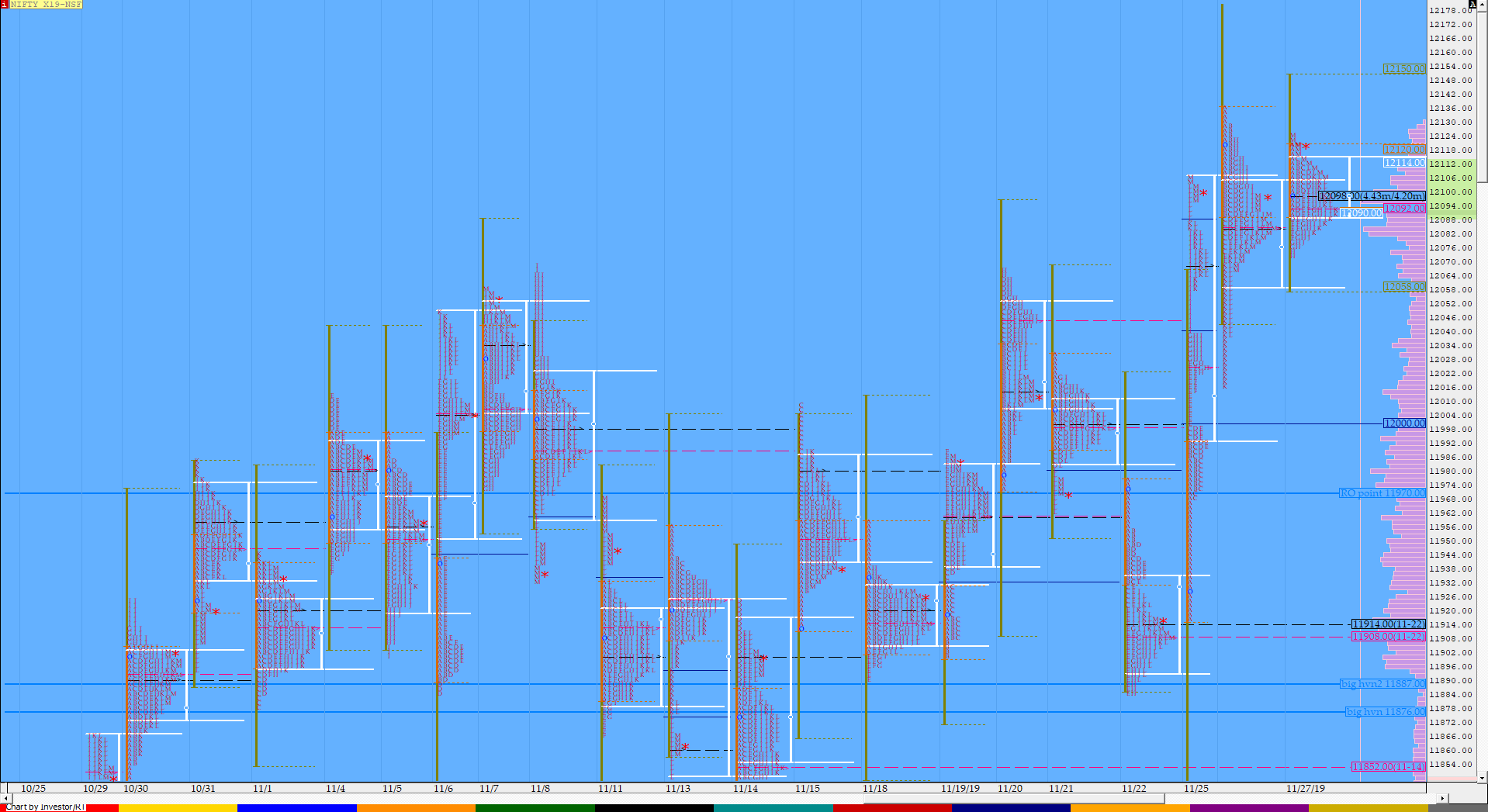

Nifty Nov F: 12108 [ 12125/ 12073 ]

HVNs – 11814 / 11852 / ( 11901) / 11914 / 11978 / 12020 / *12085-100*

NF made an inside day today both in terms of range as well as Value as it tested both sides of the previous day’s 3-1-3 profile but could not negate any of the two rejections making the narrowest daily range of just 52 points of this series as it left a Neutral Day which was also a nice Gaussian profile with a prominent POC at 12100 and has a good chance of moving away from this on the expiry day.

(Click here to view the 3-day composite ‘p’ profile)

(Click here to view the November series Composite)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Neutral Day (Gaussian profile)

- Largest volume was traded at 12100 F

- Vwap of the session was at 12098 with volumes of 93 L and range of 52 points as it made a High-Low of 12125-12073

- The Trend Day VWAP of 25/11 at 12023 will be important reference on the downside. This was tagged on 26/11 and broken briefly but was swiftly rejected so proves to be support.

- The Trend Day VWAP of 29/10 at 11810 will be important reference on the downside.

- NF confirmed a multi-day FA at 11465 on 16/10 and completed the 2 ATR move up of 11776. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11503 on 17/10 and completed the 2 ATR move up of 11808. This FA has not been tagged since & hence is now positional support

- NF confirmed a FA at 11162 on 09/10 and completed the 2 ATR move up of 11554. This FA has not been tagged since & hence is now positional support

- The settlement day Roll Over point (Nov) is 11970

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12088-12100-12112

Hypos / Estimates for the next session:

a) NF needs to take out the supply at 12120-125 for a move to 12148 / 12166 & 12185-199

b) Immediate support is at 12100 below which the auction could test 12085-74 / 12050-30 & 12012

c) Above 12199, NF can probe higher to 11215-233 / 12248-255 & 12282

d) Below 12012, auction becomes weak for 11997-994 / 11978-960 & 11940

e) If 12282 is taken out, the auction go up to to 12310 / 12340 & 12375-384

f) Break of 11940 can trigger a move lower to 11914*-11901 / 11885 & 11860-852*

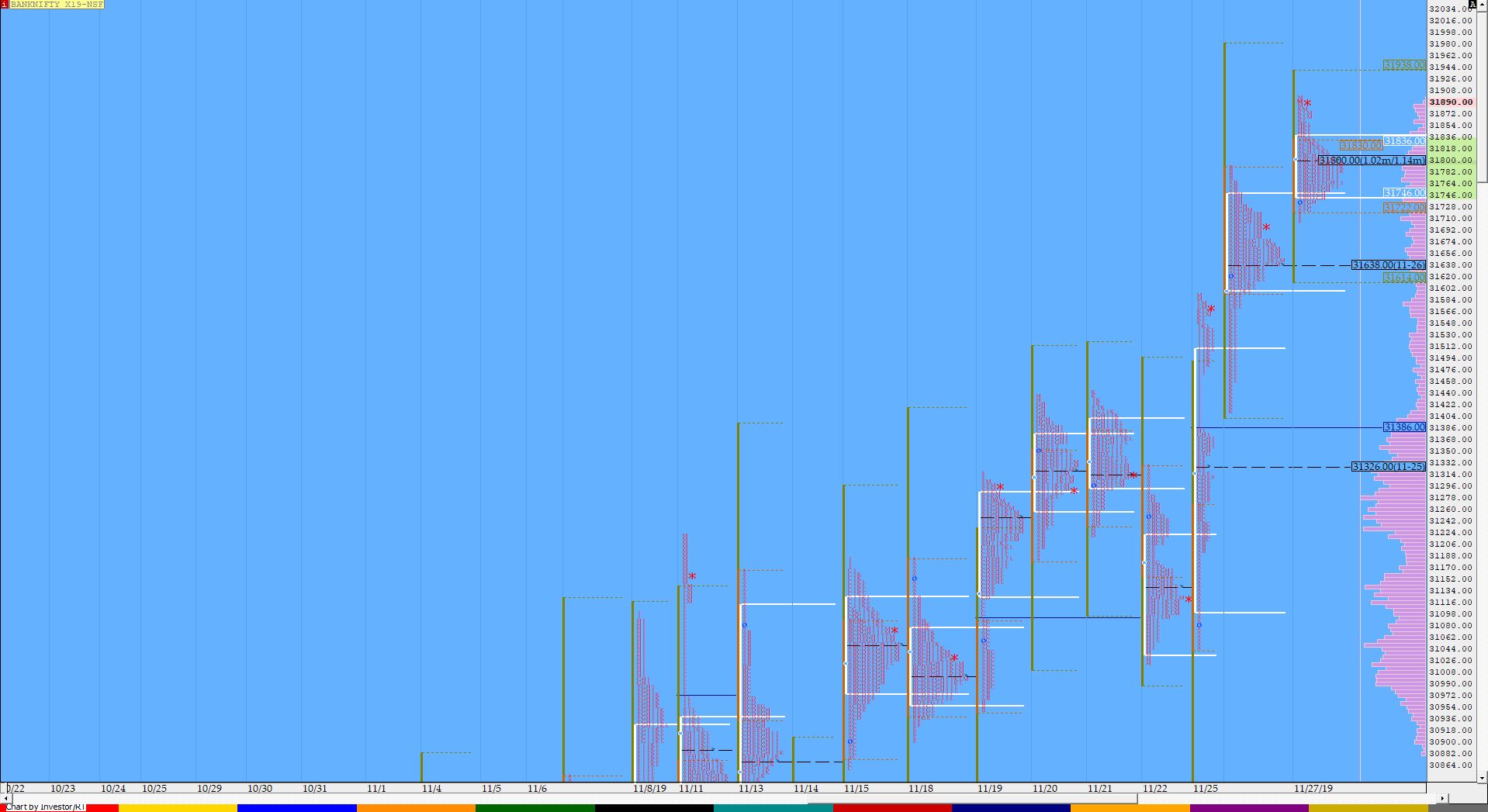

BankNifty Nov F: 31872 [ 31898 / 31705 ]

HVNs – 31020 / 31145/ (31290) / 31330-360 / 31530-580 / 31640 / 31800 / (31890)

BNF opened higher & stayed above previous day’s Value but like NF left the narrowest daily range of just 193 points forming a nice balance for most part of the day and also confirmed a fresh FA (Failed Auction) at 31705 as the day closed as a Neutral Extreme profile making highs of 31898 almost tagging the 2 ATR objective of the earlier FA of 30860. Value was higher for the day & the FA will be the new trigger for a new leg to the upside in the session(s) to come.

(Click here to view BNF make higher Value after moving away from the 4-day composite)

- The BNF Open was an Open Auction (OA)

- The day type was a Neutral Extreme Day – Up (NeuX)

- Largest volume was traded at 31800 F

- Vwap of the session was at 31791 with volumes of 23.4 L and range of 193 points as it made a High-Low of 31898-31705

- BNF confirmed a FA at 31705 on 27/11 and the 1 ATR target comes to 32141.

- The Trend Day VWAP of 25/11 at 31356 will be important reference on the downside.

- The Trend Day VWAP of 06/11 at 30447 will be important reference on the downside.

- BNF had confirmed a FA at 30052 on 06/11 and tagged the 2 ATR target of 31049 on 08/11. This FA has not been tagged since & hence is now positional support

- The Trend Day VWAP of 29/10 at 29945 will be important reference on the downside. This was tagged on 30/10 and broken but was swiftly rejected so proves to be support.

- BNF confirmed a FA at 27900 on 09/10 and completed the 2 ATR move up of 29779. This FA has not been tagged since & hence is now positional support

- The settlement day Roll Over point (Nov) is 30150

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

- The VWAP & POC of August Series 27858 & 27960 respectively

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 31748-31800-31826

Hypos / Estimates for the next session:

a) BNF needs to sustain above 31890-908 for a rise to 32001 / 32045-58 & 32107-141

b) Immediate support is at 31840 below which the auction could test 31800 / 31735-728 & 31650*-638

c) Above 32141, BNF can probe higher to 32197-213 / 32277-299 & 32341-359

d) Below 31638, lower levels of 31590-580 / 31532 & 31450 could be tagged

e) If 32359 is taken out, BNF can give a fresh move up to 32465-503 / 32607 & 32648

f) Below 31450, we could see lower levels of 31393 / 31355-330 & 31280-269

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout