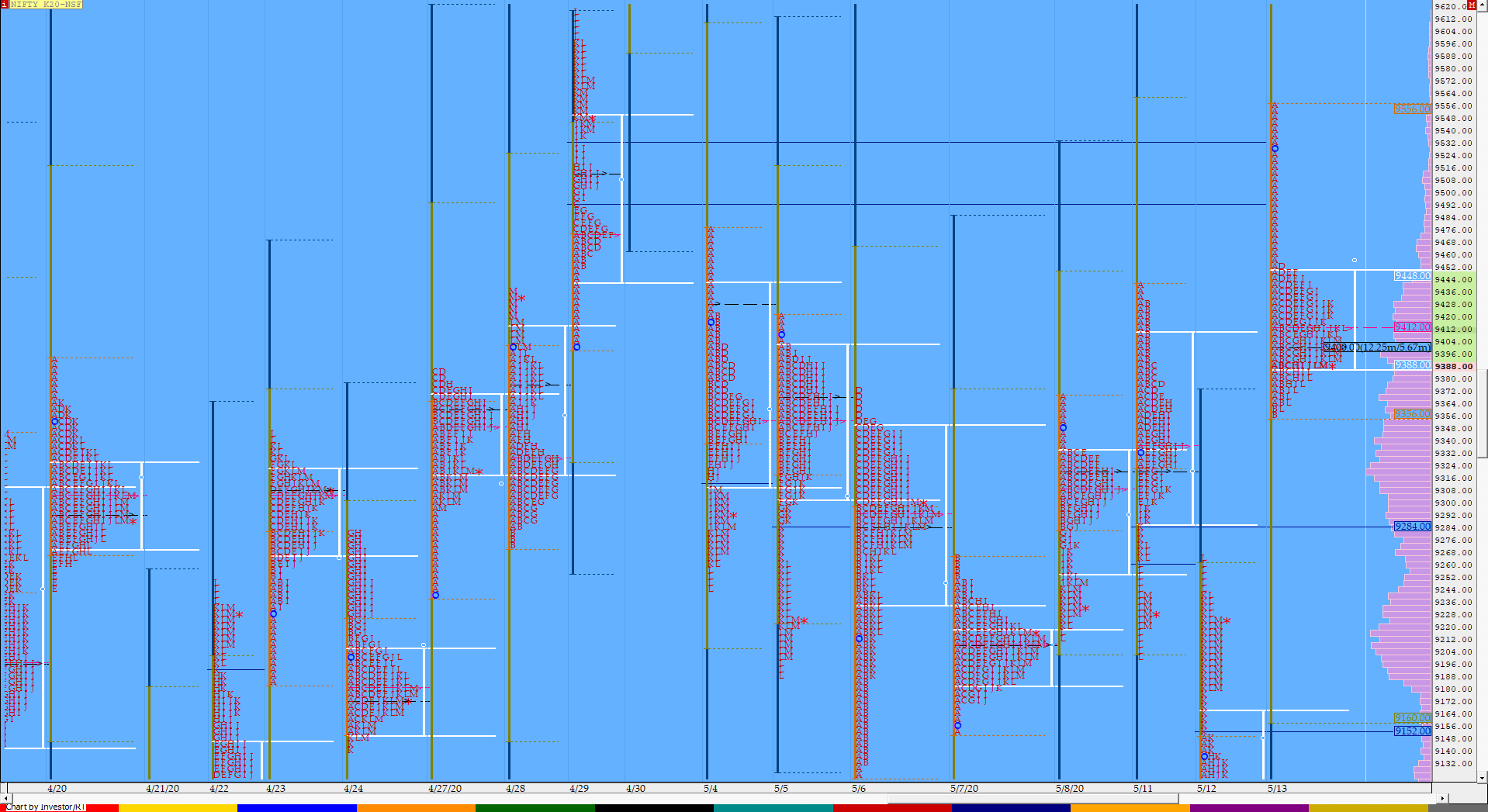

Nifty May F: 9393 [ 9557 / 9356 ]

HVNs – 9111 / 9218 / (9285) / 9320 / 9400 / 9800 / 9822-40

NF opened with a big gap up of 319 points but right in that huge selling tail of 4th May from 9721 to 9477 as it made a high of 9557 in the opening minute & was swiftly rejected from that spike low of 29th April and got back below 9477 in the opening 10 minutes itself which indicated that fresh supply was entering as the auction continued to move lower as it made a low of 9356 in the ‘B’ period to leave a relatively big IB range of 200 points. NF then stayed below 9477 all day as it formed a ‘b’ shape profile and left yet another long selling tail of 9455 to 9557 along with a prominent POC at 9400 which would be the important level in the coming session(s). Staying below 9400, the auction could go in for a test of the HVNs of 9320 / 9218 & 9111 where as on the upside it would need to get accepted in today’s selling tail which could lead to a good short covering move higher towards the VPOC of 9831.

- The NF Open was a Open Rejection Reverse (ORR)

- The day type was a Normal Day [‘b’ shape profile]

- Largest volume was traded at 9400 F

- Vwap of the session was at 9421 with volumes of 191.5 L and range of 200 points as it made a High-Low of 9557-9356

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8643 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9385-9400-9446

Main Hypos for the next session:

a) NF needs to sustain above 9400 for a rise to 9420 / 9444-77 / 9503-30 / 9555 & 9574-94

b) The auction gets weak below 9385 and could test 9366-56 / 9320-9290 / 9264-31 / 9216-04 & 9186-82

Extended Hypos:

c) Above 9594, NF can probe higher to 9616-25 / 9653-70 / 9721-30 / 9750-60 & 9796-9800

d) Below 9182, the auction can fall further to 9150 / 9123-11 / 9085-69 / 9042-37 & 9012-8989

BankNifty May F: 19617 [ 20199 / 19423 ]

HVNs – 18350 / 18855 / 19340 / 19620 / 19830 / (21600) / (21850)

BNF also opened with a big gap up of 1111 points as it not only completed the 2 ATR target of 19668 from previous day’s FA of 18209 but went on to test the selling tail of 4th May which was from 20078 to 21287 as it made a high of 20199 in the opening minutes but was immediately pushed back below the recent swing high of 19950 indicating aggressive supply coming in as it made a low of 19455 in the ‘B’ period to give a big IB range of 743 points. Similar to NF, the auction confirmed a selling tail from 19834 to 20199 and formed a balance inside the IB all day to form a ‘b’ shape profile with a failed attempt to move lower in the ‘I’ period which was rejected as it made a marginal new low of 19423 taking support right at the weekly VAL. BNF has closed right at the day’s prominent POC of 19620 & could start a new move away from here in the next session. The PLR would be to the downside till the selling tail of today is not taken out towards the HVNs of 19340 / 18855 & 18350.

- The BNF Open was a Open Rejection Reverse (ORR)

- The day type was a Normal Day [‘b’ shape profile]

- Largest volume was traded at 19620 F

- Vwap of the session was at 19687 with volumes of 82.1 L and range of 776 points as it made a High-Low of 20199-19423

- BNF confirmed a FA at 18209 on 12/05 and tagged the 2 ATR objective of 19668 on 13/05.

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA has not been tagged and is now positional supply point.

- BNF confirmed a FA at 17977 on 07/04 and tagged the 2 ATR target of 21771 on 30/04. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19599-19620-19790

Main Hypos for the next session:

a) BNF needs to sustain above 19620 for a rise to 19680-700 / 19780-835 / 19934 / 20013-120 / 20199-220 & 20324-396

b) The auction remains weak below 19610 for a test of 19560-534 / 19455-420 / 19340-262 / 19188-163 / 19076 & 19010-18970

Extended Hypos:

c) Above 20396, BNF can probe higher to 20430-535 / 20600 / 20735-755 / 20819-840 / 20898-914 & 20975-21030

d) Below 18970, lower levels of 18915-855 / 18792-696 / 18570-543 / 18480-414 / 18375-350 & 18270-209 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout