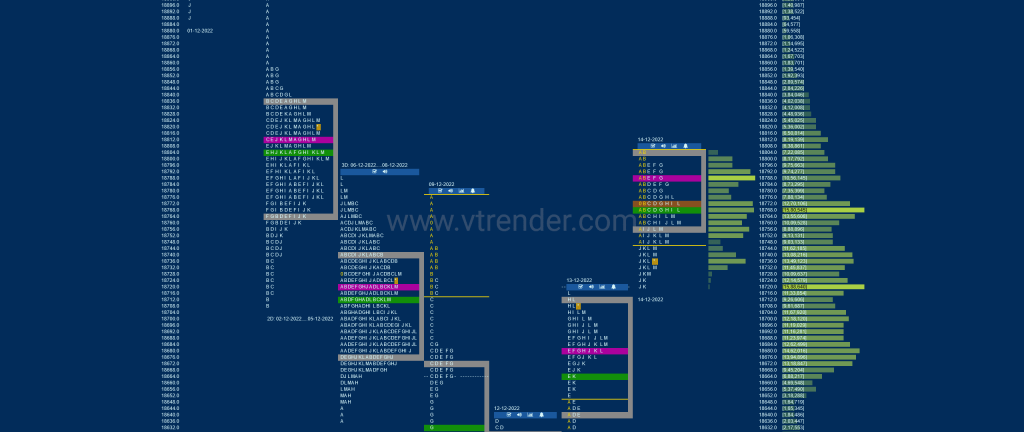

Market Profile Analysis dated 16th Dec 2022

Nifty Dec F: 18328 [ 18488 / 18313 ] NF continued the Trend Day imbalance with a lower open and took support at the 22nd Nov Closing singles of 18375 as it made a low of 18367 triggering a sharp bounce higher where it stalled near the lowermost extension handle of 18477 from yesterday while making […]

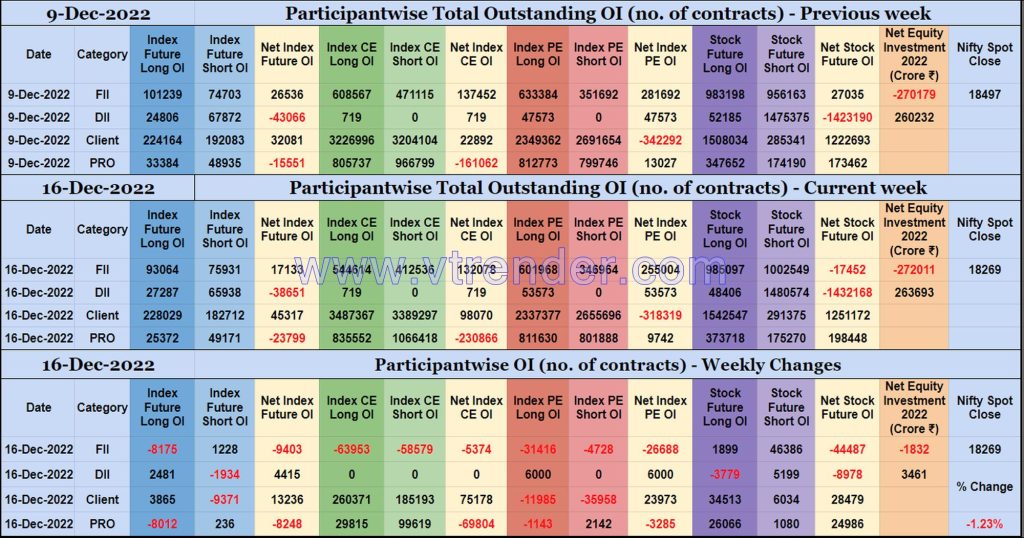

Participantwise Open Interest (Weekly changes) – 16th DEC 2022

Weekly changes in Participantwise Open Interest FIIs have added 1K short Index Futures and net 44K short Stocks Futures contracts this week besides liquidating 8K long Index Futures contracts and shedding OI in Index Options. FIIs have been net sellers in equity segment for ₹1832 crore during the week. Clients have added 3K long Index […]

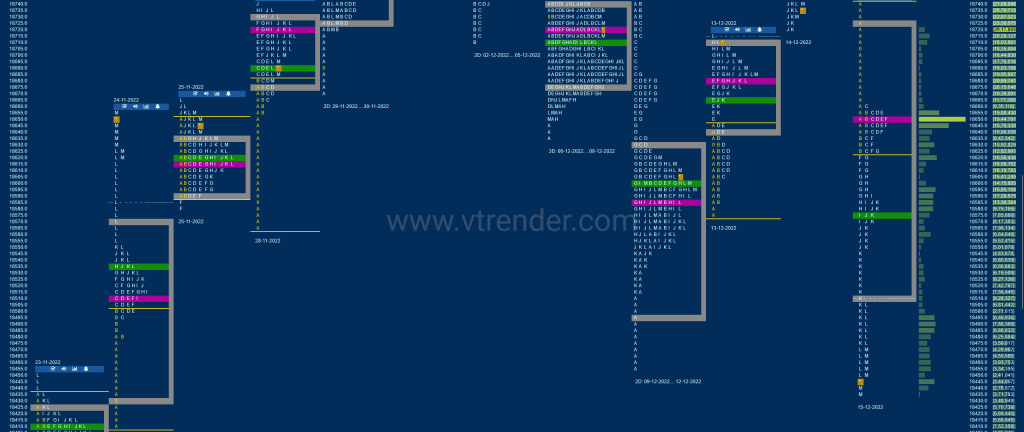

Market Profile Analysis dated 15th Dec 2022

Nifty Dec F: 18467 [ 18742 / 18437 ] NF gave the second ORR (Open Rejection Reverse) Down start of this week leaving an initiative selling tail from 18742 to 18662 after which it formed a narrow range balance after taking support just above the HVN of 18620 building volumes right at the RO point of […]

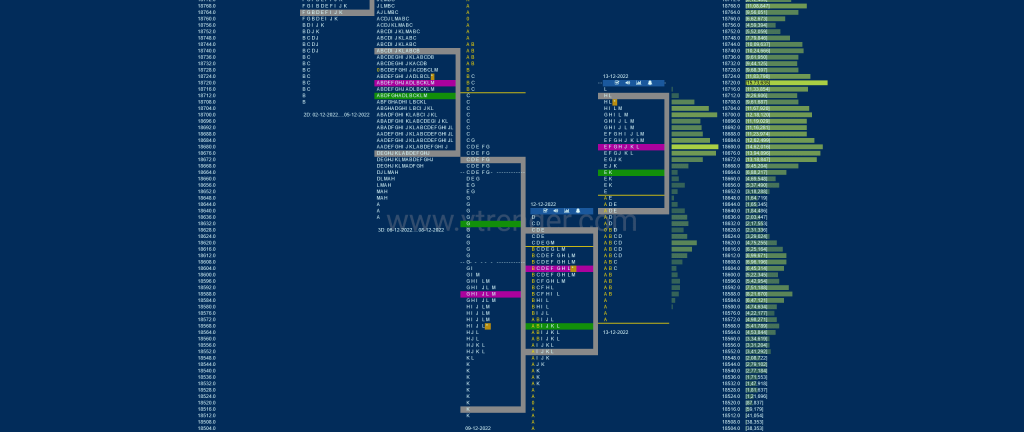

Market Profile Analysis dated 14th Dec 2022

Nifty Dec F: 18748 [ 18807 / 18720 ] NF opened with a gap up negating the 09th Dec’s Trend Day’s selling tail from 18747 to 18777 and even went on to almost tag the 2-day composite VPOC (2nd & 5th Dec) of 18809 while making a high of 18807 in the A period but settled […]