Nifty Aug F: 11054 [ 11072 / 10745 ]

NF opened with a big gap up of over 100 points and probed higher as it tagged 10977 but was swiftly rejected as it closed the gap confirming an ORR (Open Rejection Reverse) start to the week and went on to fall by 233 points in the IB (Initial Balance) taking support at 10745 which was also the pull back low of Friday. (Click here to view the profile chart for August NF for better understanding) The huge IB range meant that the auction had moved too fast so could consolidate as it made an inside bar in the ‘C’ period getting resisted at 10853 which was the overlapping POC of last 2 days but once it got above this in the ‘D’ period, NF made an OTF (One Time Frame) till the ‘L’ period making multiple REs (Range Extension) to the upside making a high of 11072 & in the process tagged the August series composite POC of 11061. (click here to watch the latest composite). The auction is more likely to remain in this composite while continuing to give big moves on both sides till expiry.

- The NF Open was an Open Rejection Reverse – Down (ORR) which failed yet again

- The day type was a Trend Day – Up

- Largest volume was traded at 10982 F

- Vwap of the session was at 10917 with volumes of 213 L and range of 327 points as it made a High-Low of 11072-10745

- NF confirmed a multi-day FA at 11083 on 21/08 and tagged the 2 ATR objective of 10736 on 22/08. This FA is currently on ‘T+5’ Days

- The Trend Day POC & VWAP of 26/08 at 10982 & 10917 would be important references on the upside.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11315

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

- The VWAP & POC of May Series is 11613 & 11696 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10868-10982-11067

Hypos / Estimates for the next session:

a) NF needs to get above 11067-70 & sustain for further rise to 11088 / 11106 & 11124

b) Immediate support is at 11031 below which auction can test 11015-07 / 10980-974 & 10958-950

c) Above 11124, NF can probe higher to 11145-152 & 11180-186

d) Below 10950, auction becomes weak for 10930 / 10910-905 & 10890-878

e) If 11186 is taken out, the auction can rise to 11205-217 & 11240-248

f) Break of 10878 can trigger a move lower to 10856-852 / 10828-806 & 10777-770

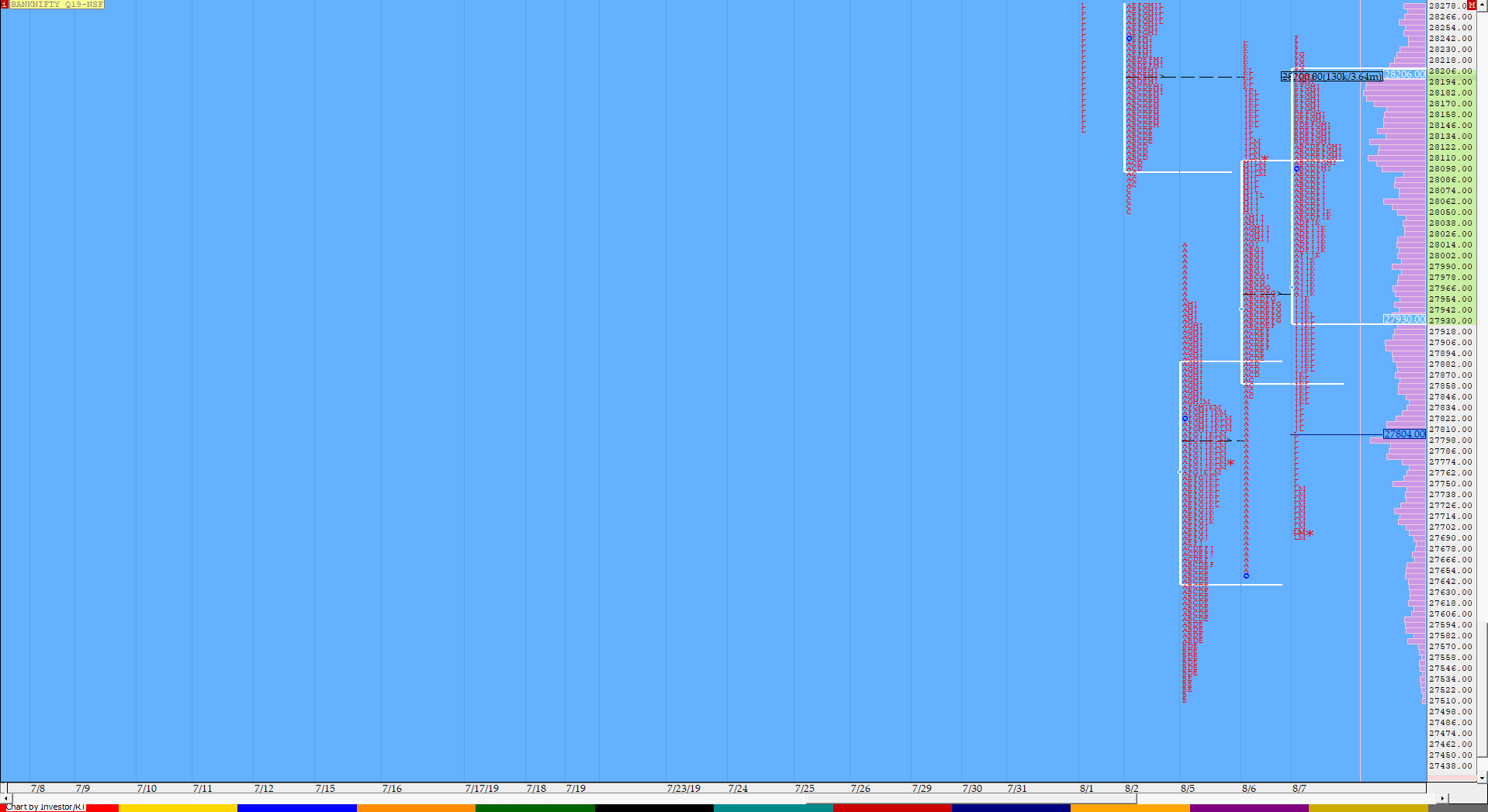

BankNifty Aug F: 27921 [ 27985 / 26822 ]

BNF had moved away from the composite it was forming from 1st to 21st Aug last week with a selling tail of 27606 to 27746 and an extension handle at 27405 which was also the Trend Day VWAP of 22nd Aug and the Friday move higher saw it getting rejected at 27250 which were the references for this week. The auction today opened with a huge gap up & an freak OH (Open=High) of 27624 where it got swiftly rejected from that selling tail and gave a drive lower falling by 800 points in the IB as it made a low of 26822 in the ‘B’ period. (Click here to view the profile chart for August BNF for better understanding) After the big imbalance of the first hour, BNF then made an inside bar in the C period & similar to the auction in NF went on to make a OTF move higher from the D period onwards and went on to make a RE to the upside in the ‘I’ period after which BNF entered the composite by leaving an extension handle at 27680 and not just negated the entire selling tail but went on to tag the HVN & weekly POC of 27925 as it made a high of 27985 in the ‘K’ period. BNF then consolidated for the last 45 minutes staying inside the range of ‘K’ and closed at the HVN of 27925 well inside the composite & could continue to probe higher for a tag of 28184 & 28270 in the coming session(s)

- The BNF Open was an Open Drive (Down) (OD) which failed

- The day type was a Trend Day (Up)

- Largest volume was traded at 27930 F

- Vwap of the session was also at 27411 with volumes of 63.7 L in a session which traded in a range of 1163 points making a High-Low of 27985-26822

- The Trend Day POC & VWAP of 22/08 at 27485 & 27406 would be important references on the upside.

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 29250

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

- The VWAP & POC of May Series 30211 & 28940 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27200-27930-27960

Hypos / Estimates for the next session:

a) BNF needs to sustain above 27925 for a move to 27960 / 28013-40 & 28090

b) Staying below 27920, the auction can test 27850-840 / 27790 & 27723

c) Above 28090, BNF can probe higher to 28130-185 / 28227 & 28270-291

d) Below 27723, lower levels of 27680-675 / 27624-604 & 27560 could come into play

e) Sustaining above 28291, BNF can give a fresh move up to 28357-367 & 28410-425

f) Break of 27560 could trigger a move down 27510 / 27441-411 & 27350

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout