Nifty Aug F: 11058 [ 11152 / 11032 ]

NF opened above the HVN of 11060 and made a low of 11065 in the ‘A’ period indicating that the PLR was to the upside and it probed higher to get above previous week’s high as it made a high of 11124 in the IB giving a relatively smaller range of 59 points so could expect a multiple range day ahead more so because it looked to be moving away from a balance. (Click here to view the profile chart for August NF for better understanding) The auction then made a RE (Range Extension) higher immediately post IB in the ‘C’ period as it made highs of 11139 and even sustained above it and continued making higher highs in the ‘E’, ‘G’ & ‘H’ periods but was only able to marginally extend the range as the new high in H period at 11152 was a mere 12 points higher than the C period highs which indicated that in spite of an OTF (One Time Frame) move higher since open, there was poor trade facilitation at these new highs and this view got more confirmation as NF was unable to even complete the 1.5 IB extension higher though it remained above IBH over multiple periods. All this meant that the inventory had gone dangerously long and could require an adjustment which started in the ‘I’ period which signaled the stop of the OTF move higher as it made a lower low on 30 minutes for the first time in the day & this led to a sharp move down over the next 3 periods as NF made new lows for the day breaking below the IBL & the HVN of 11060 in the ‘K’ period as it tagged 11032 which marked the 1.5 IB extension to the downside confirming a Neutral Day. The last 45 minutes of the day remained below IBL but stayed above 11032 giving a sign that the inventory adjustment could be over for the time being which arrested more downside but the auction will need to get above 11060-65 & sustain for a trip back to today’s HVN & dPOC of 11135.

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Day

- Largest volume was traded at 11135 F

- Vwap of the session was at 11103 with volumes of 106 L and range of 120 points as it made a High-Low of 11152-11032

- NF had confirmed a FA at 10807 on 05/08 and tagged the 2 ATR objective of 11085 on 08/08. This FA has not been tagged and is now positional support

- The Trend Day POC & VWAP of 13/08 at 11075 & 11043 were again tagged on 16/08 but once again the auction could not close above them.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11315

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

- The VWAP & POC of May Series is 11613 & 11696 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11084-11135-11144

Hypos / Estimates for the next session:

a) NF sustaining above 11065 could tag 11088-92 & 11106-130

b) Staying below 11060, the auction can test 11040-30 & 11004-10997

c) Above 11130, NF can probe higher to 11150-182 & 11205-217

d) Below 10997, auction becomes weak for 10979-965 & 10938-926

e) If 11217 is taken out, the auction can rise to 11240-248 & 11268

f) Break of 10926 can trigger a move lower to 10910 / 10890-886 & 10865

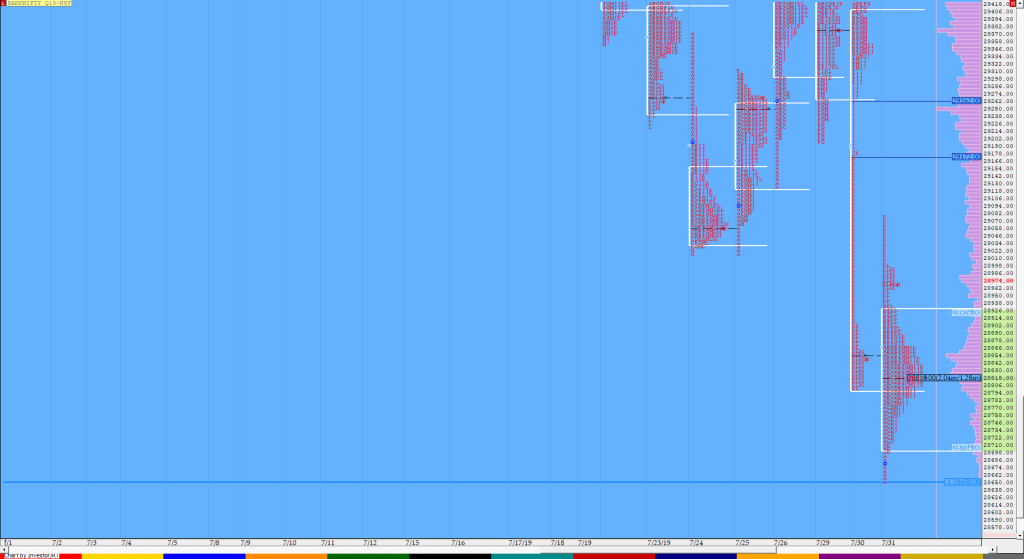

BankNifty Aug F: 28203 [ 28485 / 28122 ]

BNF also made a higher opening & similar to the auction in NF, took support at the HVN & yPOC of 28265 in the IB (Initial Balance) where it gave a below average range of just 181 points making a high of 28445. (Click here to view the profile chart for August NF for better understanding) The auction then made a marginal RE to the upside in the C period & followed it up with another RE in the D period as it tagged new highs of 28485 but struggled to sustain above the IBH & as in NF failed to tag the 1.5 IB move higher in spite of making another attempt to get above the IBH in the ‘H’ period but could only make a lower high of 28465. This led to the break of VWAP for the first time in the day in the ‘I’ period and after a narrow range ‘J’ period which was an inside bar, BNF made a big move down breaking below IBL to make new lows of 28122 after which it consolidated in the last 2 periods between the HVN of 28265 & lows of the day. There is a good chance of the 45 degree rule playing out in the next session as the dPOC for the day still remained higher at 28410 but for that to happen the auction will need to stay above 28220.

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Day

- Largest volume was traded at 28410 F

- Vwap of the session was also at 28357 with volumes of 28.6 L in a session which traded in a range of 363 points making a High-Low of 28485-28122

- The Trend Day POC & VWAP of 13/08 at 27740 & 28063 are immediate references on the upside. The auction stayed above 27740 on 13/08 which is now important support.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 29250

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

- The VWAP & POC of May Series 30211 & 28940 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 28291-28410-28467

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28220 for a move to 28288-291 & 28357-367

b) Staying below 28220, the auction can test 28176 / 28125-120 & 28075-43

c) Above 28367, BNF can probe higher to 28410-425 / 28475-485 & 28550

d) Below 28043, lower levels of 28012-27990 / 27937 & 27880 could come into play

e) Sustaining above 28550, BNF can give a fresh move up to 28596-620 / 28675 & 28710-750

f) Break of 27880 could trigger a move down 27825-816 / 27766-735 & 27675-660

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout