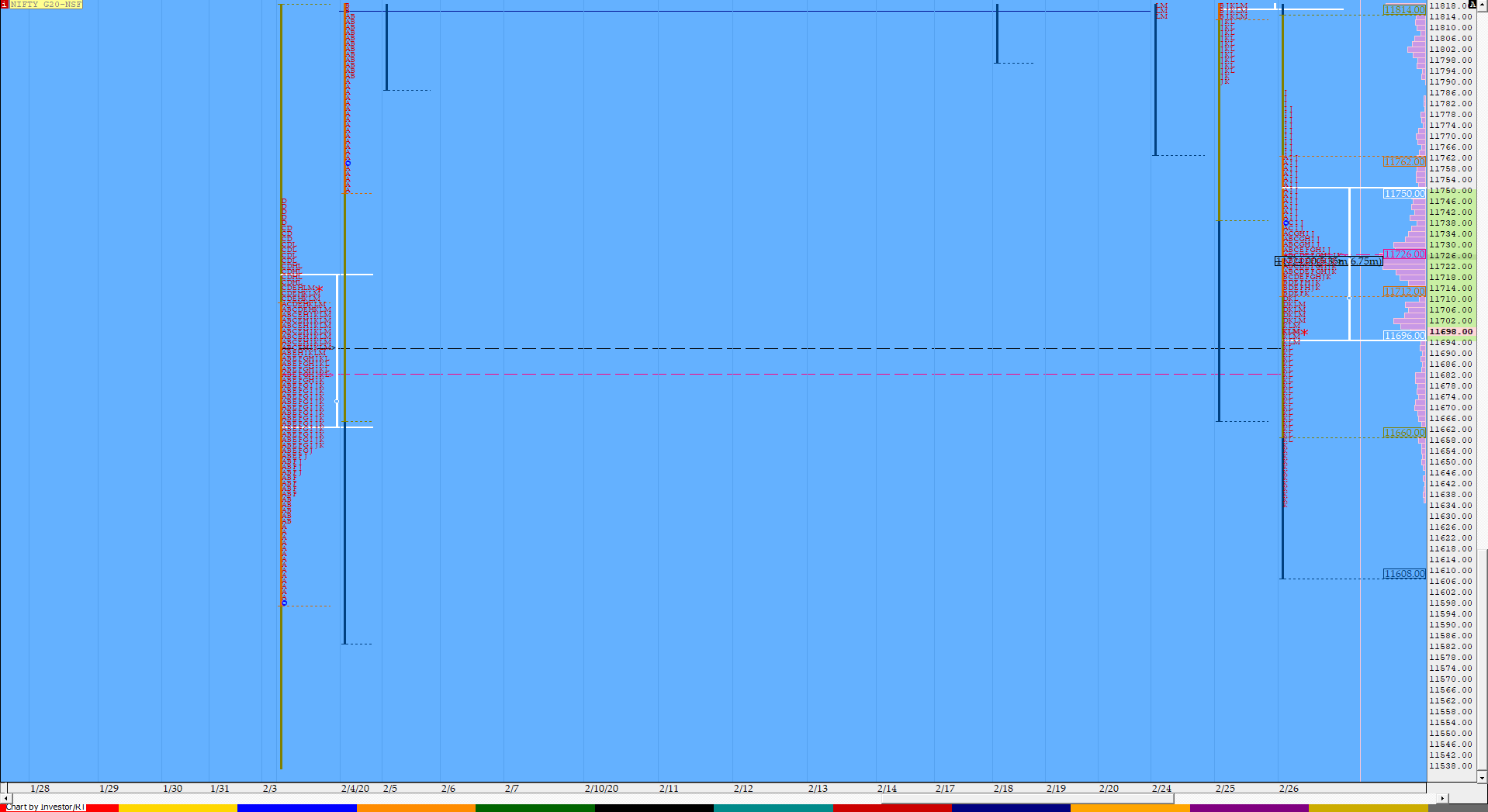

Nifty Feb F: 11695 [ 11788 / 11635 ]

HVNs – hvns at 11725 / 11830-842 / 11930-934 / 12012 / 12080 / 12111 / 12130 / 12162 / (12220)

NF opened with a big gap down at 11739 and remained weak as it made highs of 11763 in the opening minutes but settled down into an OAOR (Open Auction Out of Range) leaving a narrow IB range of just 52 points. The auction then attempted a RE (Range Extension) to the downside in the ‘D’ period but got rejected from 11702 as it failed to attract new sellers. As often happens in an OAOR start, NF then stayed in a narrow range doing almost nothing till the ‘H’ period as it started to build a prominent POC at 11725 and in the process was forming a ‘b’ shape profile but the ‘I’ period saw a big short squeeze move coming in which led to a RE on the upside followed by a higher high in the ‘J’ period at 11788 which was swiftly rejected. This rejection from just below the PDL (Previous Day Low) meant that fresh initiative supply was coming into the auction and this gave a trending move to the downside as NF made a fresh RE to the downside not only tagging that VPOC of 11692 but went on to complete the 2 IB move down and made lows of 11635 in the ‘K’ period where it saw some profit booking setting up the 45 degree Rule as it made an attempt to move back to that prominent POC of the day to finally close at 11695 leaving a Neutral Centre Day. Value for the day was completely lower continuing the trend of this week but NF has left a small buying tail at lows from 11658 to 11635 which it would need to negate for the PLR (Path of Least Resistance) to remain down. On the upside, the auction would need to give a move away from 11725 on initiative volumes for a probe towards the VPOCs of 11841 & 11930 failing which NF could form a balance for the next session or two before giving the next imbalance move.

- The NF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 11725 F

- Vwap of the session was at 11718 with volumes of 127.9 L and range of 152 points as it made a High-Low of 11788-11635

- NF confirmed a FA at 12047 on 19/02 and the 1 ATR objective comes to 12186. This FA was negated on 24/02 & it tagged the 2 ATR move of 11771 on 26/02.

- The 14th Feb VWAP of 12169 will be the immediate reference on any upside.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11702-11725-11764

Main Hypos for the next session:

a) NF needs to sustain above 11715-725 for a bounce to 11745-760 / 11780-785 & 11817

b) The auction gets weak below 11680 and could fall to 11658-640 / 11628-606 & 11587-580

Extended Hypos:

c) Above 11817, NF can probe higher to 11830-841* / 11859 & 11888-904

d) Below 11580, the auction can move lower to 11557 / 11535 & 11503-496-484*

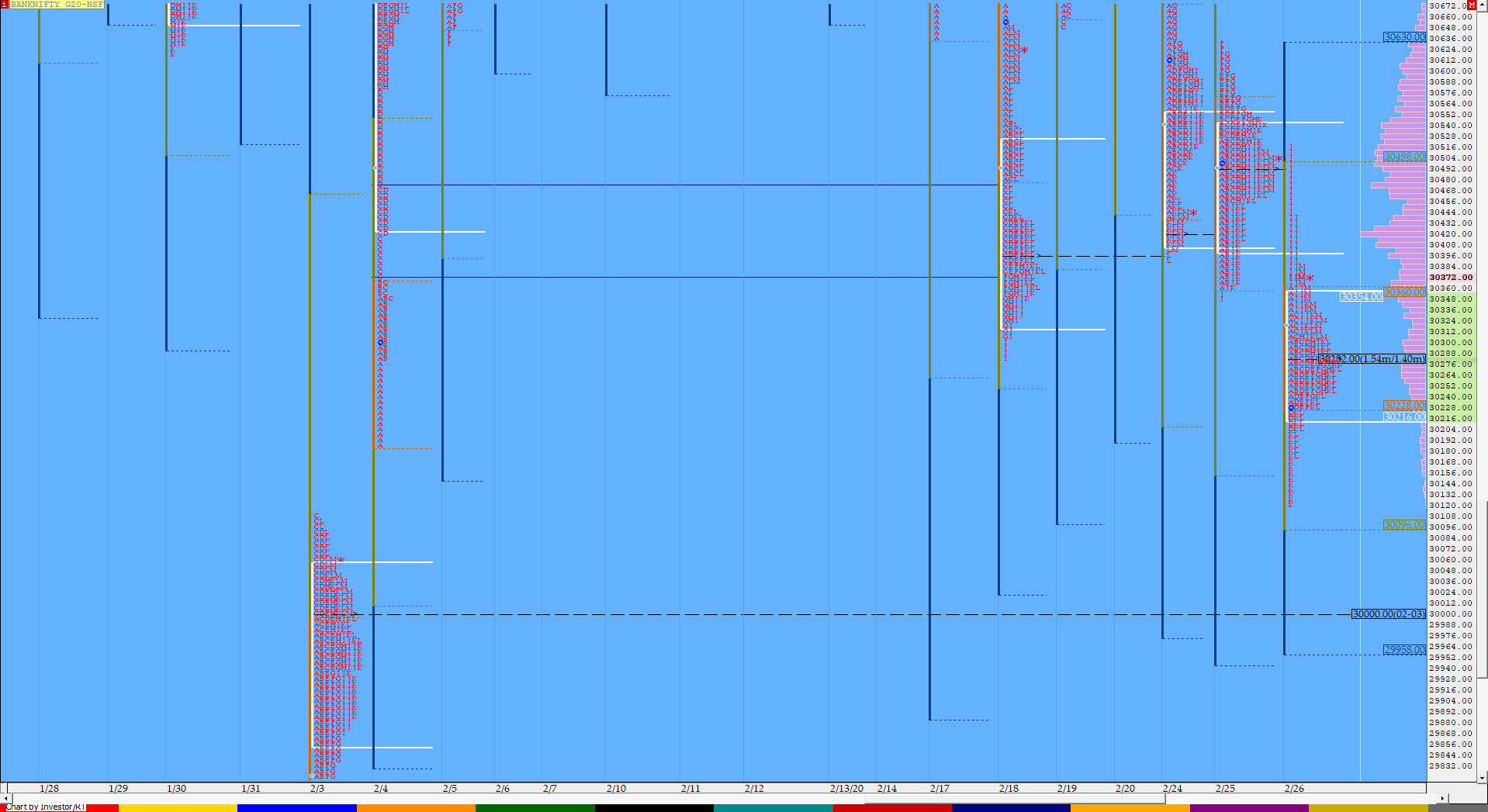

BankNifty Feb F: 30315 [ 30517 / 30125 ]

HVNs – (29970) / (30280) / (30360) / 30420 / 30525 / 30720 / 30795 / 30890 / 31040

BNF moved away from the 2-day balance on the downside as it opened with a big gap down but was also an OL (Open=Low) start at 30230 which was the 1 ATR objective from the FA of 30689 which meant that the downside could be limited after which it made highs of 30365 in the IB but could not sustain above the PDL (Previous Day Low) indicating that the OAOR could lead to a balance being formed for the first part of the day. The auction then started to coil in a narrow range and similar to NF, it made a failed attempt to make a RE to the downside in the ‘D’ period which eventually led to a spike higher in the ‘I’ & ‘J’ period as BNF completed the 2 IB objective of 30498 but got stalled just below the POC of the 2 day balance which was at 30527. This rejection triggered a big probe lower as the auction not only made new lows for the day in the K period but also tagged the 1.5 IB target while making lows of 30125 but BNF faced swift rejection at these new lows to give back to back Neutral Day profiles.

- The BNF Open was an Open Auction Out of Range (OAOR)

- The day type was a Neutral Day (NeuD)

- Largest volume was traded at 30280 F

- Vwap of the session was at 30290 with volumes of 30.9 L and range of 392 points as it made a High-Low of 30517-30125

- BNF confirmed a FA at 30689 on 24/02 and tagged the 1 ATR objective of 30233 on 26/02.

- BNF confirmed a multi-day FA at 30652 on 20/02 and almost tagged the 1 ATR objective of 31107 on the same day. This FA got negated on 24/02 & the and tagged the 1 ATR objective of 30197 on 26/02.

- The 14th Feb VWAP of 31067 will be the immediate reference on any upside. This reference was briefly taken out on 20/02 but the was not able to close above it.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30216-30280-30357

Main Hypos for the next session:

a) BNF needs to sustain above 30360 for a rise to 30408-431 / 30480-527* / 30575 & 30620-625

b) Immediate support is at 30325-310 below which the auction could fall to 30265-224-215 / 30175 / 30125-102 & 30060-040

Extended Hypos:

c) Above 30625, BNF can probe higher to 30674-689 / 30726-752 / 30812-859 & 30935-948*

d) Below 30040, lower levels of 29960-951 / 29890-873 / 29827 / 29778-753 & 29705 could be tagged

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout