Nifty Dec F: 11956 [ 12082/ 11931 ]

HVNs – 11914 / 11953 / 12090 / 12108 / 12128-143 / 12192

NF did give a move away from the 3-day balance as expected (read previous day’s report here) to the downside leaving a Trend Day Down with the auction almost tagging the 2 ATR objective of 11924 from the FA of 12116 as it made lows of 11931 stalling right at the earlier weekly FA of 11930 before giving a close at the dPOC of 11953. The Trend Day VWAP & PBH (Pull Back High) of 12005 & 12027 will be the important references on the upside for the coming session(s).

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 11953 F

- Vwap of the session was at 12005 with volumes of 96.9 L and range of 151 points as it made a High-Low of 12082-11931

- NF confirmed a FA at 12116 on 05/12 and almost tagged the 2 ATR objective of 11924 on 06/12.

- NF confirmed a FA at 11977 on 04/12 and tagged the 1 ATR target of 12072. This FA was tagged on ‘T+2’ Days

- The Trend Day VWAP of 06/12 at 12005 will be important reference on the upside.

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11932-11955-12013

Hypos / Estimates for the next session:

a) NF has immediate supply at 11967 above which it could rise to 11984-988 / 12005 & 12027-30

b) The auction has immediate support at 11930 below which it could fall to 11914-901 / 11883 & 11860

c) Above 12030, NF can probe higher to 12048-54 / 12075 & 12090-96

d) Below 11860, auction becomes weak for 11848-843 / 11816*-810 & 11795

e) If 12096 is taken out, the auction go up to to 12116-120 / 12138-141 & 12166

f) Break of 11795 can trigger a move lower to 11771-767 & 11749-744

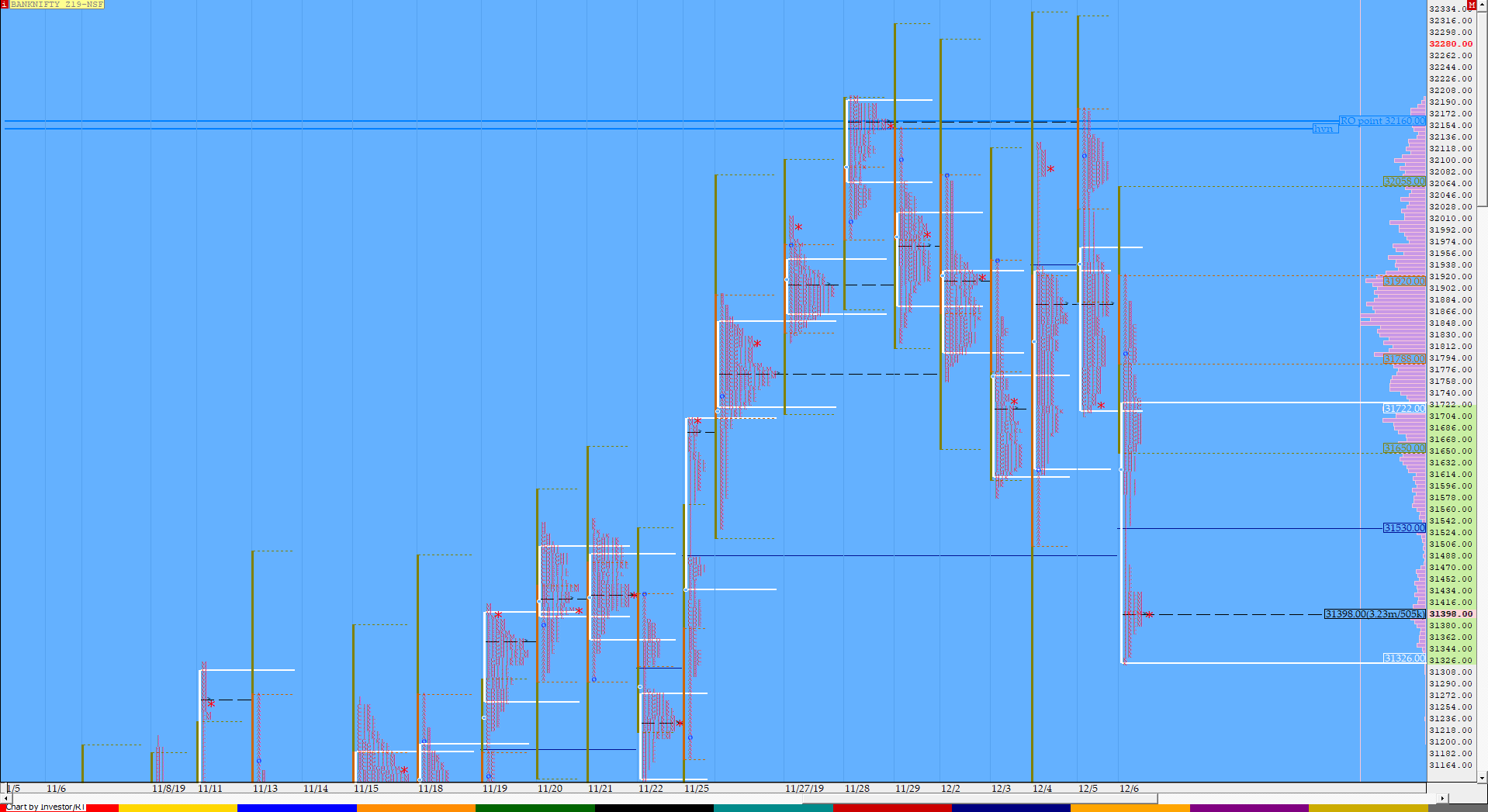

BankNifty Dec F: 31762 [ 32173 / 31705 ]

HVNs – 31426 / 31470 / 31720 / 31880 / 32090 / [32150-160]

BNF also moved away from the 5-day balance in the form of a Trend Day Down as it completed the 2 ATR objective of 31501 from the FA of 32167 and closed well below it near the dPOC of 31400 after making lows of 31323. BNF has immediate support at the buying tail of the Trend Day of 25th Nov which is at 31307 to 31178 which if taken out could be a trigger to tag the zone of 30968-947 in the coming week. On the upside, the Trend Day VWAP & PBH of 31625 & 31741 would be the important levels on watch.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 31400 F

- Vwap of the session was at 31625 with volumes of 38.5 L and range of 602 points as it made a High-Low of 31925-31323

- BNF confirmed a FA at 32173 on 05/12 and tagged the 2 ATR target of 31501 on 06/12. This FA is currently on ‘T+2’ Days

- The Trend Day VWAP of 25/11 at 31532 was broken on 06/12 so no longer a valid support.

- The Trend Day VWAP of 06/12 at 31625 will be important reference on the upside.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31325-31400-31718

Hypos / Estimates for the next session:

a) BNF needes to sustain above 31400 for a move to 31448-470 / 31515-550 & 31625

b) Staying below 31400, the auction could test 31325-308 / 31255 & 31195

c) Above 31625, BNF can probe higher to 31689-705 / 31760 & 31855-860

d) Below 31195, lower levels of 31137 / 31073-049 & 31002 could be tagged

e) If 31860 is taken out, BNF can give a fresh move up to 31890-920 / 31965 & 32019-25

f) Below 31002, we could see lower levels of 30968-947 / 30891* & 30836

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout