Nifty May F: 9286 [ 9477 / 9245 ]

HVNs – 9354 / (9475) / 9800 / 9822-40

NF opened with a big gap down of over 400 points and continued to probe lower as it left a selling tail in the IB (Initial Balance) from 9422 to 9477 while making a low of 9343 in the ‘B’ period with the highest first hour volumes of 70L since 20th March. The auction then slowed down post IB to form a ‘b’ shape profile but remained below VWAP all day and even went on to leave an extension handle at 9317 in the ‘J’ period after which it completed the 1.5 IB objective of 9276 but took support just above previous week’s low of 9240 where it had seen good demand coming in last Monday. The close at 9286 was still below the day’s Value which obviously was much lower than the previous session but NF will need to break & sustain below 9240 for a move towards the weekly VPOC of 9177 and below it, the monthly POC of 9010. On the upside, the extension handle of 9317 & today’s POC of 9354 would be the important references below that initiative weekly selling tail we have at top.

- The NF Open was a Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day (Down) (‘b’ profile)

- Largest volume was traded at 9354 F

- Vwap of the session was at 9348 with volumes of 181.8 L and range of 232 points as it made a High-Low of 9477-9245

- NF confirmed a multi-day FA at 9142 on 27/04 and tagged the 2 ATR of 9715 on 30/04. This FA is currently on ‘T+6’ Days.

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAPs of 9518 & 8643 would be important support level. The first Trend Day VWAP of 9518 was broken on 04/05 & is no longer a support.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9312-9354-9443

Main Hypos for the next session:

a) NF needs to sustain above 9294 for a rise to 9312-36 / 9354*-81 / 9402-14 / 9432-43 & 9462-75

b) The auction gets weak below 9272 for a test of 9250-40 / 9222 / 9189-77** / 9142-11 & 9093

Extended Hypos:

c) Above 9475, NF can probe higher to 9513-49 / 9574 / 9616-25 & 9653-70

d) Below 9093, the auction can fall further to 9063-40 / 9012-00 / 8975-64 / 8940 & 8900

-Additional Hypos-

e) Sustaining above 9670` could take NF to 9721-30 / 9750-60 / 9796 / 9822 & 9840-68

f) If 8900` is taken out, NF can start a new leg down to 8876-45 / 8822-13 / 8792-60* / 8721 & 8706

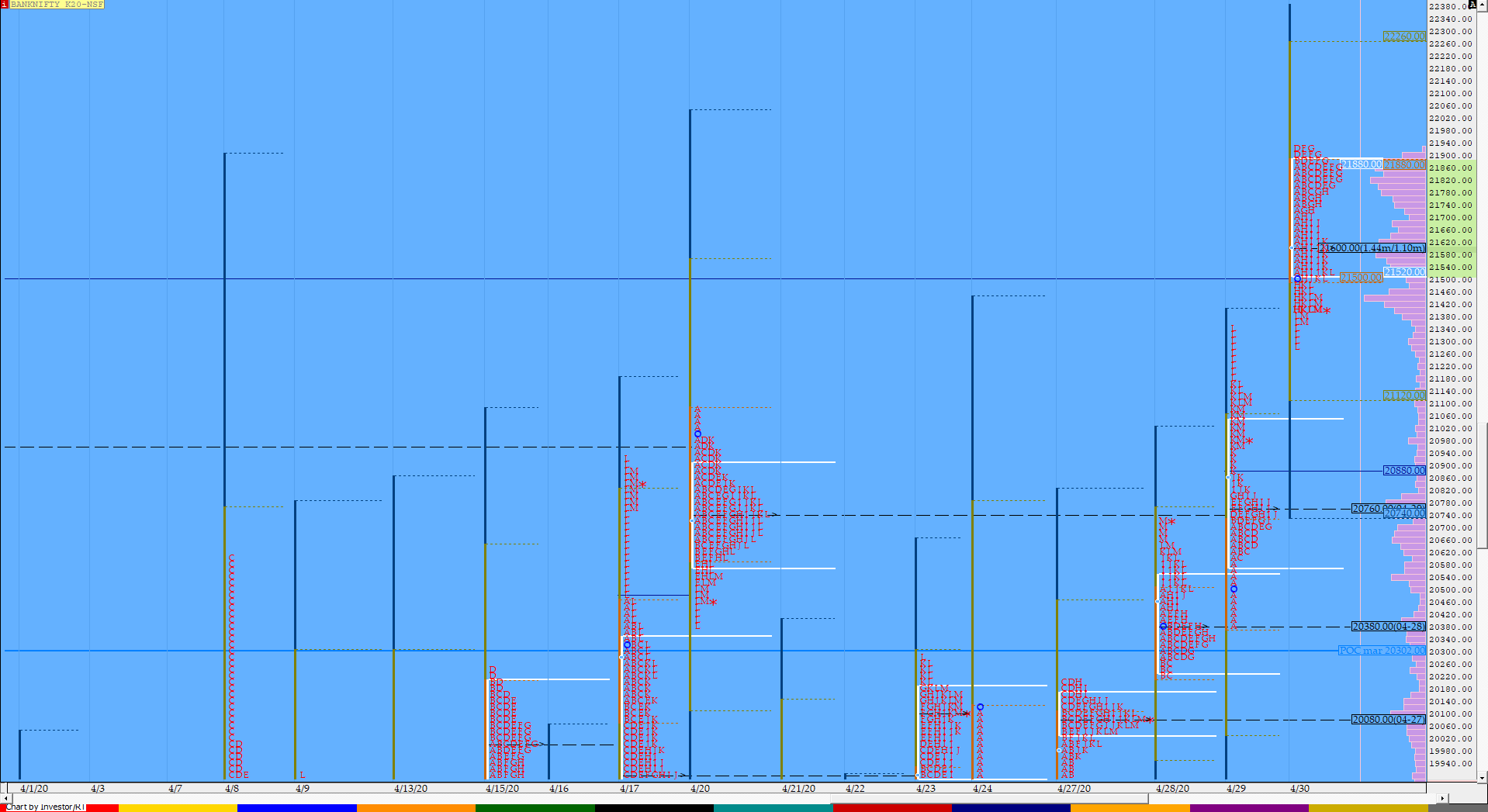

BankNifty May F: 19633 [ 20600 / 19505 ]

HVNs – 19840 / 20090 / 20765 / 21600 / (21850)

BNF also opened with a huge gap down and remained weak all day after leaving a big selling tail from 20078 to 20600 along with an extension handle at 20003 in the IB as it made lows of 19777 and in the process completed the 2 ATR objective of 20125 from the FA of 21932 it had confirmed in the previous session. The auction then remained largely in this IB range but below VWAP forming a ‘b’ shape profile with a prominent POC forming at 19840 and like NF, gave an extension handle on the downside in the ‘J’ period at 19760 as it made multiple REs till the ‘L’ period and in the process tagged the weekly VPOC of 19600 while making a low of 19505. BNF closed the day off the lows at 19633 but still below the extension handle of 19760 which would be the first important reference on the upside above which we have today’s POC of 19840 as the next supply point. On the downside, we have the positional FA reference of 19394 below today’s low which needs to be taken out for a new leg lower in the coming session(s).

- The BNF Open was a Open Auction Out of Range plus Drive (OAOR)

- The day type was a Normal Variation Day (Down) (‘b’ profile)

- Largest volume was traded at 19840 F

- Vwap of the session was at 19833 with volumes of 53.4 L and range of 1095 points as it made a High-Low of 20600-19505

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05.

- BNF confirmed a multi-day FA at 19394 on 27/04 and tagged the 2 ATR objective of 21406 on 30/04. This FA is currently on ‘T+6’ Days.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19637-19840-19969

Main Hypos for the next session:

a) BNF needs to sustain above 19680 for a rise to 19760-770 / 19833-860 / 19950-980 / 20078 & 20160-220

b) The auction has immediate support at 19600-570 below which it could test levels of 19500-444 / 19331-316 / 19275 / 19185-125 & 19020

Extended Hypos:

c) Above 20220, BNF can probe higher to 20396-430 / 20535 / 20600 / 20735-755 & 20840

d) Below 19020, lower levels of 18956 / 18860 / 18777-750 / 18690-603 & *18563* could come into play

-Additional Hypos`-

e) If 20840` is taken out, BNF could rise further to 20898-914 / 20975 / 21030 / 21090-116 & 21175

f) Below 18563`, the auction could start a new leg to 18420 / 18300* / 18236-215 / 18170 & 18100

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout