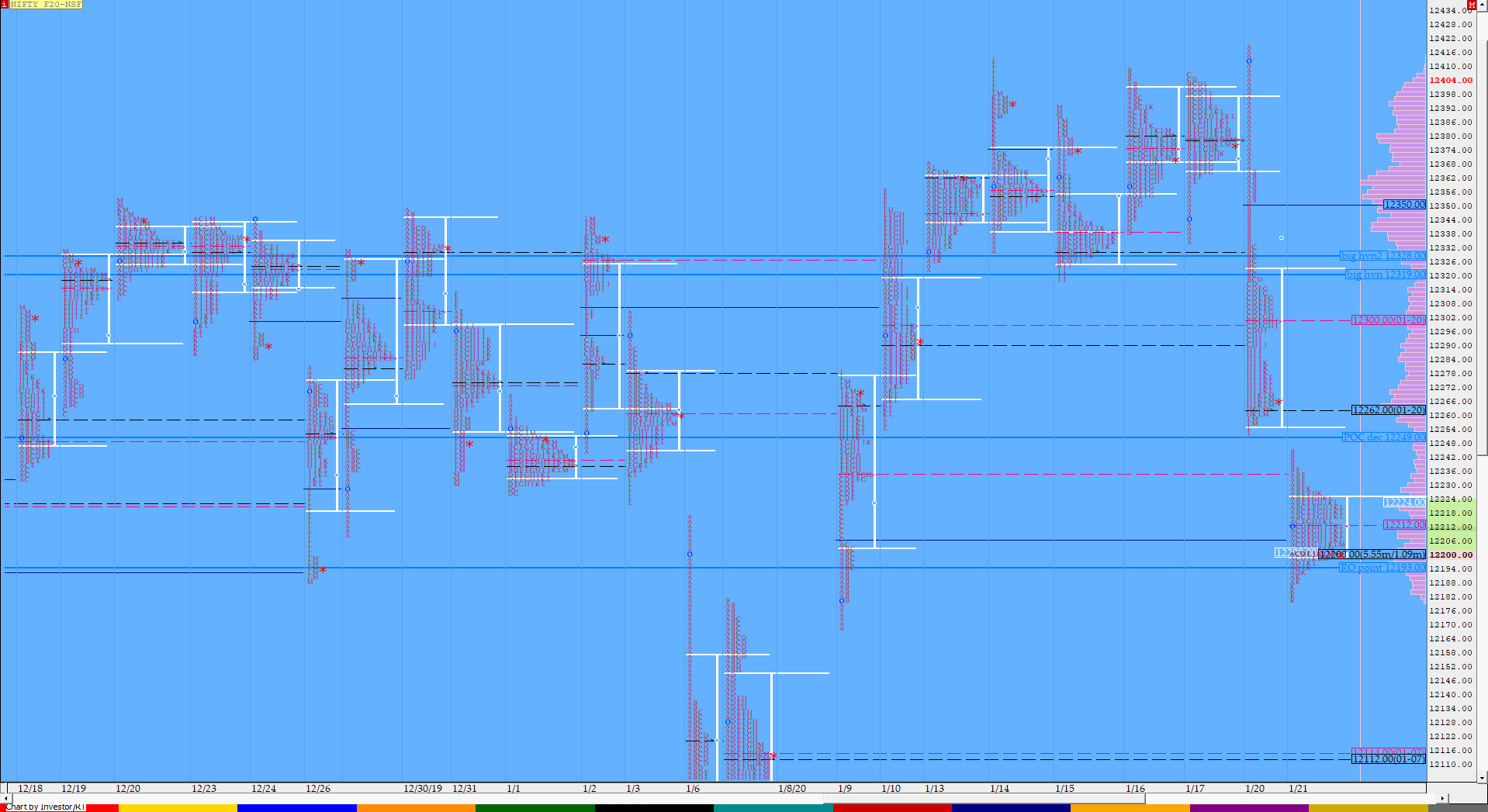

Nifty Jan F: 12203 [ 12244 / 12181 ]

HVNs – 11994 / 12040 / 12062 / 12113 / 12200 / 12265 / 12305 / 12357 / 12380

NF continued the previous day’s imbalance as it opened with a big gap down of 50 points and probed lower in the first 5 minutes as it tested the Volume Cluster of 12195 to 12181 and took support at 12188 confirming an OAOR (Open Auction Out of Range) start after which it reversed the probe to the upside and went on to make new highs for the day at 12244 in the ‘B’ period but was not able to get back into the previous day’s range which indicated that a balance could be forming. The auction then stayed in this narrow IB range of 56 points almost all day with a failed attempt to make a RE (Range Extension) lower in the ‘K’ period when it tagged 12181 to leave a perfect Gaussian Profile for the day with a close around the dPOC of 12200. Value for the day was completely lower and there is a good chance to see this balance leading to another imbalance in the coming session(s).

Click here to see balance returning in form of a Gaussian Profile in NF

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Day – Gaussian Profile

- Largest volume was traded at 12200 F

- Vwap of the session was at 12213 with volumes of 72.6 L and range of 63 points as it made a High-Low of 12244-12181

- NF confirmed a FA at 12319 on 15/01 and tagged the 1 ATR target of 12415 on 20/1. This FA was negated on 20/01 and the 1 ATR move down of 12223 got tagged on 21/01.

- The 20th Jan Trend Day VWAP of 12308 would be important supply point.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12198-12200-12222 was tagged

Hypos / Estimates for the next session:

a) NF needs to sustain above 12201-210 for a move to 12232 & 12252-268*

b) Immediate support is at 12191-185 below which the auction could test 12160 & 12139-126

c) Above 12268, NF can probe higher to 12300-308 & 12320-330

d) Below 12126 auction could probe lower to 12112* / 12090-79 & 12062*

e) If 12330 is taken out, the auction go up to to 12352-365 / 12380 & 12405-408

f) Break of 12062 can trigger a move lower to 12045-042* / 12023 & 12005

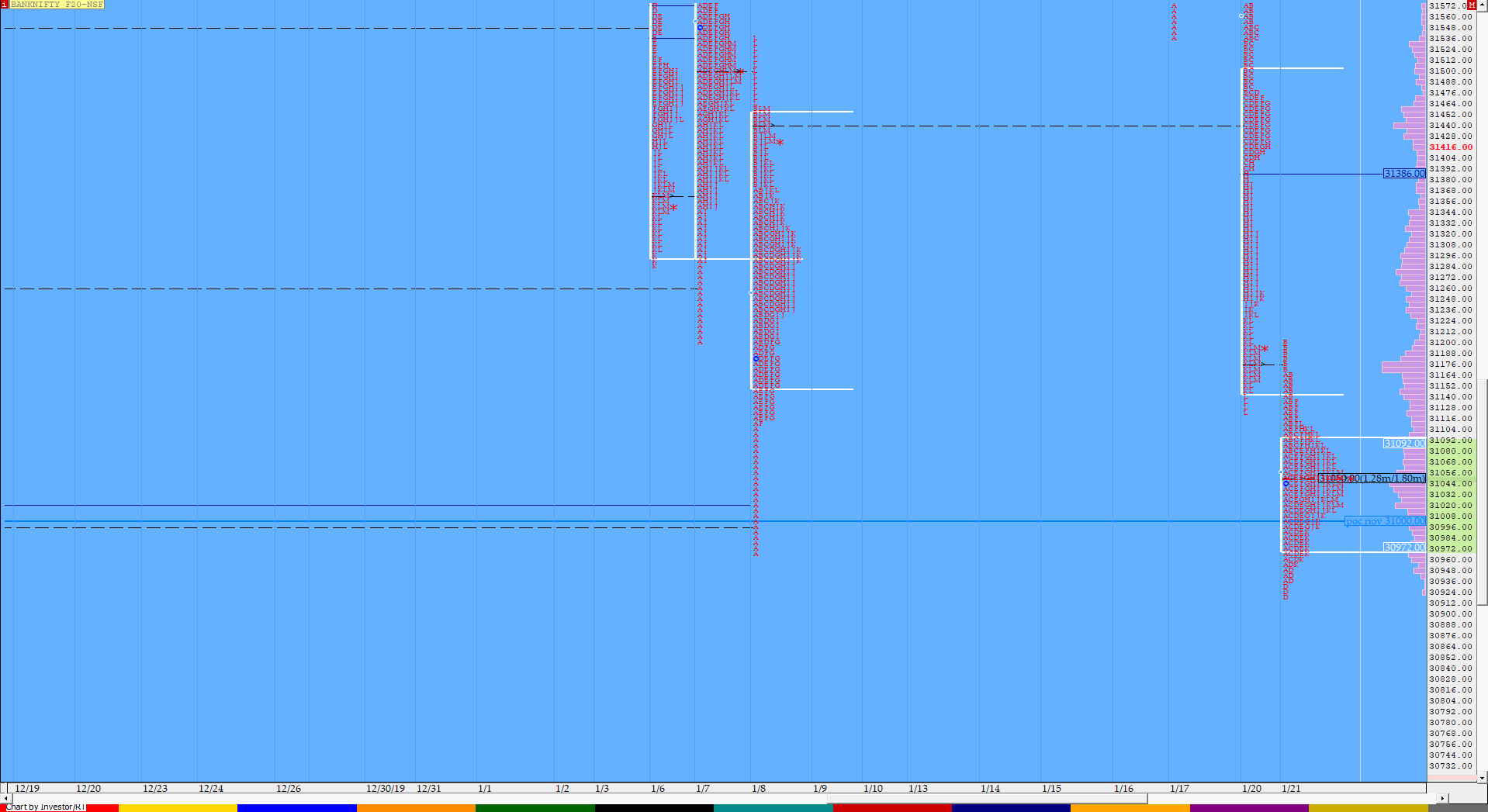

BankNifty Jan F: 31043 [ 31200 / 30920 ]

HVNs – 30880 / 31050 / 31175 / 31455 / 31525 / 31770 / 31840 / 31935

BNF made a replica of the auction that happened in NF leaving a similar Gaussian Profile along with a Normal Day which had a failed attempt to make a RE lower in the ‘D’ period and a close at the dPOC of 31050. BNF also opened with a gap down as it tested the 8th Jan swing lows of 30971 in the opening 5 minutes and made lows of 30940 but was swiftly rejected back and even got into previous day’s range tagging the yPOC of 31175 as it made highs of 31200 in the ‘B’ period but faced rejection from there which not only led to the entire retracement of the probe higher but the auction even made new lows for the day in the ‘D’ period to tag 30920 but once again could not sustain facing a hat-trick of rejections in the first couple of hours. BNF then settled down for a rather quiet auction for the rest of the day as it remained inside the IB range and formed a nice Bell Profile with a prominent POC and this pause seems to be a signal for another imbalance coming very soon.

View the MPLite chart of Trend Day being followed by a Normal Day in BNF

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Normal Day – Bell Curve

- Largest volume was traded at 31050 F

- Vwap of the session was at 31050 with volumes of 32.7 L and range of 279 points as it made a High-Low of 31200-30920

- BNF confirmed a multi-day FA at 32260 on 14/01 and tagged the 2 ATR target of 31507 on 20/01. This FA has not been tagged and is now positional resistance.

- BNF confirmed a FA at 32774 on 30/12 and tagged the 2 ATR target of 32142 on 03/01. This FA has not been tagged and is now positional resistance.

- The 20th Jan Trend Day VWAP of 31396 would be important supply point.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30990-31050-31110

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31081 for a move to 31130-175 / 31235 & 31275-304

b) Staying below 31019, the auction could test 30950-930 / 30885 & 30805*

c) Above 31304, BNF can probe higher to 31375-396 / 31430 & 31480

d) Below 30805, lower levels of 30741 / 30695 & 30645-625 could be tagged

e) If 31480 is taken out, BNF can give a fresh move up to 31525 / 31565-587 & 31625-650

f) Break of 30625 could trigger a move down to 30560 / 30500 & 30435-430

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout