Nifty Mar F: 11629 [ 11685 / 11541 ]

HVNs – 11580 / 11610-630 / 11704-730 / 11855 / 11945

NF opened lower which was also an OH (Open=High) start at 11685 after which it gave a drive down on relatively lower volumes but nonetheless went on to make new lows for the month to give a pretty big IB (Initial Balance) range of 127 points as it tagged 11558 in the ‘B’ period and even left a selling tail from 11612 to 11685. The auction then made new lows of 11541 as it made a RE (Range Extension) to the downside but after a big imbalance of 160 points from previous close, it was more likely that we were having that dreaded C side RE which could lead to a retracement. The ‘D’ period made an inside bar further confirming that the downside probe looks exhausted after which the ‘E’ period probed higher giving a move to VWAP but left a PBH (Pull Back High) at 11589 indicating that supply was coming back but NF took support at IBL in the ‘F’ period leaving a higher low and this set up a good move on the upside for the next 3 periods as the auction got into the selling tail and tagged 11629 in the ‘I’ period. The morning supply however seemed to have got back in this zone as it pushed the auction back below VWAP but formed similar lows near 11570 for 3 periods which meant that the demand was coming back at lower levels forming a HVN (High Volume Node) around 11580 which led to a fresh probe higher in the last 60 minutes as NF got above the PBH of 11629 and made highs of 11643 but saw some huge volumes coming in as the DPOC for the day shifted to 11631 giving a close right there to leave a ‘b’ shape profile and a Normal Day on the first day of the new series. On the upside, the auction would need to stay above 11631 and get accepted in the singles of 11643 to 11699 for a move towards the VPOCs of 11734 / 11850 & 11946 and on the downside, NF remains weak below 11630 with 11580 being a minor support level.

- The NF Open was an Open Drive – Down (OD) on lower volumes

- The day type was a Normal Day (‘b’ shape profile)

- Largest volume was traded at 11631 F

- Vwap of the session was at 11593 with volumes of 118.8 L and range of 144 points as it made a High-Low of 11685-11541

- The 14th Feb VWAP of 12190 will be the immediate reference on any upside.

- The settlement day Roll Over point (Mar) is 11610

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11582-11631-11640

Main Hypos for the next session:

a) NF has immediate supply at 11636-642 above which it could rise to 11660-665 / 11685-699 & 11734*

b) The auction gets weak below 11614-610 and could fall to 11592 / 11576-565 & 11544-535

Extended Hypos:

c) Above 11734, NF can probe higher to 11764 / 11792-800 & 11829-850*

d) Below 11535, the auction can move lower to 11503-484 / 11471-465 & 11442

*Additional Downside Hypo:

e) Below 11442, levels to watch would be 11424-412 / 11390-375 / 11343-340 & 11301*-289

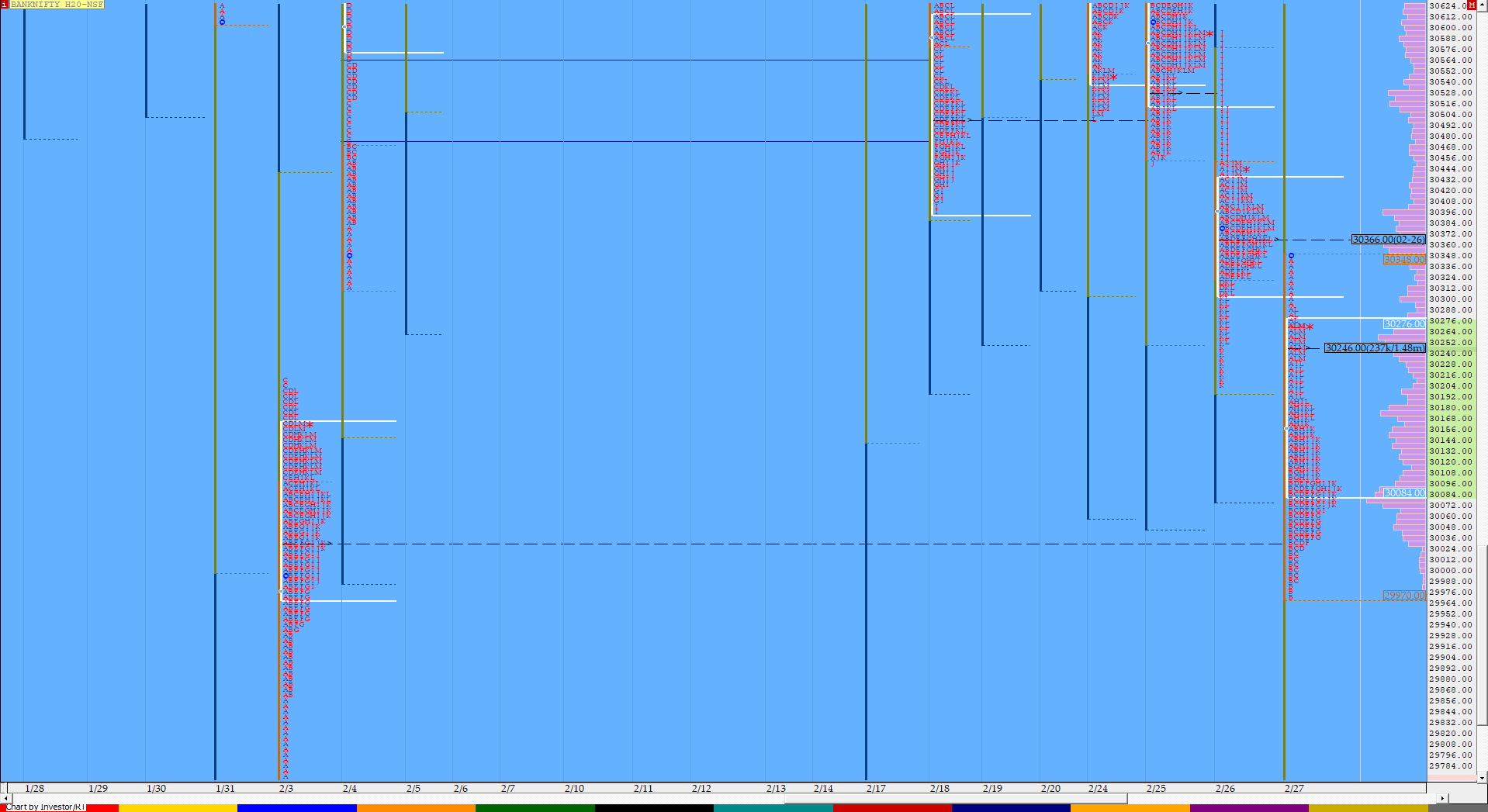

BankNifty Mar F: 30256 [ 30350 / 29972 ]

HVNs – 30085 / 30250 / 30365-397 / 30520 / 30590

BNF also gave a Open Drive Down on low volumes from just below previous day’s POC of 30366 as it made a OH start at 30350 and similar to NF, gave a big move of 379 points in the IB as it made new lows for the week at 29972 taking support near the PBL it had left on 3rd Feb at 29982. The auction then remained in this IB range for rest of the day giving a Normal profile with a HVN at 30085 and dPOC at 30250 where it eventually closed. Value for the day was once again lower so this week’s Trending profile is still going strong hence the PLR remains to the downside.

- The BNF Open was an Open Drive – Down (OD) on lower volumes

- The day type was a Normal Day

- Largest volume was traded at 30250 F

- Vwap of the session was at 30122 with volumes of 18.1 L and range of 379 points as it made a High-Low of 30350-29972

- The 14th Feb VWAP of 31118 will be the immediate reference on any upside. This reference was briefly taken out on 20/02 but the was not able to close above it.

- The settlement day Roll Over point (Mar) is 30520

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 30090-30250-30289

Main Hypos for the next session:

a) BNF has immediate supply at 30290-310 above which it could rise to 30366*-395 / 30432 / 30505-527 & 30590-645

b) Immediate support is at 30250-230 below which the auction could fall to 30150-120 / 30085-030 / 29990-935 & 29865

Extended Hypos:

c) Above 30645, BNF can probe higher to 30710 / 30800-855 & 30934*

d) Below 29865, lower levels of 29820-775 / 29705 & 29630-575 & could be tagged

*Additional Downside Hypo:

e) Below 29575, levels to watch would be 29460-448 / 29370 / 29296-288* / 29230-200 / 29136-070 & 29011-005

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout