Nifty Mar F: 8434 [ 9071 / 8380 ]

HVNs – 8550 / (8680) / (8900) / (9110-120) / 9200 / 9380 / [9425] / (9530) / 9680 / 9740 / 9900 / 9950 / 10450 / 10544

NF opened higher for the second day running with a gap up of 125 points leaving yet another instance of not giving a follow up after a Neutral Extreme Day but similar to the previous day, the gap up saw supply coming back in the form of an initiative selling tail in the IB (Initial Balance) from 9071 to 8908 as it made lows of 8776. The auction then made the dreaded ‘C’ side extension to the downside and was swiftly rejected back into the IB triggering a move to VWAP where it got stalled right at the morning selling tail of 8908 indicating that the morning sellers were very much in control. NF then made a trending move lower for the rest of the day making multiple REs lower starting from the ‘D’ period as it left couple of extension handles at 8721 & 8660 to complete more than the 2 IB objective to the downside inspite of the big IB range of 295 points as it made lows of 8380 leaving a Trend Day Down though it closed a bit higher at 8433. The profile also has a typical afternoon PBH (Pull Back High) of 8594 confirmed in the ‘I’ period which would be an important reference above the dPOC of 8560 in the coming sessions.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Trend Day – Down (TD)

- Largest volume was traded at 8560 F

- Vwap of the session was at 8660 with volumes of 285.1 L and range of 691 points as it made a High-Low of 9071-8380

- NF confirmed a FA at 9358 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA is currently on ‘T+2’ Days

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8383-8560-8778

Main Hypos for the next session:

a) NF has immediate supply at 8463-88 above which it could rise to 8510-35 / 8560-86 / 8625 / 8650-80 & 8721-30

b) The auction remains weak below 8420 for a fall to 8395-80 / 8347-29 / 8297-60 / 8214-02* & 8176-40

Extended Hypos:

c) Above 8730, NF can probe higher to 8775-80 / 8805 / 8825-50 / 8885 & 8920-31

d) Below 8140, the auction can move lower to 8079 / 8048-36 / 7981-58 / 7920 & 7896

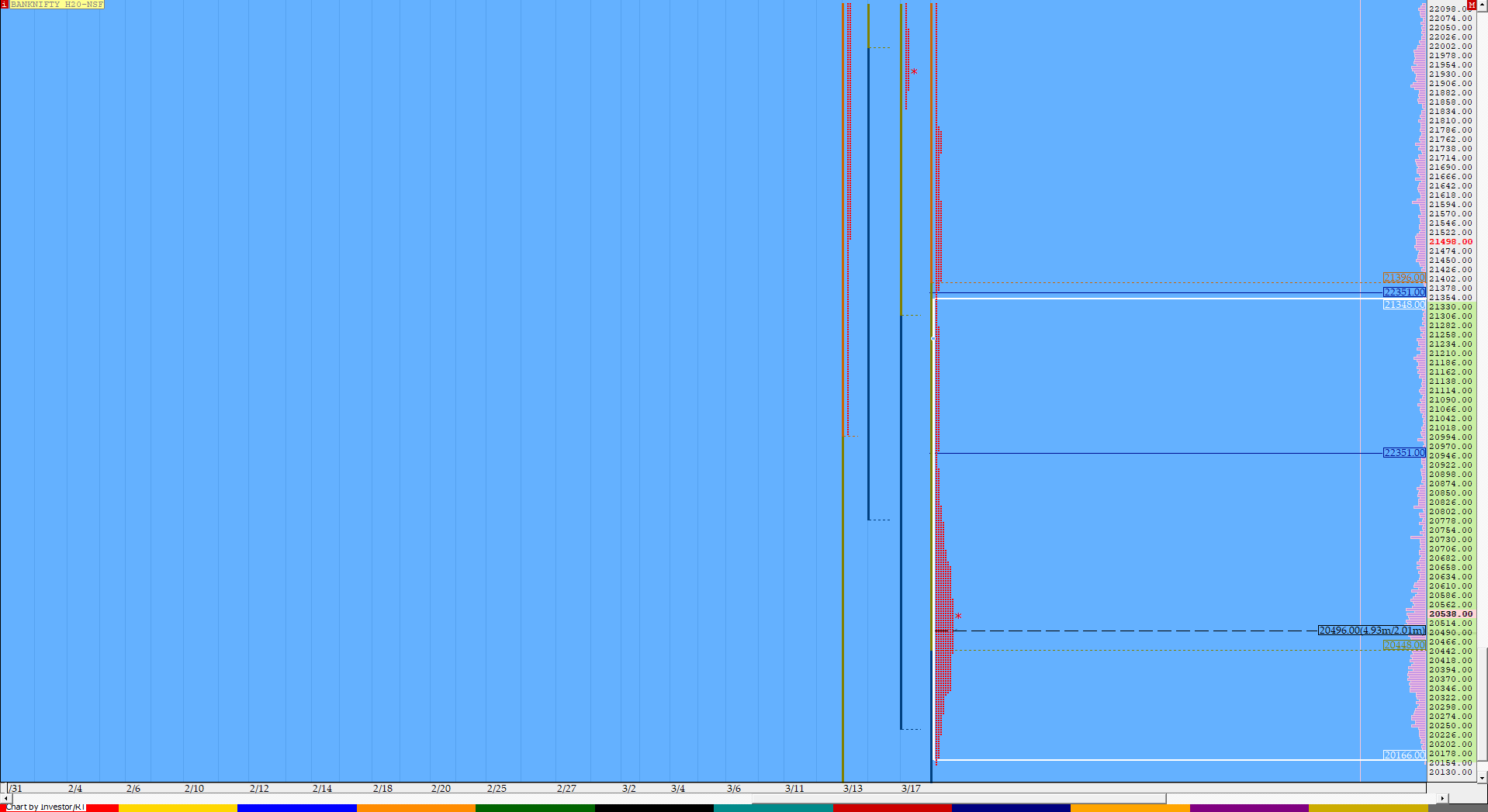

BankNifty Mar F: 20518 [ 22351 / 20150 ]

HVNs – 20500 / 23000 / (23680) / (23920) / 24260 / 24500 / 24980 / 25039 / 25156 / (26150) / 26480

BNF also opened higher but was unable to take out the previous day’s extension handle of 22360 as it made highs of 22351 at open which was a confirmation that the initiative seller(s) were still present in that zone which then led to a big move down of 950 points in the IB as the auction broke below previous day’s low to hit 21401. Similar to NF, BNF also made a C side extension which led to a quick move to VWAP where it got rejected at 21785 just below the morning selling tail from 21796 to 22351 and this rejection triggered a fresh probe to the downside resulting in couple of extension handles at 21375 & 20959 as the auction went on to make lows of 20150 in the ‘G’ period itself completing a 2201 point move. This imbalance then led to a balance being formed in the lower part of the day’s profile for the rest of the day as BNF built volumes at 20500 and even closed around it to leave a Double Distribution Trend Day Down. The PBH (Pull Back High) of 20913 and today’s VWAP of 20990 will be the important references on the upside for the coming sessions whereas on the downside, 20228 would be a level to watch.

- The BNF Open was a Open Rejection Reverse – Down (ORR)

- The day type was a Double Distribution Trend Day – Down (DD)

- Largest volume was traded at 20500 F

- Vwap of the session was at 20990 with volumes of 70.3 L and range of 2201 points as it made a High-Low of 22351-20150

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 20167-20500-21277

Main Hypos for the next session:

a) BNF sustaining above 20520 could test higher levels of 20610 / 20704-750 / 20832 / 20913-959 & 21080-210

b) The auction has immediate support at 20500 below which it could fall to 20400 / 20265-228 / 20150-130 / 20055 & 19970

Extended Hypos:

c) Above 21210, BNF can probe higher to 21270-280 / 21350-375 / 21460-480 / 21530-600 & 21780-796

d) Below 19970, lower levels of 19803 / 19636* / 19526-492 / 19351 & 19236*

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout