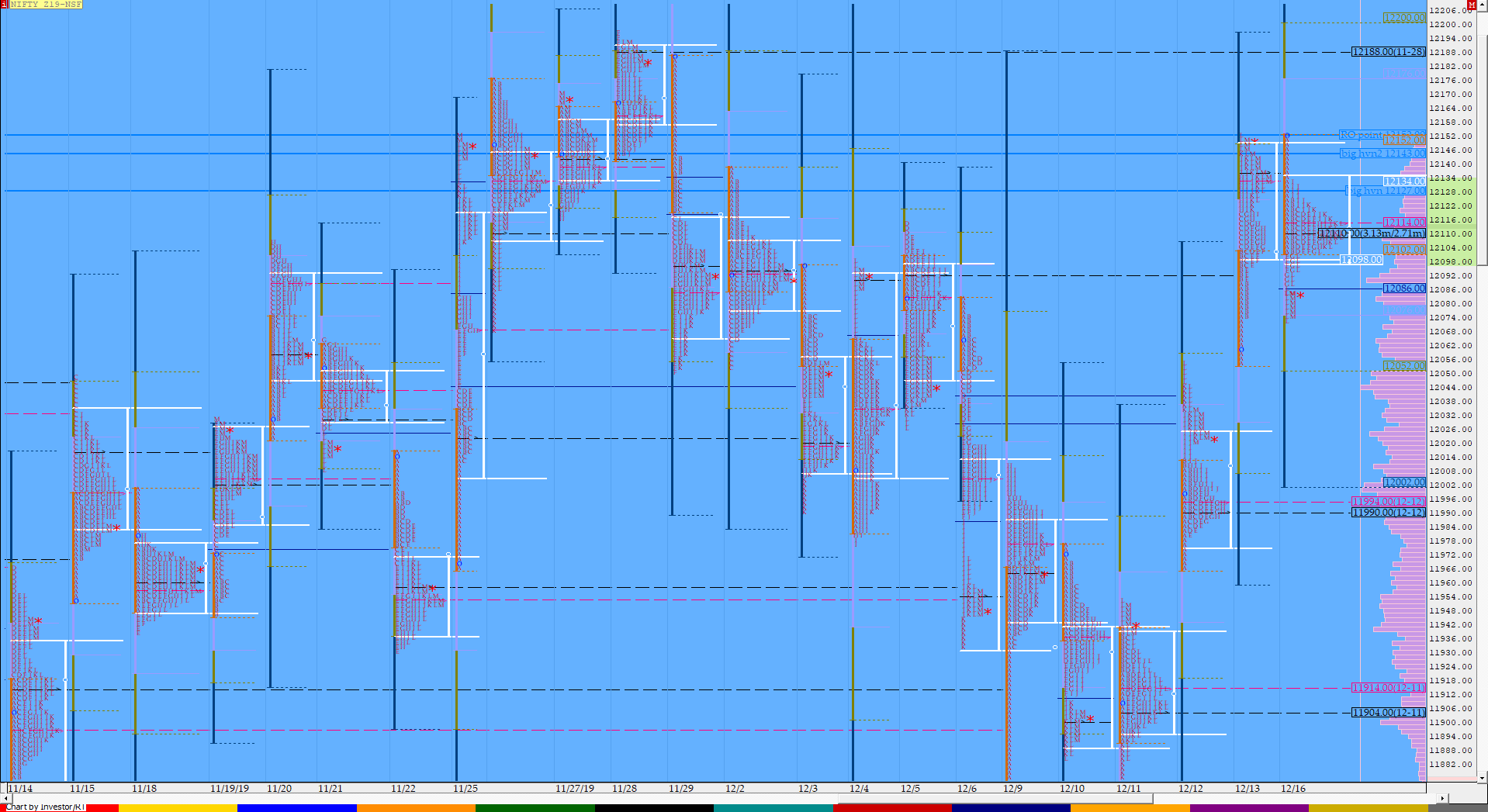

Nifty Dec F: 12082 [ 12152/ 12073 ]

HVNs – 11900-910 / (11940) / 11990 / 12024 / (12080-100) / 12135 / 12192

NF gave a OH start to the day at 12152 and once again failed to get above the RO point of 12153 which triggered a probe lower in the ‘A’ period as the auction went on to break below the PBL of 12121 & Friday’s VWAP of 12114 while making lows of 12102 which indicated that the supply was more aggressive than the demand. NF made a narrow range inside bar of just 24 points in the ‘B’ period confirming a selling tail from 12125 to 12152 in the IB as balance returned after the imbalance of last 3 days from 11872 and the next 3 periods also remained inside the range of ‘B’. There was finally a RE (Range Extension) in the ‘F’ period as the auction broke below IBL followed by another one in the ‘G’ period as it made a low of 12088 tagging the first PBL (Pull Back Low) of Friday which was at 12090 and gave a swift rejection which led to a retracement higher over the next 2 periods as NF scaled above VWAP and went on to test the morning selling tail as it left a PBH of 12133 indicating that the morning supply was still active in this zone. The probe then turned lower for the rest of the day as NF gave a spike close from 12088 to 12074 leaving an inside bar for the day both in terms of Range & Value along with a prominent POC at 12112 which would be the level to watch in the next session above the spike high of 12088.

Click here to watch the 2-day composite in NF

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a slow Normal Variation Day – Down (NV) with a spike close

- Largest volume was traded at 12112 F

- Vwap of the session was at 12112 with volumes of 62.4 L and range of 78 points as it made a High-Low of 12152-12074

- The Trend Day VWAP of 13/12 at 12114 was broken & NF closed below it on 16/12 so no longer a reference

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12104-12112-12142

Hypos / Estimates for the next session:

a) NF has immediate supply at 12092 above which it could test 12112 / 12126 & 12142

b) The auction gets weak below 12078-70 for a move to 12056-54 & 12024-18

c) Above 12142, NF can probe higher to 12166 & 12186*-192

d) Below 12018, auction could fall to 11994*-988 / 11969 & 11952*

e) If 12192 is taken out, the auction go up to to 12216-224 / 12245 & 12282

f) Break of 11952 can trigger a move lower to 11938 / 11914*-904 & 11880

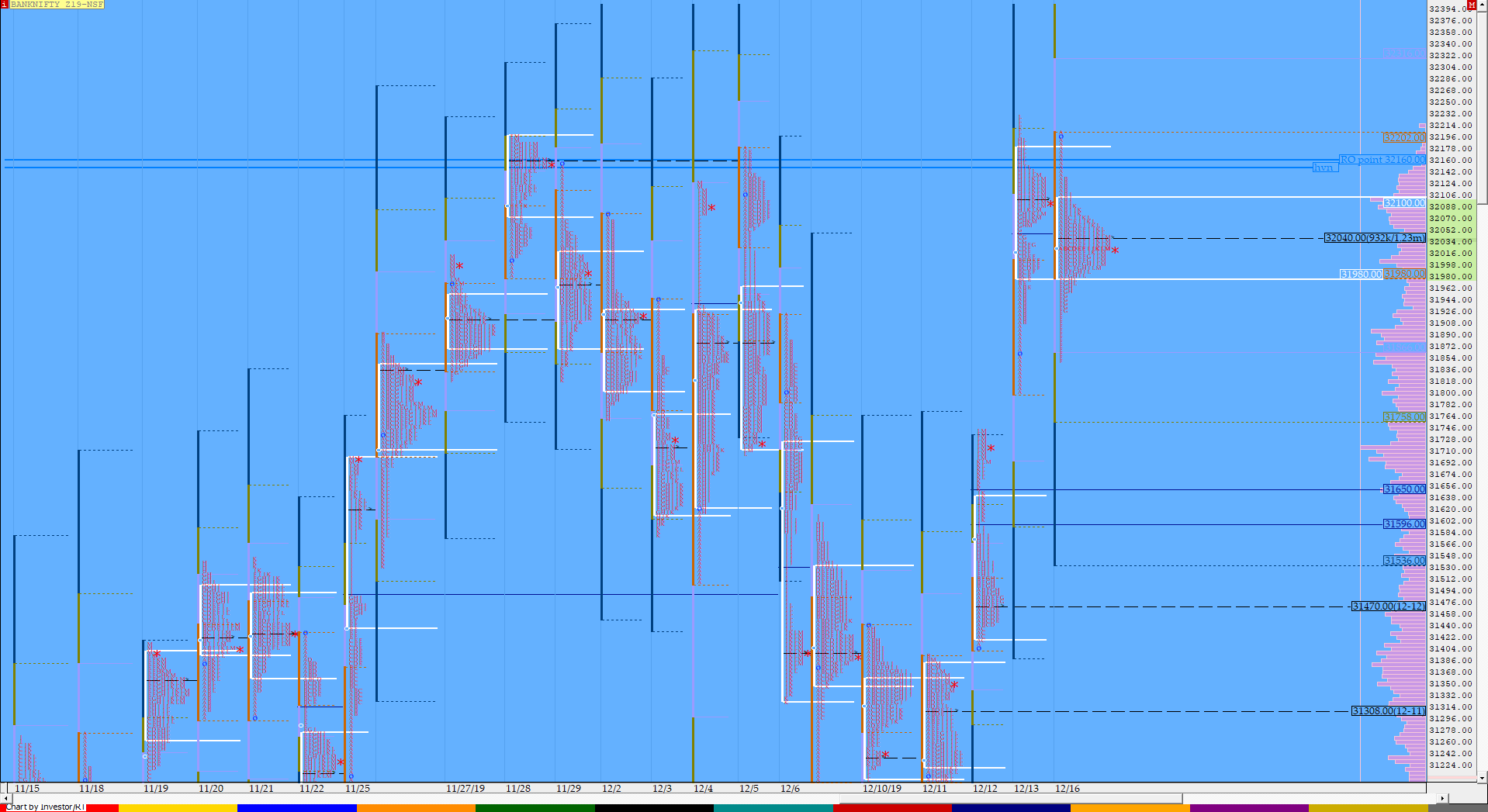

BankNifty Dec F: 32010 [ 32205 / 31848]

HVNs – 31370-400 / 31470 / 31715 / 31855 / 31896 / 32040 / 32100

BNF opened higher but got rejected from the selling tail of 32195 to 32230 & drove lower in the ‘A’ period and similar to NF, broke below the Friday’s POC & VWAP of 32100 & 32057 leading to a sharp probe lower as it made lows of 31982 after which it made an inside bar in the ‘B’ period where it also confirmed a selling tail in the day’s profile from 32130 to 32205. The next 3 periods stayed inside the range of ‘B’ coiling around the VWAP which led to a meltdown in the ‘F’ period as the auction broke below IBL and made a spike down to 31848 completing the 1.5 IB extension where it got rejected and left a buying tail till 31927 as it got back to test the yPOC of 32100 forming a balanced profile on the daily with tails at both ends (3-1-3 profile) with a prominent POC at 32040. The Range & Value were both inside the previous day’s levels thus forming a nice 2-day composite from where we can expect the auction to give a move away in the coming session(s).

Click here to watch the 2-day composite in BNF

- The BNF Open was an Open Auction In Range plus a Drive Down (OAIR)

- The day type was a slow Normal Variation Day – Down (3-1-3 profile)

- Largest volume was traded at 32040 F

- Vwap of the session was at 32038 with volumes of 23 L and range of 357 points as it made a High-Low of 32205-31848

- The Trend Day VWAP of 13/12 at 32057 was broken & BNF closed below it on 16/12 so no longer a reference

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31980-32040-32082

Hypos / Estimates for the next session:

a) BNF needs to stay above 32040 for a rise to 32095 / 32130-160 & 32225

b) Immediate support is at 31980-952 below which the auction could test 31896 / 31850 & 31805

c) Above 32225, BNF can probe higher to 32275-326 / 32384 & 32450-465

d) Below 31805, lower levels of 31745-715 / 31670-645 & 31590 could be tagged

e) If 32465 is taken out, BNF can give a fresh move up to 32510 / 32573-577 & 32628

f) Below 31590, we could see lower levels of 31545 / 31490-470 & 31420

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout