Nifty Mar F: 8362 [ 8423 / 7681 ]

HVNs – (7580) / 7719 / (7820) / 7880-7892 / (7920) / 8196 / 8280 / 8346 / 8568 / 8740 / (8900) / (9110-120)

NF started with balancing in the 2-day composite in the first part of the day with a small buying tail in the IB at 7725 to 7681 but gave a move away from the balance in the second half with the first extension handle at 7977 as the auction witnessed a huge move to the upside making multiple REs and leaving 2 more extension handles at 8090 & 8196 to hit highs of 8423 before closing near the dPOC of 8348 leaving a Double Distribution Trend Day Up.

- The NF Open was a Open Auction In Range (OAIR)

- The day type was a Double Distribution Trend Day – Up (DD)

- Largest volume was traded at 8348 F

- Vwap of the session was at 8060 with volumes of 190.5 L and range of 742 points as it made a High-Low of 8423-7681

- NF confirmed a FA at 7526 on 24/03 and tagged the 1 ATR objective of 8061 on 25/03. The 2 ATR target comes to 8596

- NF confirmed a FA at 9358 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point.

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 7908-8348-8423

Main Hypos for the next session:

a) NF has immediate supply at 8370 above which it could rise to 8395-8405 / 8435-51 / 8490-8510 / 8556-68* & 8596

b) The auction turns weak below 8340 and could test 8310-8290 / 8250 / 8208-8196 / 8160-50 / 8112-8090 & 8069-55

Extended Hypos:

c) Above 8596, NF can probe higher to 8620-61 / 8700-27 / 8760 / 8800-50 / 8885-8900 & 8950-80

d) Below 8055, the auction can fall further to 8007 / 7981-74 / 7950-28 / 7900-7890 / 7820-10 & 7795-60

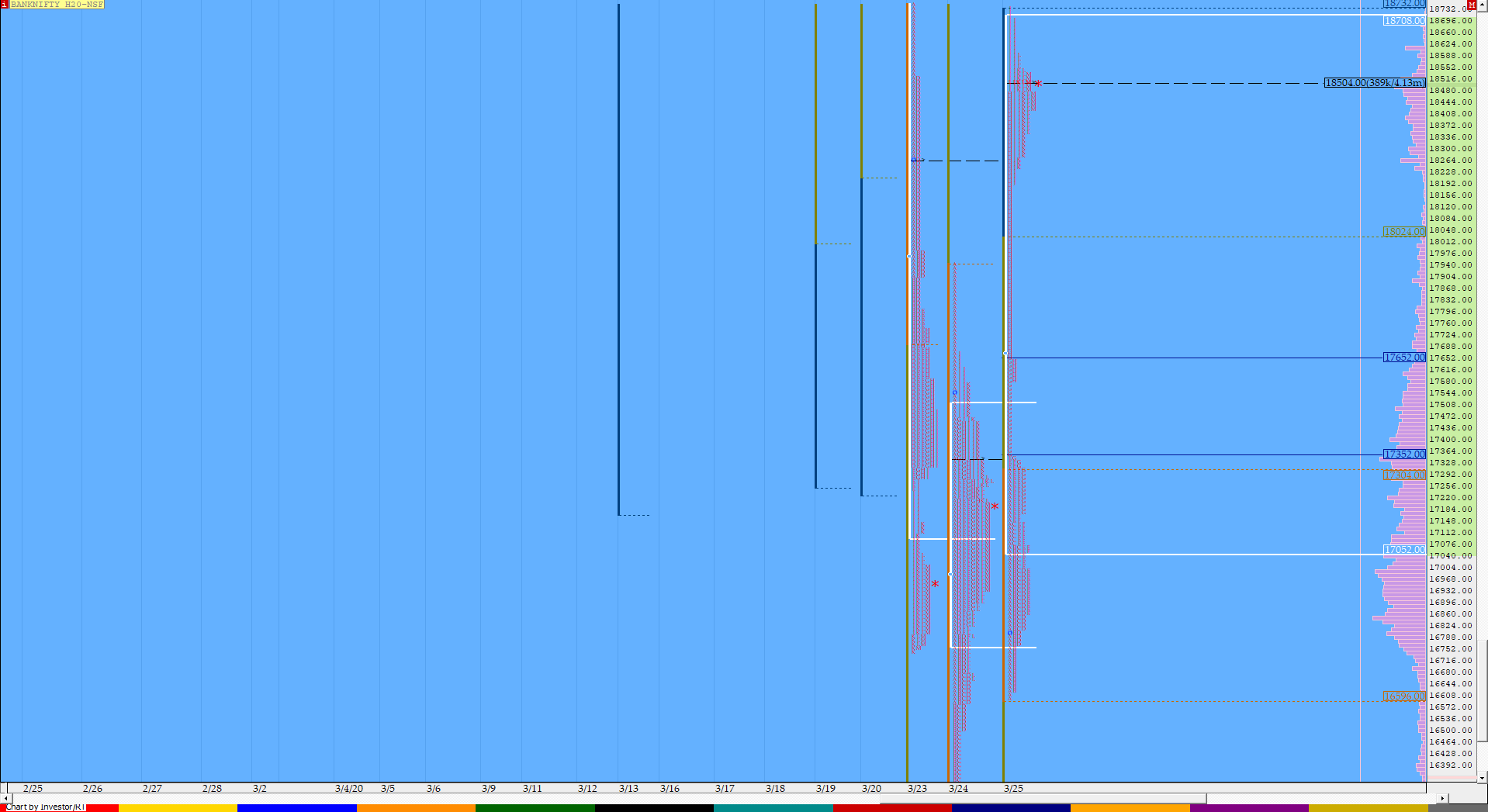

BankNifty Mar F: 18487 [ 18735/ 16600 ]

HVNs – 16850 / 16970 / 17085 / 17200 / 17355 / (18280) / 18500 / (18620) / 18930 / 19550 / 19785 / 19930

BNF also began the day with balancing in the 2-day composite while staying below the composite POC of 17355 but similar to NF, this also gave a big move on the upside leaving an extension handle at 17345 as it trended higher tagging the 3 IB move very early in the afternoon after which it began to form a small balance higher with the dPOC also shifting up at 18504 where it eventually closed. The profile has another extension handle at 17649 and a zone of singles from 18199 t0 17586 which would be the immediate reference on the downside.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Double Distribution Trend Day – Up (DD)

- Largest volume was traded at 18504 F

- Vwap of the session was at 17555 with volumes of 46.3 L and range of 2135 points as it made a High-Low of 18735-16600

- The Trend Day VWAP of 18/03 at 20990 will be an important positional supply point in the days to come.

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 17264-18504-18734

Main Hypos for the next session:

a) BNF needs to sustain above 18510 for a rise to 18576-610 / 18693-710 / 18790 / 18910-930 / 19000-055 & 19104-150

b) The auction has immediate support at 18450 below which it could probe down to 18370 / 18270 / 18199-100 / 18025-00 & 17950

Extended Hypos:

c) Above 19150, BNF can probe higher to 19200-220 / 19290 / 19360-430 / 19550 & 19655-700

d) Below 17950, lower levels of 17775 / 17710-649 / 17586-544 / 17490-425 & 17352-345 could come into play

Additional Hypos*:

e) BNF if gets accepted above 19700* could lead to a rise to 19785 / 19900-965 / 20130 / 20265 & 20304-383

f) If 17345* is taken out, the auction can fall to 17260-200 / 17125-060 / 16950 / 16850 / 16800-770 & 16675-600

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout