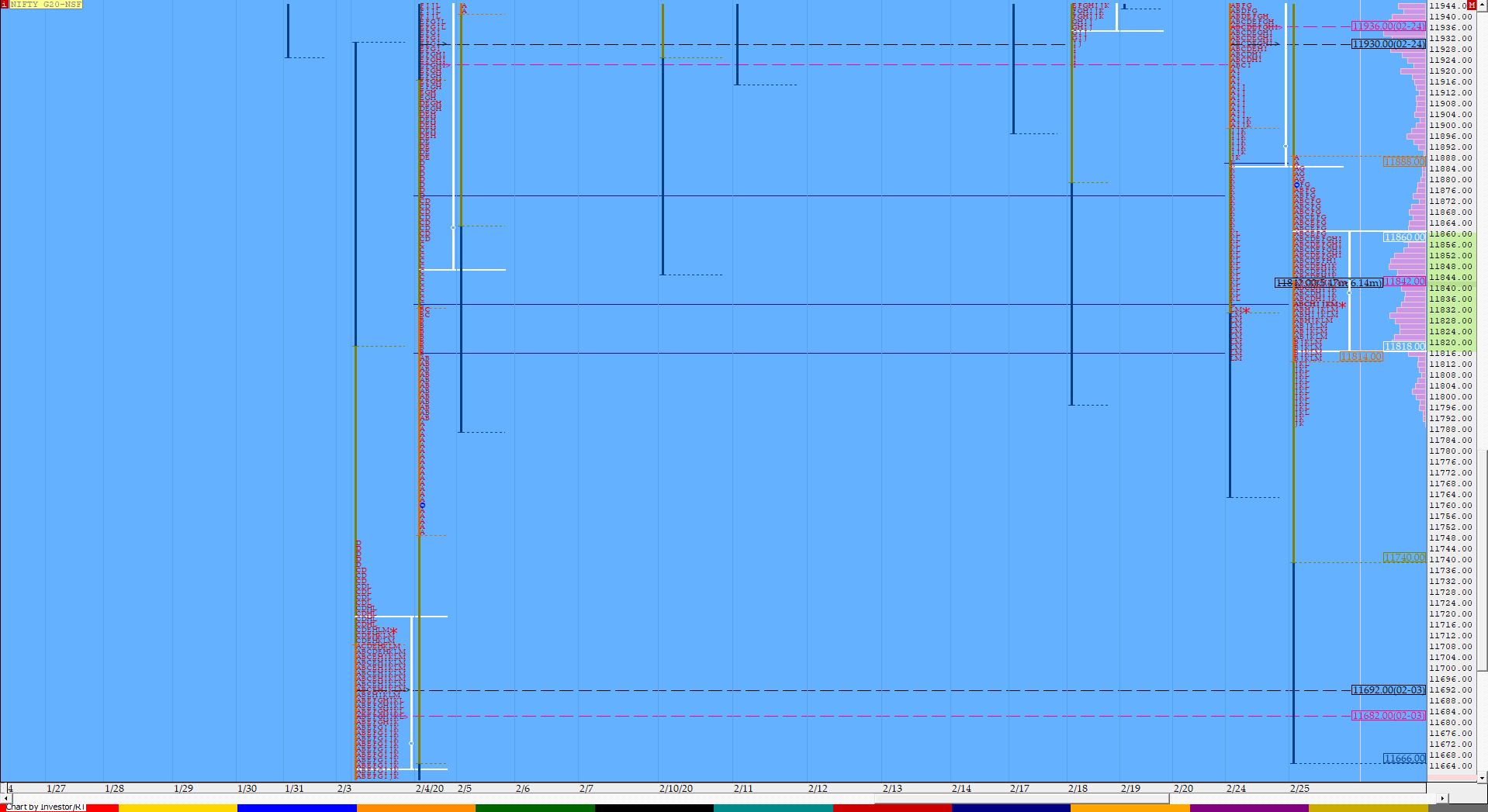

Nifty Feb F: 11827 [ 11970 / 11814 ]

HVNs – hvns at 11830-842 / 11930-934 / 12012 / 12080 / 12111 / 12130 / 12162 / (12220)

Previous day’s report ended with this ‘Spike rules would apply for the next session with the spike zone being from 11837 to 11814 which if taken out, NF has another supply zone in form of the selling tail from 11861 to 11888 which would come into play.’

NF opened higher into the previous day’s selling tail and got stalled right at the top of the singles which was at 11888 after which it made a balanced profile for the day with Value lower getting accepted in that spike zone which means the PLR still remains to the downside for a tag of the VPOC of 11692. On the upside, the HVN of 11842 would be the important reference in the coming session above which the auction could make an attempt towards the higher HVN of 11934.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Down (NV)

- Largest volume was traded at 11841 F

- Vwap of the session was at 11841 with volumes of 120.8 L and range of 98 points as it made a High-Low of 11888-11791

- NF confirmed a FA at 12047 on 19/02 and the 1 ATR objective comes to 12186. This FA was negated on 24/02 & it tagged the 1 ATR objective of 11909 to the downside. The 2 ATR move down comes to 11771.

- The 14th Feb VWAP of 12169 will be the immediate reference on any upside.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11817-11841-11861

Main Hypos for the next session:

a) NF needs to sustain above 11817 for a bounce to 11830 / 11847-859 / 11876-888 & 11910-918

b) The auction gets weak below 11800-791 for a test of 11771-763 / 11745 / 11730-722 & 11692*-685

Extended Hypos:

c) Above 11918, NF can probe higher to 11930-936* / 11960-970 & 12005-011

d) Below 11685, the auction can move lower to 11665-644 / 11628 & 11606-600

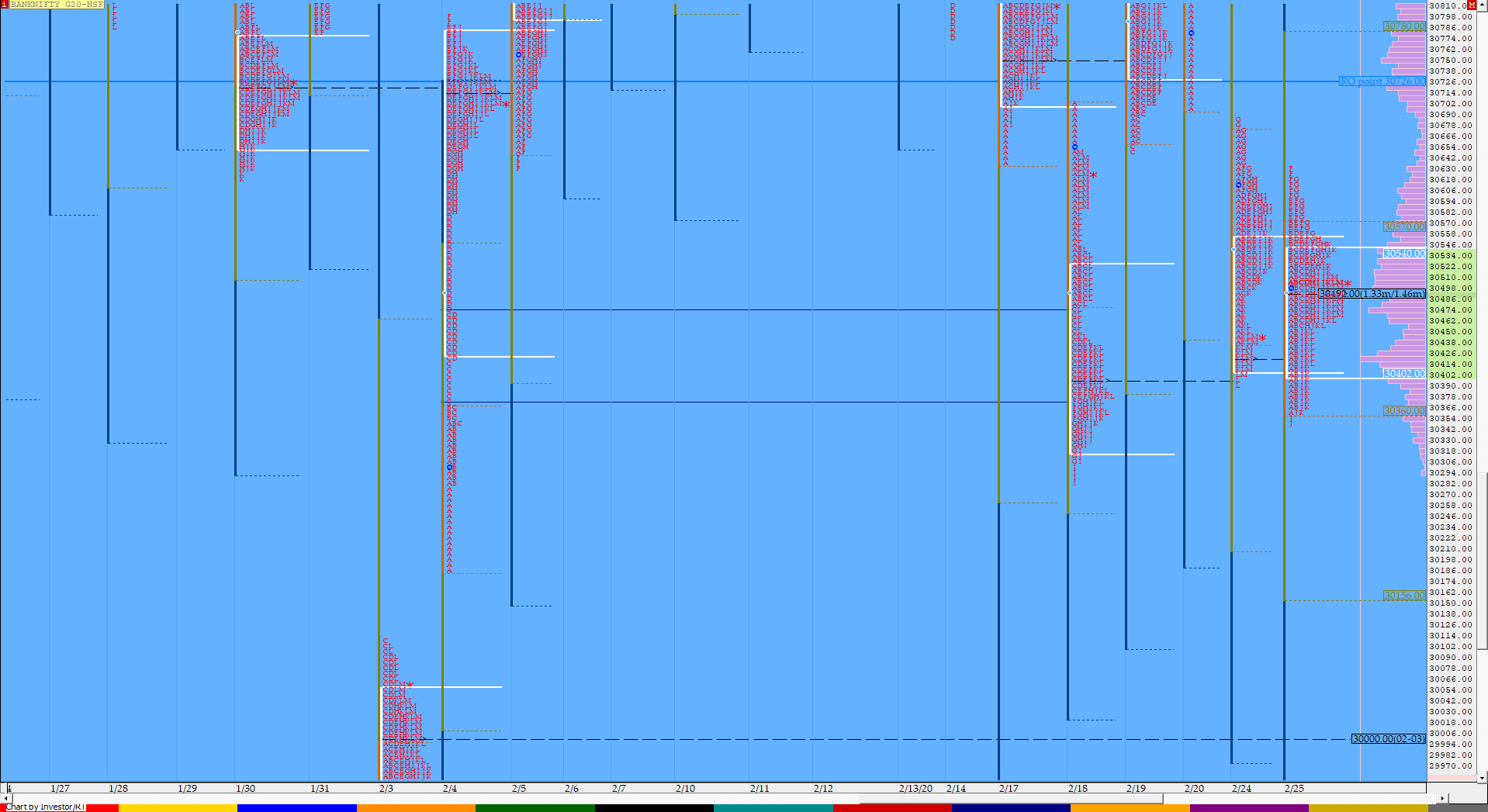

BankNifty Feb F: 30468 [ 30633 / 30351 ]

HVNs – (29970) / (30360) / 30420 / 30525 / 30720 / 30795 / 30890 / 31040

BNF also opened higher and formed a nice balanced profile for the day as it filled up the low volume zone of previous day’s making a nice 2-day Gaussian profile with a FA at top & looks set to give a move away from here in the coming session(s). The 2-day balance has Value at 30431-30527-30570

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Centre Day (NeuD)

- Largest volume was traded at 30500 F

- Vwap of the session was at 30490 with volumes of 29.3 L and range of 282 points as it made a High-Low of 30633-30351

- BNF confirmed a FA at 30689 on 24/02 and the 1 ATR objective comes to 30233.

- BNF confirmed a multi-day FA at 30652 on 20/02 and almost tagged the 1 ATR objective of 31107 on the same day. This FA got negated on 24/02 & the 1 ATR target on downside comes to 30197.

- The 14th Feb VWAP of 31067 will be the immediate reference on any upside. This reference was briefly taken out on 20/02 but the was not able to close above it.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30423-30500-30565

Main Hypos for the next session:

a) BNF needs to sustain above 30490-527 for a rise to 30575-625 / 30674-689 / 30726-752 & 30812-859

b) Immediate support is at 30445-420 below which the auction could fall to 30365-320 / 30285 / 30233-197-163 / 30102 & 30060-040

Extended Hypos:

c) Above 30859, BNF can probe higher to 30935-948* / 30985 / 31020-050 & 31095-143

d) Below 30040, lower levels of 29960-951 / 29890-873 / 29825 & 29778-752 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout