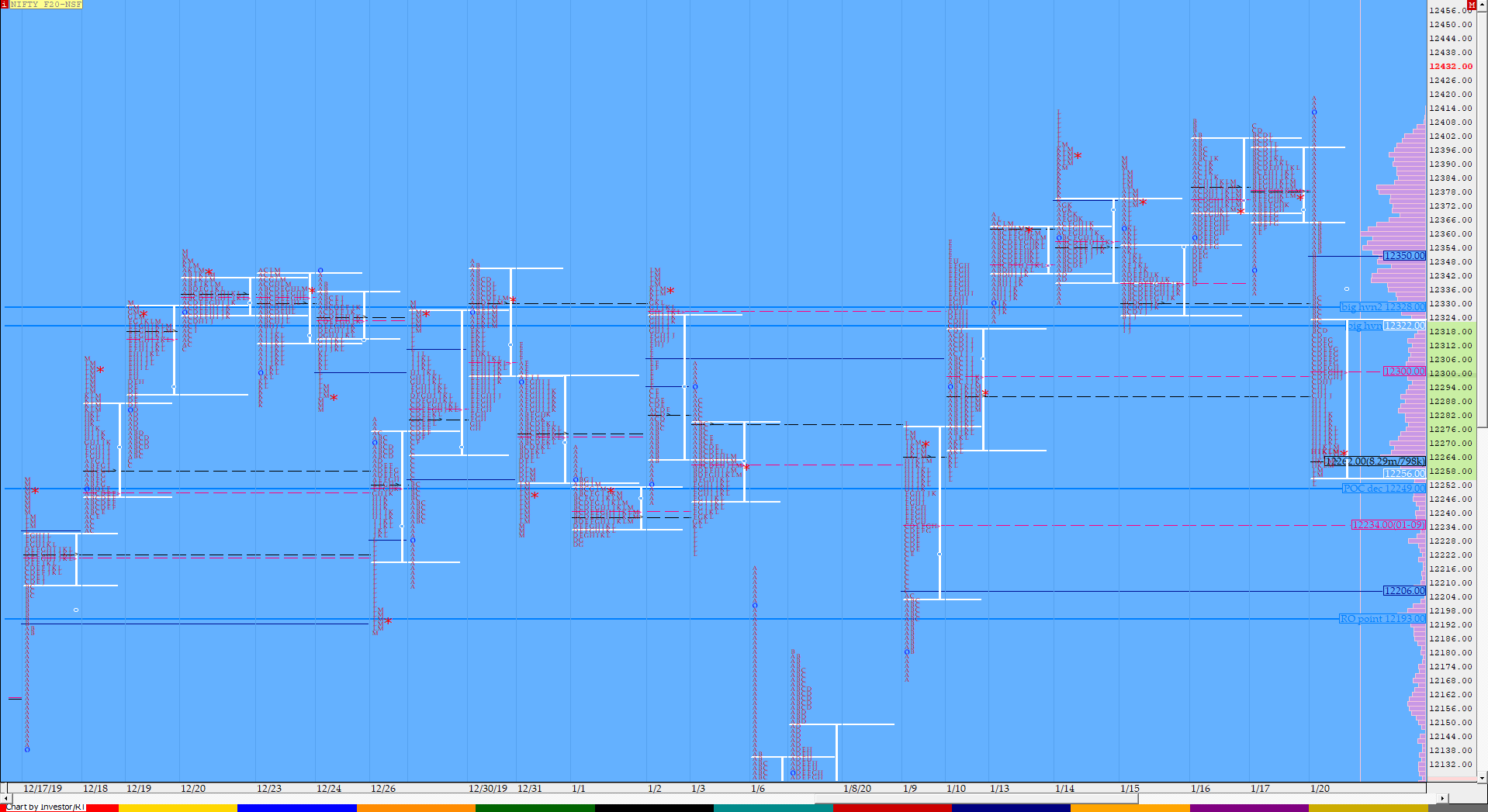

Nifty Jan F: 12263 [ 12419 / 12252 ]

HVNs – 12040 / 12062 / 12113 / 12195 / 12265 / 12290 / 12330 / 12357 / 12380

NF opened higher making new all time highs at 12419 but was swiftly rejected as it gave an ORR (Open Rejection Reverse) start to get back into the 5-day composite Value and completing a quick 80% Rule from 12384 to 12339 in the IB (Initial Balance) after which it even went on to test the previous week’s low and FA (Failed Auction) of 12319 leaving a pretty large IB range of 100 points. The auction then made a C-side RE (Range Extension) to the downside as it tagged the VPOC of 12290 and seemed to have stalled the move lower as it gave a retracement but was unable to get above 12319 in the ‘D’ period and then left a PBH (Pull Back High) of 12316 in the ‘F’ period which confirmed that the PLR (Path of Least Resistance) is still to the downside and this led to a fresh RE lower in the ‘H’ period as NF completed the 1.5 IB of 12269. The next 2 periods saw another retracement as the auction left another PBH at 12300 and this made way for another round of REs lower as NF made new lows of 12252 in the ‘L’ period and closed around 12263 leaving a Trend Day Down but with the dPOC for the day shifting lower to 12268 which will be the immediate reference for the next session.

- The NF Open was an Open Rejection Reverse – Down (ORR)

- The day type was a Trend Day Down

- Largest volume was traded at 12268 F

- Vwap of the session was at 12308 with volumes of 95.1 L and range of 167 points as it made a High-Low of 12419-12252

- NF confirmed a FA at 12319 on 15/01 and tagged the 1 ATR target of 12415 on 20/1. This FA got tagged today on ‘T+3‘ Days and is looking good for the 1 ATR move down of 12223

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12253-12268-12320

Hypos / Estimates for the next session:

a) NF needs to sustain above 12268 for a move to 12300-308 & 12320-330

b) Staying below 12255, the auction could test 12234* / 12217-210 & 12195-181

c) Above 12330, NF can probe higher to 12352-365 / 12380 & 12405-408

d) Below 12181, auction could probe lower to 12160 / 12139-126 & 12110

e) If 12408 is taken out, the auction go up to to 12421 /12437-445 & 12463-487

f) Break of 12110 can trigger a move lower to 12090-79 / 12062* & 12045-042*

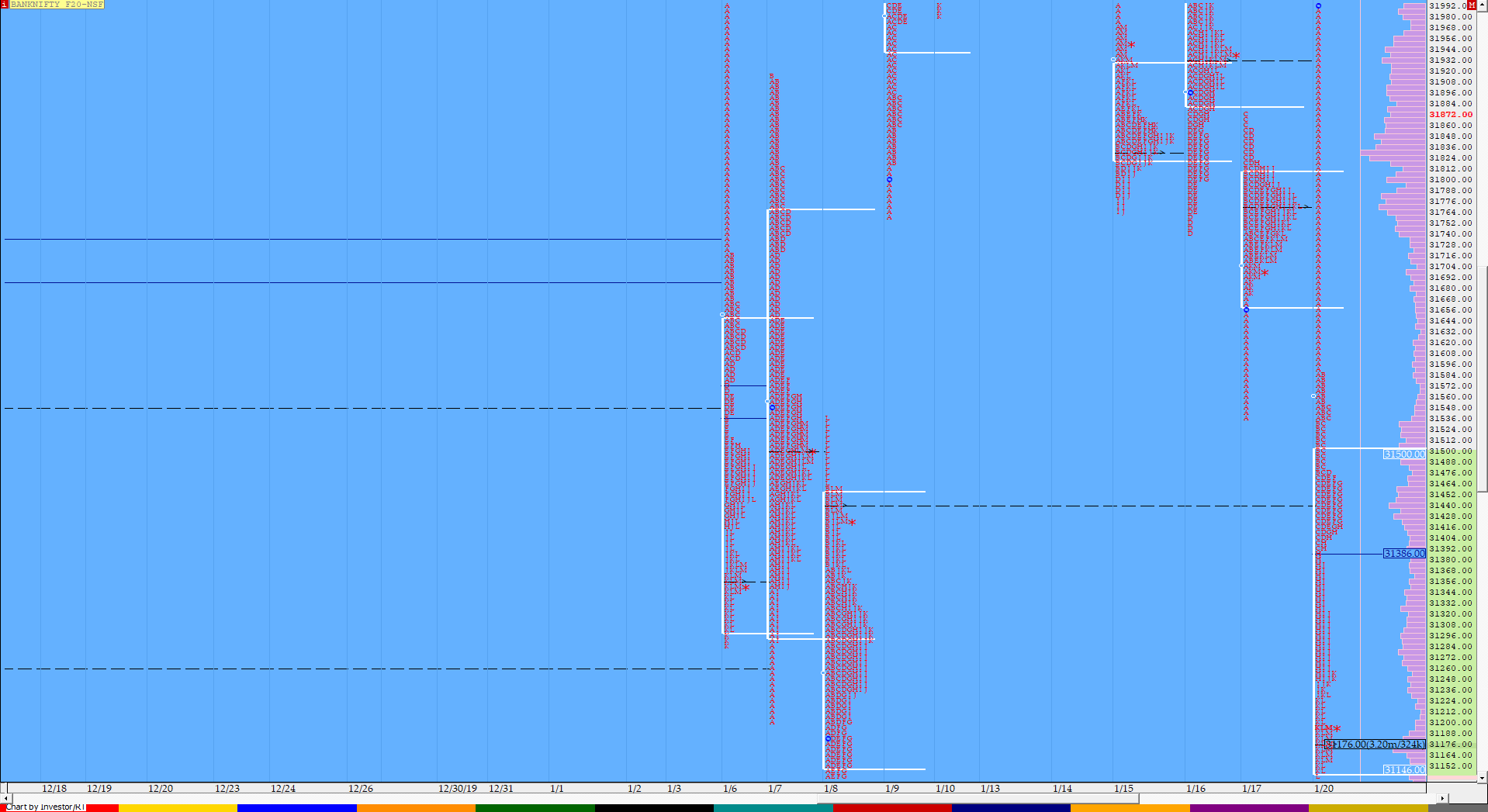

BankNifty Jan F: 31182 [ 31936 / 31126 ] (freak OH of 31997)

HVNs – 30880 / 31175 / 31455 / 31525 / 31770 / 31840 / 31935

Previous day’s report had ended with this ‘BNF will need to first stay above today’s dPOC of 31770 and then taken out the HVN of 31845 for a rest of the VPOCs of 31932 & 32152‘

BNF opened with a gap up above the HVN of 31845 and even tagged the first VPOC of 31932 but was swiftly rejected from there as it left a big selling tail from 31936 to 31587 in the IB and went on to tag the lower VPOC of 31480 laving a very large IB range of 456 points. The auction then made a RE in the C period as it made new lows of 31392 after which it made a small balance below the IBL for the next 4 periods staying in a narrow range of just 90 points before making a fresh RE down in the ‘H’ period completing the 1.5 IB objective of 31252. BNF then gave an afternoon pull back high in the ‘J’ period as it made highs of 31375 but the inability to get past the morning extension handle of 31392 led to a fresh probe to the downside as it made lows of 31126 in the ‘L’ period before closing at 31182 leaving a Trend Day Down. Similar to NF, the dPOC in BNF also shifted lower to 31175 which would be the immediate reference for the next open.

View the MPLite chart of BNF leaving a Trend Day Down

- The BNF Open was an Open Rejection Reverse – Down (ORR)

- The day type was a Trend Day Down

- Largest volume was traded at 31175 F

- Vwap of the session was at 31396 with volumes of 36.6 L and range of 810 points as it made a High-Low of 31936-31126

- BNF confirmed a multi-day FA at 32260 on 14/01 and tagged the 2 ATR target of 31507 on 20/01. This FA is currently on ‘T+5‘ Days.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31127-31175-31467

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31175 for a move to 31235 / 31275-304 & 31375-396

b) Staying below 31175, the auction could test 31127-115 / 31050 & 30980-970

c) Above 31396, BNF can probe higher to 31430-480 / 31525 & 31565-587

d) Below 30970, lower levels of 30885 / 30805* & 30741 could be tagged

e) If 31587 is taken out, BNF can give a fresh move up to 31625-650 / 31720-775 & 31850

f) Break of 30741 could trigger a move down to 30695 / 30645-625 & 30560-500

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout