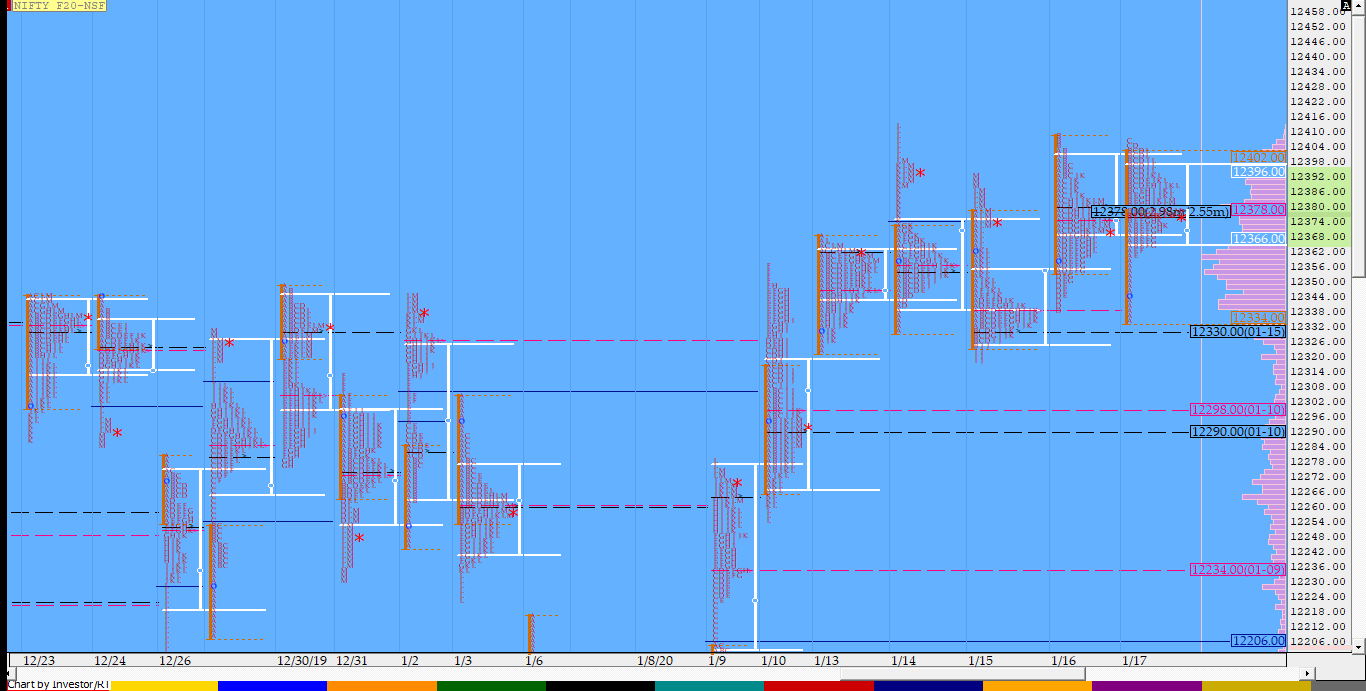

Nifty Jan F: 12384 [ 12407 / 12335 ]

HVNs – 12040 / 12062 / 12113 / 12195 / 12265 / 12290 / 12330 / 12357 / 12380

NF opened with a gap down and briefly broke below PDL (Previous Day Low) as it tagged 12335 but was swiftly rejected as it not only got back into the previous day’s range but also completed the 80% Rule in the Gaussian profile also making highs of 12404 in the IB. (Initial Balance) The auction then made the dreaded C side extension as it made new day high of 12407 but could not get above the PDH (Previous Day High) of 12409 and as it does most of the times, the C side failed extension then led to a probe lower as NF got below VWAP but took support in the morning buying tail of 12365 to 12335 leaving a pull back low at 12360 after which the auction remained in the IB range making yet another balanced daily profile for the week which in turn has left a nice Gaussian profile on the weekly also and looks complete and ready to move away in the coming week.

Click here to view the MPLite chart of the 5-day composite in NF

- The NF Open was an mini Open Rejection Reverse – Up (ORR) on low volumes

- The day type was a Normal Day – ‘p’ shape profile

- Largest volume was traded at 12380 F

- Vwap of the session was at 12380 with volumes of 60 L and range of 73 points as it made a High-Low of 12407-12335

- NF confirmed a FA at 12319 on 15/01 and almost tagged the 1 ATR target of 12415 on 16/1. The 2 ATR objective comes to 12511. This FA is currently on ‘T+3‘ Days.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12361-12380-12394

Hypos / Estimates for the next session:

a) NF needs to sustain above 12385 for a move to 12400 / 12415-421 & 12437-445

b) Staying below 12380, the auction could test 12360 / 12339-333 & 12319

c) Above 12445, NF can probe higher to 12463-487 & 12511-515

d) Below 12319, auction could probe lower to 12298-290* & 12270-255

e) If 12515 is taken out, the auction go up to to 12530 /12550 & 12569-576

f) Break of 12255 can trigger a move lower to 12234* / 12217-210 & 12195-181

BankNifty Jan F: 31723 [ 31874 / 31540 ]

HVNs – 31280 / (31430) / (31480-500) / (31700) / 31770 / 31840 / 31935 / (32001) / 32152 / 32250

BNF opened with a huge gap down of 275 points and continued to probe lower as it tested the spike high of 31541 of 8th Jan making a swift rejection from there as it got back into the previous day’s range in the ‘B’ period and went on to make highs of 31817 in the IB leaving a long buying tail from 31711 to 31540. The auction then made a RE to the upside in the C period as it made new day highs of 31874 but was not able to get above the previous day’s IBL which indicated that the supply was coming back in this zone. BNF then got back into the IB range in the D period & similar to NF not only broke below VWAP but tested the buying tail of morning as it left a PBL of 31679 in the ‘K’ period leaving a ‘p’ shape profile for the day with a close around the day’s VWAP. Although Value for the day was lower, there was some indication of short covering today but for more upside in the coming session(s), BNF will need to first stay above today’s dPOC of 31770 and then taken out the HVN of 31845 for a rest of the VPOCs of 31932 & 32152.

View the MPLite chart of BNF forming a ‘p’ shape profile

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Variation Day – Up (‘p’ shape profile)

- Largest volume was traded at 31770 F

- Vwap of the session was at 31752 with volumes of 29.3 L and range of 334 points as it made a High-Low of 31874-31540

- BNF confirmed a multi-day FA at 32260 on 14/01 and tagged the 1 ATR target of 31883. The 2 ATR objective from this FA comes to 31507. This FA is currently on ‘T+4’ Days.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31702-31770-31840

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31725 for a move to 31770 / 31815-845 & 31890

b) Staying below 31700, the auction could test 31658 / 31580-550 & 31507-480*

c) Above 31890, BNF can probe higher to 31932*-961 / 32040-57 & 32100

d) Below 31480, lower levels of 31440-425 / 31370 & 31328 could be tagged

e) If 32100 is taken out, BNF can give a fresh move up to 32152*-160 / 32205 & 32250-260

f) Break of 31328 could trigger a move down to 31280*-265 / 31210-180 & 31126-115

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout