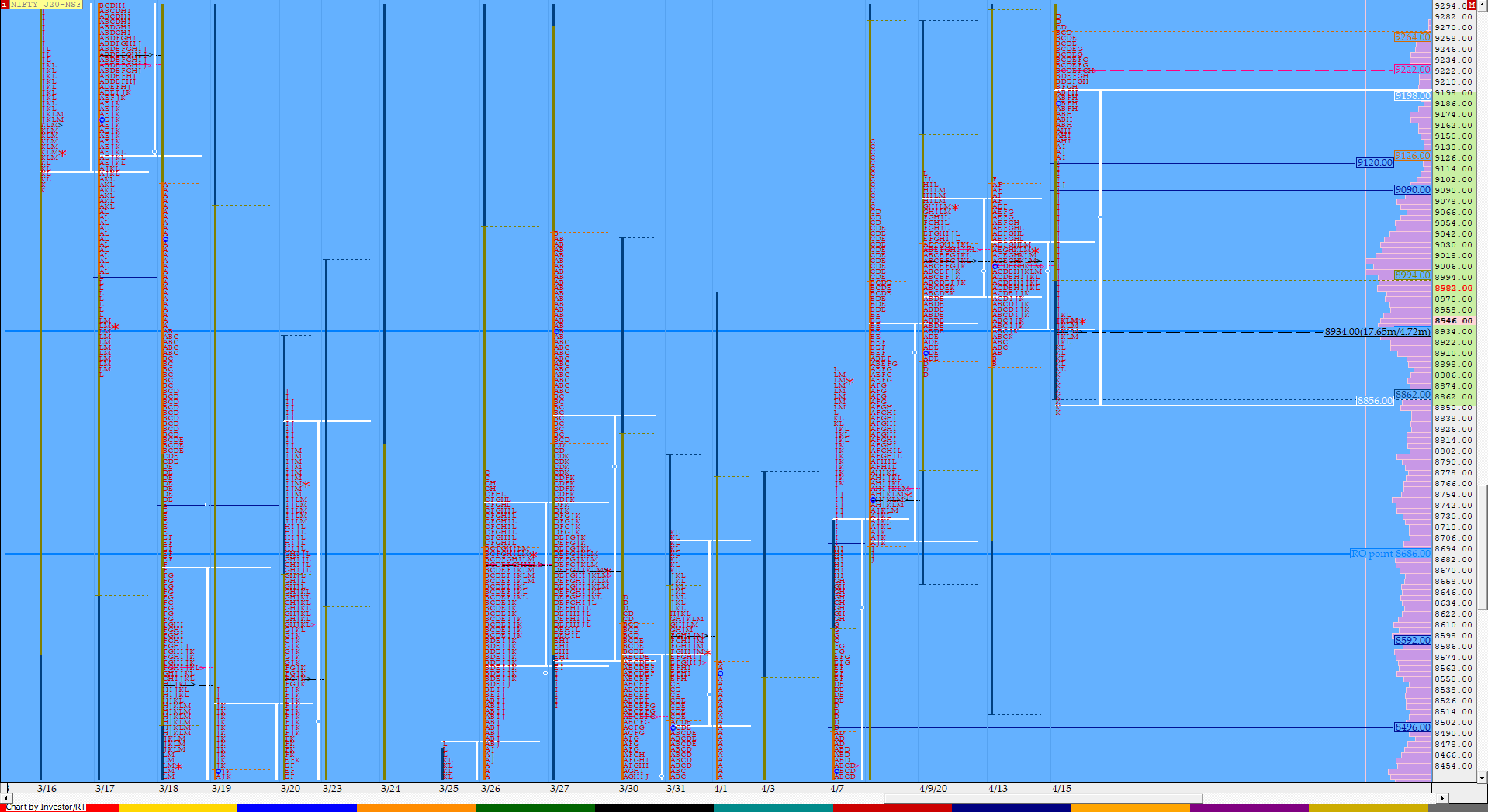

Nifty Apr F: 8930 [ 9282 / 8846 ]

HVNs – 7900 / 8130 / 8259 / 8305-35 / 8420-55 / 8555 / 8604 / 8670 / 8750 / 8800 / 8937 / 9015 / 9080 / 9175 / 9222

NF opened with a big gap up of 179 points and stayed above the PDH (Previous Day High) in the ‘A’ period which led to a fresh probe higher in the ‘B’ period of exactly 100 points as it made highs of 9265 following it up with a ‘C’ side RE resulting in marginal new highs of 9274. The auction made another RE attempt in the ‘D’ period making new highs of 9282 but once again it was not able to sustain above IBH which indicated that the upside was getting limited. NF then formed a nice balance inside the IB range till the ‘G’ period with a prominent TPO POC at 9222 and this balance then led to a big imbalance to the downside from the ‘H’ period onwards where it left an extension handle of 9131 to start with confirming a FA at highs and followed it up with another extension handle at 9095 in the ‘I’ period which took the auction inside the Value of the 2-day composite as it completed the 80% Rule from 9060 to 8949 in the ‘J’ period and went on to make lower lows of 8847 in the ‘K’ period completing the 3 IB objective of 8863 marking the end of this imbalance. NF left a tail from 8847 to 8896 at lows as it made a retracement to 8955 and saw big volumes coming in at 8937 which was mostly the shorts booking out as the DPOC also shifted lower to this point and even the day closed here. Though today’s profile has a big zone of singles from 8955 to 9095 which would be the immediate reference on the upside, NF continues to remain in a balance after today’s failed attempt to move away on the upside and has a composite POC at 9015 which would be an important reference for the rest of the series.

Click here to view the 3-day composite on MPLite

- The NF Open was a Open Auction Out of Range (OAOR)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 8937 F

- Vwap of the session was at 9112 with volumes of 233.5 L and range of 436 points as it made a High-Low of 9282-8847

- NF confirmed a FA at 9282 on 15/04 and the 1 ATR target comes to 8808.

- NF had confirmed a multi-day FA at 8686 on 09/04 and tagged the 1 ATR objective of 9211 on 15/04.

- NF had confirmed a FA at 8891 on 09/04 which got revisited in ‘T+2’ Days and stands negated.

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8848-8937-9196

Main Hypos for the next session:

a) NF needs to sustain above 8937 for a rise to 8955 / 8997 / 9015-31 / 9060-80 & 9095-9112

b) The auction has immediate support at 8903-8892 below which it could test levels of 8850-28 / 8808-04 / 8775 & 8745*-36

Extended Hypos:

c) Above 9112, NF can probe higher to 9132-48 / 9172-80 / 9196-9222 / 9244-65 & 9282-95

d) Below 8736, the auction can fall further to 8715-00 / 8667-62 / *8620* / 8590 & 8559-45

-Additional Hypos*-

e) Sustaining above 9295* could take NF to 9325 / 9358-65 / 9385-9416 / 9460-80 & 9510

f) If 8545* is taken out, NF can start a new leg down to 8525 / 8490 / 8455-20 / 8376 & 8335

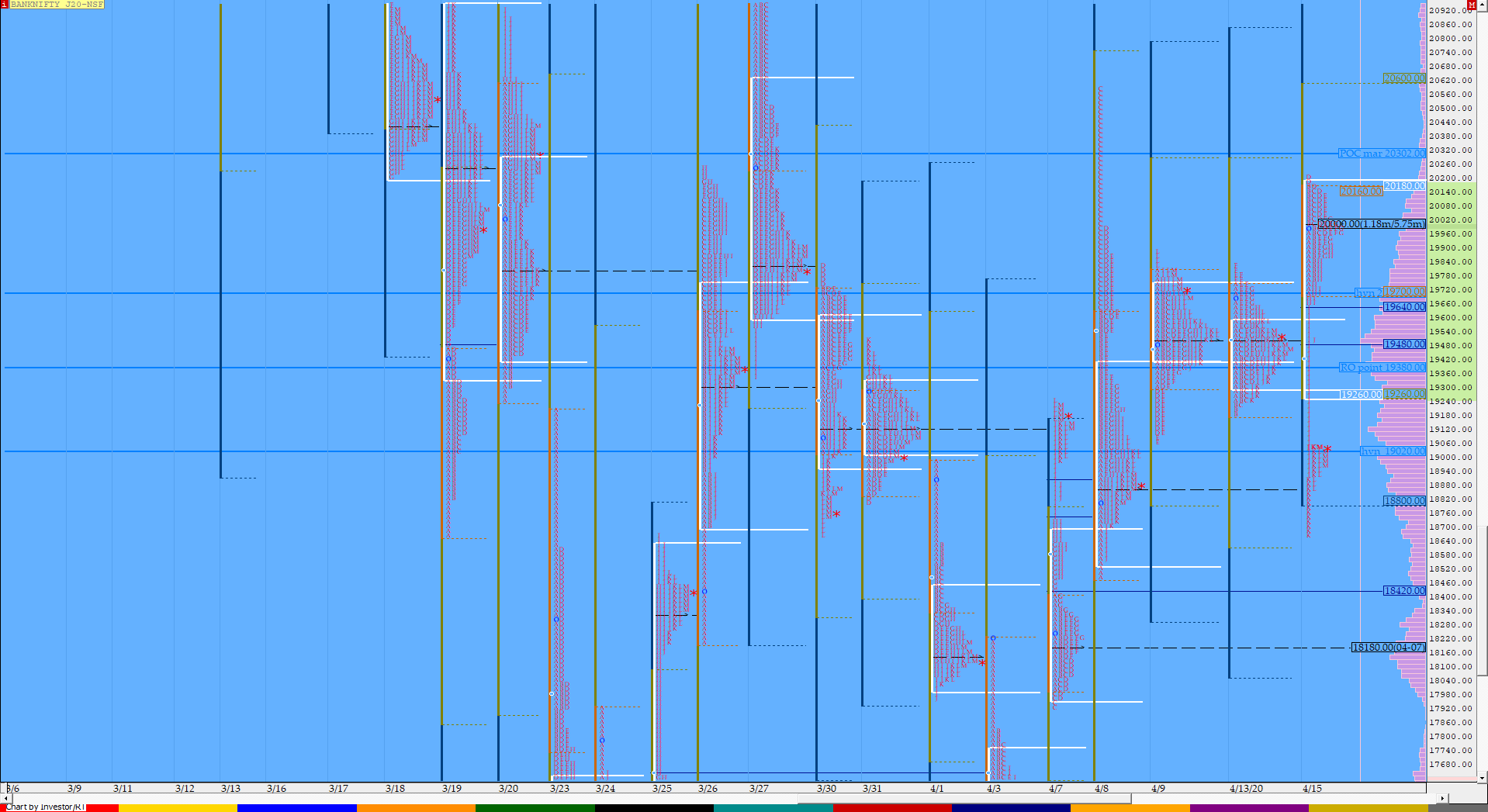

BankNifty Apr F: 18990 [ 20219 / 18661 ]

HVNs – 17075 / 17540 / 18180 /18260 / 18790 / 18970 / 19125 / 19345 / 19410 / 19500 / 19820 / 19900 / 20000

BNF opened with a gap up of 500 points and took support just above the compostite VAH of 19666 as it made a low of 19711 in the ‘A’ period after which it probed higher making new highs of 20172 for the day as the IB got over leaving a relatively small range of 461 points for the first hour which was the second lowest of this series giving the scope for a multiple IB day shaping up. The ‘C’ period then made an inside bar but stayed above VWAP which meant that the PLR (Path of Least Resistance) was to the upside and the auction made an attempt to get above the IBH as soon as the ‘D’ period began as it made new highs of 20217 but was immediately rejected giving the first sign that the PLR could be changing. BNF then remained inside the IB making a nice balance in the narrow range typical of the first half of an OAOR day till the ‘G’ period after which it made an RE to the downside in the ‘H’ period confirming a FA (Failed Auction) at 20217 as it made new lows of 19665 which was the composite VAH to the dot. Fueled by the FA at top, the auction then changed gears in the ‘I’ period as it left an extension handle at 19665 and completed the 80% Rule in the 2-day composite Value of 19666 to 19350 in a flash as it trended lower till the ‘K’ period where it not only completed the 3IB target of 18789 but went on to make lows of 18661 completing the 1 ATR objective from the FA in just 3 TPOs. BNF then formed a mini balance while building volumes at 18970 closed around it confirming a tail at lows from 18875 to 18661 which would be the immediate reference on the downside. On the upside, we have a big zone of singles from 19048 to 19512 which would be the zone to watch. The auction failed to move away from the balance of last 2 days on the upside and is now forming a balance on the higher 4-day scale which has a prominent POC at 19500 and the MPLite chart of the same can be viewed here.

- The BNF Open was a Open Auction Out of Range (OAOR)

- The day type was a Neutral Extreme Day – Down (NeuX)

- Largest volume was traded at 19914 F

- Vwap of the session was at 19645 with volumes of 72 L and range of 1558 points as it made a High-Low of 20219-18661

- BNF confirmed a FA at 20219 on 15/04 and completed the 1 ATR objective of 18667 on the same day. The 2 ATR target from this FA comes to 17115

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715.. This FA is currently on ‘T+5’ Days.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19395-19915-20184

Main Hypos for the next session:

a) BNF needs to sustain above 19035-49 for a move to 19140-185 / 19245-260 / 19350-395 / 19478-500 & 19561-600

b) The auction gets weak below 18970-950 for a test of 18885-870 / 18800-690 / 18570-544 / 18495-480 & 18430-375

Extended Hypos:

c) Above 19600, BNF can probe higher to 19692-730 / 19800-850 / 19900-925 / 19986-20040 & 20115-184

d) Below 18375, lower levels of 18300 / 18225-195* / 18150 / 18075-10 / 17920-902 & 17865-826 could come into play

-Additional Hypos*-

e) BNF sustaining above 20184* could start a new leg up to 20251-295 / 20326-350 / 20450-520 / 20600 & 20666-715

f) If 17826* is taken out, BNF could fall further to 17740 / 17665-600 / 17540* / 17490-462 / 17415 & 17376-311

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout