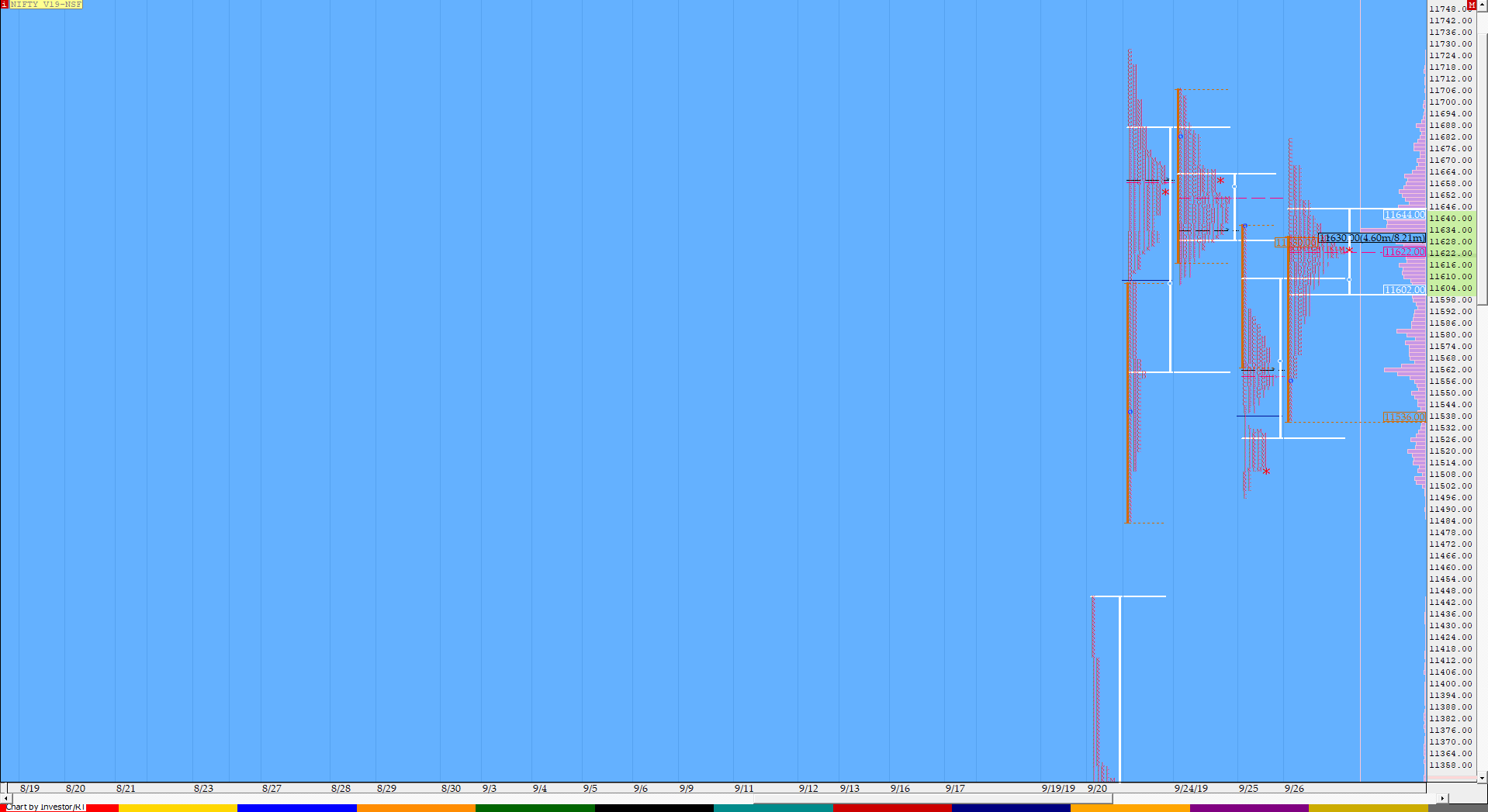

Nifty Oct F: 11631 [ 11680 / 11538 ]

NF rejected the lower distribution of previous day as it opened higher and took support at the extension handle of 11540 (Oct F) in the opening minutes which suggested that the PLR would be to the upside. The auction continued to probe higher as it got above the yPOC & entered the selling tail of previous day making a high of 11630 in the IB and had a long buying tail at lows from 11606 to 11522. NF then made a range extension to the upside in the ‘C’ period in the form of a spike as it made highs of 11680 but could not sustain above 11660 as it made a narrow balance above VWAP for the next 2 periods. The ‘F’ period then saw a probe lower as NF broke below VWAP and entered the morning tail and went on to test the open price of 11557 in the ‘G’ period where it stopped leaving a pull back low as it got back above VWAP but stayed below the IBH till the ‘J’ period filling up the lower part of the day’s profile. NF did make another attempt to probe above the IBH in the ‘K’ period as it made highs of 11667 but could not spike into the close as the ‘L’ period made similar highs of 11666 but could not move away from the developing HVN of 11630 where the auction finally closed leaving a nice 3-1-3 balanced profile with overlapping to higher Value. The weekly profile which started with ‘p’ shape on the first 2 days is slowly turning into a more balanced profile as the 4 day composite can be seen at the below link so will need to see if the auction moves away from this prominent composite POC of 11630 in the coming session(s) or continues to build Value around it.

(Click here to view this week’s auction in Oct NF)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (‘3-1-3’ profile)

- Largest volume was traded at 11631 F

- Vwap of the session was at 11617 with volumes of 136.7 L and range of 142 points as it made a High-Low of 11680-11538

- The Trend Day POC & VWAP of 20/09 at 11330 & 11178 are now now important support levels.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside. NF has closed above both of these on 23/09.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point (Oct) is 11630

- The VWAP of Sep Series is 11127.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11602-11631-11645

Hypos / Estimates for the next session:

a) NF needs to sustain above 11630-635 for a move to 11660-670 & 11700

b) Immediate support is at 11624-618 below which the auction can test 11586-582 & 11565-558

c) Above 11700, NF can probe higher to 11725-730 & 11751

d) Below 11558, auction becomes weak for 11538-520 & 11485

e) If 11751 is taken out, the auction can rise to 11776 & 11805-810

f) Break of 11485 can trigger a move lower to 11445 & 11415-410

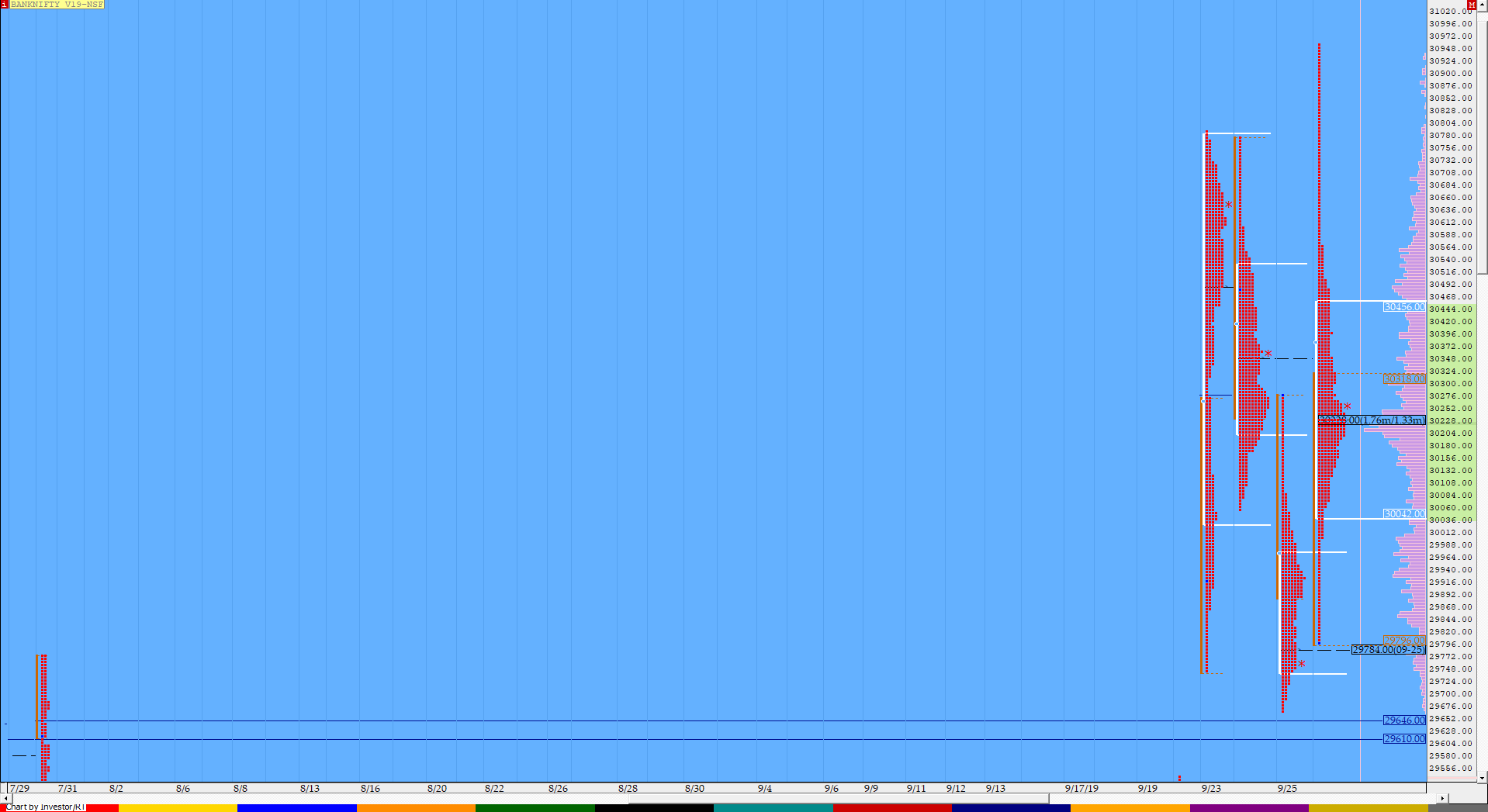

BankNifty Oct F: 30225 [ 30958 / 29800 ]

BNF opened higher with an OL (Open=Low) at 29800 & moved away from the yPOC of the previous day’s ‘b’ shape profile setting up the PLR to the upside for the day and similar to NF, it scaled above the PBH (Pull Back High) of 30085 and got accepted the previous day’s selling tail in the ‘A’ period itself after which it probed above the PDH (Previous Day High) to make highs of 30322 in the IB leaving a big 522 point range. The ‘C’ period then saw an unexpected spike higher which could have been caused by the stuck players being caught unaware as the auction made a highs of 30958 doubling the IB range in just a few minutes. However, the spike could not sustain as BNF got back to test the IBH in the ‘D’ period where it found support after which it left a pull back high at 30565 in the ‘E’ period & this lower high led to the break of VWAP and this time it got accepted below the IBH as the ‘G’ period went on to make a low of 30001 after which the auction remained between these 2 levels for the rest of the day building volumes at 30230 and even closing around it leaving a large 3-1-3 profile for the day with the buying tail from 30001 to 29750 and the singles at top from 30958 to 30565. The next leg of auction would depend on which side of the singles gets accepted or rejected and till then BNF could continue to balance in today’s range. The 4 day composite this week is also giving a nice balance so far & can be seen at the below link.

(Click here to view this week’s action in Oct BNF)

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (‘3-1-3’ profile)

- Largest volume was traded at 30230 F

- Vwap of the session was at 30282 with volumes of 32.1 L and range of 1158 points as it made a High-Low of 30958-29800

- The Trend Day POC & VWAP of 20/09 at 29075 & 28548 are now now important support levels.

- The higher Trend Day VWAP of 08/07 at 30995 remains important reference going forward

- The settlement day Roll Over point (Oct) is 30230

- The VWAP of Sep Series is 28416.

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30095-30230-30420

Hypos / Estimates for the next session:

a) BNF needs to sustain above 30230 for a rise to 30300 / 30390-396 & 30480-500

b) Staying below 30225, the auction could test 30150-100 / 30061-50 & 30001-29990

c) Above 30500, BNF can probe higher to 30565-600 & 30728-750

d) Below 29990, lower levels of 29950-925 / 29885-860 & 29800-750 could come into play

e) Sustaining above 30750, BNF can give a fresh move up to 30800-850 & 30900-935

f) Break of 29750 could trigger a move down 29665-630 / 29550-528 & 29425

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout