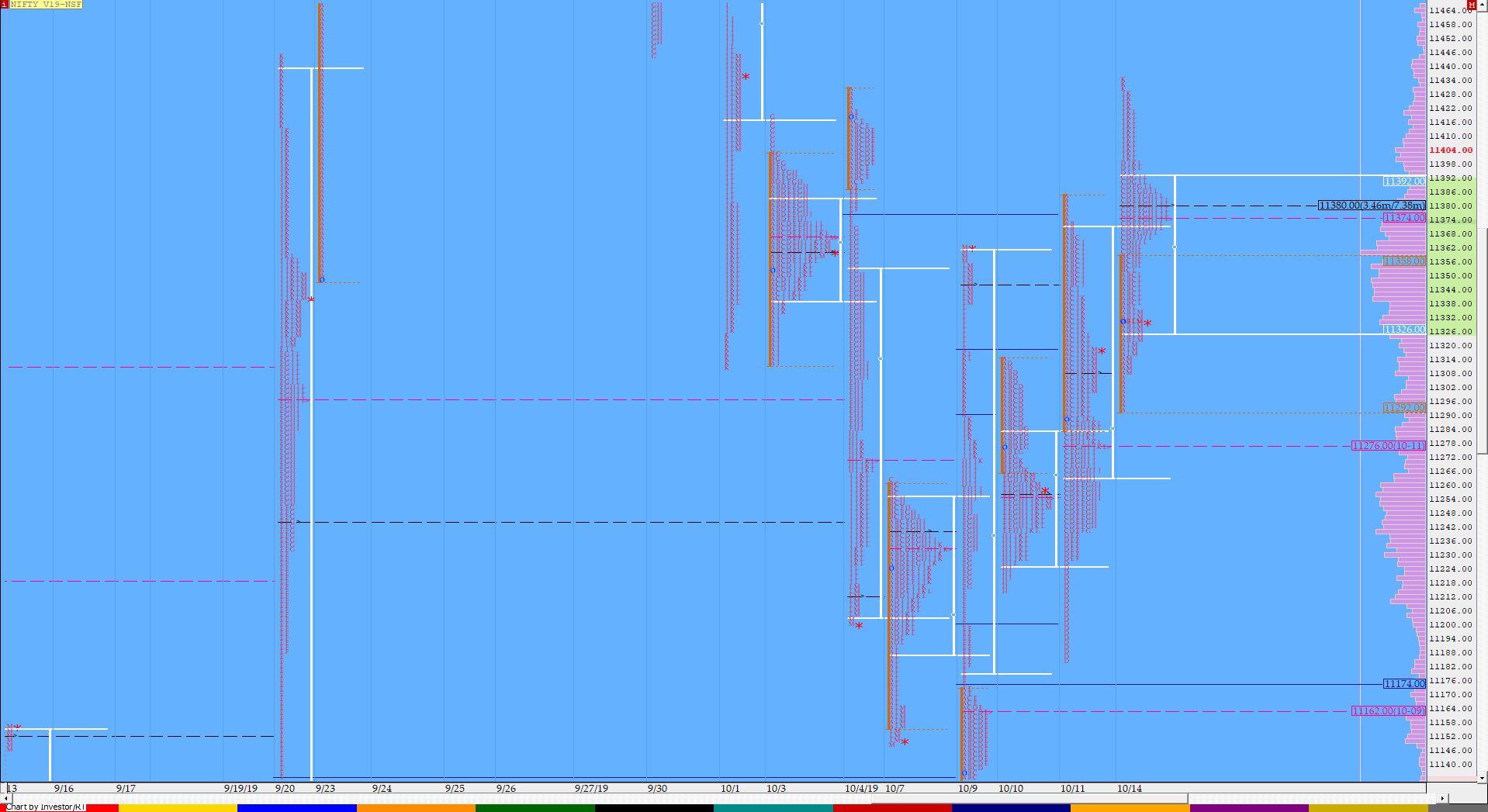

Nifty Oct F: 11336 [ 11434/ 11293 ]

HVNs – 11155 / 11250-253 / (11276) / 11330 / 11380 / [11354] / 11400 / 11480 / 11550

NF gave an OAIR start to the day but stayed above the yPOC as it moved away from the 5 day composite to the upside leaving a small buying tail in the IB (Initial Balance) which hinted that the PLR is to the upside. The auction then made an immediate RE (Range Extension) in the dreaded ‘C’ period getting above the important HVN of 11361 but was accepted above IBH as it tagged the 1.5 IB objective of 11392 to the dot in the ‘C’ period itself. The ‘D’ period saw a marginal higher high of 11398 but could not extend any further indicating exhaustion in the upside probe after which NF consolidated for the next 3 periods in a narrow range but stayed above IBH & VWAP which meant that the supply also was not doing a good job so far. The auction then gave a dip below VWAP & IBH in the ‘H’ period as it made a low of 11354 and was swiftly rejected showing that there was some demand coming in at lower levels and this led to a fresh RE to the upside in the ‘J’ period as NF completed the 2 IB move of 11425 and went on to make a new high of 11434 as the ‘K’ period began as it briefly looked above the high of 4th Oct (from where it had started the probe down to 11114) but did not sustain making a narrow range bar with a close well inside the previous period which indicated fresh supply coming in. NF then saw a big liquidation move happening in the ‘L’ period which made the biggest range of the day of more than 100 points as the auction fell from 11420 to 11317 and went on to make a low of 11308 in the ‘K’ period stopping exactly at the yPOC to give a close at 11336. Value for the day was overlapping to higher but the rejection at an earlier important reference had turned the PLR to the downside with today’s POC of 11380 an important reference for the rest of the week.

(Click here to view how NF stalled at the VAL of the DD of 1st October)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (2 IB)

- Largest volume was traded at 11380 F

- Vwap of the session was at 11369 with volumes of 113.5 L and range of 141 points as it made a High-Low of 11434-11293

- NF confirmed a FA at 11113 on 09/10 and completed the 1 ATR move up of 11309. The 2 ATR objective comes to 11505. This FA is currently on ‘T+4’ Days

- The Trend Day VWAP of 09/10 at 11224 will be important support and this held on 10/10 as well as on 11/10

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11324-11380-11391

Hypos / Estimates for the next session:

a) Sustaining above 11330, NF can probe higher to 11345-360 / 11380-385 & 11402

b) Immediate support is at 11310 below which the auction could test 11293-285 / 11267-245 & 11228

c) Above 11402, NF can probe higher to 11430-434 / 11450-456 & 11473-480

d) Below 11228, auction becomes weak for 11205 / 11185-173 & 11155-150

e) If 11480 is taken out, the auction go up to to 11505-510 / 11529-538* & 11550*-565

f) Break of 11150 can trigger a move lower to 11125-120 / 11092-90 & 11068-22

BankNifty Oct F: 28210 [ 28636 (28790 – freak high) / 28083 ]

HVNs – 28025 / 28130-152 / 28295-315 / 28410-445 / 28560 / 28860 / 29350-382

BNF made a freak high at open of 28790 which marked the upside for the day as it probed lower post open and was rejected from the composite POC of 28130 as it left a small tail at lows from 28105 to 28212 in the ‘A’ period after which it made a slow probe to the upside till the ‘D’ period where it made highs of 28512. The auction then consolidated in a narrow range for the next 3 periods before giving a dip below VWAP in the ‘H’ period as it left a pull back low at 28285 and the rejection from here saw BNF probe higher in the ‘J’ period as it tagged 28636 and made similar highs of 28634 in the ‘K’ period which displayed exhaustion and this triggered a huge liquidation move down as BNF gave up all the gains of the day & went on to make new lows of 28083 just before the close. Value for the day was overlapping to higher but the attempt to move away from the 5-day composite to the upside has failed and today’s auction has in fact added to the upper low volume zone making the composite smoother so can expect the auction to remain here with 28410 being an important reference on the upside.

(Click here to view the 6-day composite in BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day

- Largest volume was traded at 28410 F

- Vwap of the session was at 28390 with volumes of 46.8 L and range of 707 points as it made a High-Low of 28790-28083

- BNF confirmed a FA at 27774 on 09/10 and completed the 1 ATR move up of 28713. The 2 ATR objective comes to 29653. This FA is currently on ‘T+4’ Days

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28218-28410-28505

Hypos / Estimates for the next session:

a) BNF has immediate supply at 28232-265 above which it could rise to 28305-315 / 28365-370 & 28410-445

b) Staying below 28190, the auction gets weak for 28105-095 / 28035-25 & 27970

c) Above 28445, BNF can probe higher to 28490-540 / 28590-600 & 28704

d) Below 27970, lower levels of 27900-880 / 27774 & 27675-650 could come into play

e) Sustaining above 28704, BNF can give a fresh move up to 28805-875 / 28954-990 & 29069

f) Break of 27650 could trigger a move down 27570 / 27495-420 & 27352-340

Additional Hypos

g) Above 29069, higher levels of 29140 / 29222-283 & 29350-382 could get tagged

h) If 27340 is broken, BNF could fall to 27157-135 / 27065-027 & 26976-925

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout