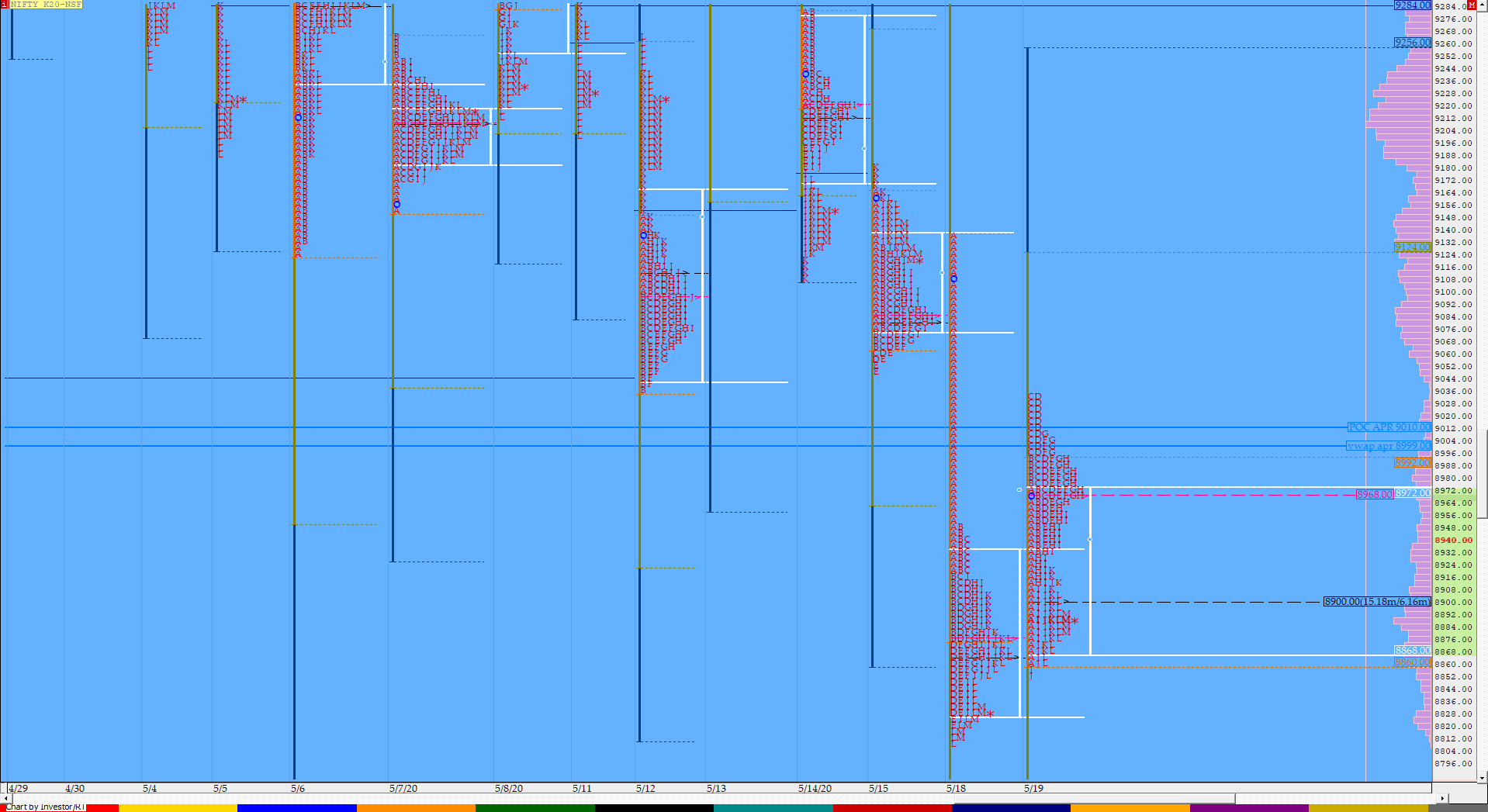

Nifty May F: 8884 [ 9035 / 8852 ]

HVNs – (8884) / (9111) / (9180) / 9210 / 9306 / (9400)

Previous day’s report ended with this ‘the dPOC for the day shifted to the lows at 8826 at close which would be an important reference for the rest of the week holding which we could see a retracement towards the PBH of 8917 above which we have the long selling tail from 8949 to 9139‘

NF opened with a big gap up of 145 points right in the previous day’s selling tail with an almost OH (Open=High) start at 8974 and began to probe lower making a quick fall of over 100 points as it made a low of 8860 taking support at previous day’s prominent TPO POC after which the auction reversed to the upside and made new highs of 8992 in the ‘B’ period leaving a buying tail from 8934 to 8860 in the IB (Initial Balance). NF then made a C side extension higher to hit 9035 but failed to extend any further in the D period as it made similar highs of 9033 and the stalling of the auction just below previous week’s low of 9037 indicated that the supply was coming back in this zone which led to a test of VWAP which was broken in the ‘E’ period as NF made a low of 8937 but got support just above the morning buying tail and this was a sign that the buyers were also defending their zone. The next 2 periods then saw a probe higher once again getting above the IBH but once it confirmed a PBH (Pull Back High) in the ‘G’ period, the sellers got more aggressive and made a trending move lower over the next 3 periods as it not only negated the morning tail but went on to make marginal new lows for the day at 8852 in the ‘J’ period. NF then formed a small balance in the lower part of the IB for the rest of the day as it left another PBH at 8923 building volumes around the 8900 level where it eventually closed leaving an inside bar on the daily with overlapping to higher Value. The 2-day composite of this week still resembles a ‘b’ shape profile with the POC at 8889 and is right now in balance mode in the 2-day Value which is at 8844-8883-8977 (Click here to view the MPLite chart)

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 8890 F

- Vwap of the session was at 8943 with volumes of 224.6 L and range of 182 points as it made a High-Low of 9035-8852

- NF confirmed a multi-day FA at 9180 on 18/05 and almost tagged the 2 ATR objective of 8810 on the same day.

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8667 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8868-8890-8976

Main Hypos for the next session:

a) NF needs to sustain above 8890 for a rise to 8905-16 / 8945-76 / 8992-9006 / 9020-33 / 9053-64 & 9086-96

b) The auction has immediate support at 8876 below which it could test 8860-52 / 8826-10 / 8792-60* / 8721-06 / 8686 & *8667*

Extended Hypos:

c) Above 9096, NF can probe higher to 9125-39 / 9155 / 9172-86 / 9200-13* & 9238-52

d) Below 8667, the auction can fall further to 8648 / 8619-06 / 8560 / 8510-05 & 8465

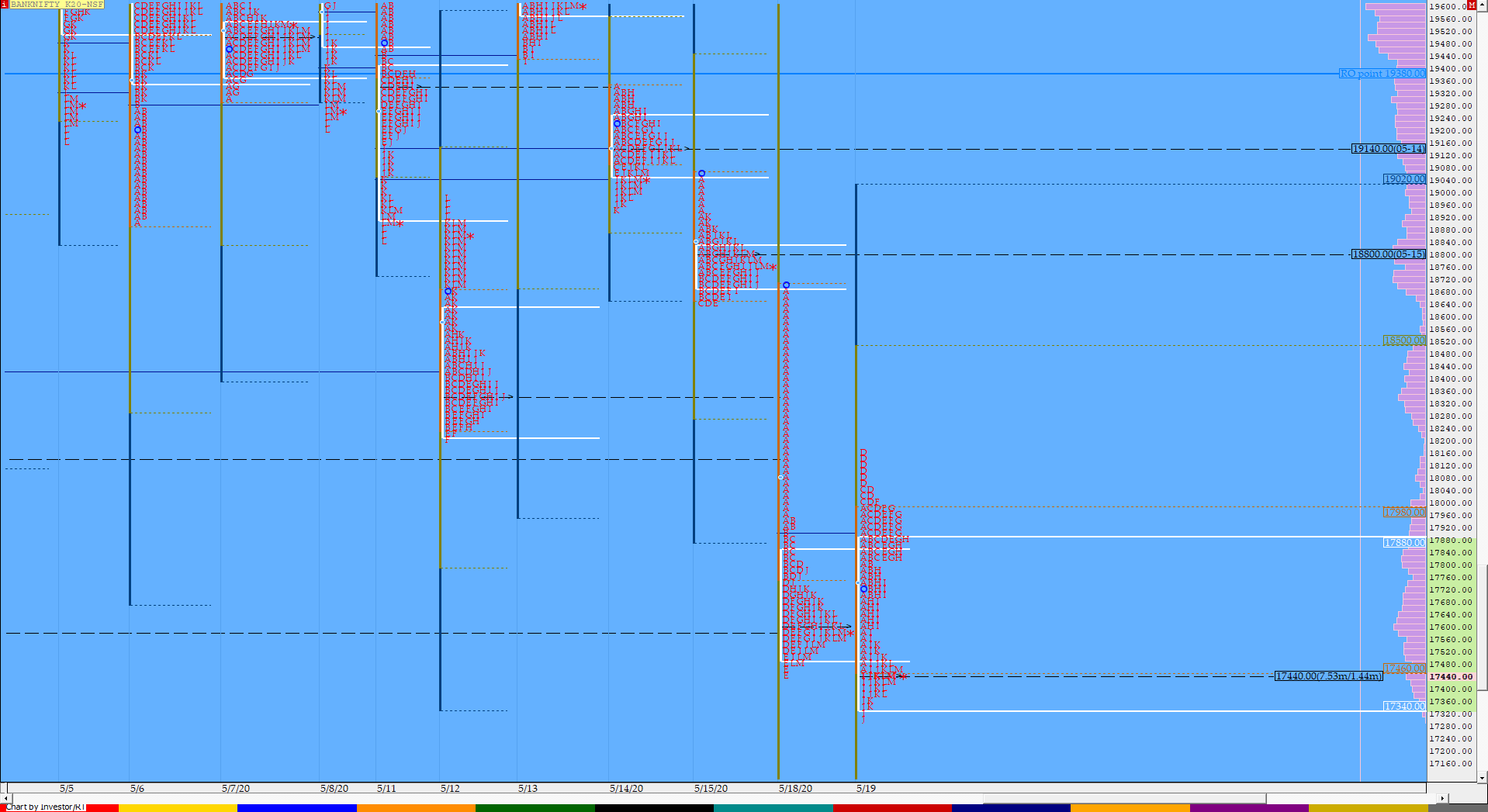

BankNifty May F: 17439 [ 18165 / 17318 ]

HVNs – (17620) / (18350) / 18800 / 19220 / 19620 / 19800

BNF also opened with a gap up and made highs of 17993 in the opening minutes as it got rejected from previous day’s selling tail and made a quick drop lower almost testing the PDL (Previous Day Low) as it hit 17465 in the ‘A’ period from where it reversed the probe once again to the upside. The auction then made a ‘C’ side extension to make a new high for the day at 18049 and followed it up with another RE (Range Extension) in the ‘D’ period as it hit 18165 but just as had happened in NF, previous week’s low & for now the monthly extension handle of 18209 came into play as important supply zone which triggered a reversal for the day. BNF took support at VWAP in the first attempt in the ‘E’ period after which it left a PBH at 18014 in the ‘F’ after which it made a big OTF (One Time Frame) move lower till the ‘J’ period making multiple REs on the downside as it made new lows for the week at 17318 but could not complete the 1.5 IB objective and ended up as a Neutral Day with a close right at the day’s POC of 17440. The 2-day composite in BNF has Value at 17491-17606-17974 which would be the zone to watch if the auction stays above 17440 in the next session.

(Click here to view the MPLite chart)

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 17440 F

- Vwap of the session was at 17723 with volumes of 86 L and range of 847 points as it made a High-Low of 18165-17318

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA has not been tagged and is now positional supply point.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17321-17440-17870

Main Hypos for the next session:

a) BNF needs to sustain above 17470 for a rise to 17550-620 / 17700-725 / 17790-830 / 17892-965 / 18014-025 / 18125-150 & 18209-230

b) The auction remains weak below 17420 and could test 17380-321 / 17277-265 / 17190-095 / 17022 / 16970-905 / 16860*-800 & 16721-675

Extended Hypos:

c) Above 18230, BNF can probe higher to 18270-300 / 18358-416 / 18475-535 / 18650-711 / 18800*-882 & 18940-970

d) Below 16675, lower levels of 16600-540 / 16490-395* / 16290 / 16206-170 / 16110-008 & 15906 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout