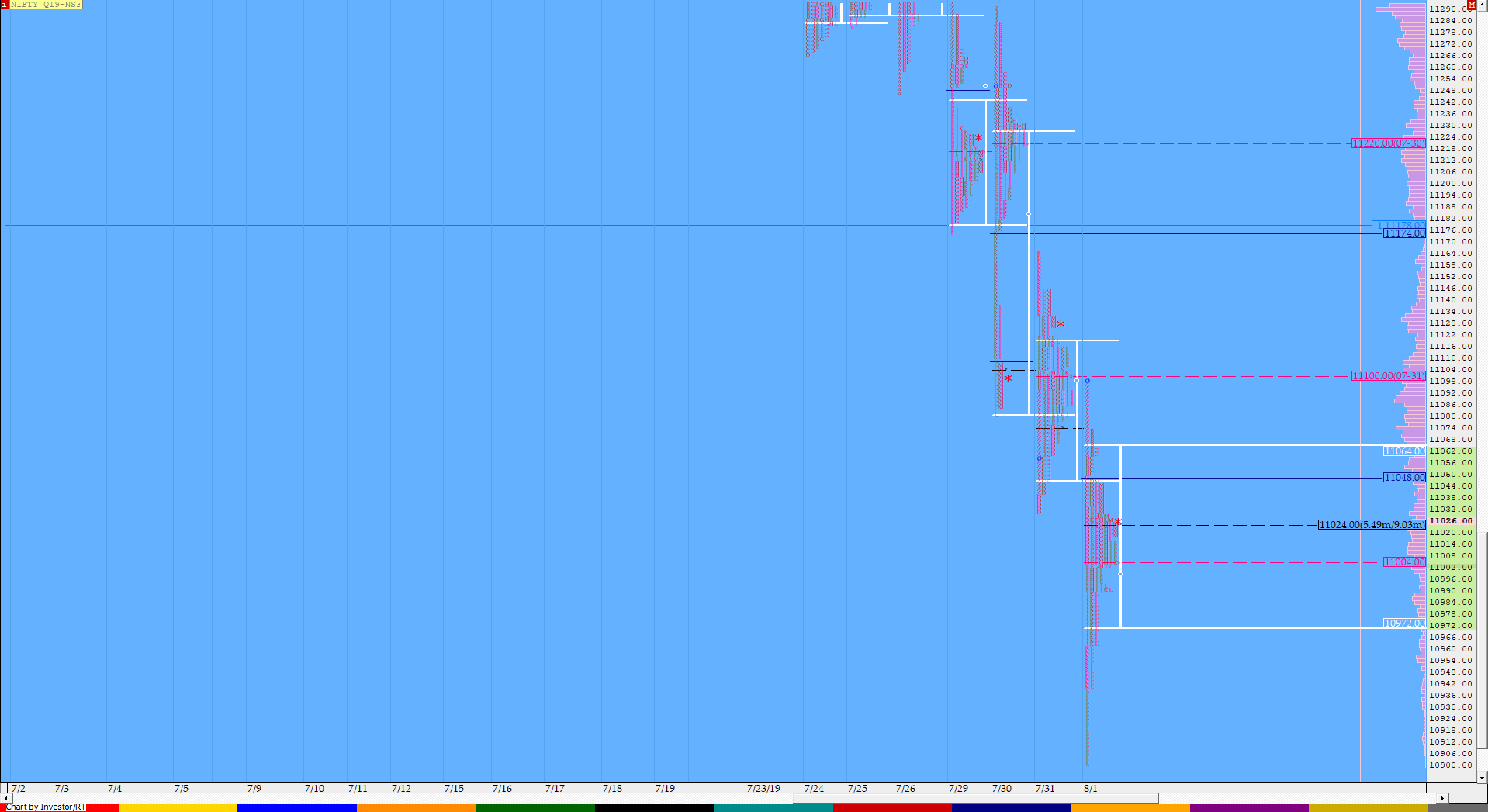

Nifty Aug F: 11028 [ 11083 / 10977 ]

NF opened around the HVN of 11060-65 and made attempts to probe higher in the ‘A’ period but could only make a high of 11078 indicating return of supply at this zone as it then tested the PDL (Previous Day Low) making a low of 11034 in the first 30 minutes. The ‘B’ period then saw initiative action as NF broke below PDL to give a sharp move lower as it made a low of 10990 leaving a pretty large IB range of 88 points. (Click here to view the profile chart for August NF for better understanding) The auction then gave a small retracement over the next 2 periods as it tagged 11029 in the D period but could not get back into previous day’s range which suggested the downside probe is still not over after which it made a small OTF (One Time Frame) move lower over the next 3 periods making a range extension to the downside as it made new lows of 10977 in the ‘G’ period but was not able to sustain below the IBL (Initial Balance Low). The ‘H’ period then made a narrow inside bar and the inability to expand the range further down led to the auction probing higher as it made a big move in the ‘I’ period scaling above VWAP and followed it up in the ‘J’ period by making new highs for the day at 11083 and in the process confirming a FA (Failed Auction) at lows. However, this IBH break was even more swiftly rejected as the morning sellers seem to have returned at the same zone and NF retraced the entire move up by making another trip to the IBL where it took support before closing at the combo of the dPOC & VWAP of the day leaving a Neutral Centre Day and a probable multi-day FA at highs which will get confirmed if the earlier FA of 10977 would be taken out in the next session. On a larger time frame, NF has been forming a composite from the past 6 trading sessions between 10910 & 11152 with Value of the composite at 11001-11061-11134 (Click here to view the composite) so staying below the VAL of 11001 could bring test of the composite low 10910 which would also be the 1 ATR move from the multi-day FA of 11083 if it gets confirmed. On the upside, NF will need to get above 11061 & 11078 for a move to the VAH of the composite and above it the composite high of 11152 which would be the 1 ATR move from the confirmed FA of 10977.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Centre Day

- Largest volume was traded at 11027 F

- Vwap of the session was at 11026 with volumes of 116.5 L and range of 106 points as it made a High-Low of 11083-10977

- NF had confirmed a FA at 10807 on 05/08 and tagged the 2 ATR objective of 11085 on 08/08. This FA has not been tagged and is now positional support

- The Trend Day POC & VWAP of 13/08 at 11075 & 11043 were again tagged on 16/08 but once again the auction could not close above them.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11315

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

- The VWAP & POC of May Series is 11613 & 11696 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10990-11027-11046

Hypos / Estimates for the next session:

a) NF needs to stay above 11025-27 for a rise to 11040-45 / 11061 & 11078-83

b) Staying below 11025, the auction can test 11001-10990 & 10977-965

c) Above 11083, NF can probe higher to 11106 / 11124-130 & 11145-152

d) Below 10965, auction becomes weak for 10938-926 & 10909-892

e) If 11152 is taken out, the auction can rise to 11180 / 11195-205 & 11217

f) Break of 10892 can trigger a move lower to 10865-844 / 10822-818 & 10804-802

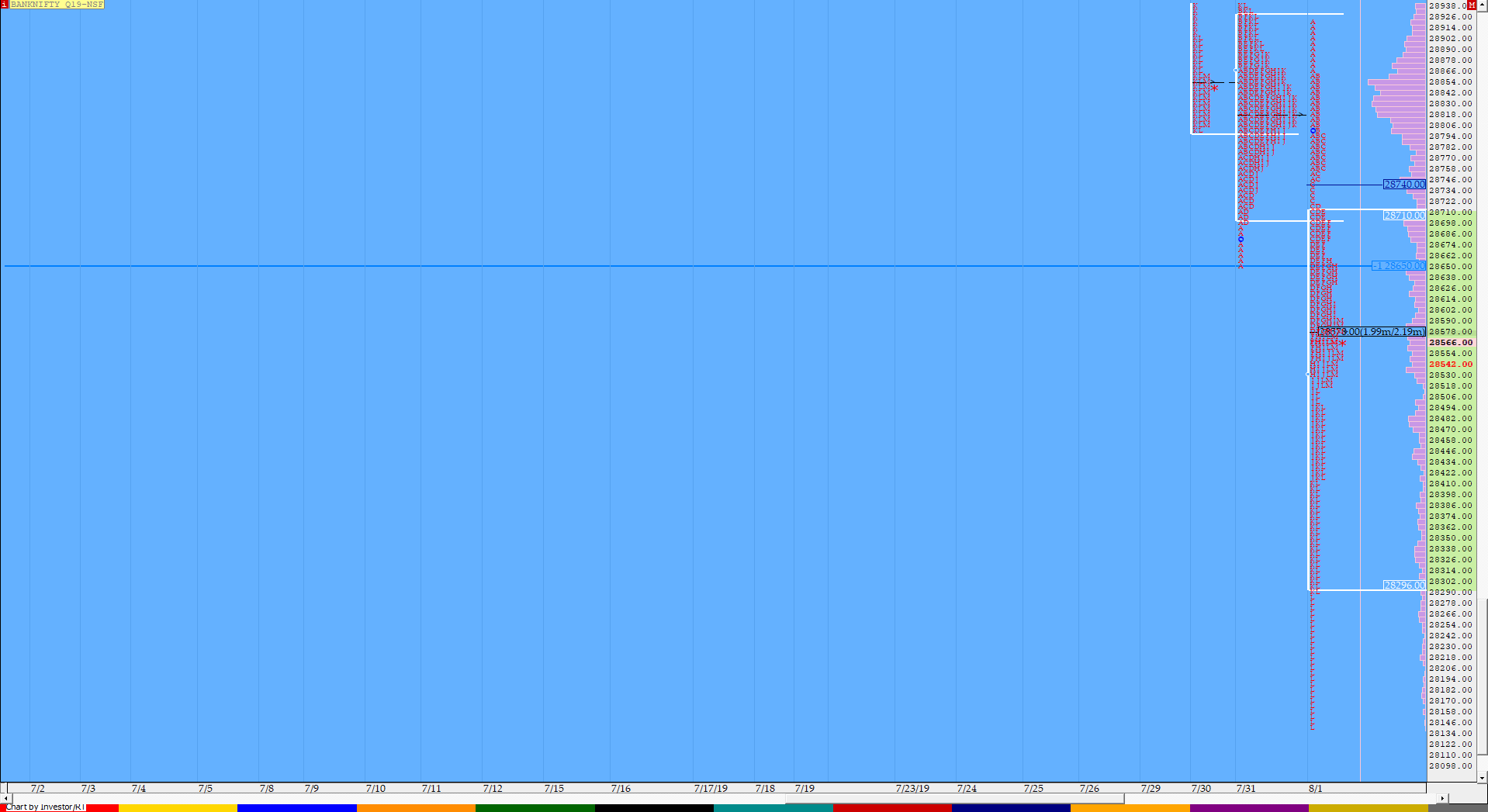

BankNifty Aug F: 27995 [ 28220 / 27822 ]

report to be updated…

- The BNF Open was an Open Drive Down on low volumes (OD)

- The day type was a Normal Day (‘b’ shape profile)

- Largest volume was traded at 28020 F

- Vwap of the session was also at 27967 with volumes of 31.9 L in a session which traded in a range of 398 points making a High-Low of 28220-27822

- The Trend Day POC & VWAP of 13/08 at 27740 & 28063 are immediate references on the upside. The auction stayed above 27740 on 13/08 which is now important support.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 29250

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

- The VWAP & POC of May Series 30211 & 28940 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27896-28020-28055

Hypos / Estimates for the next session:

a) BNF needs to sustain above 28012-40 for a move to 28112-120 / 28176 & 28216-227

b) Staying below 28012 the auction can test 27965 / 27880-860 & 27825-816

c) Above 28227, BNF can probe higher to 28288-291 / 28357-367 & 28410-425

d) Below 27816, lower levels of 27766-735 / 27675-660 & 27625-610 could come into play

e) Sustaining above 28425, BNF can give a fresh move up to 27475-485 / 28550 & 28596

f) Break of 27610 could trigger a move down 27536 / 27490-486 & 27440-390

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout