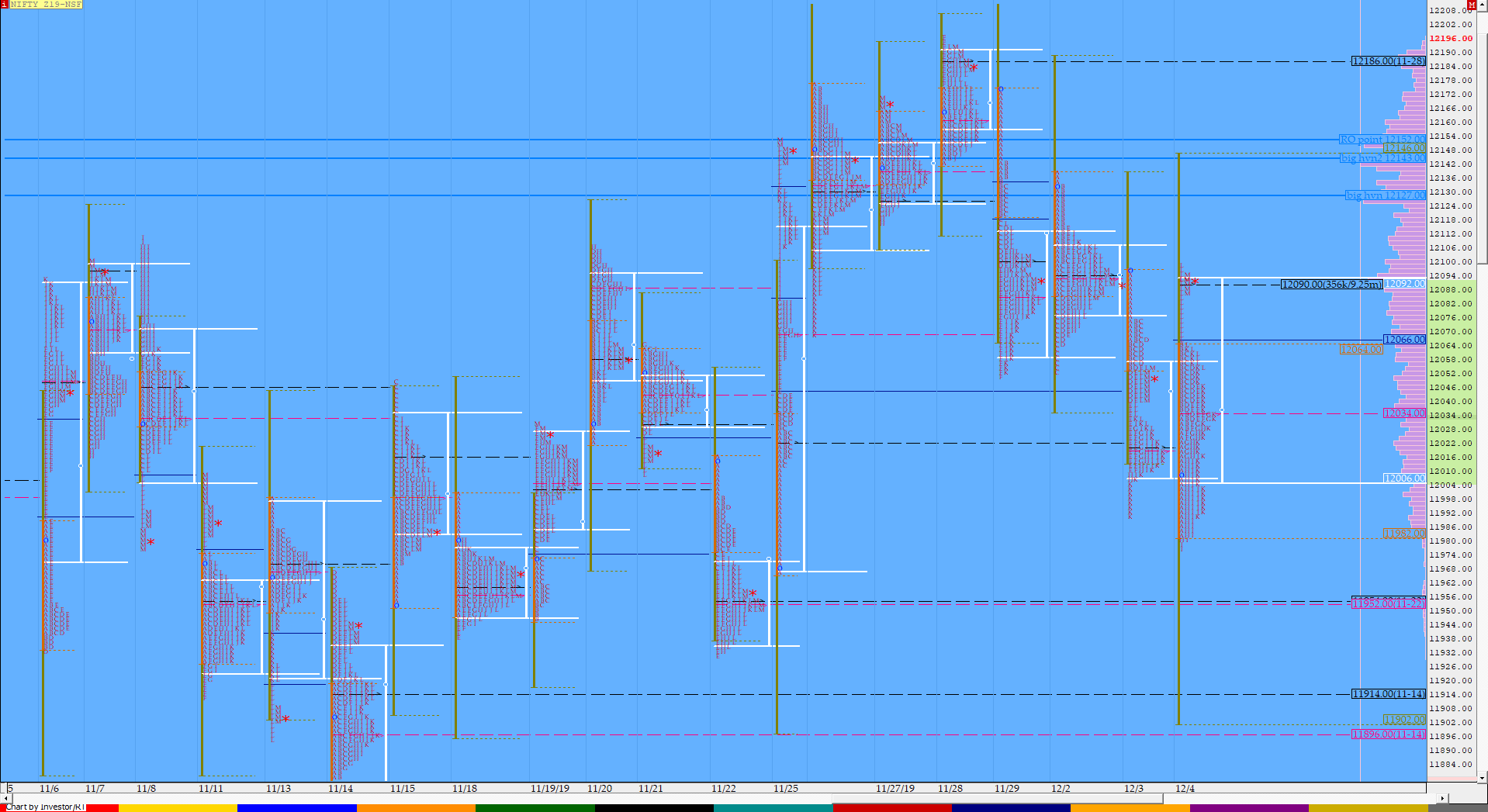

Nifty Dec F: 12090 [ 12098/ 11977 ]

HVNs – 11914 / 11954 / 12000 / 12048 / 12090 / 12128-143 / 12192

NF opened with a gap down below the 2 HVNs of 12047 & 12020 and probed lower catching the previous day longs by surprise as it broke below PDL (Previous Day Low) in the opening 15 minutes tagging new lows for the week at 11983 but was swiftly rejected as the auction got back into the previous day’s range scaling above VWAP as it went on to make new highs of the day at 12034 as the ‘A’ period closed to confirm an ORR Up (Open Rejection Reverse). NF continued to move higher in the ‘B’ period as it got above the HVN of 12047 and made highs of 12065 leaving the highest range & volumes in the IB (Initial Balance) in over a month but did not find fresh demand it needed to get into the previous day’s selling tail of 12075 to 12091. The auction then began a slow probe down post IB as it made lower lows till the ‘I’ period and the fall accelerated in the ‘H’ period as NF got some big volumes below VWAP and went on to make new lows for the day at 11981 and this imbalance was carried on at the start of the ‘I’ period as 11977 was tagged but just as had happened at IBH in the morning, there seem to be no fresh supply below IBL in the afternoon because of which the auction once again got back into previous day’s range as it closed the ‘I’ period. The ‘J’ period then made higher high on 30 mins which also marked the end of the OTF move down since IB as NF approached VWAP after which the ‘K’ period made the killer move to the upside it is so accustomed to as it headed for the IBH which was not only tagged as the ‘L’ period began but the auction got into that selling tail negating it completely as it made highs of 12098 & in the process left an extension handle at 12065 and also confirmed a FA (Failed Auction) at 11977. The last 15 minutes saw volumes being build at 12090 as NF closed the day as a Neutral Extreme profile and the Neutral Extreme reference for the next session would be from 12065 to 12098. The day was also an outside bar with Value also overlapping and extending on both sides thus giving a nice 2-day balanced composite and the MPLite chart of the same can be viewed here.

- The NF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Neutral Extreme Day – Up (NeuX)

- Largest volume was traded at 12090 F

- Vwap of the session was at 12028 with volumes of 101.2 L and range of 121 points as it made a High-Low of 12098-11977

- NF confirmed a FA at 11977 on 04/12 and tagged the 1 ATR target of 12072. The 2 ATR objective from this FA comes to 12166

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12009-12090-12097

Hypos / Estimates for the next session:

a) NF needs to sustain above 12099-106 for a move to 12120 / 12138-141 & 12166

b) Staying below 12090 at open, the auction can test 12065-60 / 12040-34 & 12014-06

c) Above 12166, NF can probe higher to 12186*-192 / 11215-224 & 11245

d) Below 12006, auction becomes weak for 11986-977 / 11952 & 11930

e) If 12245 is taken out, the auction go up to to 12281 & 12310-333

f) Break of 11930 can trigger a move lower to 11914* / 11901-885 / 11860-852 & 11833

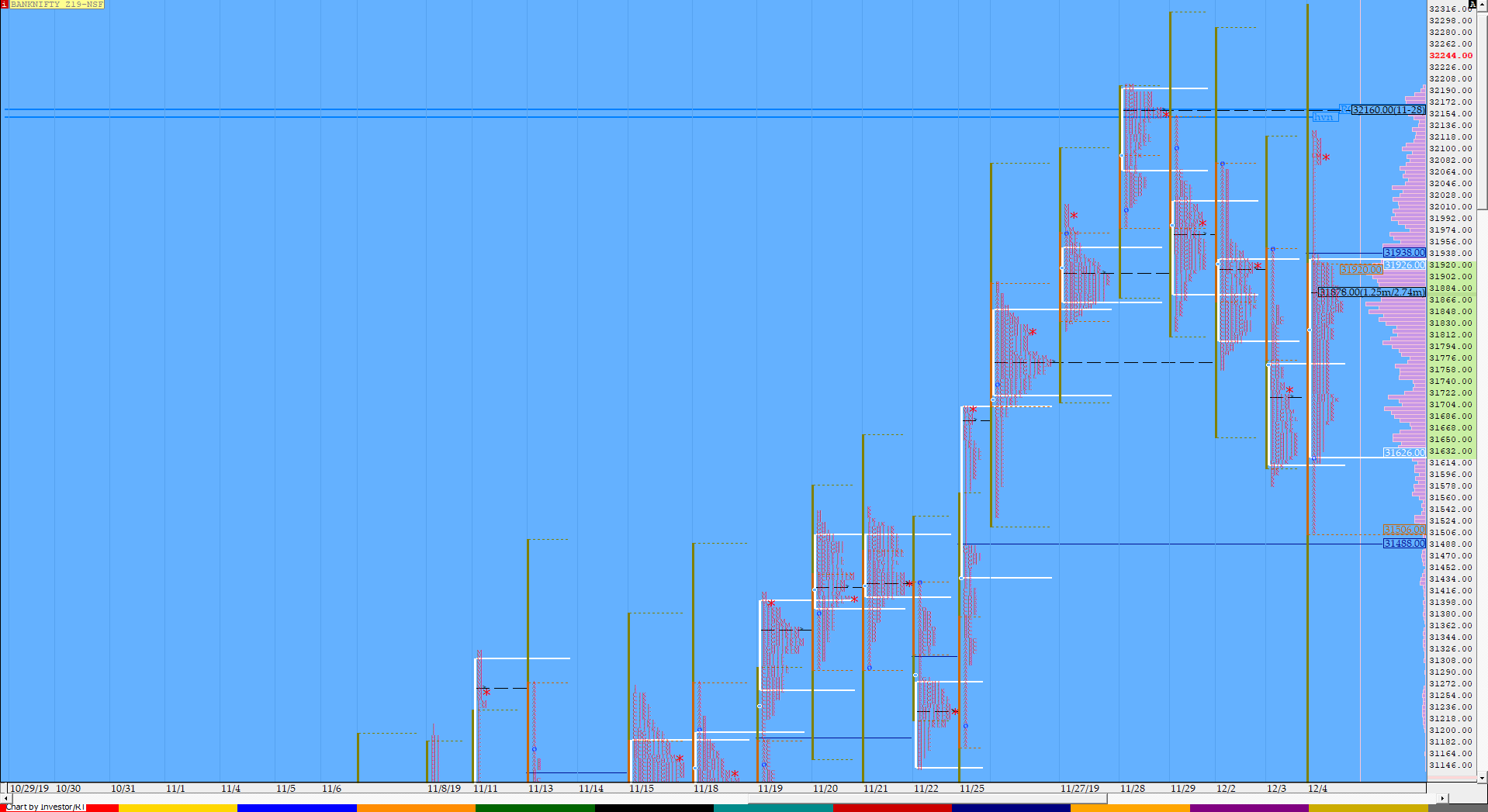

BankNifty Dec F: 32090 [ 32125 / 31511 ]

HVNs – 31426 / 31470 / 31860-890 / 32090 / [32150-160]

BNF also opened lower and broke below the PDL to make lows of 31511 in the opening 15 minutes thereby testing the important zone of the Trend Day VWAP of 25th Nov which was at 31532 and was swiftly rejected from there as it got back into previous days range and closed the gap in the ‘A’ period itself which was a sign that the buyers of that Trend Day are back. The auction continued to probe higher in the ‘B’ period as it went on to take out the PDH while making a high of 31922 leaving a huge IB range of 411 points which included a 200 point buying tail from 31711 to 31511 with the highest volumes in over a month just like it did in NF. A big IB leads to consolidation as BNF then started to form a balance in a narrow range making a ‘p’ shape profile as it stayed above VWAP till the ‘G’ period and the break of VWAP in the ‘H’ period led to a inventory adjustment move as the auction entered the morning buying tail and saw demand coming back just above the PDL of 31580 as it tagged 31619. The ‘I’ period then made a narrow range inside bar indicating that any fresh supply below VWAP was getting absorbed after which BNF probed higher in the next 2 periods to get above VWAP where it got rejected in the first attempt and left a PBL at 31676 just as the ‘K’ period began and then made a big move higher as it went on to make new highs for the day at 31936. BNF then spiked higher into the close as leaving an extension handle at 31936 to scale above 32000 and made new highs of 32125 in the last 15 minutes with volumes building up at 32090 where it eventually closed. The spike zone of 31935 to 32125 will be the immediate reference for the next session with a good chance of the auction making new all time highs repairing the poor highs it had left in the previous week.

(Click here to view the 4-day composite of the Dec BNF)

- The BNF Open was an Open Rejection Reverse – Up (ORR)

- The day type was a Normal Variation Day – Up (with a spike close)

- Largest volume was traded at 31890 F

- Vwap of the session was at 31806 with volumes of 41 L and range of 614 points as it made a High-Low of 32125-31511

- The Trend Day VWAP of 25/11 at 31532 will be important reference on the downside. The auction tested this zone on 04/12 and was swiftly rejected so this continues to be positional support.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31629-31890-31942

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32120 for a rise to 32160*-185 / 32222-265 & 32326

b) Immediate support is at 32060-35 below which the auction could test 31990-975 / 31935 & 31890-860

c) Above 32326, BNF can probe higher to 32376 / 32450-465 & 32510

d) Below 31860, lower levels of 31800-760 / 31700 & 31650 could be tagged

e) If 32510 is taken out, BNF can give a fresh move up to 32573-577 / 32628-682 & 32725-785

f) Below 31650, we could see lower levels of 31600 / 31530-485 & 31426

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout