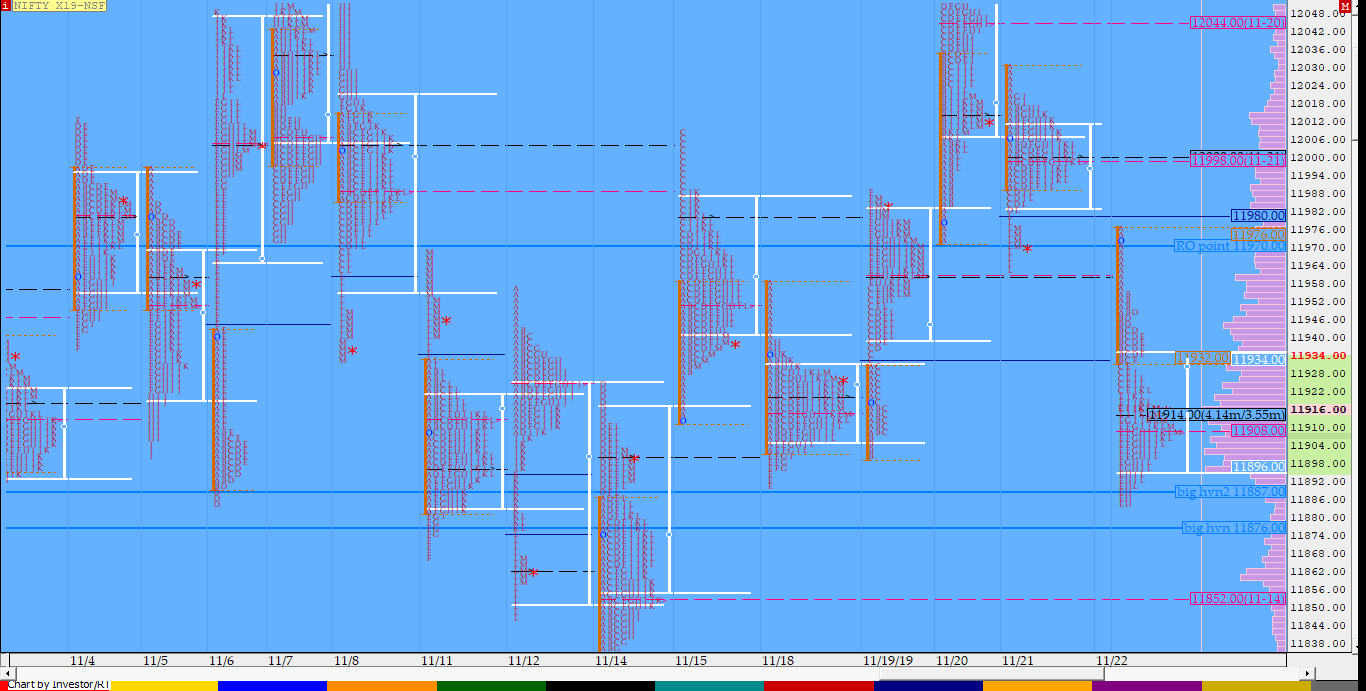

Nifty Nov F: 11914 [ 11977/ 11884 ]

HVNs – 11667 / 11760 / 11814 / 11876 / ( 11901-920 ) / 11916 / 12000 / (12044)

Report to be updated…

- The NF Open was an Open Rejection Reverse – Down (ORR) but on low volumes

- The day type was a Normal Variation Day (Down) ‘b’ shape profile

- Largest volume was traded at 11916 F

- Vwap of the session was at 11921 with volumes of 82.8 L and range of 93 points as it made a High-Low of 11977-11884

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11894-11916-11934

Hypos / Estimates for the next session:

a) NF needs to sustain above 11916 for a move to 11934-945 / 11965-974 & 11990-12000*

b) Immediate support is at 11910-901 below which the auction could test 11885 / 11860-852* & 11833

c) Above 12000, NF can probe higher to 12021-30 / 12052-60 & 12080-94

d) Below 11833, auction becomes weak for 11816*-810 / 11795 & 11771-767*

e) If 12094 is taken out, the auction go up to to 12117-121 / 12148 & 12166-185

f) Break of 11767 can trigger a move lower to 11749-734 / 11716-709 & 11689

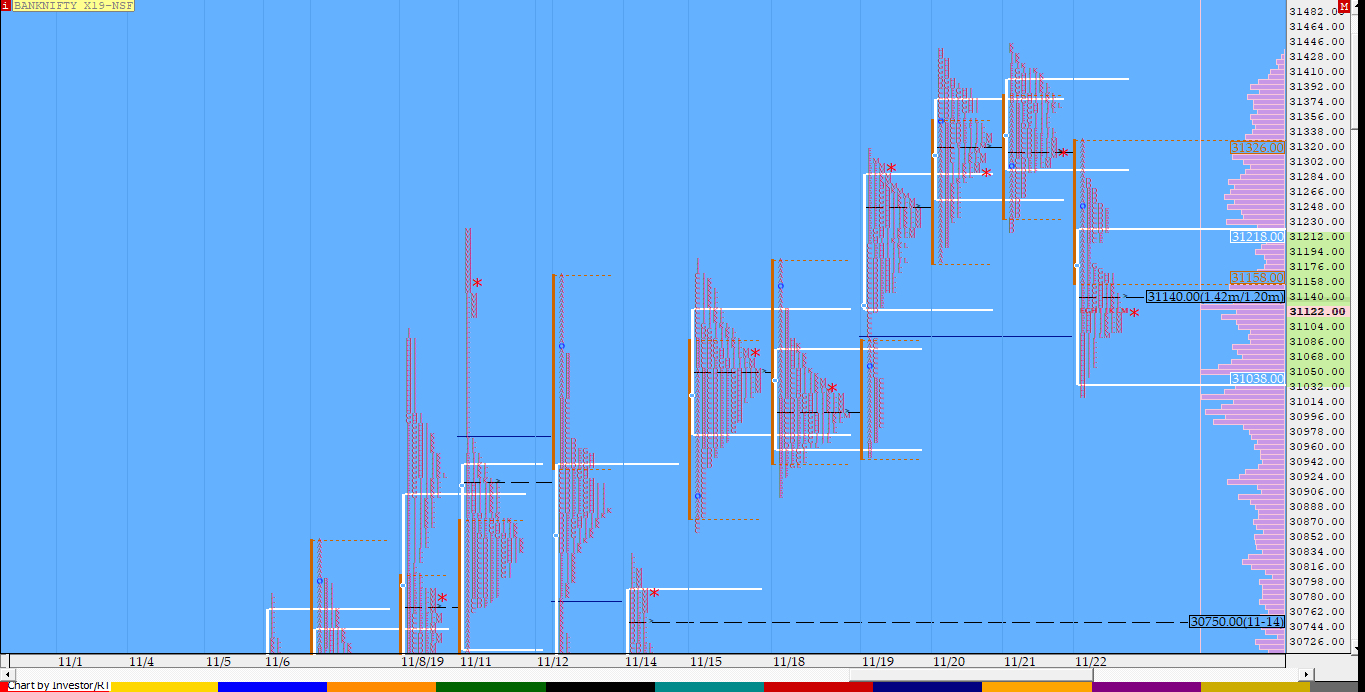

BankNifty Nov F: 31114 [ 31329 / 31023 ]

HVNs – 30075 / 30150 / 30288 / 30400 / 30690 / 30760 / 31020 / 31115 / (31225) / 31315 / (31390)

Report to be updated…

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Double Distribution Day – Down (DD)

- Largest volume was traded at 31131 F

- Vwap of the session was at 31173 with volumes of 27.7 L and range of 306 points as it made a High-Low of 31329-31023

- BNF confirmed a FA at 31224 on 21/11 which got negated on 22/11. The 1 ATR move down comes to 30782.

- BNF had confirmed a FA at 30052 on 06/11 and tagged the 2 ATR target of 31049 on 08/11. This FA has not been tagged since & hence is now positional support

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 06/11 at 30447 will be important reference on the downside.

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31034-31131-31214

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31115 for a rise to 31170-180 / 31225 & 31280-345

b) Staying below 31110, the auction could test 31058-020 / 30965-914 & 30860

c) Above 31345, BNF can probe higher to 31390-410 / 31490 & 31560

d) Below 30860, lower levels of 30780-750* / 30686-658 & 30585-580 could be tagged

e) If 31560 is taken out, BNF can give a fresh move up to 31618-625 / 31665-680 & *31785-803*

f) Below 30580, we could see lower levels of 30540 / 30500-460 & 30375-370

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout