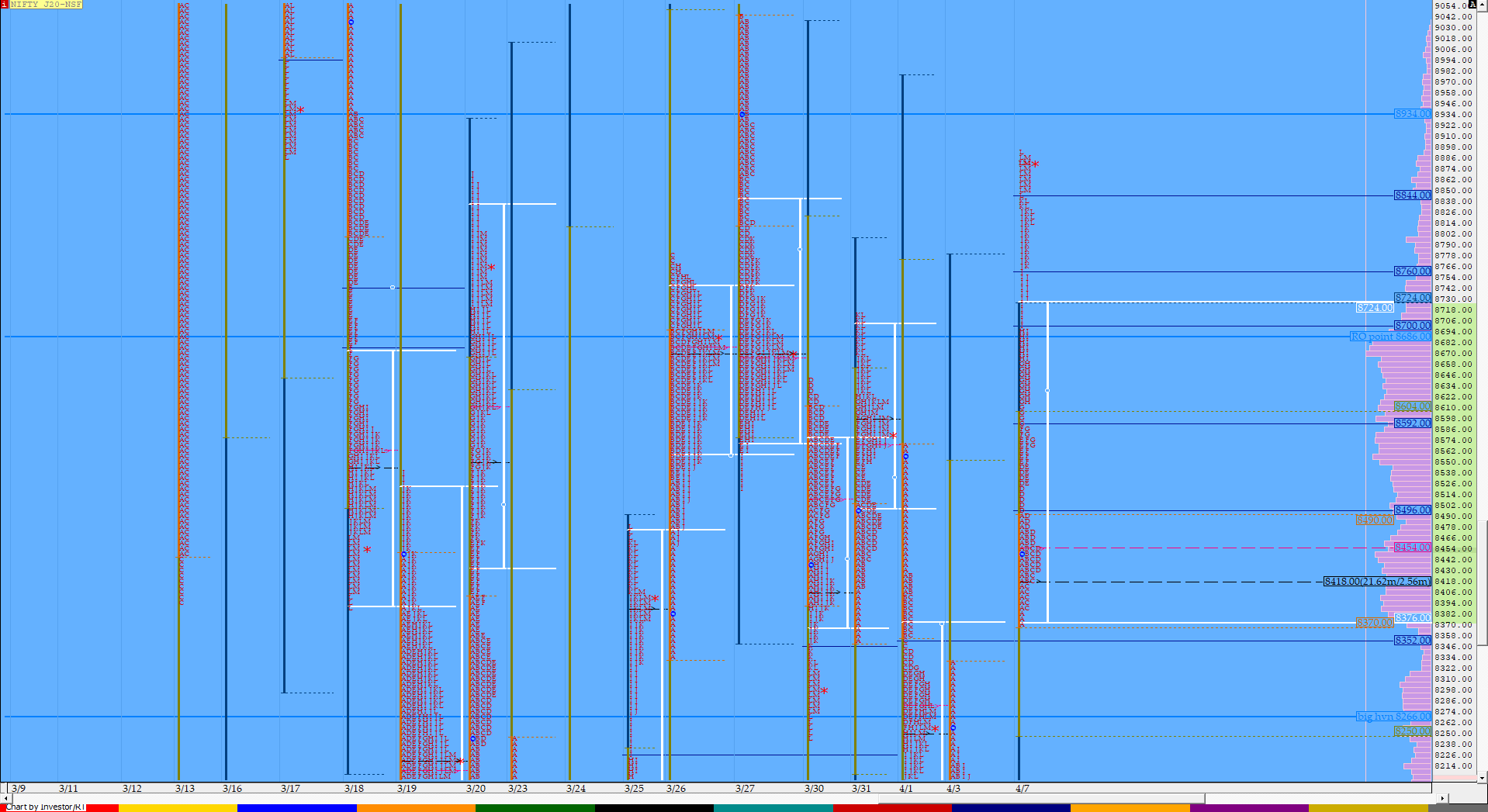

Nifty Apr F: 8876 [ 8893 / 8372 ]

HVNs – 7900 / 8130 / 8259 / 8305 / 8420-55 / 8555 / 8604 / 8670 / 8800 / (8865)

NF opened with a big gap up of 366 points at 8451 as it negated the ‘b’ shape profiles of the last 2 sessions and then took support at 8372 in the IB which was just above the selling extension handle of 8363 from last week which had started the new leg down. The auction made a narrow IB range of just 118 points not seen since a month which meant that a successful RE could lead to a big multiple IB day. NF remained inside the IB in the ‘C’ period which added even more conviction to the view & once the ‘D’ period made a RE to the upside while leaving an extension handle at 8490, the auction kept gaining in momentum as it not only made higher lows & higher highs throughout the day but confirmed several more extension handles in the profile completing the biggest daily range of this series of 521 points while making highs of 8893 which was almost 4.5 times the IB range. The day’s profile was no doubt a Trend Day but looks too stretched & has too many anomalies within so can expect some of them to be repaired in the coming session. The immediate reference for the next open would be from 8840 to 8892 below which we have the extension handles of 8759 / 8695 & 8662 and today’s VWAP of 8620 as important levels to watch for.

- The NF Open was a Open Auction Out of Range (OAOR)

- The day type was a Trend Day – Up

- Largest volume was traded at 8450 F

- Vwap of the session was at 8620 with volumes of 251.3 L and range of 521 points as it made a High-Low of 8893-8372

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8374-8450-8732

Main Hypos for the next session:

a) NF has immediate supply at 8888 above which it can rise to 8912 / 8950 / 8993 / 9025 & 9050-60

b) The auction sustaining below 8865 could test lower levels of 8840 / 8802 / 8755-33 / 8715-8695 & 8667-62

Extended Hypos:

c) Above 9060, NF can probe higher to 9087 / 9125 / 9150-60 / 9200-25 & 9270-95

d) Below 8662, the auction can fall further to 8620-8590 / 8559-45 / 8525 / 8490 & 8455-45

-Additional Hypos*-

e) Sustaining above 9295* could take NF to 9325 / 9358-65 / 9385 / 9412 & 9460-80

f) If 8445* is taken out, NF can start a new leg down to 8420 / 8376 / 8330 / 8304-8290 & 8268-59

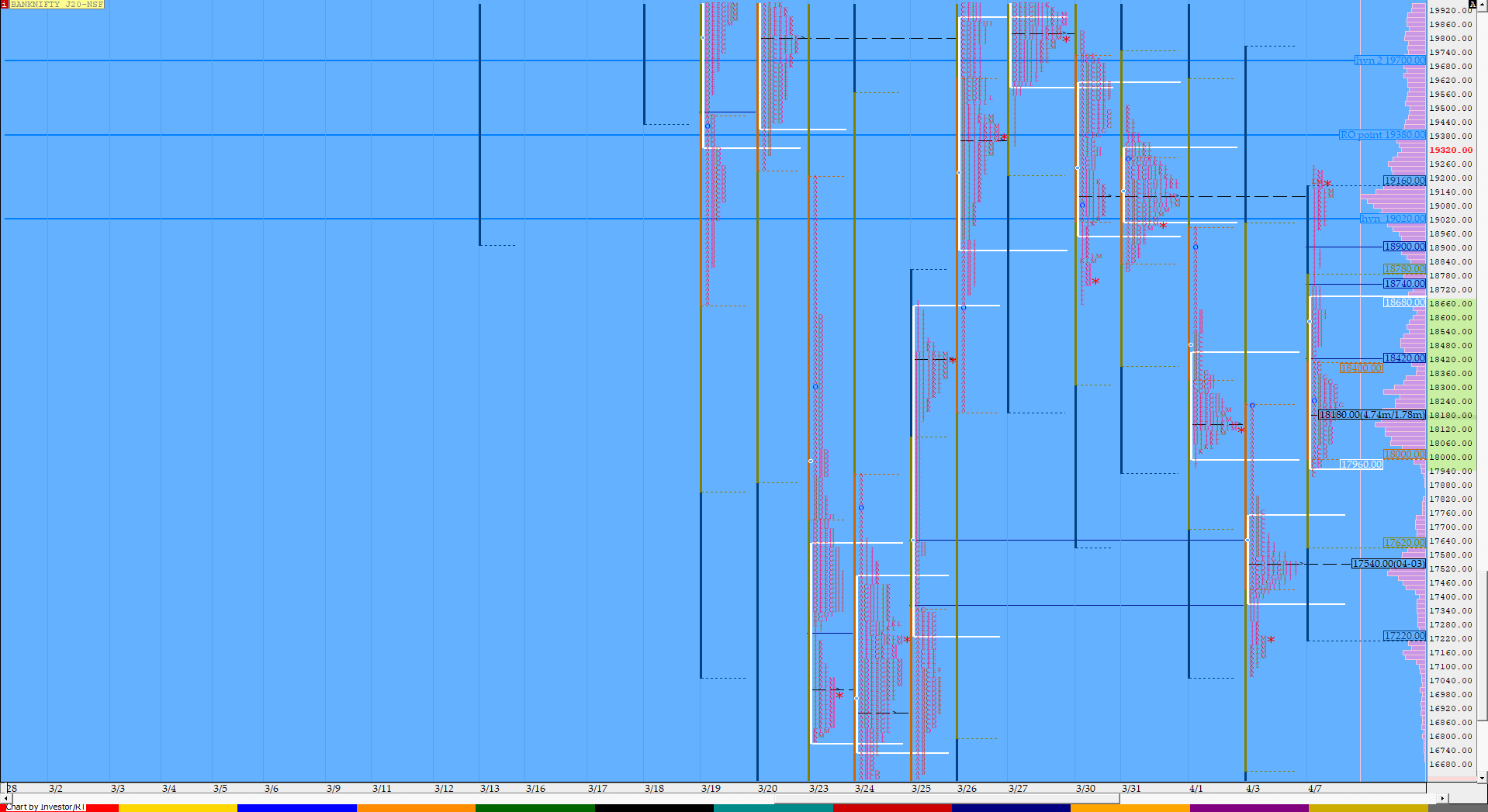

BankNifty Apr F: 19172 [ 19250 / 17921 ]

HVNs – 17540 / 18140-180 / 18790 / 18985 / 19020 / 19125 / 19345 / (19550) / 19700 / 19840

BNF also opened with a huge gap up of more than 1000 points above Friday’s OH level of 18226 and was pulled back in the previous day’s selling tail of 17829 to 18225 where it negotiated with the supply as it left a very narrow IB range of less than 400 points which was the lowest in over a month indicating that a big multiple IB day is in the offing. The auction then made the dreaded ‘C’ side extension where it got rejected at 17921 and swiftly sent back into the IB which triggered a trending move to the upside for the rest of the day with BNF gaining in momentum from the ‘G’ period onward where it left an extension handle at 18400 and in the process also confirmed a FA at lows. The auction went on to leave 2 more extension handles at 18720 & 18893 as it kept rising forming an elongated profile for the day as it tagged the VPOC & weekly HVN of 19125 while making highs of 19250 in the ‘L’ period which also marked the 3 IB objective before closing the day at 19172 leaving a combo of a Neutral Extreme plus a Trend Day profile. The Neutral Extreme reference for the coming session would be from 18893 to 19250 below which the other 2 extension handles along with today’s VWAP of 18507 would be the important references as BNF looks to tag that VPOC of 19550.

- The BNF Open was a Open Auction Out of Range (OAOR)

- The day type was a Neutral Extreme Day – Up (NeuX)

- Largest volume was traded at 18180 F

- Vwap of the session was at 18507 with volumes of 67.7 L and range of 1329 points as it made a High-Low of 19250-17921

- BNF confirmed a FA at 17921 on 07/04 and the 1 ATR target comes to 19818

- BNF confirmed a FA at 19820 on 30/03 and tagged the 1 ATR objective of 17880 on 03/04. The 2 ATR target comes to 15939. This FA is currently on ‘T+5’ Days.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17960-18180-18680

Main Hypos for the next session:

a) BNF needs to get above 19176-205 & sustain for a rise to 19274-290 / 19400 / 19454-500 / 19550 / 19650-680 / 19725-778 & 19818-845

b) The auction has immediate support at 19159-150 below which it could test 19095 / 18990 / 18893-888 / 18820-790 / 18720-670 / 18615 & 18507*-480

Extended Hypos:

c) Above 19845, BNF can probe higher to 19950-967 / 20064-81 / 20130-180 / 20251-295 / 20326-350 & 20397-425

d) Below 18480, lower levels of 18430-300 / 18225-195* / 18150 / 18075-60 / 18010 & 17920 could come into play

-Additional Hypos*-

e) BNF sustaining above 20425* could start a new leg up to 20496-520 / 20570-600 / 20666-715 / 20795 / 20925 & 21000-30

f) If 17920* is taken out, BNF could fall further to 17826-740 / 17665-600 / 17540* / 17490-462 / 17415 & 17376-311

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout