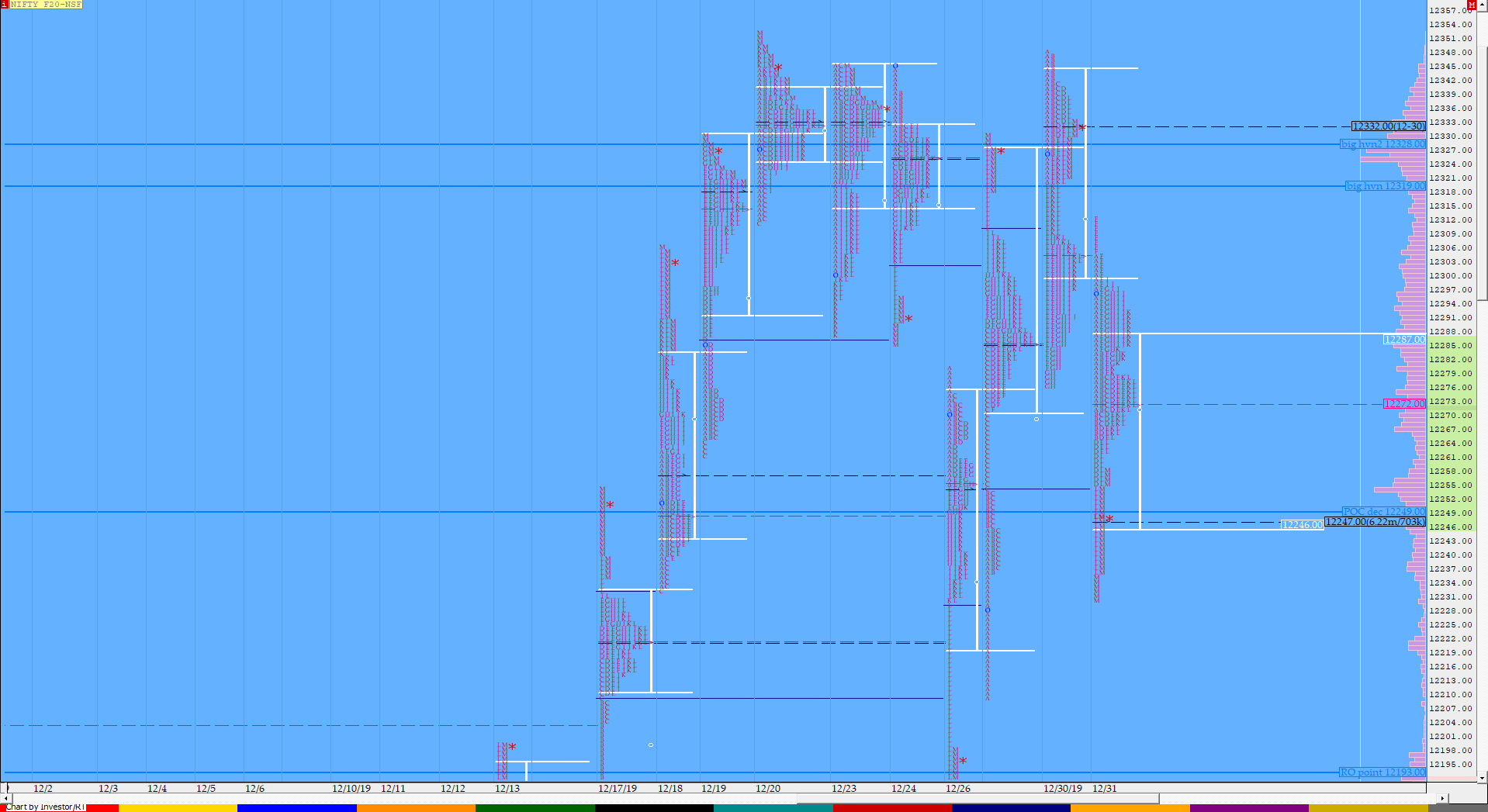

Nifty Jan F: 12244 [ 12270/ 12226 ]

HVNs – 12130 / 12160 / 12193 / (12240-250) / 12274 / 12330

Previous day’s report ended with this ‘The reference for the first open of 2020 would be 12265 to 12230 above which 12274-278 will be an important zone in the coming sessions.’

NF opened in the zone of 12230 to 12265 and even made an attempt to scale above it but could only make a high of 12270 in the opening minutes as it got back into that zone forming a narrow range Initial Balance (IB) of 34 points while making a low of 12236 as it left a selling tail from 12270 to 12255. The auction then made an attempt to probe lower in the ‘D’ period as it made a Range Extension and even broke below the Previous Day Low of 12230 tagging 12226 but was immediately rejected back into the IB suggesting that either there was no new selling or that the demand was over-riding any selling & this failed attempt led to a probe to VWAP in the ‘F’ period as NF even made a brief attempt above VWAP in the next period but made a swift rejection from the morning selling tail as it matched the day lows of 12226 but once again got stalled there which confirmed that there were only locals who were present in the market and hence there is no initiative move happening from the zone of 12230 to 12265. After having left poor lows, the auction then made another trip above VWAP in the ‘J’ period where it left a pull back high of 12258 but once again that selling tail of morning resisted and sent it back again lower to test that 12230 again twice in the ‘K’ & ‘L’ periods before closing the day around the HVN & dPOC of 12240. It was more of a Non-Trend Day in NF as we had a range of just 44 points with one of the lowest volumes ever with a ‘b’ shape profile on the daily and need some initiative volumes to come in for the first directional move of 2020.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 12240 F

- Vwap of the session was at 12243 with volumes of 40.8 L and range of 44 points as it made a High-Low of 12270-12226

- NF confirmed a FA at 12313 on 31/12 and tagged the 1 ATR target of 12230. The 2 ATR target from this FA comes to 12147

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12233-12240-12250

Hypos / Estimates for the next session:

a) NF needs to get above 12258 & sustain for a move to 12272*-278 / 12298 & 12313

b) Immediate support is at 12240-235 below which the auction could test 12220-204 / 12190 & 12173-162

c) Above 12313, NF can probe higher to 12332 / 12348-352 & 12368

d) Below 12162, auction could probe lower to 12147-144 / 12126-122 & 12101

e) If 12368 is taken out, the auction go up to to 12384-391 / 12414-420 & 12437

f) Break of 12101 can trigger a move lower to 12078-67 & 12042-31

BankNifty Jan F: 32285 [ 32496 / 32223 ]

HVNs – 32125 / 32210 / (32280-300) / 32550

BNF opened higher and continued the probe to the upside as it tested the pull back high of 32480 as it tagged 32496 but was swiftly rejected from there as it negated the entire rise in the ‘A’ period itself after which it broke below the yPOC of 32380 in the ‘B’ period to confirm a selling tail from 32411 to 32496 and went on to break below previous day’s low as it made lows of 32286 in the IB. The auction then made a RE to the downside in the ‘D’ period to make lows of 32253 but could not find new volumes & stayed below VWAP all day as it left pull back highs at 32345 & 32337 in the 2 attempts it made in the ‘G’ & ‘J’ period as it made another new low for the day at 32225 in the ‘K’ period almost tagging that 1 ATR objective from the FA of 32522 and closed near the dPOC of 32300 leaving a ‘b’ shape profile for the day. BNF would need to get some initiative volumes to move away from the zone of 32280 to 32300 in the coming session(s)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 32300 F

- Vwap of the session was at 32318 with volumes of 19.2 L and range of 271 points as it made a High-Low of 32496-32225

- BNF confirmed a FA at 32774 on 30/12 and tagged the 1 ATR target of 32458. The 2 ATR target from this FA comes to 32142

- BNF confirmed a FA at 32522 on 31/12 and almost tagged the 1 ATR target of 32223 on 01/01 . The 2 ATR target from this FA comes to 31925

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32251-32300-32336

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32300 for a rise to 32352-382 & 32440-455

b) Immediate support is at 32280 below which the auction could test 32230-208* & 32168-130

c) Above 32455, BNF can probe higher to 32522-550* & 32622-634

d) Below 32130, lower levels of 32088 / 32028 & 31976 could be tagged

e) If 32634 is taken out, BNF can give a fresh move up to 32712-755 & 32821

f) Break of 31976 could trigger a move down to 31925-900 / 31840 & 31780

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout