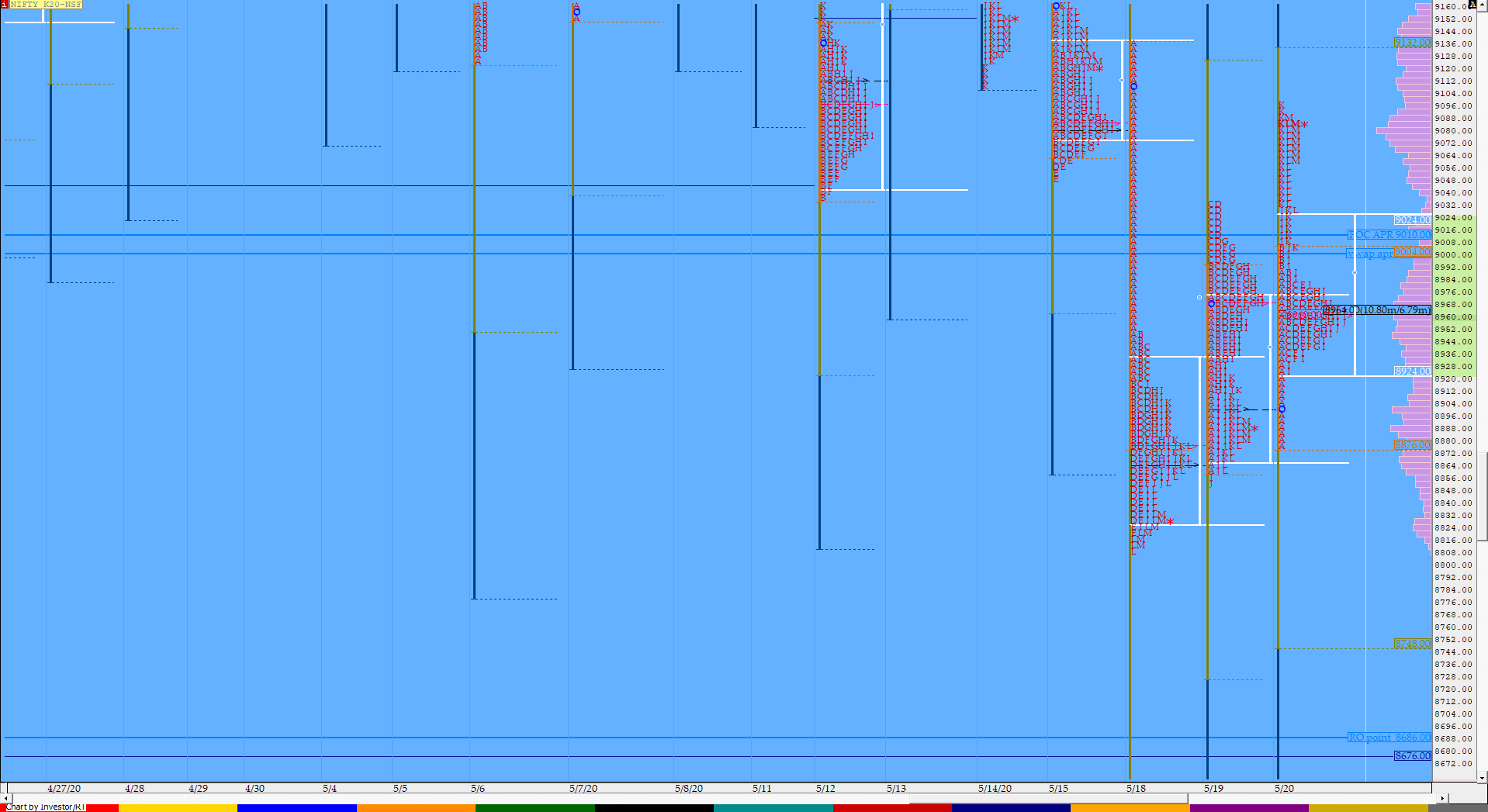

Nifty May F: 9066 [ 9098 / 8879 ]

HVNs – (8884) / (8965) / (9111) / (9180) / 9210 / 9306 / (9400)

NF moved away from the 2-day POC as it confirmed a multi-day FA at 8852 and the buying interest was further confirmed by the buying tail it left in the IB (Initial Balance). However, the auction remained inside the IB for the first half of the day forming a ‘p’ shape profile but went on to give a late RE which led to further short covering as it scaled above PDH & made highs of 9098 in the process completing the 1 ATR objective of 9053 from 8852. Close was at highs so can expect this imbalance to continue at open in the next session.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 8965 F

- Vwap of the session was at 8985 with volumes of 188.3 L and range of 219 points as it made a High-Low of 9098-8879

- NF confirmed a multi-day FA at 8852 on 20/05 and tagged the 1 ATR objective of 9053 on the same day. The 2 ATR target comes to 9252

- NF confirmed a multi-day FA at 9180 on 18/05 and almost tagged the 2 ATR objective of 8810 on the same day.

- NF had confirmed a multi-day FA at 8706 on 09/04 and tagged the 2 ATR objective of 9756 on 30/04. This FA has not been tagged & is now important support.

- The Trend Day VWAP of 8667 would be important support level.

- The settlement day Roll Over point (May) is 9822

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 8922-8965-9026

Main Hypos for the next session:

a) NF needs to sustain above 9080 for a rise to 9093-9111 / 9132-39 / 9155 / 9172-86 / 9200-13* & 9238-52

b) The auction has immediate support at 9052 below which it could test 9036 / 9016-07 / 8985-64* / 8943-24 / 8910 -8888 & 8860-52

Extended Hypos:

c) Above 9252, NF can probe higher to 9272-82 / 9312-20 / 9356-66 / 9385-9400* / 9420 & 9444-60

d) Below 8852, the auction can fall further to 8826-10 / 8792-60* / 8721-06 / 8686 & *8667*-48

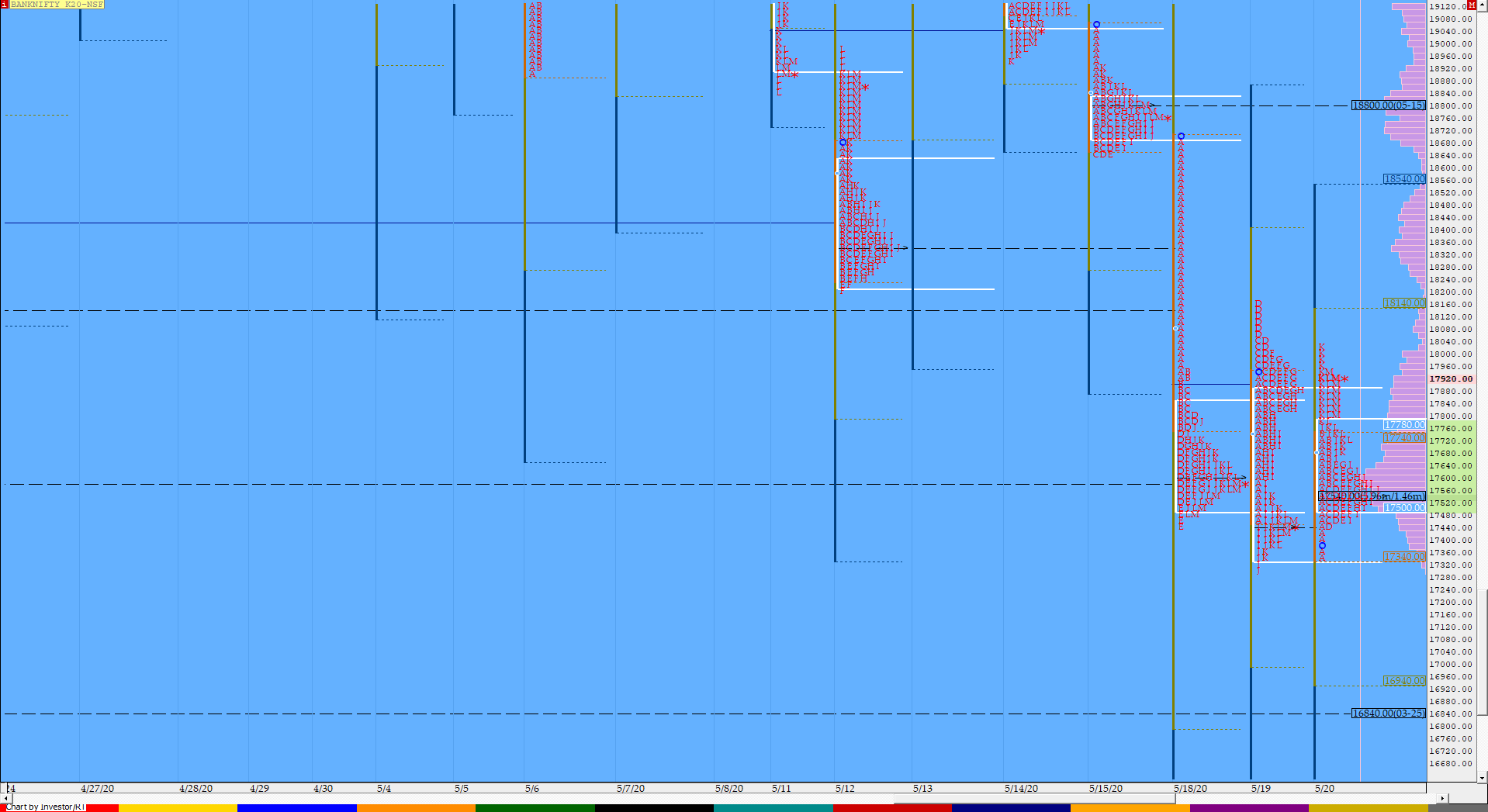

BankNifty May F: 17837 [ 18037 / 17352 ]

HVNs – (17620) / (18350) / 18800 / 19220 / 19620 / 19800

In BNF also, the auction moved away from the yPOC of 17440 by means of a buying tail in the IB but remained in the 2-day composite Value all day to leave an inside bar both in terms of Value & Range and has now formed a 3-day composite ‘b’ shape profile with the POC at 17610 and has a good chance to move away from here in the coming session(s).

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 17600 F

- Vwap of the session was at 17646 with volumes of 80.4 L and range of 675 points as it made a High-Low of 18027-17352

- BNF confirmed a FA at 21932 on 30/04 and tagged not just the 1 ATR objective of 21028 but also the 2 ATR target of 20125 on 04/05. This FA has not been tagged and is now positional supply point.

- The settlement day Roll Over point (May) is 21380

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17460-17600-17738

Main Hypos for the next session:

a) BNF needs to sustain above 17830 for a rise to 17880-895 / 17940 / 18010-25 / 18125-150 / 18209-270 / 18358-416 & 18475-535

b) The auction staying below 17830 could bring a test of 17780-720 / 17660-610 / 17565-515 / 17475-440 / 17380-360 / 17321-265 & 17190-140

Extended Hypos:

c) Above 18535, BNF can probe higher to 18650 / 18711-751 / 18800*-882 / 18940-970 / 19080 / 19140*-170 & 19220-278

d) Below 17140, lower levels of 17095 / 17022-16970 / 16905-860* / 16800-721 / 16675-600 / 16540-490 & 16395* could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout