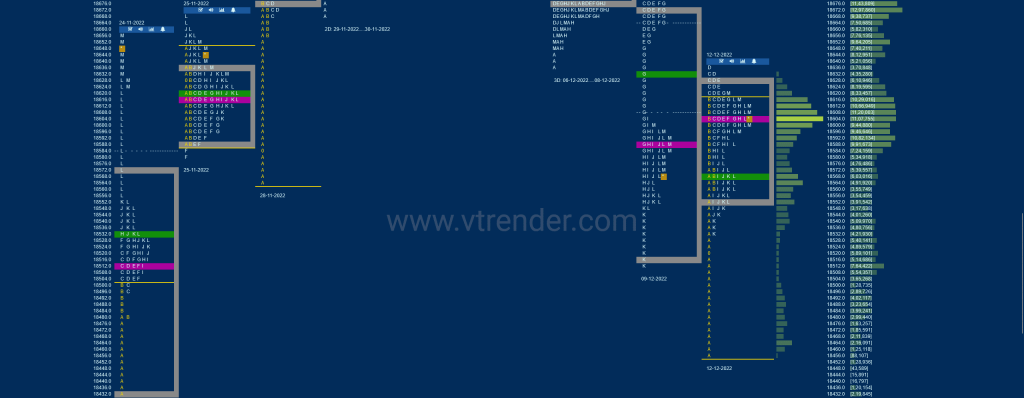

Market Profile Analysis dated 13th Dec 2022

Nifty Dec F: 18703 [ 18718 / 18575 ] NF opened higher but stalled just below the lower extension handle of 18654 from 09th Dec’s elongated Trend Day profile triggering a probe lower in the A period as it got back into previous Value and broke below the yPOC of 18606 and went on to test […]

Market Profile Analysis dated 12th Dec 2022

Nifty Dec F: 18605 [ 18638 / 18456 ] NF continued previous session’s imbalance to the downside with a lower open as it broke below the 24th Nov VPOC of 18513 probed into the initiative buying tail of that making a low of 18456 taking support just above the singles mid-point and confirmed yet another ORR […]

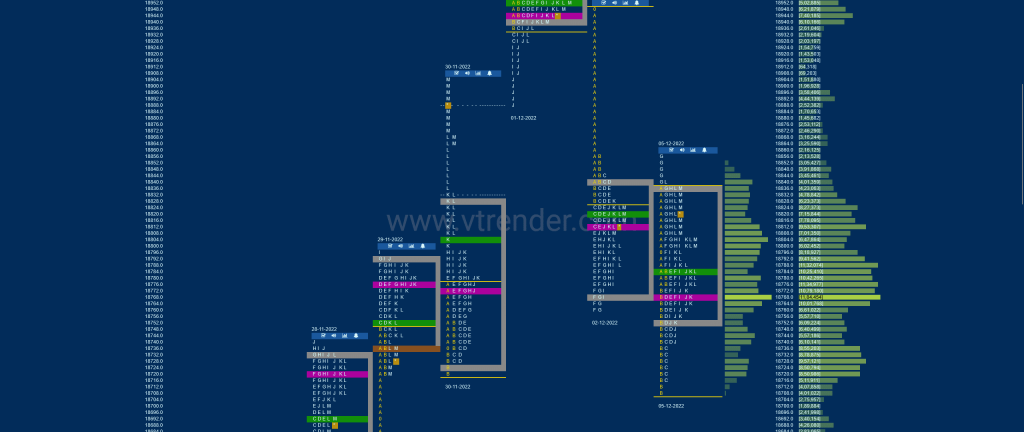

Market Profile Analysis dated 09th Dec 2022

Nifty Dec F: 18583 [ 18777 / 18515 ] NF opened higher and tagged the FA (Failed Auction) of 18775 but could only manage 18777 as the other time frame sellers came back strongly to confirm an ORR (Open Rejection Reverse) down leaving an initiative selling tail till 18747 along with 3 extension handles at 18732 […]

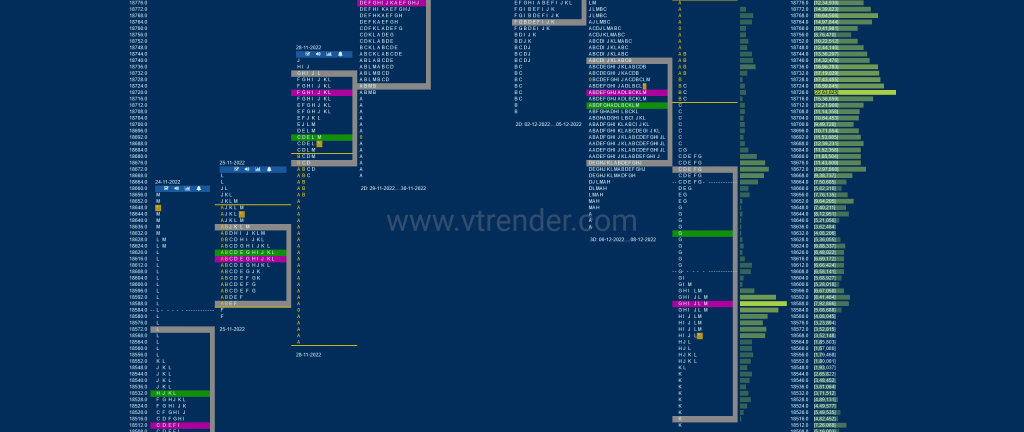

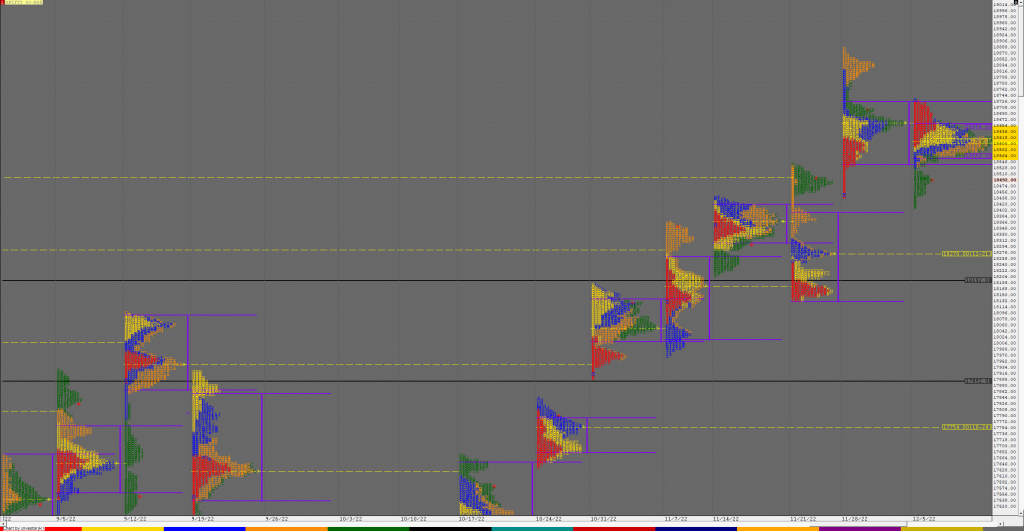

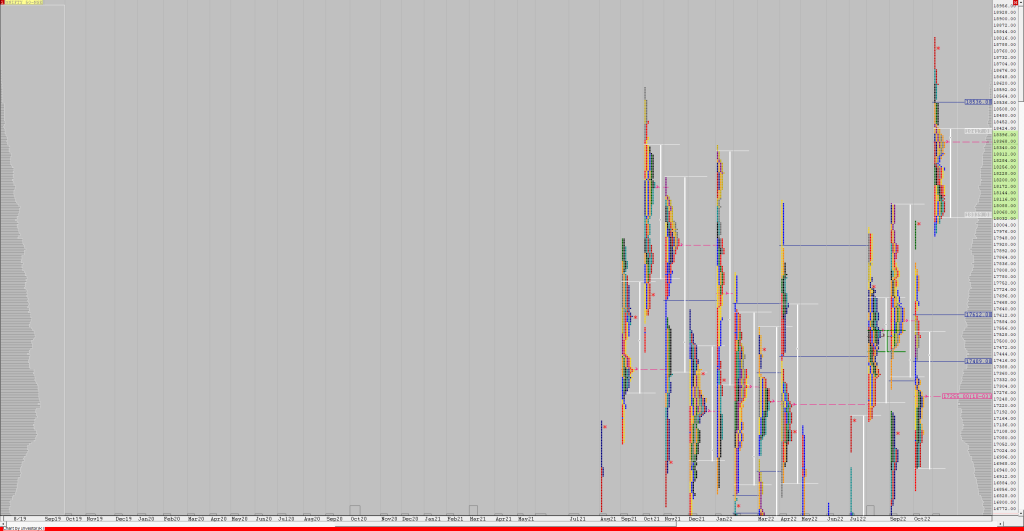

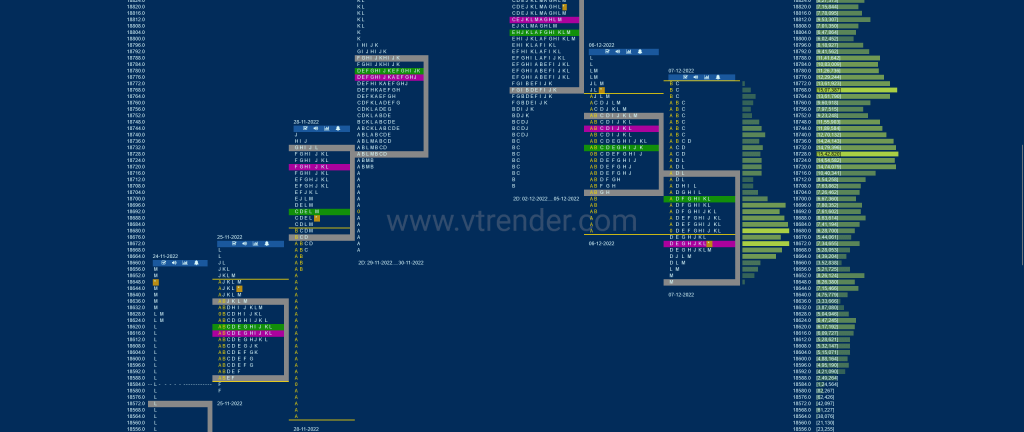

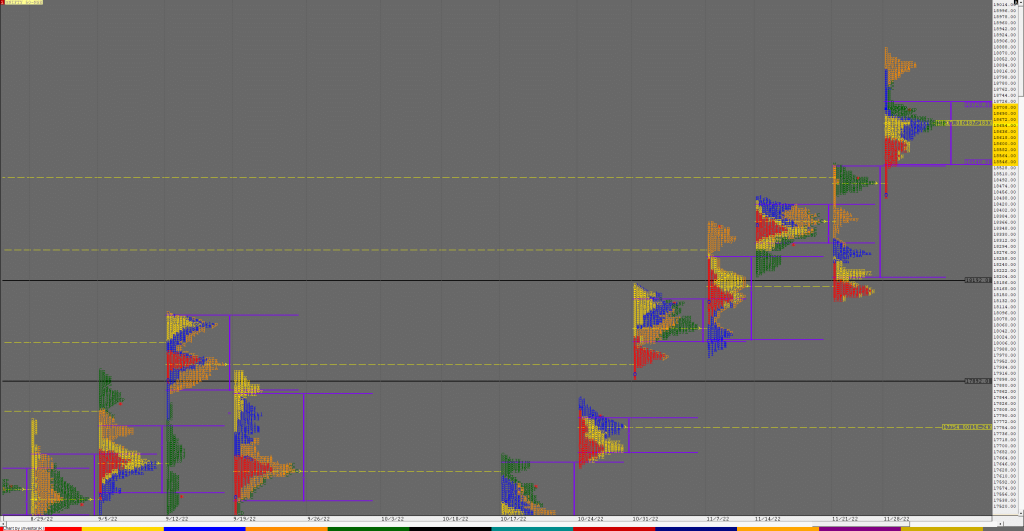

Weekly Charts (05th to 09th Dec 2022) and Market Profile Analysis

Nifty Spot Weekly Profile (05th to 09th Dec 2022) 18496 [ 18728 / 18410 ] Previous week’s report ended with this ‘The weekly profile resembles a Double Distribution Trend one to the upside which started with a drive up & recorded new ATH of 18887 with completely higher Value at 18540-18660-18720 but has closed in […]

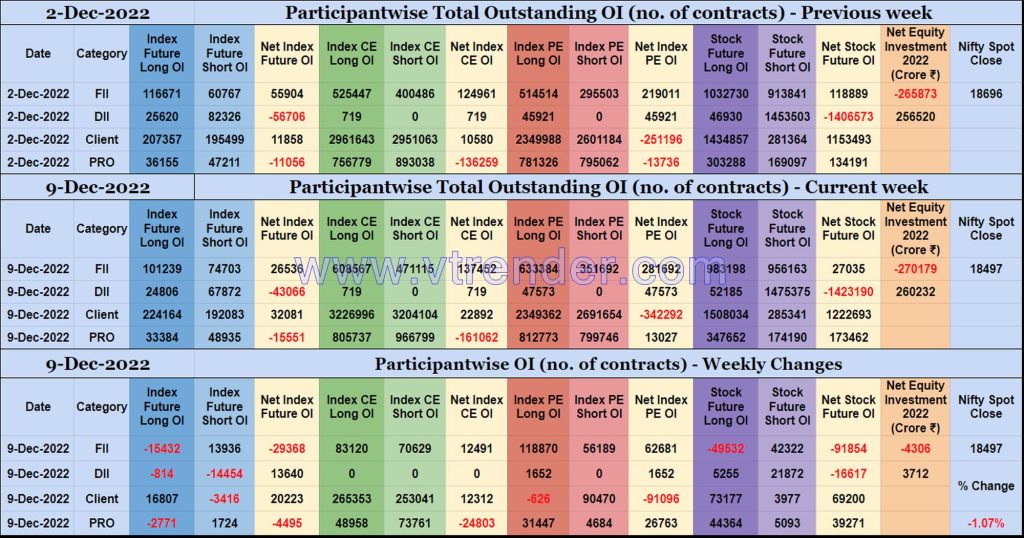

Participantwise Open Interest (Weekly changes) – 9th DEC 2022

Weekly changes in Participantwise Open Interest FIIs have added 13K short Index Futures, net 12K long Index CE, net 62K long Index PE and 42K short Stocks Futures contracts besides liquidating 15K long Index Futures and 49K long Stocks Futures contracts. FIIs have been net sellers in equity segment for ₹4306 crore during the week. […]

Market Profile Analysis dated 08th Dec 2022

Nifty Dec F: 18720 [ 18740 / 18637 ] NF opened with a probe below PDL as it made new lows of the week at 18637 almost completing the 1 ATR target of 18633 from yesterday’s FA (Failed Auction) of 18775 but was rejected back into previous day’s range as it went on to make a […]

Market Profile Analysis dated 07th Dec 2022

Nifty Dec F: 18670 [ 18775 / 18650 ] NF opened lower and made a freak tick of 18680 but got back into previous Value completing the 80% Rule in the Gaussian Profile and made an attempt to get into the earlier 2-day balance while making a high of 18774 in the IB but a typical […]

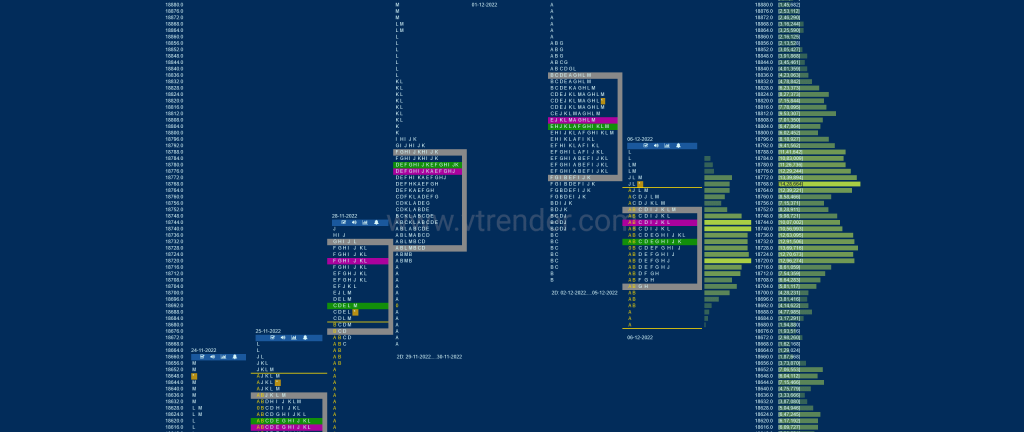

Market Profile Analysis dated 06th Dec 2022

Nifty Dec F: 18771 [ 18790 / 18682 ] NF opened lower below the 2-day VAL of 18773 & continued the fall down to 18682 looking like an Open Test Drive from just below yPOC of 18770 but then saw some good demand coming back from the VWAP zone of 28th Nov as the B period […]

Market Profile Analysis dated 05th Dec 2022

Nifty Dec F: 18817 [ 18856 / 18710 ] NF made an OAIR start in previous Value and went on to repair the poor lows at 18760 as it made a low of 18710 in the IB after which it made an attempt to make a range extension higher in the G period but got stalled […]

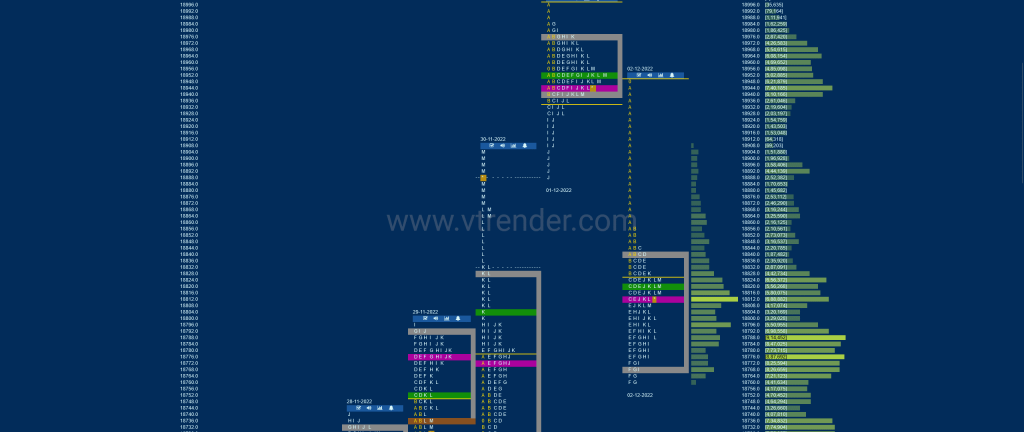

Market Profile Analysis dated 02nd Dec 2022

Nifty Dec F: 18812 [ 18949 / 18760 ] NF started the day with an Open Drive Down from previous day’s prominent POC of 18945 leaving a long initiative selling tail from 18949 to 18856 and continued to probe lower for the first half of the day making multiple REs to hit 18760 in the F […]