Nifty Jan F: 12397 [ 12412/ 12331 ]

HVNs – 12040 / 12062 / 12113 / 12195 / 12265 / 12290 / 12355 / (12395)

NF made a similar auction as the previous day staying within the range of the ‘A’ period for almost all day forming overlapping POC at 12355 but gave a spike higher into the close as it left an extension handle at 12373 to make highs of 12412 and this spike zone will be the reference for the next session open as Spike Rule will be in play.

- The NF Open was an Open Auction (OA)

- The day type was a Normal Variation Day with a spike close

- Largest volume was traded at 12355 F

- Vwap of the session was at 12363 with volumes of 65.3 L and range of 81 points as it made a High-Low of 12412-12331

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12340-12355-12374

Hypos / Estimates for the next session:

a) NF needs to sustain above 12400 for a move to 12416-421 / 11437-445 & 12463

b) Staying below 12395, the auction could test 12373 / 12355-350 & 12335-326

c) Above 12463, NF can probe higher to 12487 / 12515 & 12530

d) Below 12326, auction could probe lower to 12304 / 12290* & 12270-255

e) If 12530 is taken out, the auction go up to to 12550 / 12573-576 & 12600

f) Break of 12255 can trigger a move lower to 12234* / 12217-210 & 12195-181

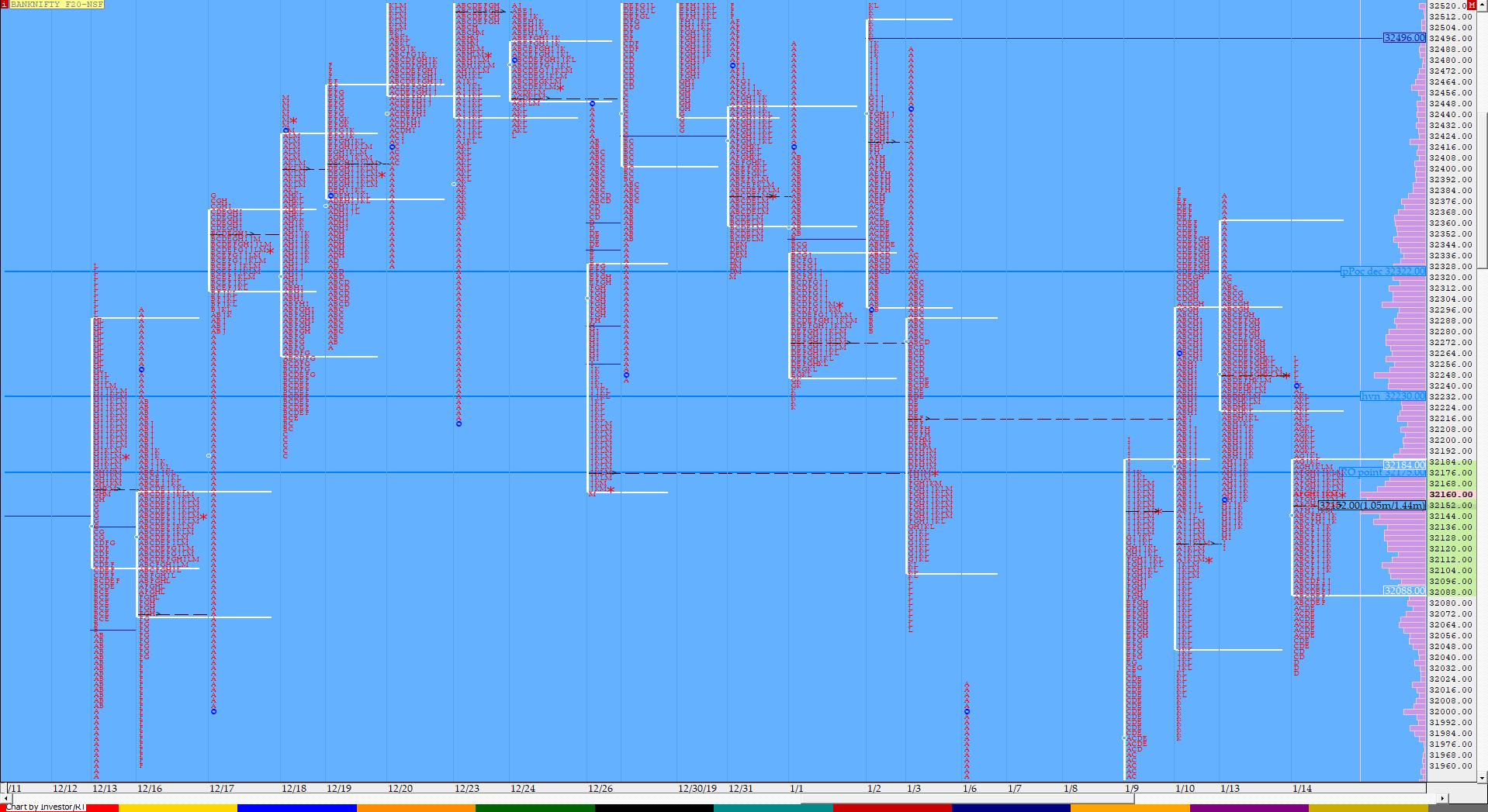

BankNifty Jan F: 32169 [ 32260 / 32032 ]

HVNs – (31830) / 32001 / 32109 / 32160 / 32250 / 32300 / (32420) / 32550-565

BNF opened with a Drive Down but on low volumes as it seemed to move away from the prominent POC of 32250 but the sellers did not do a good job as they could not extend the IB by much and this led to a short covering move as the auction confirmed a FA at 32032 and went on to scale above 32250 but once again was rejected from there to leave a Neutral Day with a close at the dPOC of 32160 with a probable multi-day FA at 32260.

- The BNF Open was an Open Drive Down (OD) on low volumes

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 32160 F

- Vwap of the session was at 32136 with volumes of 26.1 L and range of 228 points as it made a High-Low of 32260-32032

- BNF confirmed a FA at 32032 on 14/01 and tagged the 1 ATR target comes to 32408.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32100-32160-32193

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32180 for a rise to 32240 / 32282-310 & 32365-380

b) Immediate support is at 32160-153 below which the auction could test 32072-50 / 31980 & 31910

c) Above 32380, BNF can probe higher to 32400*-430 / 32490-508 & 32565*

d) Below 31910, lower levels of 31848-820 / 31760 & 31670 could be tagged

e) If 32565 is taken out, BNF can give a fresh move up to 32622-634 / 32712-755 & 32821

f) Break of 31670 could trigger a move down to 31600 / 31540 & 31480*

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout