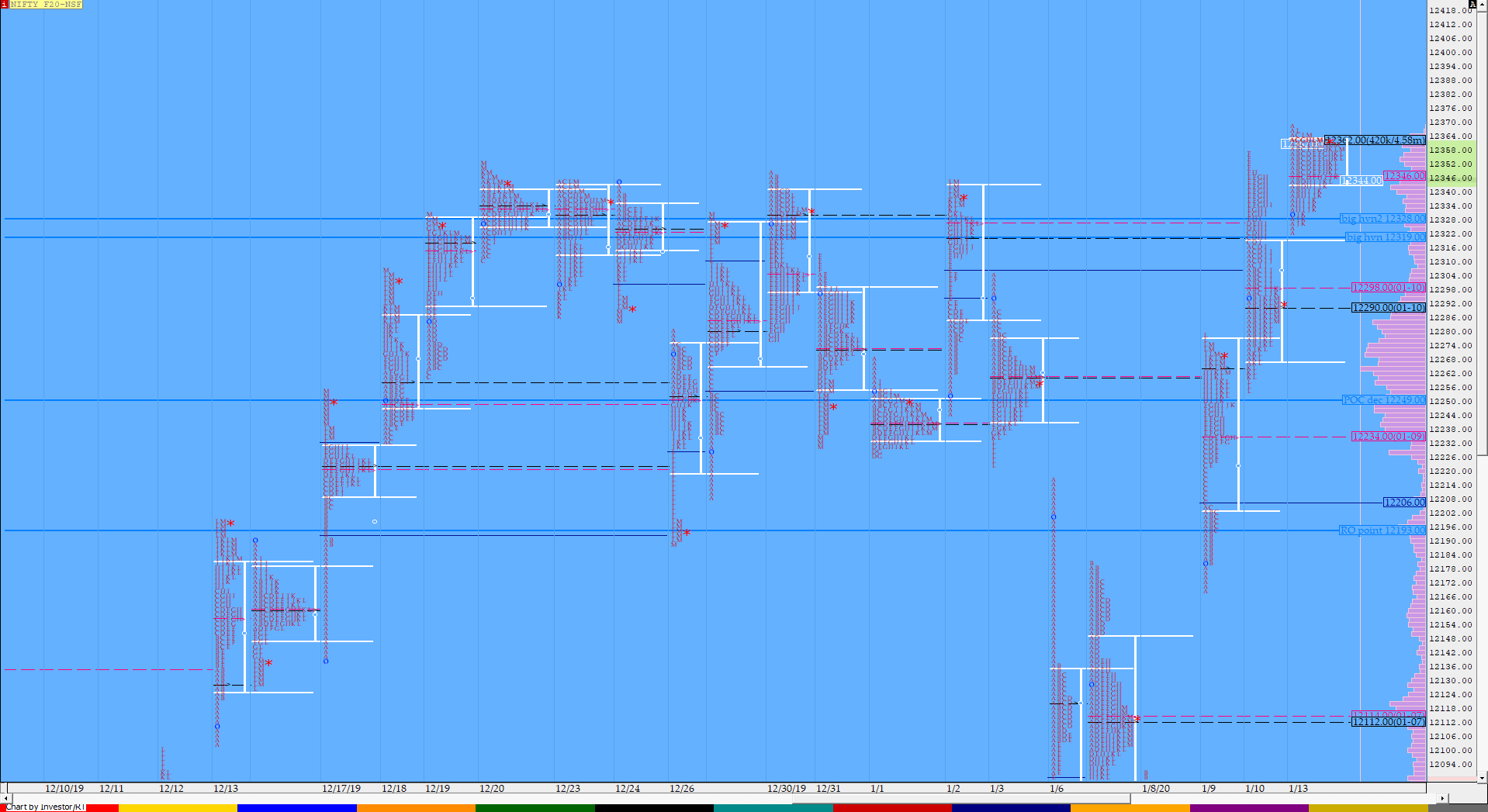

Nifty Jan F: 12362 [ 12369/ 12323 ]

HVNs – 12040 / 12062 / 12113 / 12195 / 12265 / 12290 / 12355-363

NF opened with a gap up at 12330 and took support at 12323 confirming a multi-day FA (Failed Auction) at 12255 and swiftly tagged the 1 ATR objective of 12350 as it continued to probe higher in the first 10 minutes to make new all time highs of 12369 but did not get any new volumes indicating that it was only the locals who were present in the market as the auction remained in this range of 47 points all day to leave a Normal Day with one of the lowest Volumes of this series as it closed at the dPOC of 12362 with the third consecutive day of forming higher Value but the range of the Value Area has been contracting which is a cause of concern for further upside. NF has confirmed 3 VPOCs over the last 3 sessions at 12290 / 12234 & 12062 which will be the objective(s) for any move to the downside in the coming session(s). On the upside, it would need fresh demand above today’s high for a probable move towards 12445 & 12576.

Click here to view the MPLite chart of NF confriming 3 VPOCs in the last 3 sessions

- The NF Open was an Open Auction (OA)

- The day type was a Normal Day

- Largest volume was traded at 12363 F

- Vwap of the session was at 12350 with volumes of 56.1 L and range of 47 points as it made a High-Low of 12369-12323

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12347-12363-12365

Hypos / Estimates for the next session:

a) NF needs to scale above 12369 & sustain for a move to 12393 / 12416-421 & 11437-445

b) Staying below 12360, the auction could test 12345-326 / 12304 & 12290*

c) Above 12445, NF can probe higher to 12463 / 12487 & 12515

d) Below 12290, auction could probe lower to 12270-255 / 12234* & 12217-210

e) If 12515 is taken out, the auction go up to to 12530-550 / 12573-576 & 12600

f) Break of 12210 can trigger a move lower to 12195-181 / 12160 & 12139

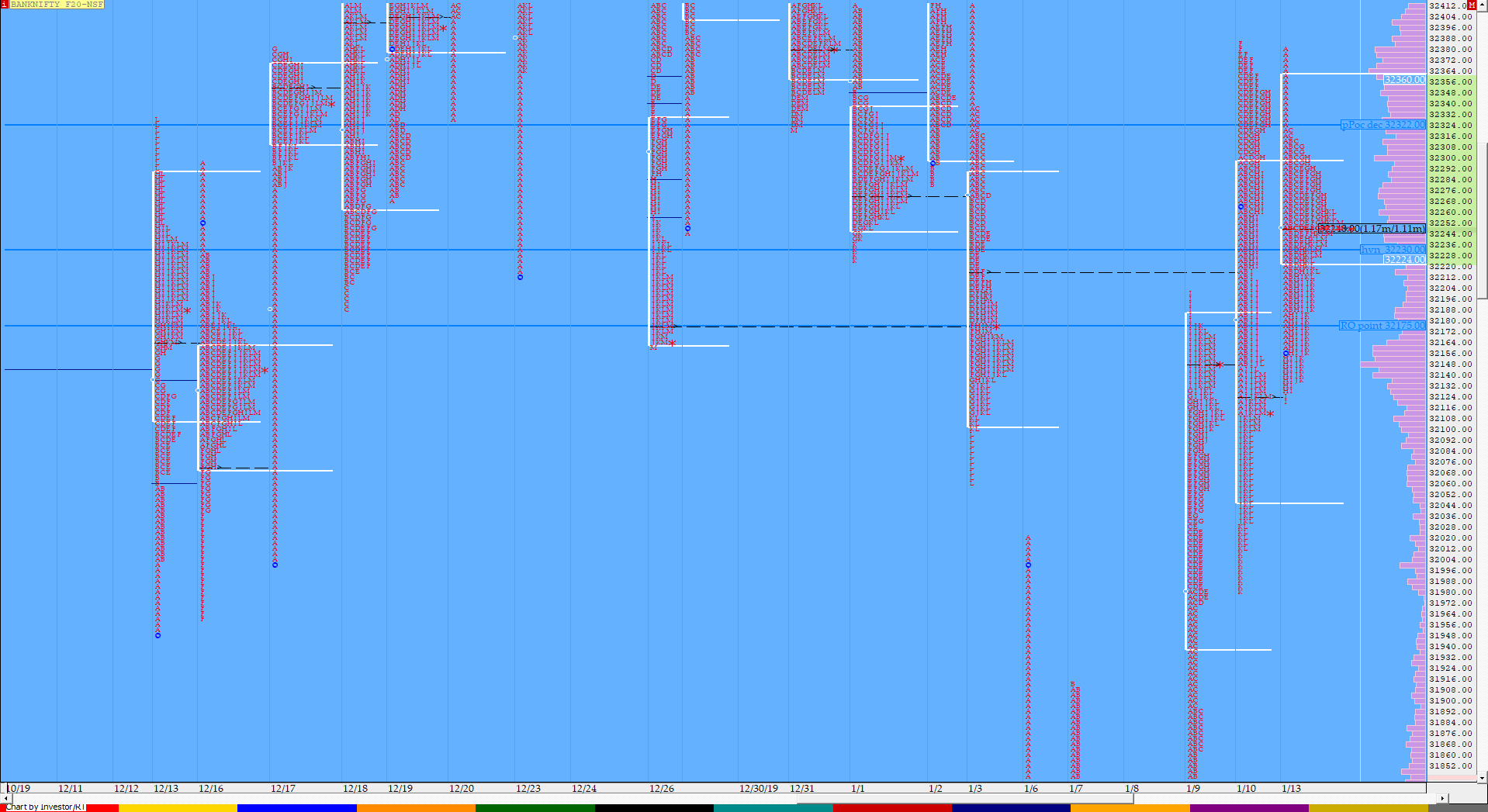

BankNifty Jan F: 32242 [ 32380 / 32123 ]

HVNs – 32001 / 32150 / 32250 / 32300 / (32420) / 32550-565

BNF opened above the previous day’s POC & HVN of 32120 making an OL (Open = Low) start at 32159 and probed higher to make highs of 32380 in the opening 10 minutes but could not scale above the PDH (Previous Day High) of 32385 after which the auction began coiling with the range becoming narrower till the ‘G’ period and this low volume environment led to an early afternoon spike to the downside in the ‘H’ period as BNF made an RE (Range Extension) to the downside as it broke below the OL start but got stalled at 32123 taking support just above the yPOC and probed back into the IB and went on to tag VWAP forming an inside bar for the day with a close at the prominent POC of 32250 which would be the level to watch at open in the next session. BNF has formed a nice 2-Day Balance with the Value at 32170-32244-32368 and could give a move away from this Value in the next session or two.

View the MPLite chart of the 2-day Balance in BNF here

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day

- Largest volume was traded at 32250 F

- Vwap of the session was at 32245 with volumes of 24.3 L and range of 256 points as it made a High-Low of 32380-32123

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32201-32250-32330

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32250 for a rise to 32298-310 / 32365-380 & *32400*-430

b) Staying below 32240 the auction could test 32180-175 / 32120 & 32045-025

c) Above 32430, BNF can probe higher to 32490-508 / 32565* & 32622-634

d) Below 32025, lower levels of 31980 / 31910 & 31848-820 could be tagged

e) If 32634 is taken out, BNF can give a fresh move up to 32712-755 / 32821 & 32885-893

f) Break of 31820 could trigger a move down to 31760 / 31670 & 31600

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout