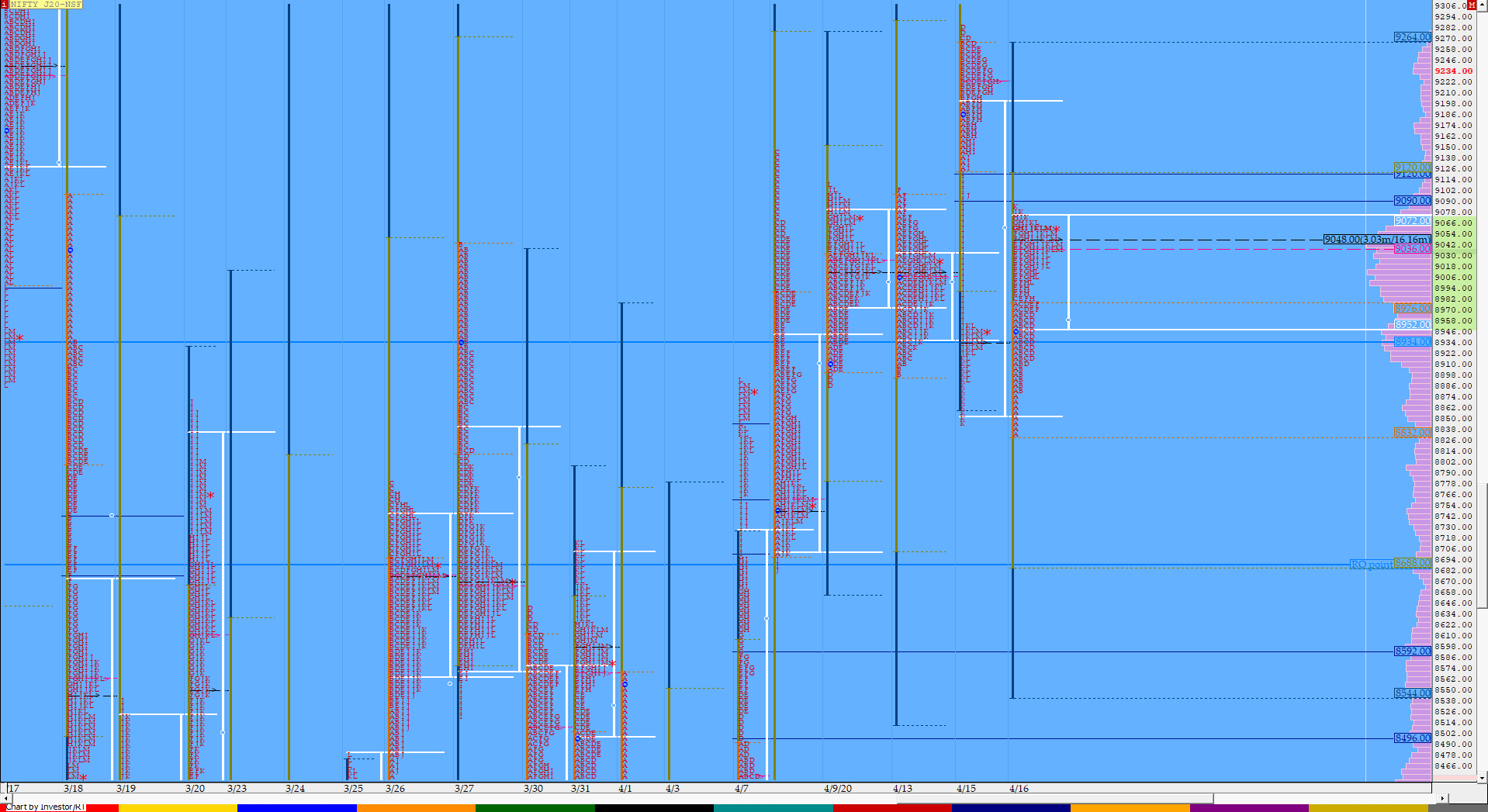

Nifty Apr F: 9035 [ 9089 / 8835 ]

HVNs – 8420-55 / 8555 / 8604 / 8670 / 8750 / 8800 / 8937 / 9015 / 9051 / 9175 / 9222

NF opened near the yPOC of 8937 but could not get into the singles of 8955 to 9095 on the upside and probed lower as it broke below PDL (Previous Day Low) making new lows for the week at 8835 but was swiftly rejected confirming an ORR (Open Rejection Reverse) after which it probed higher getting into the zone of singles as it tagged 8980 in the ‘A’ period. The ‘B’ period was an inside bar but more importantly confirmed a buying tail from 8884 to 8835 and considering that the previous day was a 3 IB one, the PLR for the day seemed to be up. The auction then made the dreaded C-side extension as it made new highs of 8986 where it faced immediate rejection and played out the retracement to VWAP where it was defended leaving the first of the many PBLs (Pull Back Low) at 8912. NF then made a fresh RE (Range Extension) in the ‘E’ period leading to higher highs being formed for the next 4 periods with the second PBL of 8972 being confirmed in the ‘F’ period as it made highs of 9074 in ‘I’. The auction then made a quite inside bar in the ‘J’ period and made another new RE higher as it hit 9089 but got stalled just below the important supply zone of 9095 marking the end of the upside probe for the day. NF then made a sharp retracement in the ‘L’ period to VWAP as it left another probable PBL at 9001 and was defended indicating that the initiative buyers of the open are still present. The day closed at 9035 with the HVN for this week shifting from 9015 to 9051 & will be the immediate reference for the next open. On the larger time frame, NF continued to build on the balance it was forming since 3 days and the updated composite has Value at 8910-9050-9070 (Click here to view the MPLite chart of the same) from where we can expect a drive away in the coming session(s).

- The NF Open was a Open Rejection Reverse (ORR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 9050 F

- Vwap of the session was at 8992 with volumes of 210.8 L and range of 254 points as it made a High-Low of 9089-8835

- NF confirmed a FA at 9282 on 15/04 and the 1 ATR target comes to 8808.

- NF had confirmed a multi-day FA at 8686 on 09/04 and tagged the 1 ATR objective of 9211 on 15/04. The 2 ATR target comes to 9736.

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8950-9050-9069

Main Hypos for the next session:

a) a) NF needs to sustain above 9051 for a rise to 9069-9075 / 9095-9112 / 9132-48 / 9172-80 & 9196-9206

b) The auction has immediate support at 9030 below which it could test levels of 9002 / 8985-72 / 8950 / 8920-12 & 8892-75

Extended Hypos:

c) Above 9206, NF can probe higher to 9222-44 / 9265 / 9282-95 / 9325 & 9358-65

d) Below 8875, the auction can fall further to 8840-28 / 8808-04 / 8775 / 8745*-36 & 8715-00

-Additional Hypos*-

e) Sustaining above 9365* could take NF to 9385 / 9412-16 / 9460-80 / 9510 & 9550-70

f) If 8700* is taken out, NF can start a new leg down to 8667-62 / *8620* / 8590 & 8559-45 & 8525-8490

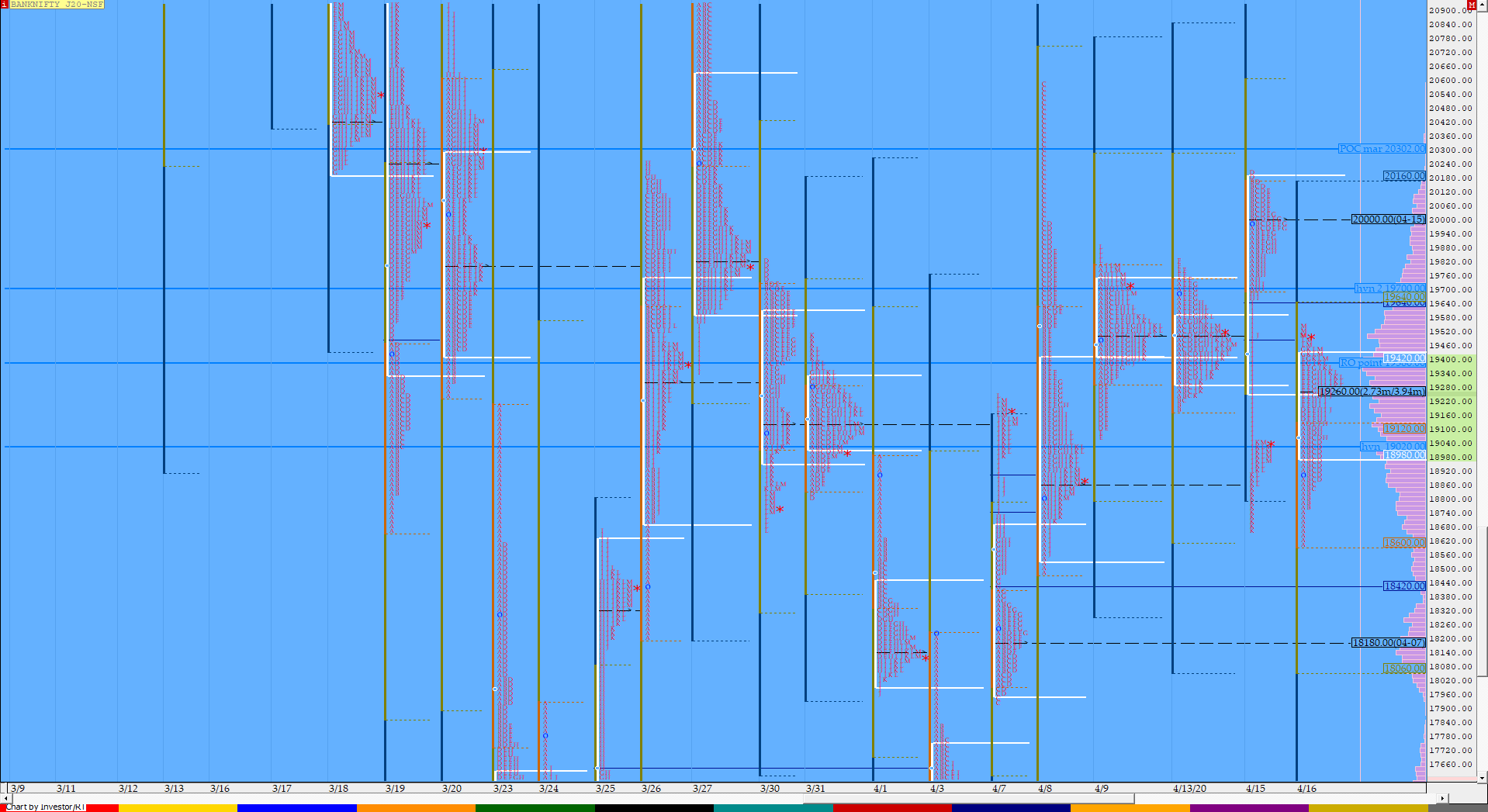

BankNifty Apr F: 19424 [ 19555 / 18601 ]

HVNs – 18180 /18260 / 18790 / 18970 / 19125 / 19270 / 19399 / 19500 / 19820 / 19900 / 20000

BNF made an OH (Open=High) start at 18905 and probed lower as it made a freak low of 18601 in the opening minutes but was immediately sent back above PDL which led not only to a test of the OH level but the auction went on to enter into the singles of 19049 to 19512 as it made highs of 19134 in the ‘A’ period. The next 2 periods saw coiling as the range contracted but as had happened in NF, there was a buying tail from 18770 to 18601 which meant that the PLR was to the upside. BNF then made a successful RE in the ‘D’ period following it up with a higher high of 19400 in the ‘E’ period completing the 1.5 IB objective and after making an inside bar in ‘F’, it made the 3rd RE in the ‘G’ period to hit 19452 where it got stalled leading to a big retracement in the ‘H’ period as it went below VWAP but found fresh demand there and went on to confirm a PBL at 19063. The auction then made a slow probe higher for the rest of the day and even went on to spike into the close as it tagged that prominent POC of 19500 while making new highs of 19555 before closing the day at 19426. BNF has also been forming a composite over the last few days & the 5-day balance now has Value from 18990-19383-19873 and an initiative move from the 19400 zone in the coming session could signal start of an imbalance. (Click here to view the MPLite chart of the 5-day composite)

- The BNF Open was a Open Rejection Reverse (ORR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 19260 F

- Vwap of the session was at 19160 with volumes of 70.5 L and range of 954 points as it made a High-Low of 19555-18601

- BNF confirmed a FA at 20219 on 15/04 and completed the 1 ATR objective of 18667 on the same day. The 2 ATR target from this FA comes to 17115

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715.. This FA is currently on ‘T+6‘ Days.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 19028-19260-19471

Main Hypos for the next session:

a) BNF has immediate supply at 19471-500 above which it could rise to 19555-575 / 19645-692 / 19755-826 / 19873-925 & 20040-115

b) The auction gets weak below 19399 for a test of 19350-325 / 19270 / 19185-130 / 19065-028 / 18970-905 & 18770

Extended Hypos:

c) Above 20115, BNF can probe higher to 20184 / 20251-295 / 20326-350 / 20450-520 / 20600-666 & 20715

d) Below 18770, lower levels of 18700-650 / 18570 / 18507-483 / 18430-375 / 18300 & 18225-195* could come into play

-Additional Hypos*-

e) BNF sustaining above 20715* could start a new leg up to 20795 / 20925 / 21000-095 / 21150 / 21250-275 & 21312

f) If 18195* is taken out, BNF could fall further to 18150 / 18075-10 / 17920-826 / 17740 / 17665-600 & 17540

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout