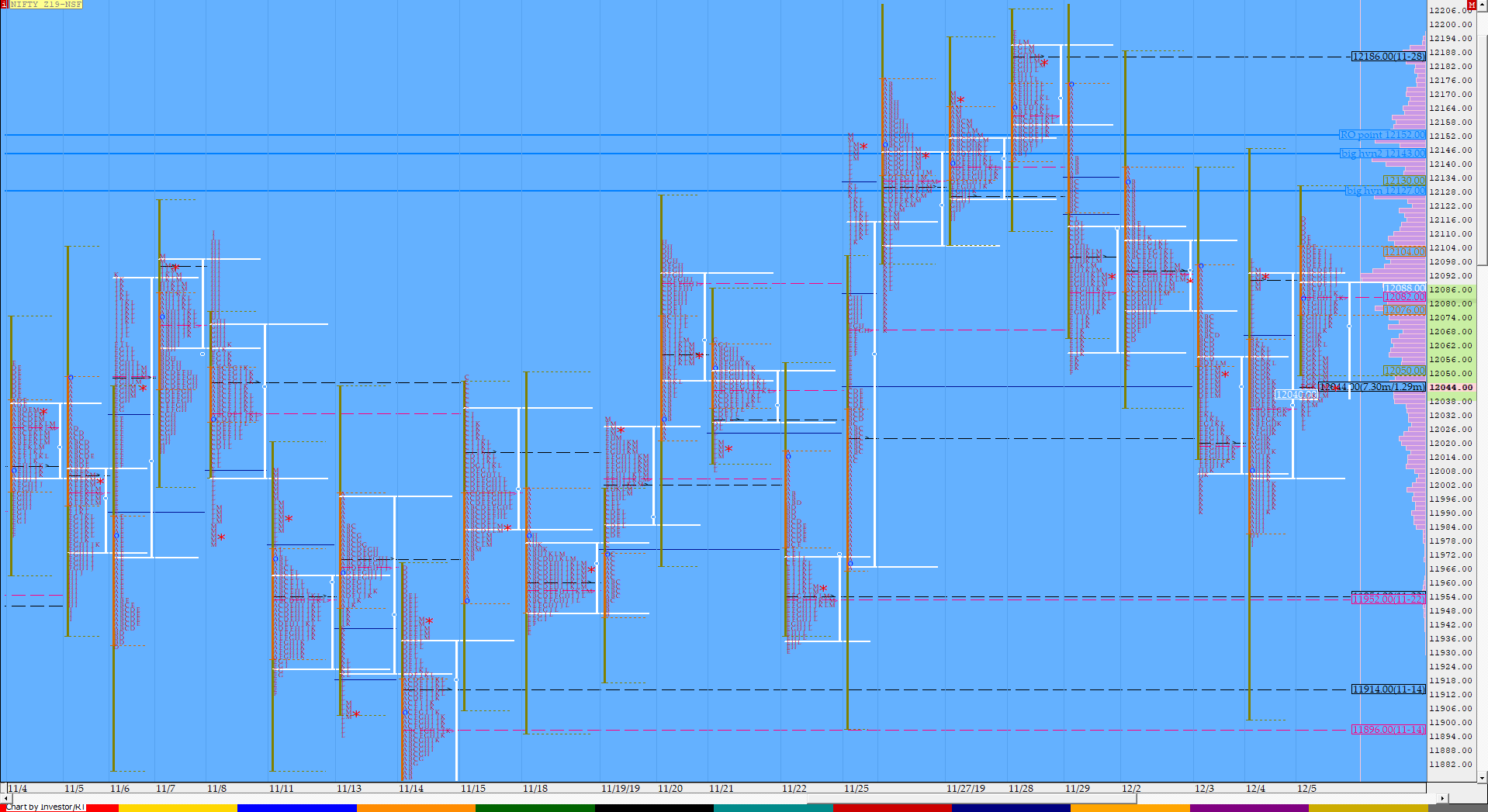

Nifty Dec F: 12048 [ 12116/ 12026 ]

HVNs – 11914 / 11954 / 12000 / 12045 / 12080-90 / 12108 / 12128-143 / 12192

NF began the day with an OA (Open Auction) start as it remained in the Neutral Extreme zone after making a high of 12104 in the opening minutes and stayed in a very narrow range of just 26 points till the ‘C’ period. The auction then made a RE (Range Extension) higher in the ‘D’ period as it spiked higher to 12116 but could not sustain above the IBH after which the ‘E’ period made an inside bar suggesting poor trade facilitation in this zone. The ‘F’ period then made a big move down as it broke below VWAP and went on to make new lows for the day as it broke below the Neutral Extreme lower reference of 12065 and completed the 2 IB objective of 12052 by making a low of 12038 and in the process confirmed a FA (Failed Auction) at day’s high of 12116. This quick imbalance led to a retracement over the next 3 periods as NF got back above VWAP and almost tagged the IBH in the ‘I’ period as it left a PBH (Pull Back High) at 12103 and this inability not being able to scale the IBH meant that the FA is still in play and the auction reversed the probe once again to the downside as it went on to make new lows of 12026 in the ‘L’ period completing the 3 IB move and narrowly missing the 1 ATR target of 12020 as it closed the day at the dPOC of 12048 leaving a second successive Neutral profile. NF has formed a nice 3-day balance with FAs at both the ends (11977 & 12116) and looks set to give a big move away from here in the coming few sessions. The MPLite chart of the 3-day composite could be viewed on here.

- The NF Open was an Open Auction (OA)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 12045 F

- Vwap of the session was at 12073 with volumes of 90.6 L and range of 89 points as it made a High-Low of 12116-12027

- NF confirmed a FA at 12116 on 05/12 and almost tagged the 1 ATR target of 12020. The 2 ATR objective from this FA comes to 11924

- NF confirmed a FA at 11977 on 04/12 and tagged the 1 ATR target of 12072. The 2 ATR objective from this FA comes to 12166. This FA is currently on ‘T+2’ Days

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12038-12045-12089

Hypos / Estimates for the next session:

a) NF needs to sustain above 12058 for a move to 12077-80 / 12098-103 & 12120

b) The auction has immediate support at 12030 below which it could fall to 12009 / 11986-977 & 11952*

c) Above 12120, NF can probe higher to 12138-141 / 12166 & 12186*-192

d) Below 11952, auction becomes weak for 11930 / 11914*-901 & 11883

e) If 12192 is taken out, the auction go up to to 12212-224 / 12245 & 12281

f) Break of 11883 can trigger a move lower to 11860-852* / 11833 & 11816*-810

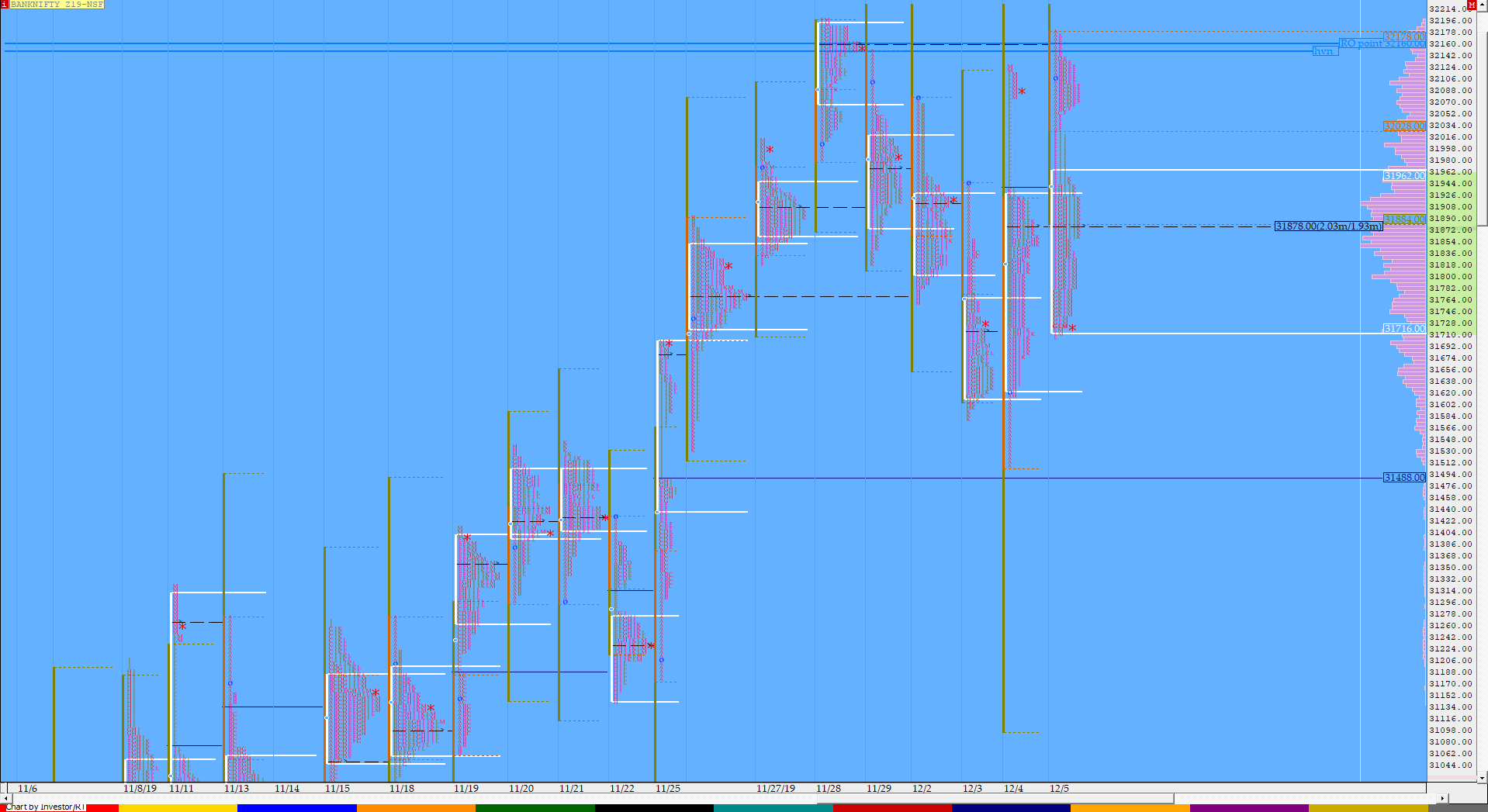

BankNifty Dec F: 31762 [ 32173 / 31705 ]

HVNs – 31426 / 31470 / 31720 / 31880 / 32090 / [32150-160]

BNF also gave an OA start as it opened in previous day’s spike and probed above PDH leaving a freak high of 32180 in the opening minute but could not sustain and this failure to repair previous week’s poor highs indicated that there was no demand coming in. Similar to NF, the auction stayed in a narrow range till the ‘E’ period where it once again made an attempt to probe higher but got stalled at 32173 after which the ‘F’ period made the big fall of 345 points confirming a daily FA at 32173 (if the freak tick of 32180 is ignored) and continued lower in the ‘G’ period where it made a low of 31725 completing the 3 IB move down and also confirming a weekly FA at day highs which is a bearish sign for BNF for the coming days. The big imbalance down then led to a bounce in the next 2 periods as the auction made a high of 32023 in the ‘I’ period stalling just below the morning extension handle of 32032 which meant that the supply was back after which BNF made a trending move lower into the close as it made new lows of 31705 and closed near the lows leaving a Neutral Extreme Down profile for the day. On a larger time frame, BNF has formed a big balance over the last 5 days and looks like could move away from here in the coming sessions.

(Click here to view the 5-day composite of the Dec BNF)

- The BNF Open was an Open Auction (OA)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 31880 F

- Vwap of the session was at 31920 with volumes of 41.6 L and range of 475 points as it made a High-Low of 32180-31705

- BNF confirmed a FA at 32173 on 05/12 and tagged the 1 ATR target of 31837. The 2 ATR objective from this FA comes to 31501

- The Trend Day VWAP of 25/11 at 31532 will be important reference on the downside. The auction tested this zone on 04/12 and was swiftly rejected so this continues to be positional support.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31735-31880-31954

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31765 for a rise to 31820 / 31865-880 & 31950-975

b) Immediate support is at 31720-705 below which the auction could test 31650 / 31600 & 31530-501

c) Above 31975, BNF can probe higher to 32019-25 / 32090 & 32150-168

d) Below 31501, lower levels of 31426* / 31374 & 31308 could be tagged

e) If 32168 is taken out, BNF can give a fresh move up to 32222 / 32265 & 32326-376

f) Below 31308, we could see lower levels of 31255 / 31195 & 31137

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout