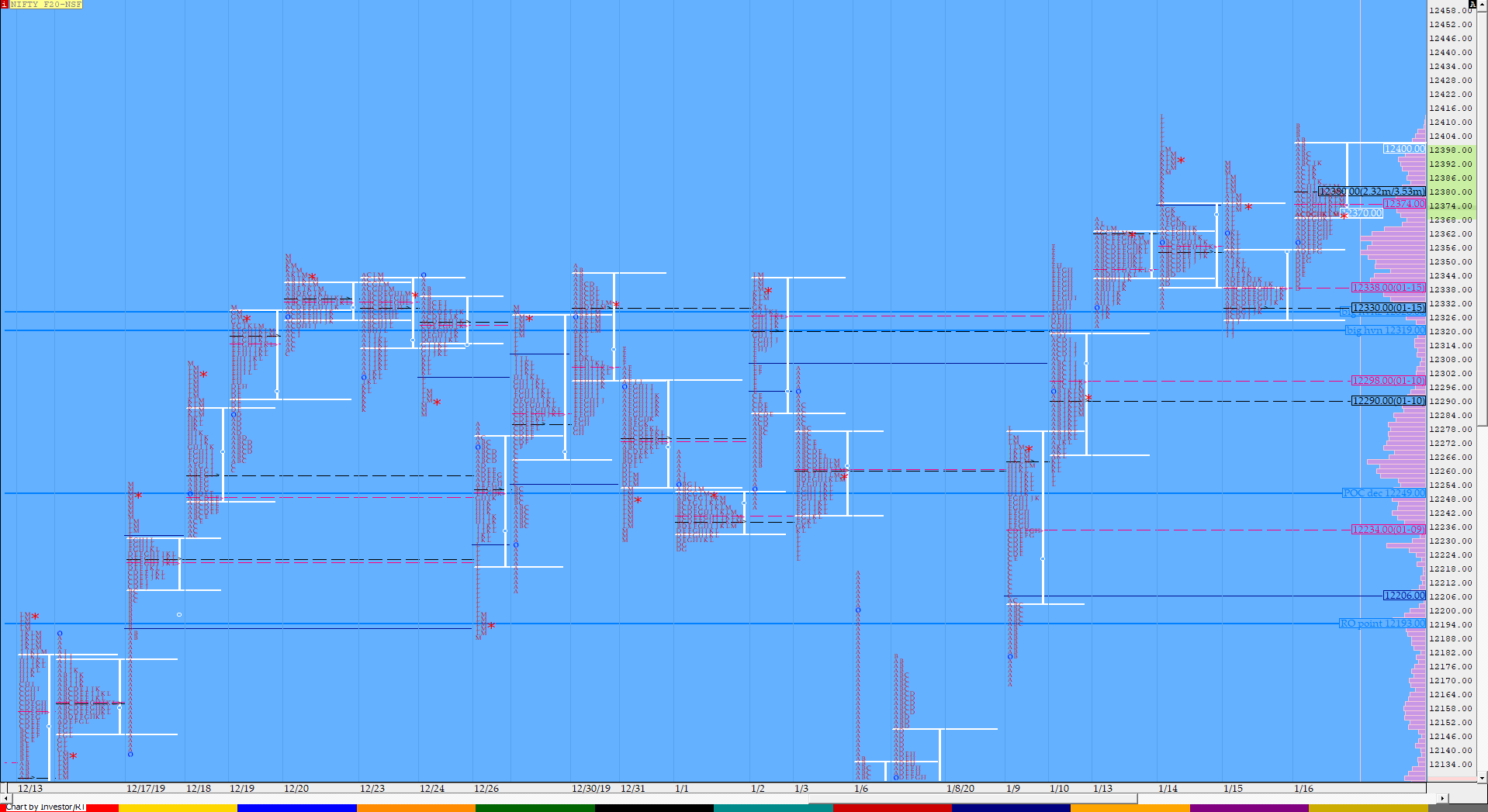

Nifty Jan F: 12374 [ 12409/ 12339 ]

HVNs – 12040 / 12062 / 12113 / 12195 / 12265 / 12290 / 12330 / 12357 / 12380

Previous day’s report ended with this ‘The last 3 days composite has formed a nice balance with Value at 12332-12355-12365 with the lows being exactly at Friday’s VAL so chances are good that it continues to remain in this composite smoothening the profile further before giving a move away‘

NF opened lower and took support right at the POC of the 3-day composite as it made a low of 12355 and reversed the probe to the upside as it scaled above PDH (Previous Day High) and went on to tag 12409 in the ‘B’ period stalling just below the all time highs which suggested that the auction is still not ready to move away from the balance it was forming this week. NF then probed lower for the next 2 periods as it got back into the composite Value and even made a RE (Range Extension) to the downside in the ‘D’ period almost completing the 80% Rule as it made lows of 12339 taking support just above yesterday’s prominent TPO POC of 12338 which indicated that the downside for the day was limited. The auction then started a slow probe higher for the next 6 periods as it got above VWAP and went on to tag the PDH of 12392 in the ‘J’ period but was not able to sustain above it which led to a probe to VWAP and a close around the dPOC of 12380 leaving a nice Gaussian profile for the day. However, today’s auction continues to be part of the weekly balance we are forming in NF and the 4-day composite now has Value at 12333-12357-12375 and would be interesting to see if there is a move away from this in the next couple of sessions.

Click here to view the MPLite chart of the 4-day composite in NF

- The NF Open was an Open Auction (OA)

- The day type was a Normal Day – Gaussian Profile

- Largest volume was traded at 12380 F

- Vwap of the session was at 12375 with volumes of 62.9 L and range of 70 points as it made a High-Low of 12409-12339

- NF confirmed a FA at 12319 on 15/01 and almost tagged the 1 ATR target of 12415 on 16/1. The 2 ATR objective comes to 12511.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12370-12380-12401

Hypos / Estimates for the next session:

a) NF needs to sustain above 12383 for a move to 12400-404 / 12421-434 & 12450-463

b) Immediate support is at 12360-357 below which the auction could test 12339-333 / 12319 & 12298-290*

c) Above 12463, NF can probe higher to 12487 / 12511-515 & 12530

d) Below 12290, auction could probe lower to 12270-255 & 12234*

e) If 12530 is taken out, the auction go up to to 12550 / 12569-576 & 12600

f) Break of 12234 can trigger a move lower to 12217-210 / 12195-181 & 12160

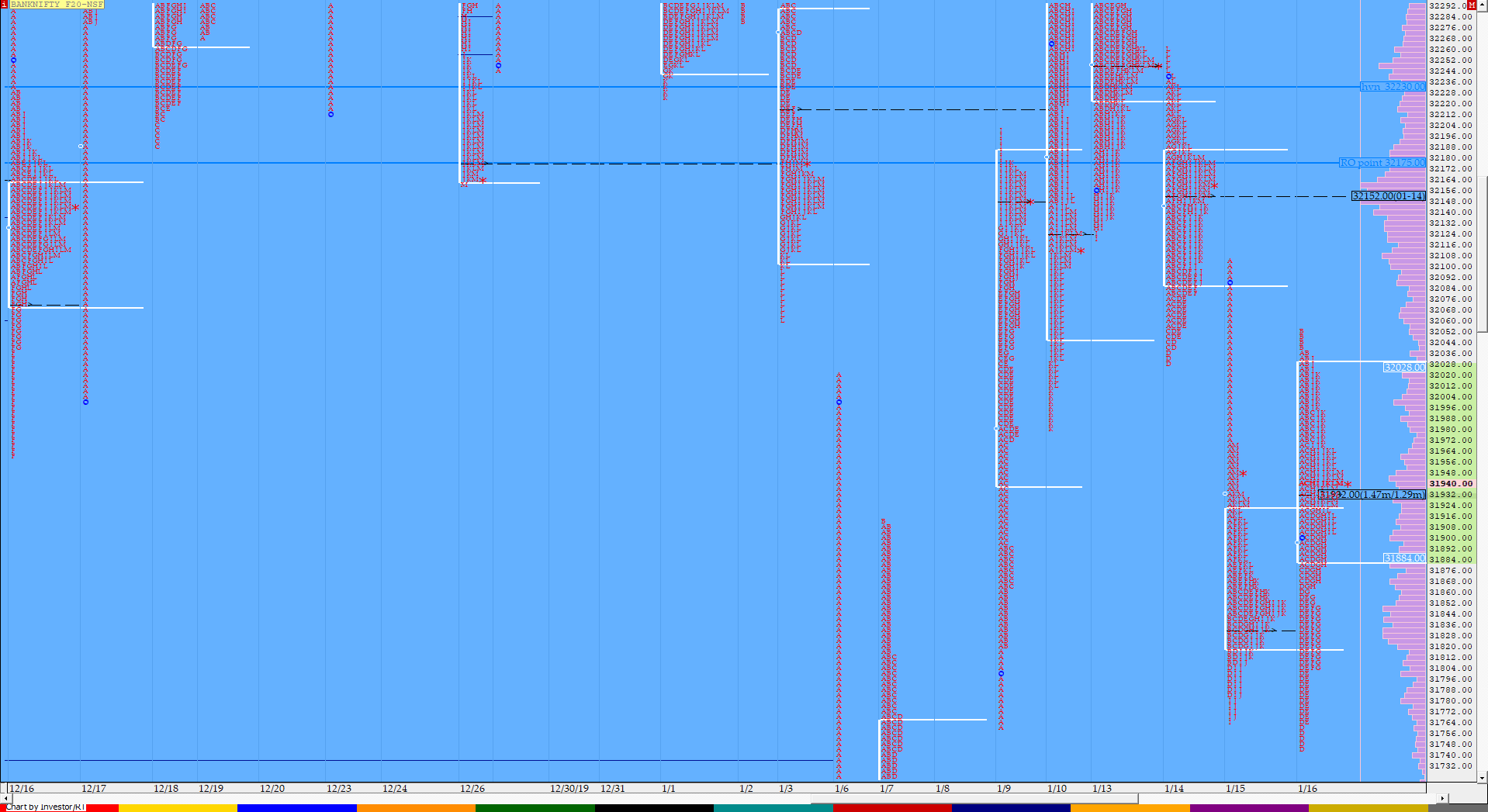

BankNifty Jan F: 31936 [ 32054 / 31745 ]

HVNs – (31480-500) / 31840 / 31935 / (32001) / 32152 / 32250 / 32300 / (32420) / 32550-565

BNF gave an OAIR start and took support above previous day’s POC of 31832 which was a bullish signal as it probed higher getting into that selling tail of 31970 but got stalled at that negated FA of 32032 in the ‘A’ period. The ‘B’ period made new highs of 32054 but was immediately rejected which triggered a quick move to the downside over the next 2 periods as the auction not only made new lows for the day in the ‘C’ period but followed up with a probe below the PDL (Previous Day Low) in the ‘D’ period as it made lows of 31745 but was swiftly rejected and this led to a probe higher till the ‘J’ period where once again BNF stalled at the level of 32034 as it left a PBH (Pull Back High) there and made a dip to the dPOC before closing the day at 31935 leaving a balanced profile for the day but in the process has also formed a nice 2-day balance with Value at 31822-31843-31961 with probable objectives on the upside at 32152 & 32565 and on the downside at 31480 in the coming session(s).

View the MPLite chart of BNF forming a 2-day balance

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 31935 F

- Vwap of the session was at 31917 with volumes of 28.8 L and range of 309 points as it made a High-Low of 32054-31745

- BNF confirmed a multi-day FA at 32260 on 14/01 and tagged the 1 ATR target of 31883. The 2 ATR objective from this FA comes to 31507.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31895-31935-32034

Hypos / Estimates for the next session:

a) BNF has immediate supply at 31960-980 which if negated could rise to 32040-57 / 32100 & 32152*-160

b) Immediate support is at 31930 below which the auction could test 31885 / 31840-822 & 31760-718

c) Above 32160, BNF can probe higher to 32205-260 / 32310 & 32365-380

d) Below 31718, lower levels of 31670-655 / 31585 & 31540 could be tagged

e) If 32380 is taken out, BNF can give a fresh move up to 32430 / 32490-508 & 32565*

f) Break of 31540 could trigger a move down to 31480* / 31440-425 & 31370-328

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout