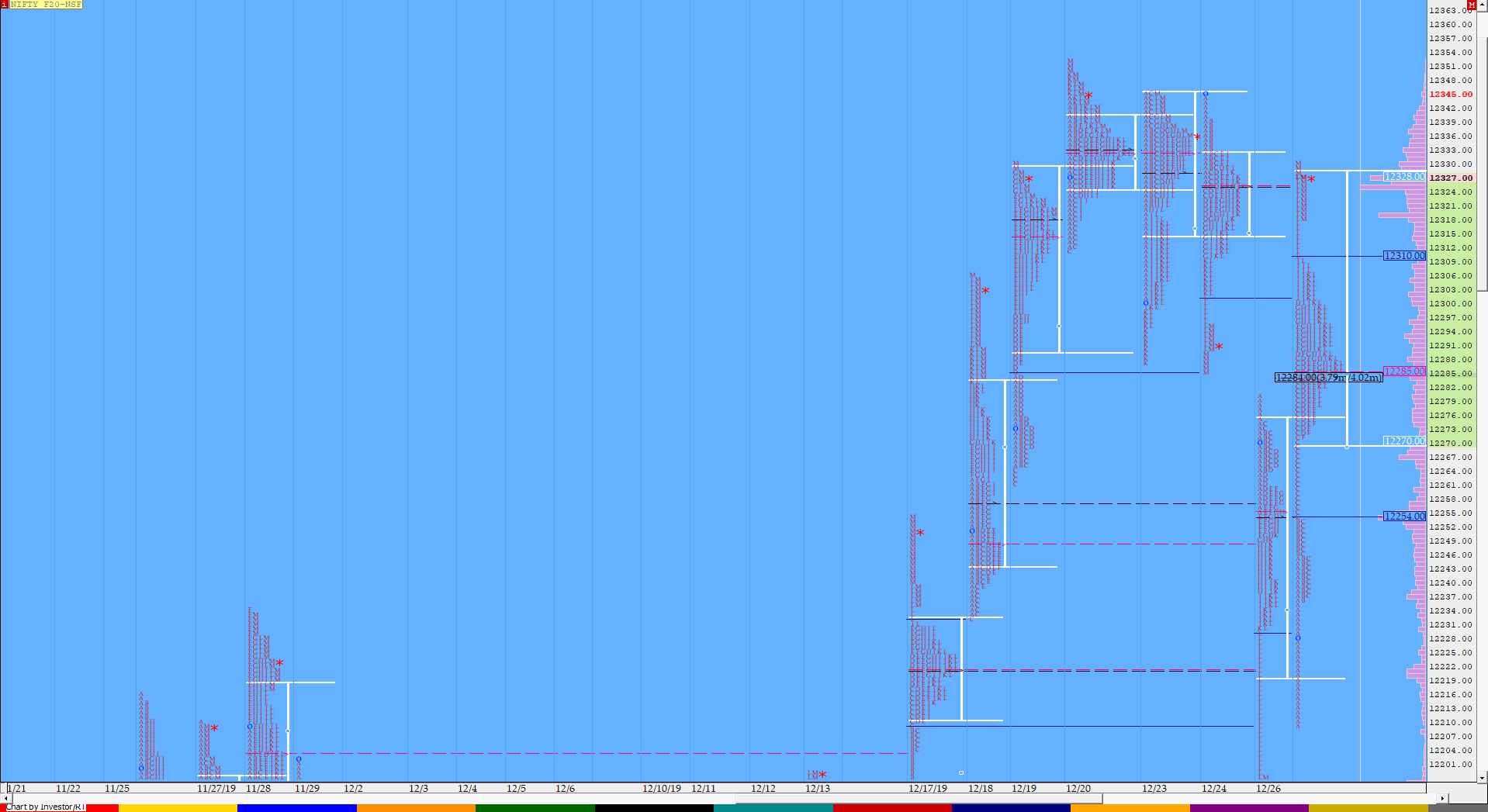

Nifty Jan F: 12319 [ 12330/ 12209 ]

HVNs – 11949 / 11995 / 12042 / 12130 / 12160 / 12193 / 12276 / 12327

NF opened higher right at the spike high of 12231 and probed lower as it stayed inside the spike zone but took support above the HVN of 12195 while making a low of 12209 from where it reversed the probe and went on to get above the spike high and even tagged the Trend Day VWAP of 12244 in the ‘A’ period itself which was a signal that the PLR (Path of Least Resitance) has turned ‘Up’. The auction then left an extension handle at 12253 as it made a big ‘C’ side RE (Range Extension) scaling above PDH (Previous Day High) and completing the 1.5 IB objective of 12275 as it made highs of 12288. This imbalance to the upside continued till the ‘J’ period as NF made a high of 12310 after which it gave the typical inventory adjustment dip to VWAP as it left a PBL (Pull Back Low) at 12278 in the ‘L’ period which was also the PDH and rejection from there triggered a fresh move to the upside in the form of a spike close from 12310 to 12330 and in the process tagged the VPOC of 12327. Spike Rules will come into play at open for the next session with the FA (Failed Auction) of 12346 the next reference on the upside along with the PBL & today’s VWAP of 12278 being the important level to watch in case of any dip.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV) with a Spike Close

- Largest volume was traded at 12285 F

- Vwap of the session was at 12278 with volumes of 77.2 L and range of 121 points as it made a High-Low of 12330-12209

- The Trend Day VWAP of 26/12 at 12244 was negated on 27/12.

- The settlement day Roll Over point (Jan) is 12193

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12270-12284-12328

Hypos / Estimates for the next session:

a) NF has immediate supply at 12327-332 above which it could rise to 12346-352 / 12368 & 12391

b) Immediate support is at 12309 below which the auction could test 12285 / 12266 & 12253

c) Above 12391, NF can probe higher to 12414 / 12428-437 & 12460

d) Below 12253, auction could probe lower to 12235-220 / 12196-190 & 12170-162

e) If 12460 is taken out, the auction go up to to 12475 / 12500 & 12530

f) Break of 12162 can trigger a move lower to 12144 / 12126-122 & 12101

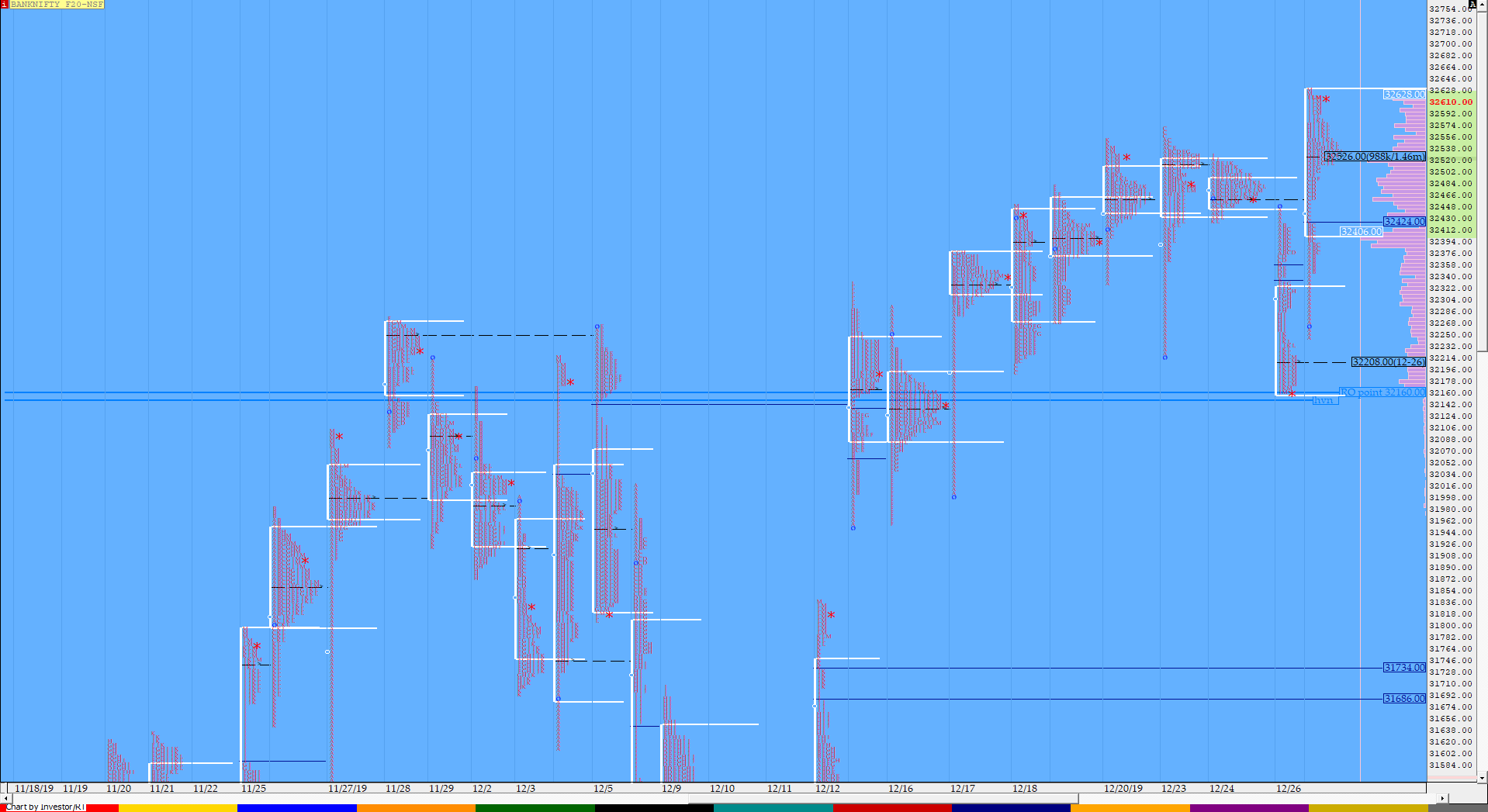

BankNifty Jan F: 32605 [ 32634 / 32246 ]

HVNs – 32125 / 32210 / 32400 / 32526 / 32616

Previous day’s report ended with this ‘The dPOC of 32210 would be the first reference on the upside above which the combo of the PBH & the day’s VWAP of 32253 & 32281 would be the important levels going forward for the new series.‘

BNF opened with a gap up much above the dPOC of 32210 which was a strong signal and gave more confirmation with an almost OL (Open=Low) start at the PBH of 32253 as it went on to scale above the previous day’s VWAP of 32281 in the opening minutes itself which set up the day for a good up-move. The auction then left a buying tail from 32348 to 32246 in the IB (Initial Balance) and like the NF made a strong ‘C’ period RE to the upside as it left an extension handle at 32421 to scale above the PDH and continued to probe higher making new all time highs of 32618 in the ‘I’ period completing the 2 IB move and in the process negated the FAs of 32529 & 32569. BNF then left a PBL in the ‘L’ period at 32514 before making marginal new highs of 32634 as it spiked higher into the close and is in completely uncharted territory for now.

- The BNF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 32526 F

- Vwap of the session was at 32478 with volumes of 25.1 L and range of 387 points as it made a High-Low of 32634-32246

- BNF confirmed a FA at 32568 on 23/12 and tagged the 1 ATR target of 32208. This FA got re-visited on 27/12 at ‘T+3’ Days

- The Trend Day VWAP of 26/12 at 32281 was negated on 27/12.

- The settlement day Roll Over point (Jan) is 32180

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32410-32526-32625

Hypos / Estimates for the next session:

a) BNF needs to scale above 32620-640 & sustain for a rise to 32715 / 32770 & 32820

b) Immediate support is at 32590-575 below which the auction could test 32526 / 32478-440 & 32400

c) Above 32820, BNF can probe higher to 32885 & 32930

d) Below 32400, lower levels of 32348 & 32287-260 could be tagged

e) If 32930 is taken out, BNF can give a fresh move up to 32989 & 33045

f) Break of 32260 could trigger a move down to 32208* & 32168-160

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout