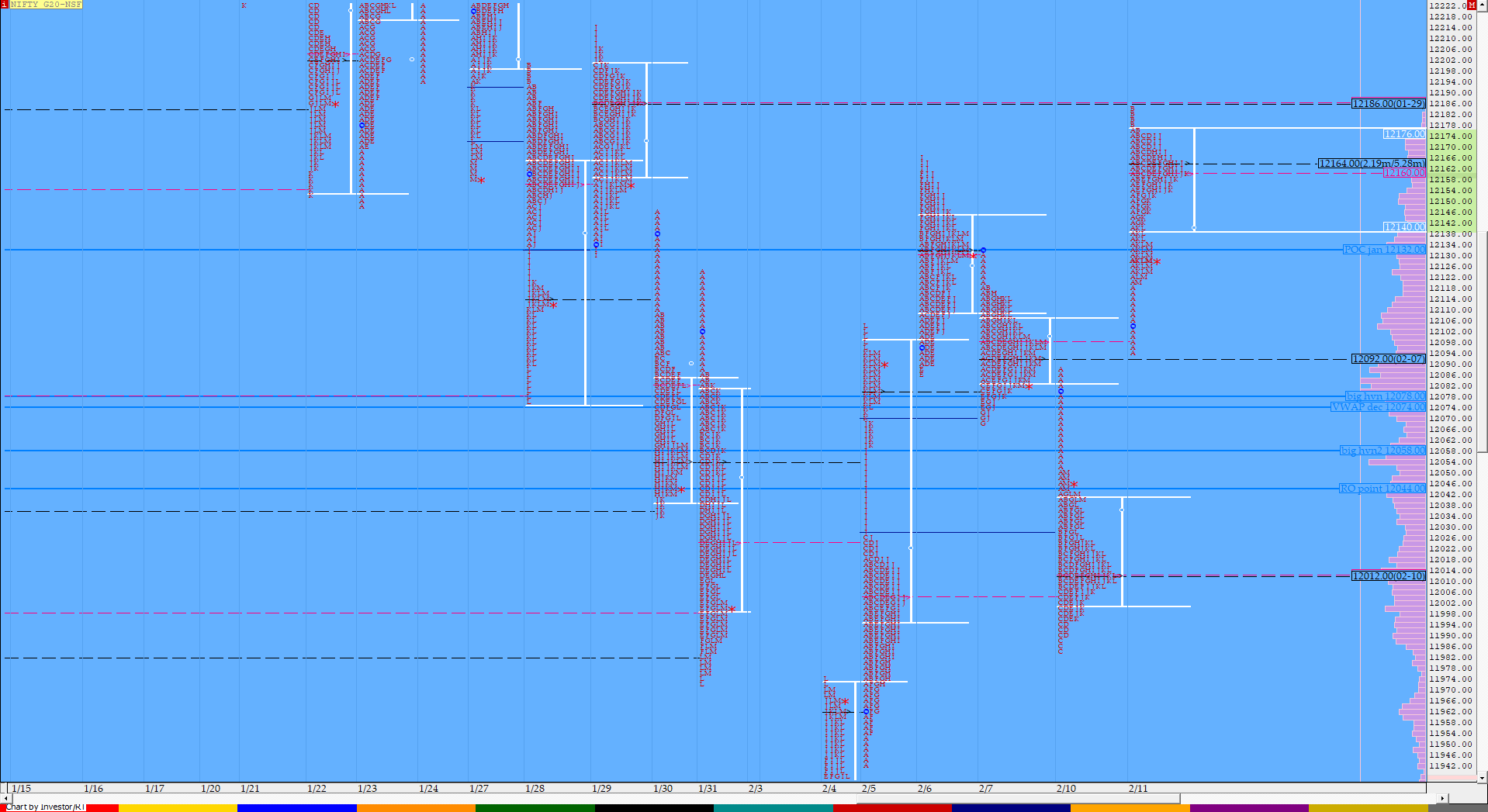

Nifty Feb F: 12127 [ 12185 / 12095 ]

HVNs – 11922 / (11965-978) / 12012-20 / 12090-95 / 12125-130 / 12165

NF opened with a big gap up of 66 points as it negated the previous day’s selling tail of 12050 to 12096 and made a low right at 12095 and drove higher to get past the HVN of 12132 as it almost tagged the VPOC of 12189 in the IB (Initial Balance) stalling at 12185. The auction remained in this IB range all day to leave a rare Normal profile for the day which was also a ‘p’ shape profile with a long buying tail from 12121 to 12040 which will be the important reference on any downside for the rest of the week. Value for the day was completely higher but the inability to tag the VPOC of 12189 suggests that the supply is back and NF would need to take out that HVN of 12165 for a fresh probe higher towards 12189 & 12230.

- The NF Open was an Open Drive (Up) (OD) on average volumes

- The day type was a Normal Day (‘p’ shape profile)

- Largest volume was traded at 12164 F

- Vwap of the session was at 12154 with volumes of 80.1 L and range of 90 points as it made a High-Low of 12185-12095

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12139-12164-12175

Hypos / Estimates for the next session:

a) NF needs to sustain above 12140-150 for a move higher to 12165 / 12180-189* & 12210-230*

b) Immediate support is at 12130-121 below which the auction could test 12095-090 / 12075-068 & 12050-040

c) Above 12230, NF can probe higher to 12258-275 & 12297-309*

d) Below 12040 auction gets weak for a test of 12020-012* / 11995-982 & 11960-942

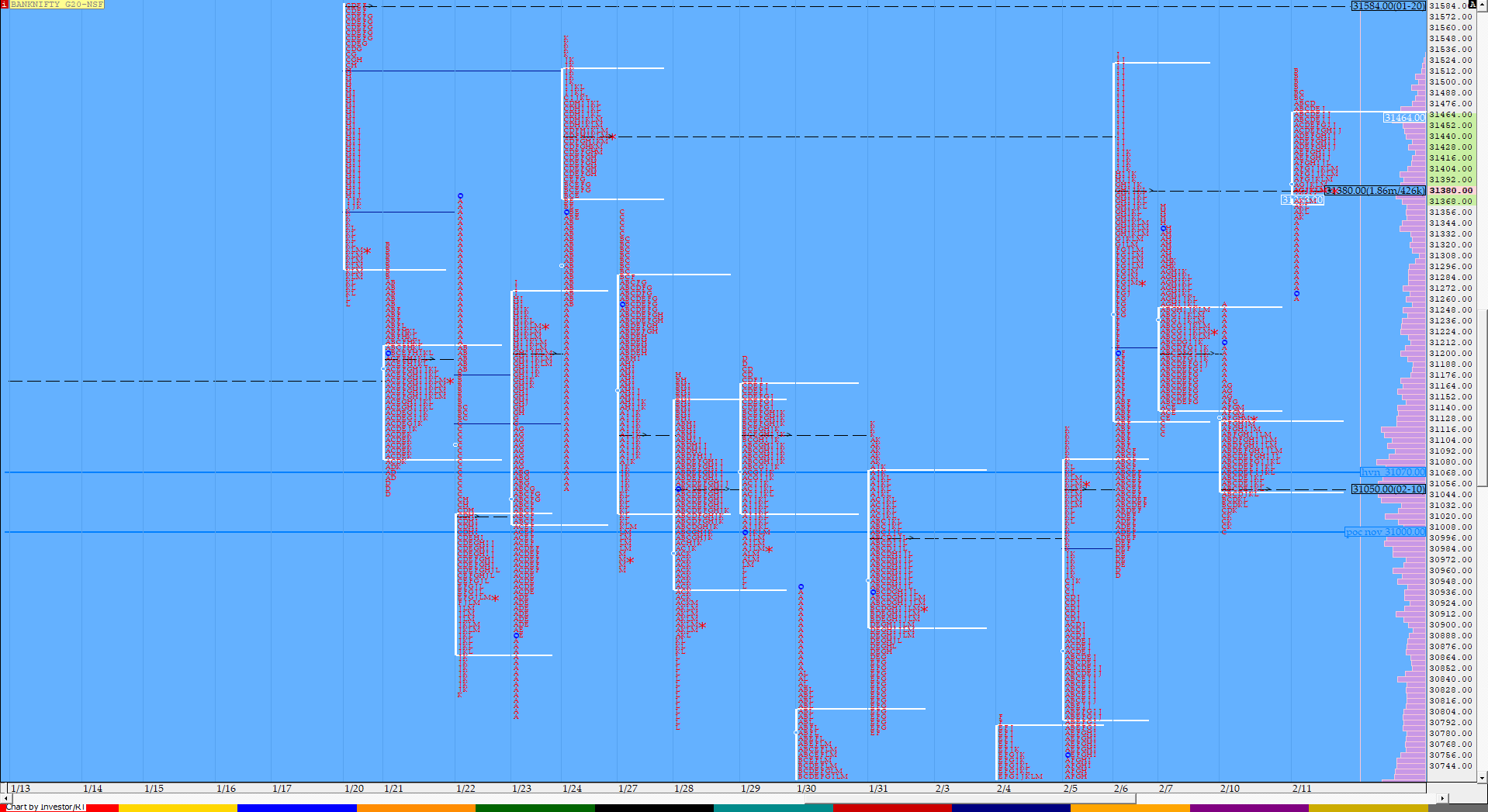

BankNifty Feb F: 31383 [ 31516 / 31265 ]

HVNs – 30720 / 30800 / 30870 / 31040 / 31070-090 / 31160 / 31200-230 / 31345-380

BNF also opened with a gap up of 160 points as it confirmed a multi-day FA at 31004 and continued to drive higher almost tagging the 1 ATR objective of 31487 in the ‘A’ period itself as it left a big buying tail from 31350 to 311. The auction made new highs of 31516 in the ‘B’ period but once again was meeting supply above that Trend Day VWAP of 31500 as it got back into the IB and gave a slow OTF move down all day with a PBH (Pull Back High) at 31475 in the ‘J’ period as it formed a ‘p’ shape profile for the day with a close around the dPOC of 31385. Value for the day was completely higher with 2 HVNs at 31385 & 31465.

- The BNF Open was an Open Drive (Up) (OD) on average volumes

- The day type was a Normal Day (‘p’ shape profile)

- Largest volume was traded at 31385 F

- Vwap of the session was at 31430 with volumes of 24.9 L and range of 251 points as it made a High-Low of 31516-31265

- BNF confirmed a multi-day FA at 31004 on 07/02 and tagged the 1 ATR move of 31487. The 2 ATR objective comes to 31963.

- BNF confirmed the 4th FA of this series in 6 sessions at 30956 on 06/02 and tagged the 1 ATR objective of 31453 on the same day. The 2 ATR move from this FA comes to 31950. This FA is currently on ‘T+4‘ Days.

- BNF confirmed the third FA of this series in 5 sessions at 30631 on 05/02 and tagged the 1 ATR objective of 31116 on the same day. The 2 ATR move from this FA comes to 31600. This FA is currently on ‘T+5‘ Days.

- The 20th Jan Trend Day VWAP of 31500 remains positional supply point. For the second time in this series, BNF tagged this VWAP on 11/02 but could not sustain above it.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31374-31385-31465

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31385 for a rise to 31420-470 / 31510-530 / 31584*-600 & 31650

b) The auction would get weak below 31350-340 for a test of 31287-255 / 31200 / 31151-135 & 31070-050*

c) Above 31650, BNF can probe higher to 31720 / 31775-800 / 31850 & 31936-963

d) Below 31050, lower levels of 31019-002 / 30956 / 30870-855 & 30800 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout