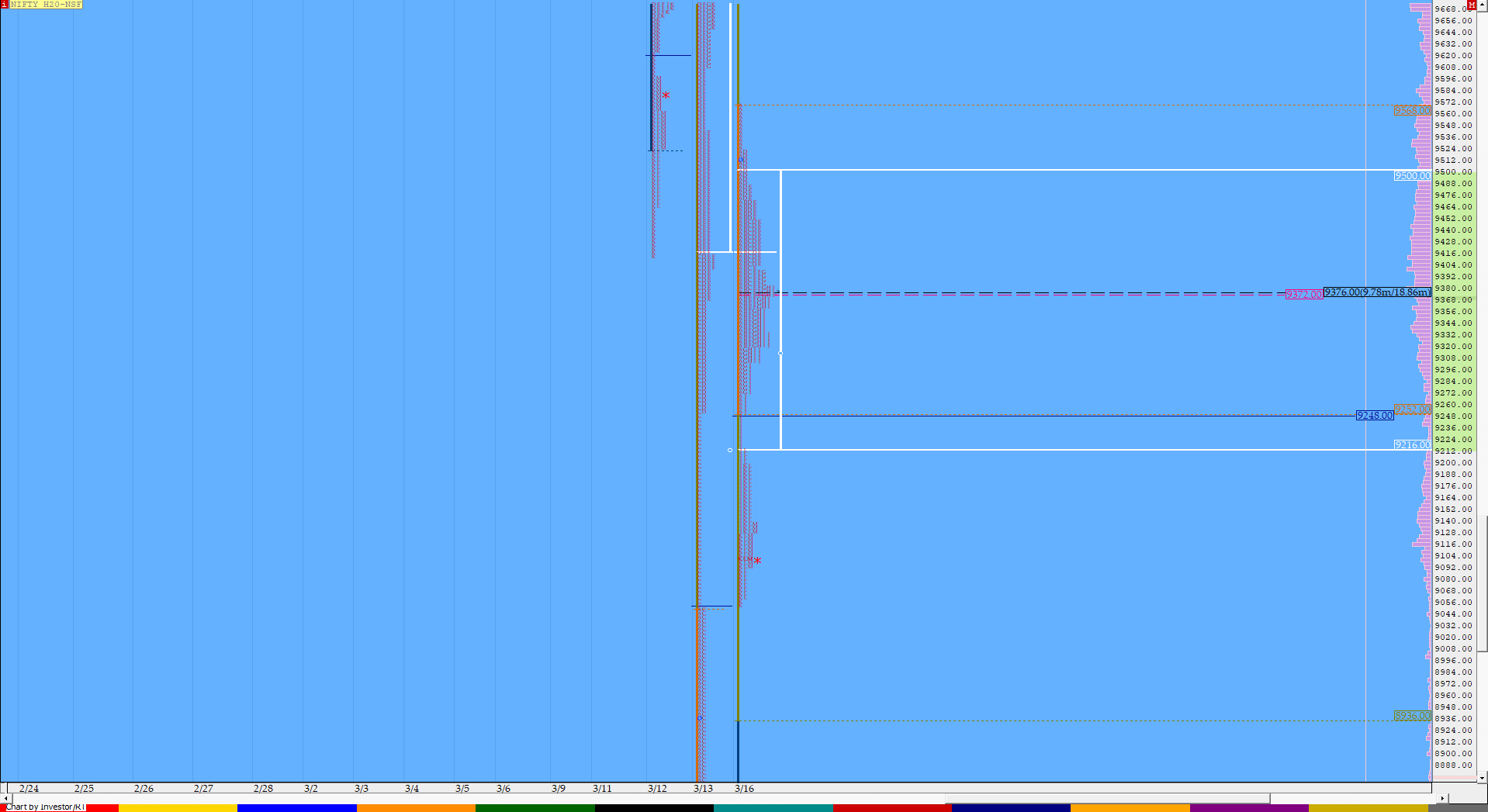

Nifty Mar F: 9118 [ 9570 / 9055 ]

HVNs – (8680) / (9120) / 9380 / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544

NF opened lower with a big gap down of 380 points and stayed below Friday’s VWAP of 9550 which was a sign that the sellers had taken control yet again following which the auction left a selling tail from 9570 to 9520 and made a balance in the IB (Initial Balance) forming a ‘b’ shape profile till late afternoon taking support right at the start of the singles from Friday which was from 9252 to 9050. However, the ‘J’ period saw an extension handle to the downside at 9255 as NF broke into the Friday singles making a swift move of 200 points as it made a low of 9055 in the ‘K’ period taking support right above 9050. The auction then made a retracement to 9213 in the ‘L’ period as it built volumes at 9120 where it finally closed to give a Normal Variation Day down with a spike close from 9255 to 9055. Spike Rules will be in play for the next session with the immediate reference being at 9120.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (‘b’ shape profile with spike close)

- Largest volume was traded at 9380 F

- Vwap of the session was at 9302 with volumes of 293.8 L and range of 515 points as it made a High-Low of 9570-9055

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9215-9380-9519

Main Hypos for the next session:

a) NF needs to sustain above 9120 for a rise to 9150-70 / 9215 / 9250-55 / 9302-40 & 9375-85

b) The auction has immediate support at 9080 below which could it fall to 9050 / 9000 / 8950-10 / 8888-60 & 8690-80

Extended Hypos:

c) Above 9385, NF can probe higher to 9412 / 9460-80 / 9510 / 9550-70 & 9615

d) Below 8680, the auction can move lower to 8600 / 8525 & 8400

-Additional Hypo on downside*-

e) Below 8400*, the auction could further fall to 8299 / 8250 & 8200

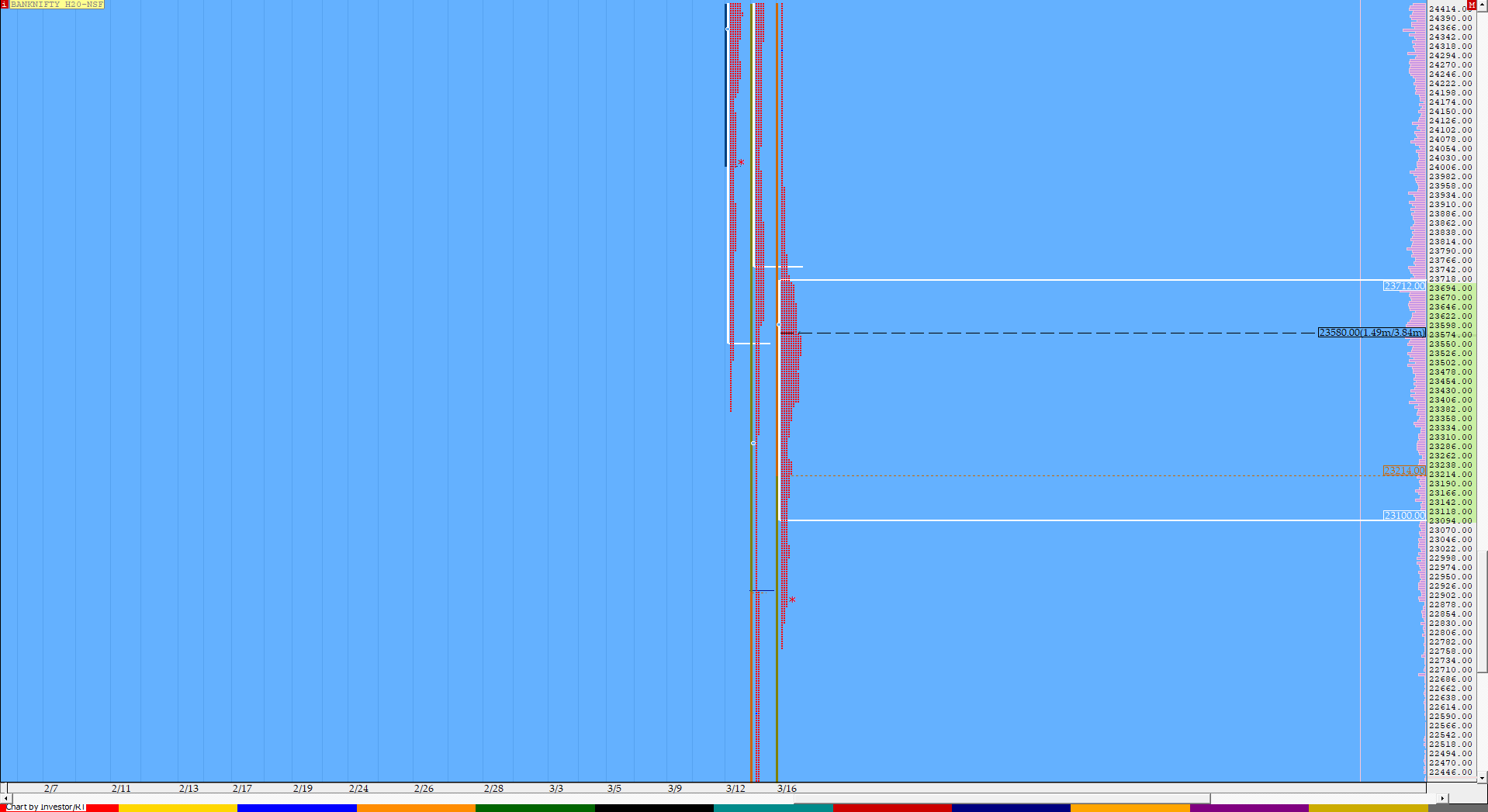

BankNifty Mar F: 22960 [ 24434 / 22766 ]

HVNs – 23580 / (23680) / (23920) / 24260 / 24500 / 24980 / 25039 / 25156 / (26150) / 26480

BNF also opened lower with a big gap of over 700 points below Friday’s VWAP & drove lower giving a big IB range of 1216 points as it made lows of 23218 in the first hour. This imbalance led to a small retracement over the next 2 periods as the auction got into the morning selling tail but left a PBH (Pull Back High) at 23956 in the ‘D’ period after which it resumed the move to the downside as it made a RE (Range Extension) in the ‘G’ period but was swiftly rejected which led to a probe to VWAP as BNF left a new PBH at 23700. The auction then made a OTF (One Time Frame) move lower from the ‘H’ to the ‘K’ periods making fresh REs lower as it made lows of 22766 and gave one more retracement this time to the IBL as it left yet another PBH at 23250 before closing the day at 22960 leaving a ‘b’ shape profile for the day.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 23580 F

- Vwap of the session was at 23385 with volumes of 54 L and range of 1668 points as it made a High-Low of 24434-22766

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 23124-23580-23720

Main Hypos for the next session:

a) BNF needs to stay above 22990 for rise to 23050-125 / 23232-290 / 23385 / 23450 & 23550-580

b) The auction has immediate support at 22900 below which it could fall to 22760-700 & 22430

Extended Hypos:

c) Above 23580, BNF can probe higher to 23630 / 23720 / 23775 / 23910-956 & 24030-100

d) Below 22430, lower levels of 22300-285 / 22200 & 21800 could be tagged

-Additional Hypo on downside*-

e) Below 21800*, the auction could further fall to 21568-500 & 21000

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout