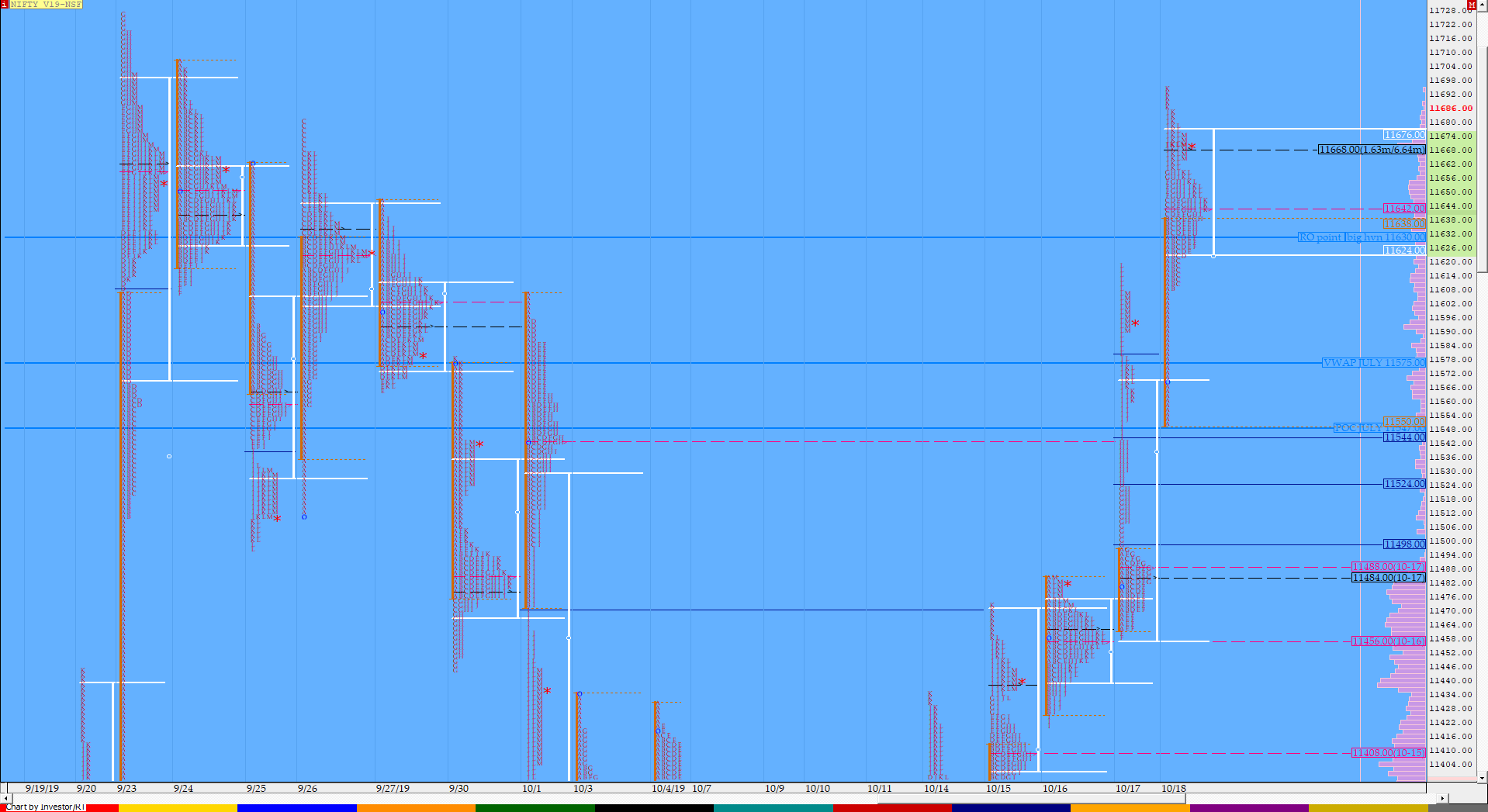

Nifty Oct F: 11670 [ 11696 / 11551 ]

HVNs – 11155 / 11250-253 / (11276) / 11330 / 11380 / [11410] / 11484 / 11592 / (11650) / 11670

Neutral Extreme profiles are known to not give any follow up and the latest instance was no different as NF opened below the Neutral Extreme reference low of 11580 and probed lower in the opening minutes taking support just above yesterday’s second extension handle of 11544 as it made a low of 11551 from where the auction made a swift rejection as it not only got back above 11580 but went on to scale above PDH to tag the weekly VPOC of 11628 as it made a high of 11639 in the IB. NF continued to make a slow probe higher on low volumes making multiple REs but could only manage to tag 11660 till the ‘H’ period and was stuck in a range of just 13 points in the ‘I’ period which indicated that one part of the locals could be forced to cover and it happened to be the weak shorts who were squeezed out in a fresh RE to the upside in the ‘J’ & ‘K’ periods as NF made new highs for the day at 11696 completing the 1.5 IB move and closed at the HVN of 11670 to leave a ‘p’ shape profile for the day which has singles from 11609 to 11551.

(Click here to view NF making higher Value this entire week)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Vairation Day – Up (‘p’ shape profile)

- Largest volume was traded at 11670 F

- Vwap of the session was at 11640 with volumes of 88.9 L and range of 145 points as it made a High-Low of 11696-11551

- NF confirmed a multi-day FA at 11420 on 16/10 and completed the 1 ATR move up of 11575. The 2 ATR objective comes to 11731. This FA is currently on ‘T+3’ Days

- NF confirmed a FA at 11458 on 17/10 and completed the 1 ATR move up of 11611. The 2 ATR objective comes to 11763. This FA is currently on ‘T+2’ Days

- NF confirmed a FA at 11113 on 09/10 and completed the 2 ATR move up of 11505. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 09/10 at 11224 will be important support and this held on 10/10 as well as on 11/10

- The higher Trend Day VWAP of 05/07 at 11965 is an important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11626-11670-11680

Hypos / Estimates for the next session:

a) NF needs to sustain above 11670 for a move to 11684-696 / 11725-731 & 11751-763

b) Immediate support is at 11650-645 below which the auction could test 11625-609 / 11590 & 11575-568

c) Above 11763, NF can probe higher to 11787 / 11805-810 & 11822-842

d) Below 11568, auction becomes weak for 11550-543 / 11522-514 & 11484-478

e) If 11842 is taken out, the auction go up to to 11863 / 11894-897 & 11908-911

f) Break of 11478 can trigger a move lower to 11458 / 11442-439 & 11424-420

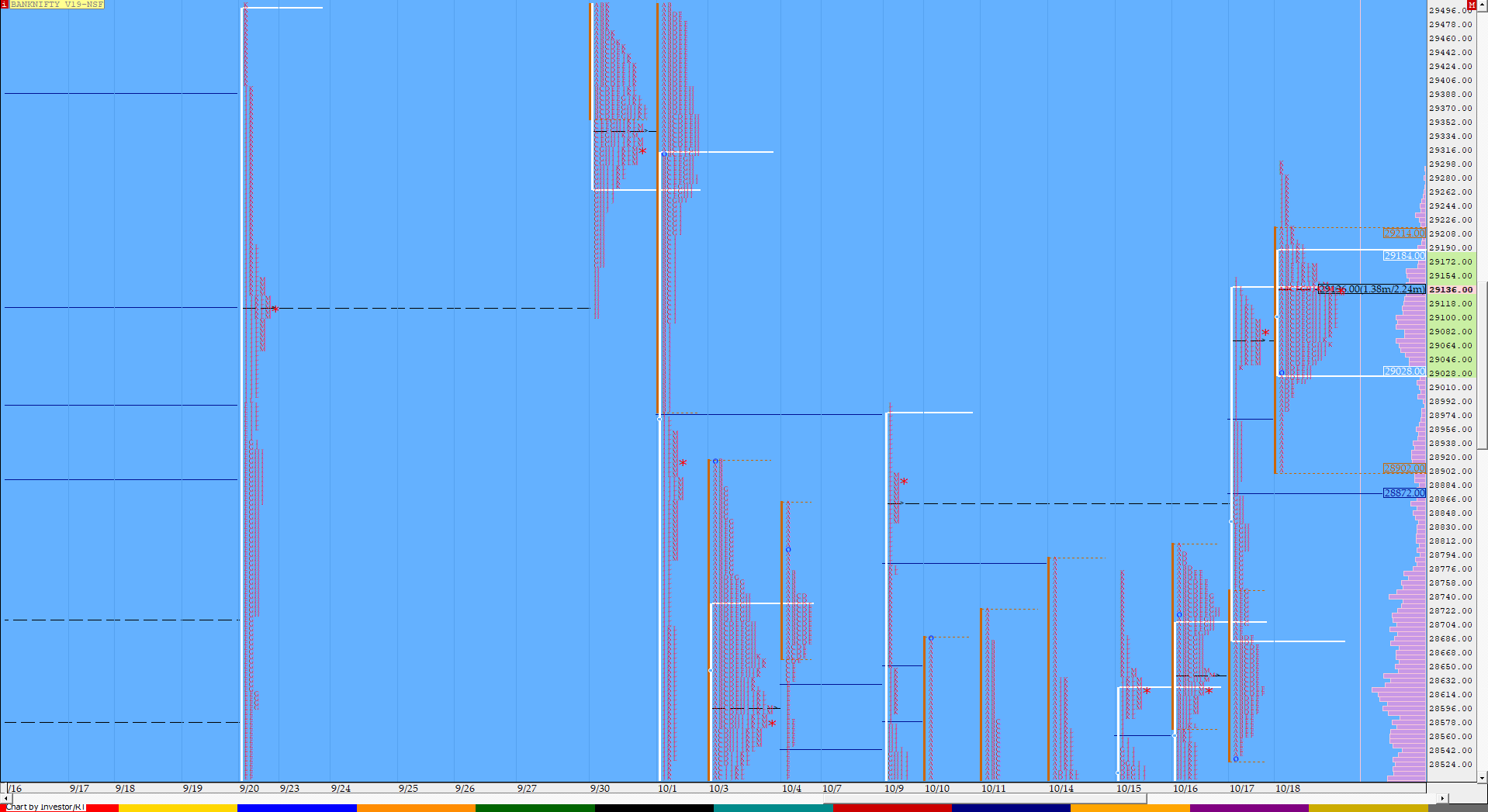

BankNifty Oct F: 29152 [ 29300 / 28903 ]

HVNs – 28025 / 28130 / 28330 / 28430 / 28625 / 29070 / 29140 / 29350-382

BNF had moved away from a 9-day composite on Thursday and was expected to give a good move on the upside but could only make a balanced 3-1-3 profile for the day and inspite of having the biggest IB range this week of 314 points between 29217 to 28903, it could not make any meaningful RE leaving the narrowest range of not just the week but also of this series of just 397 points indicating that supply is still coming in at the higher levels. The auction closed the day near the prominent POC of 29140 and has good chance of giving a move away from here in the next session setting up a good range expansion and on higher volumes. Today’s profile has a buying tail from 28983 to 28903 which will be the reference on the downside below 29140 & 29070 whereas on the upside BNF would need to take out the supply zone of 29232-29275 for an immediate probe to the weekly VPOC of 29336.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (3-1-3 profile)

- Largest volume was traded at 29140 F

- Vwap of the session was at 29105 with volumes of 38.5 L and range of 397 points as it made a High-Low of 29300-28903

- BNF confirmed a FA at 27774 on 09/10 and completed the 1 ATR move up of 28713. The 2 ATR objective comes to 29653. This FA has not been tagged since & hence is now positional support

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 29040-29140-29180

Hypos / Estimates for the next session:

a) BNF needs to sustain above 29160 for a rise to 29222-232 / 29275 / *29336-350* & 29440-460

b) Immediate support is at 29140 below which the auction could test 29070-25 / 28997-983 / 28944-910 & 28857-830

c) Above 29460, BNF can probe higher to 29532 / 29653 & 29725-735

d) Below 28830, lower levels of 28760-705 / 28650-622 & 28541-500 could come into play

e) If 29735 is taken out, BNF can give a fresh move up to 29800 / 29853-885 & 29928-950

f) Break of 28500 could trigger a move down 28430-410 / 28340-330 & 28284-250

Additional Hypos

g) Above 29950, higher levels of 30025-77* / 30140-175 & *30216*-250 could get tagged

h) If 28250 is broken, BNF could fall to 28190-150 / 28083-035 & 27970

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout