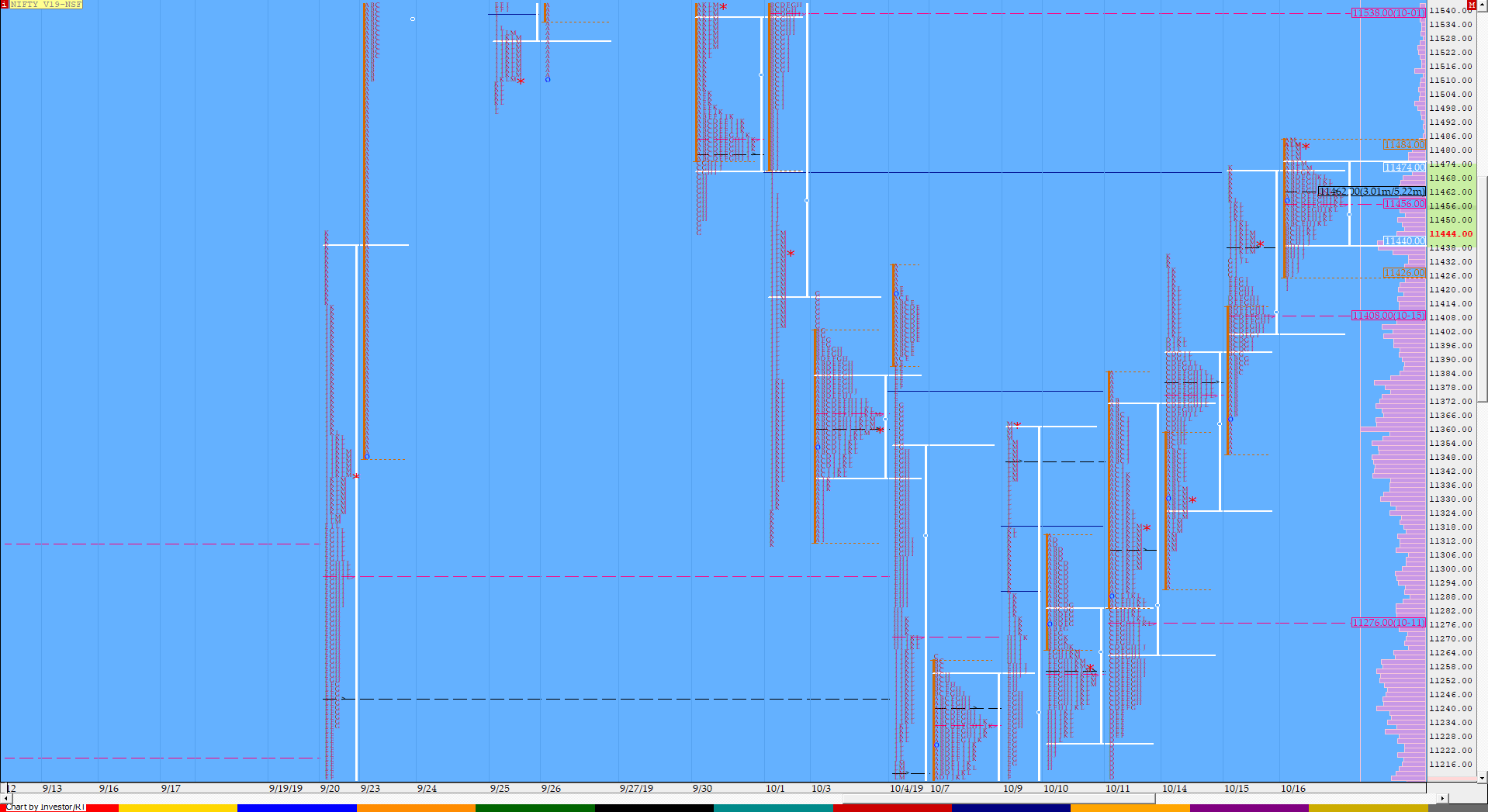

Nifty Oct F: 11475 [ 11485/ 11420 ]

HVNs – 11155 / 11250-253 / (11276) / 11330 / 11380 / [11410] / 11460 / 11480 / 11550

Yesterday’s report ended with this ‘NF will need to stay above 11440 and then take out the higher HVN of 11480 for a move towards the vPOC of 11538. On the downside 11420 would be the immediate support below which 11380 could be tested.’

NF opened with a small gap up above the 11440 level but settled down into an Open Auction as it failed to attract new business as volumes remained on the lower side as it tested the HVN of 11480 in the ‘A’ period and on failure to find new demand the probe turned lower as the auction made lows of 11427 in the IB giving a narrow range of just 58 points but even here there was no new supply coming in. The rest of the day remained in this narrow range as NF made a nice Gaussian profile for the day with one failed attempt to break lower in the ‘I’ period which got rejected at 11420 after which the auction went to the other extreme almost confirming a FA but could only match the IBH thus leaving poor highs at 11485 along with a prominent POC at 11460 as the day closed as a Normal Day with overlapping to higher Value but with one of the lowest range as well as volumes which means the trade facilitation is getting poorer & the auction is getting ready for a new leg in the coming session(s)

(Click here to view NF making higher but contracting range this week)

- The NF Open was an Open Auction (OA)

- The day type was a Normal Day (Gaussian Profile)

- Largest volume was traded at 11460 F

- Vwap of the session was at 11453 with volumes of 87.1 L and range of 65 points as it made a High-Low of 11485-11420

- NF confirmed a FA at 11113 on 09/10 and completed the 1 ATR move up of 11309. The 2 ATR objective comes to 11505. This FA is currently on ‘T+6’ Days

- The Trend Day VWAP of 09/10 at 11224 will be important support and this held on 10/10 as well as on 11/10

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11437-11460-11470

Hypos / Estimates for the next session:

a) NF has supply at 11485-490 above which it can rise to 11505-510 / 11529-538* & 11563-575

b) Immediate support is at 11460-450 below which the auction could test 11430-420 / 11395-380 & 11360

c) Above 11575, NF can probe higher to 11595-615 / 11628*-634 & 11660-670

d) Below 11360, auction becomes weak for 11340-330 / 11310 & 11285

e) If 11670 is taken out, the auction go up to to 11700 / 11725-731 & 11751-776

f) Break of 11285 can trigger a move lower to 11267-245 / 11226-205 & 11185-173

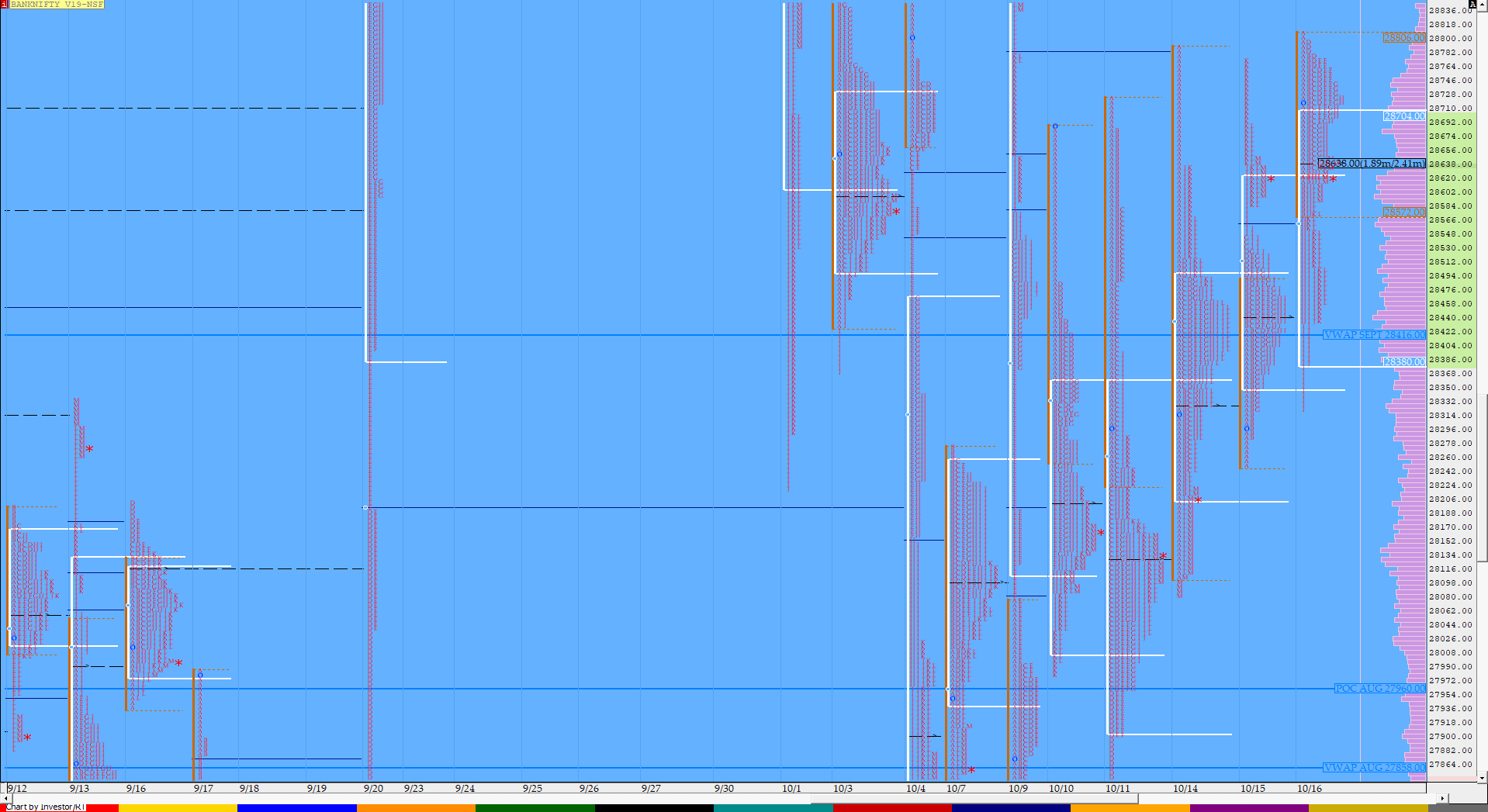

BankNifty Oct F: 28605 [ 28807 / 28321 ]

HVNs – 28025 / 28130 / 28330 / 28430 / 28625* / (28680-730) / 28860 / 29350-382

BNF also made an OA (Open Auction) start as it attempted a probe away from the 8-day composite it was forming making new highs for the week at 28807 in the ‘A’ period but could not sustain these new highs because of lack of demand and probed lower to tag lows of 28574 in the IB just stopping above the extension handle of 28555 giving a relatively narrow IB range of 233 points. The auction remained in this range for the next 5 periods before the ‘H’ period made a RE (Range Extension) to the downside breaking the 28555 level and this led to a 2 IB move lower as BNF made lows of 28321 in the ‘I’ period which saw swift rejection as it got back above IBL to close at 28605. Value for the day was overlapping to higher making the composite smoother which can be seen at the link below…

(Click here to view the 9-day composite in BNF)

- The BNF Open was an Open Auction (OA)

- The day type was a Normal Variation Day – Down

- Largest volume was traded at 28625 F

- Vwap of the session was at 28615 with volumes of 44.2 L and range of 486 points as it made a High-Low of 28807-28321

- BNF confirmed a FA at 27774 on 09/10 and completed the 1 ATR move up of 28713. The 2 ATR objective comes to 29653. This FA is currently on ‘T+6’ Days

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28533-28625-28800

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28625-636 for a rise to 28680 / 28730-762 / 28810 & 28875-900

b) Immeidate support is at 28576-570 below which the auction could test 28500 / 28430-410 & 27340-330

c) Above 28900, BNF can probe higher to 28954-990 / 29069 & 29140-167

d) Below 28330, lower levels of 28284-250 / 28190-130 & 28083 could come into play

e) Sustaining above 29167, BNF can give a fresh move up to 29222-283 / 29350-382 & 29445-460

f) Break of 28083 could trigger a move down 28035-25 / 27970 & 27900-880

Additional Hypos

g) Above 29460, higher levels of 29525 / 29653 & 29725-735 could get tagged

h) If 27880 is broken, BNF could fall to 27840 / 27774 & 27675-650

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout