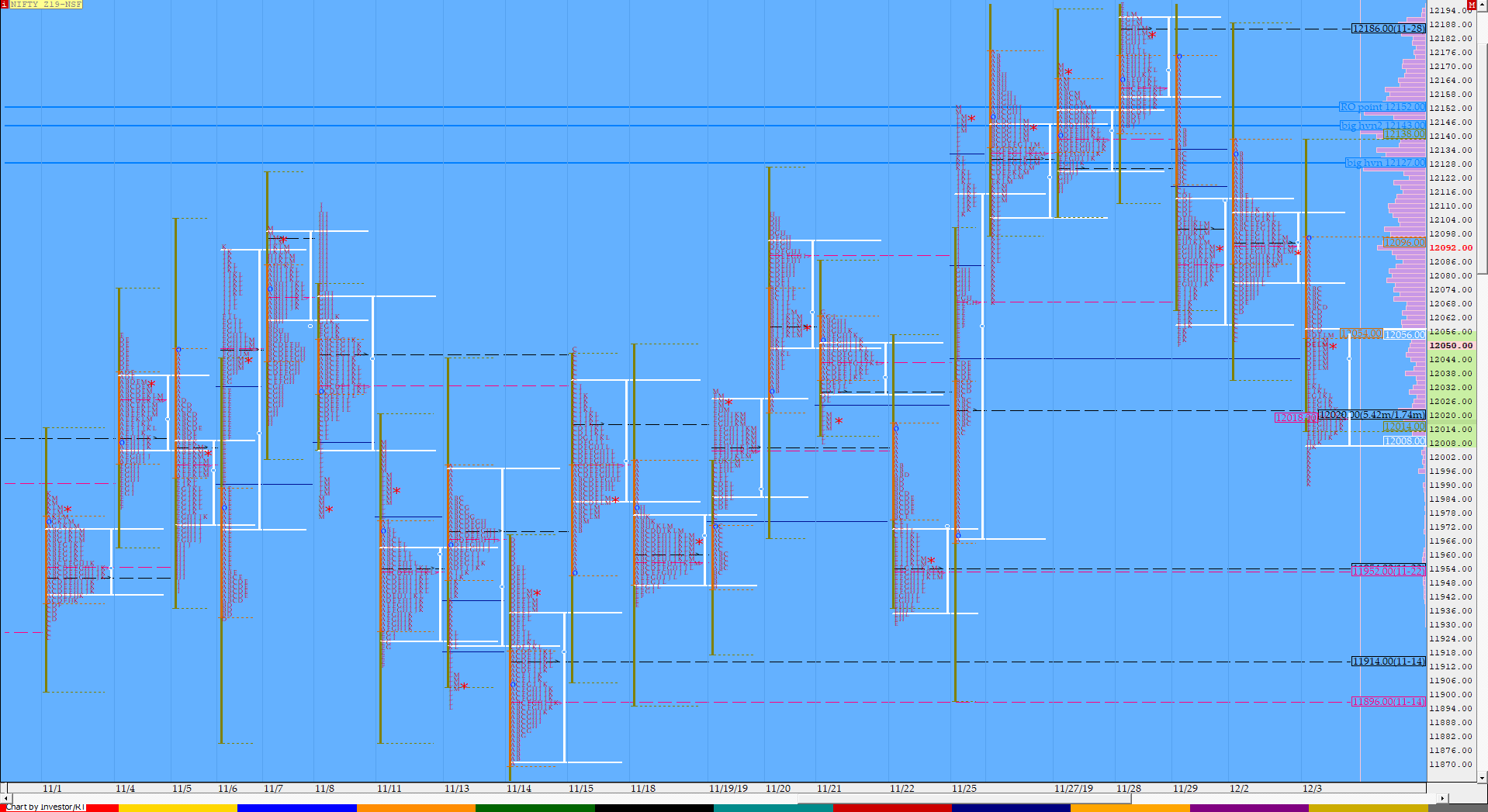

Nifty Dec F: 12046 [ 12097/ 11991 ]

HVNs – 11914 / 11954 / 12020 / 12047 / (12093-100) / 12128-143 / 12192

Previous day’s report ended with this ‘NF formed another balanced profile with overlapping value and almost similar POC at 12094 and looks set to give a move from this POC in the coming session to test one of the VPOCs of 12186 or 12022’

NF did gave a move away from the yPOC at the open as it left a selling tail from 12075 to 12091 in the IB (Initial Balance) as it made lows of 12055 taking mechanical support near the lows of the last 2 days after which ‘C’ period made an inside bar as it made similar highs as ‘B’ but got rejected at VWAP which indicated that the sellers were still in control. The auction then made a RE (Range Extension) to the downside in the ‘D’ period and continued lower in the ‘E’ period as it tagged the VPOC of 12022 while making lows of 12011. NF went on to make couple of more REs down in the ‘H’ & ‘K’ period as it made new day lows of 11991 where it made a swift rejection resulting in a big short covering move as NF got back above VWAP to tag the IBL of 12055 before closing at the dPOC of 12047 leaving another ‘b’ shape profile on the daily with Value forming completely lower. 12047 & 12020 are the 2 HVNs (High Volume Nodes) which could act as demand zones in the next session.

(Click here to view NF moving away from the 2-day balance)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 12047 F

- Vwap of the session was at 12038 with volumes of 75.6 L and range of 106 points as it made a High-Low of 12097-11991

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12021-12047-12076

Hypos / Estimates for the next session:

a) NF needs to get above 12055-60 & sustain for a move to 12076-91 & 12111

b) Immediate support is at 12038 below which the auction could test 12020 / 11998-970

c) Above 12111, NF can probe higher to 12138-141 / 12166 & 12181-192

d) Below 11970, auction becomes weak for 11955-930 & 11914-901

e) If 12192 is taken out, the auction go up to to 12215-224 / 12245 & 12281

f) Break of 11901 can trigger a move lower to 11885 / 11860-852 & 118332

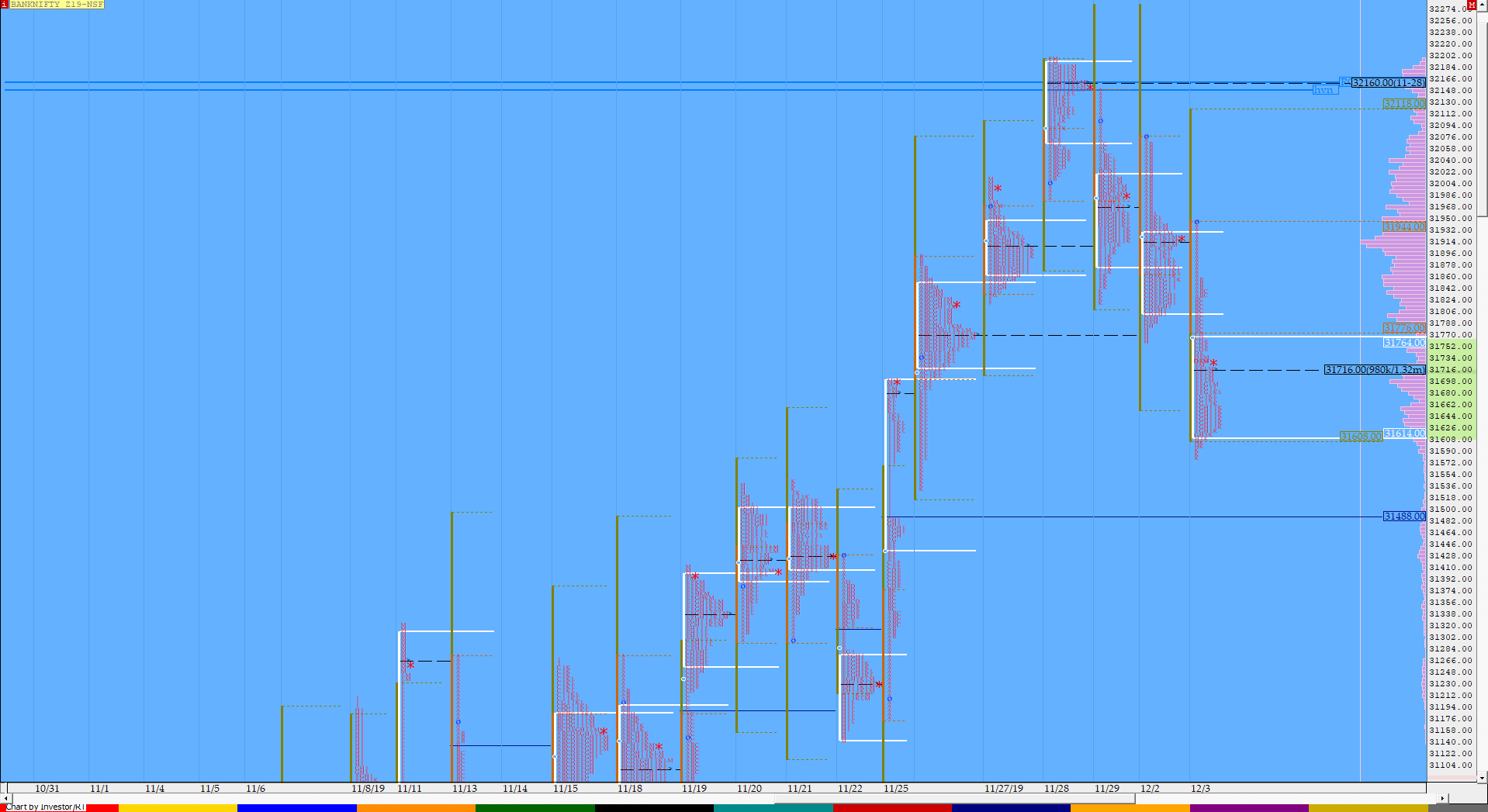

BankNifty Dec F: 31711 [ 31949 / 31580 ]

HVNs – 31426 / 31470 / (31640) / 31720 / 31854 / 31910 / 32000 / [32150-160]

BNF also moved away from the yPOC of 31910 at open giving a trending move lower all day as it made an OTF (One Time Frame) move down for most part of the day ans in the process made new lows for the week at 31580 before closing at the combo of VWAP & dPOC of 31710 turning the Trend Day Down profile to a ‘b’ shape one with Value for the day was completely lower.

(Click here to view the auction moving away from the 2-day composite ‘b’ profile in BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 31720 F

- Vwap of the session was at 31710 with volumes of 24.6 L and range of 368 points as it made a High-Low of 31949-31580

- The Trend Day VWAP of 25/11 at 31532 will be important reference on the downside.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- BNF had confirmed a FA at 30175 on 06/11 and tagged the 2 ATR target of 31172. This FA has not been tagged since & hence is now positional support

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31630-31720-31766

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31720 for a rise to 31765 / 31825-850 & 31890-910

b) Staying below 31710, the auction could test 31665-640 / 31590 & 31532

c) Above 31910, BNF can probe higher to 31960-970 / 32010 & 32060-75

d) Below 31532, lower levels of 31485 / 31426* & 31374 could be tagged

e) If 32075 is taken out, BNF can give a fresh move up to 32120 / 32170-185 & 32222

f) Below 31374, we could see lower levels of 31308 / 31255 & 31190

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout