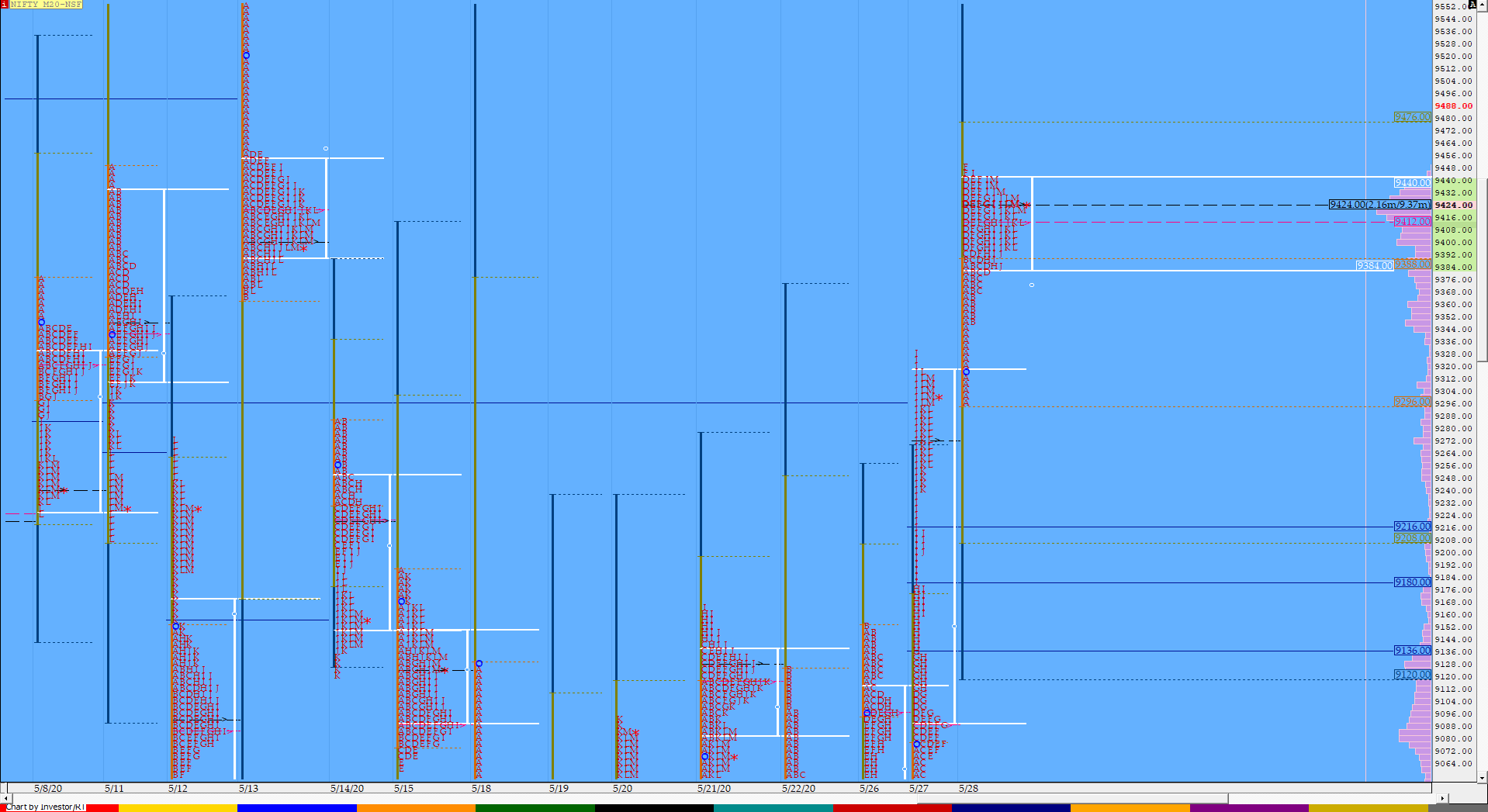

Nifty Jun F: 9428 [ 9449 / 9299 ]

HVNs – 9093 / 9275 / 9433

NF continued the imbalance of previous day at the open but then settled down to form a ‘p’ shape profile with a prominent POC at 9424 so would need fresh volumes above this to continue the probe higher.

- The NF Open was a Open Test Drive (Up) (OTD) on low volumes

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 9424 F

- Vwap of the session was at 9400 with volumes of 127.2 L and range of 149 points as it made a High-Low of 9449-9299

- The Trend Day VWAP of 9165 would be important support level.

- The settlement day Roll Over point (Jun) is 9426

- The VWAP & POC of May Series is 9183 & 9109 respectively.

- The VWAP & POC of Apr Series is 8999 & 9010 respectively.

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9383-9425-9440

Main Hypos for the next session:

a) NF needs to sustain above 9433 for a rise to 9450-74 / 9495-99 / 9510-30 / 9555-59 / 9574-94 & 9616-25

b) The auction staying below 9425 could test 9400 / 9384-72 / 9348 / 9310-9292 / 9275 & 9248-42

Extended Hypos:

c) Above 9625, NF can probe higher to 9653-70 / 9721-50 / 9772-78 / 9796-9800 & 9822

d) Below 9242, the auction can fall further to 9216-04 / *9177-65* / 9135-08 / 9093* & 9070-40

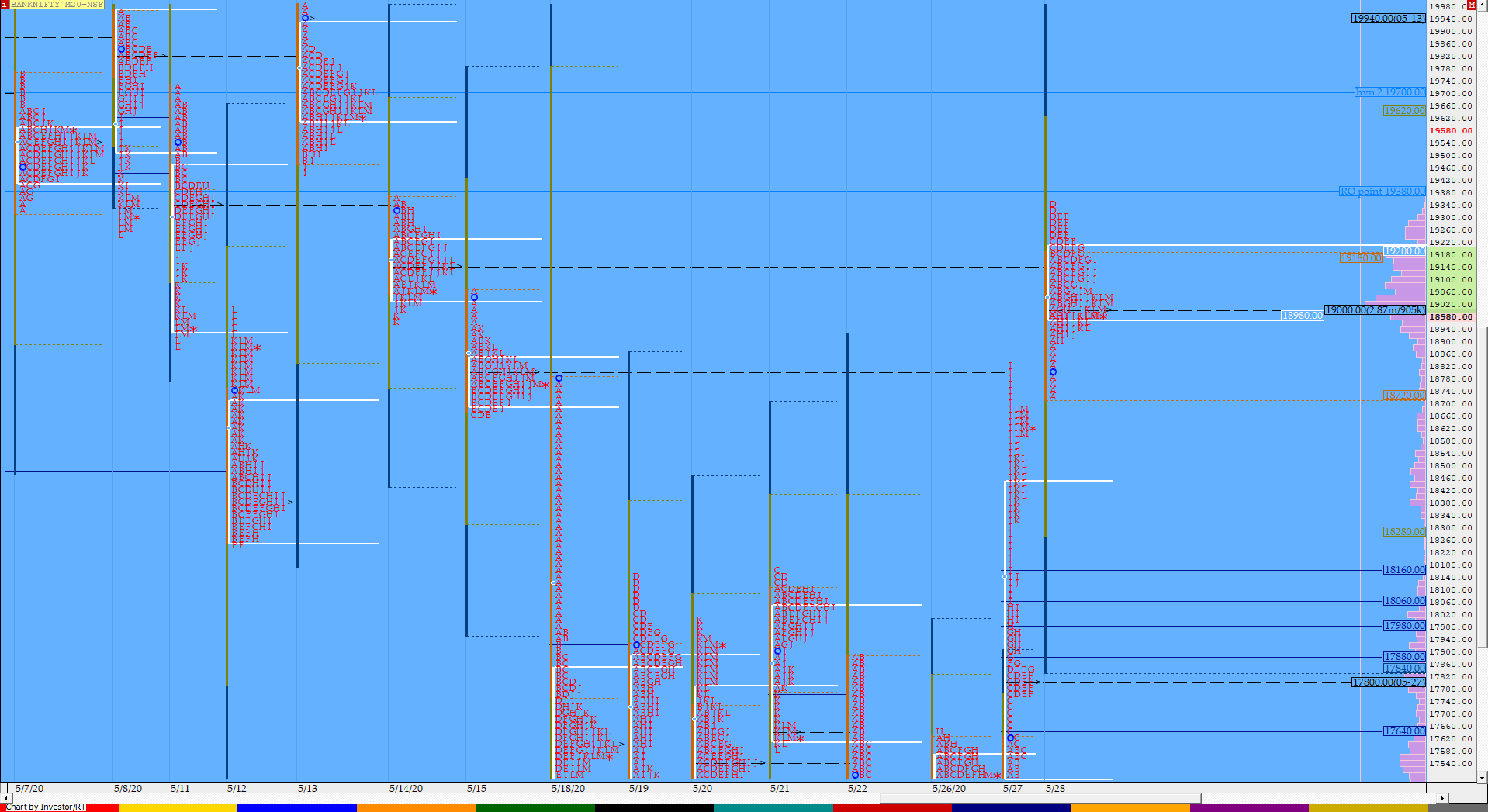

BankNifty Jun F: 19029 [ 19349 / 18721 ]

HVNs – 17800 / 19000 / 19186

BNF has also made a ‘p’ shape profile for the day with higher Value but needs fresh volumes above 19000 to start a new leg to the upside.

- The BNF Open was a Open Test Drive (Up) (OTD) on low volumes

- The day type was a Normal Day (‘p’ profile)

- Largest volume was traded at 19000 F

- Vwap of the session was at 19091 with volumes of 41.9 L and range of 629 points as it made a High-Low of 19349-18721

- The Trend Day VWAP of 18138 would be important support level.

- The settlement day Roll Over point (Jun) is 19035

- The VWAP & POC of May Series is 18767 & 19633 respectively.

- The VWAP & POC of Apr Series is 19605 & 19710 respectively.

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 18994-19000-19211

Main Hypos for the next session:

a) BNF needs to sustain above 19030 for a rise to 19080 / 19152-186 / 19260-330 / 19450-480 / 18560-650* & 19750-812

b) The auction staying below 19000 could test 18954 / 18882-825 / 18780-720 / 18666-625 / 18535-450 & 18330-250

Extended Hypos:

c) Above 19812, BNF can probe higher to 19850 / 19940-995 / 20103-140 / 20220 / 20324-396 & 20430

d) Below 18250, lower levels of 18198-138 / 18072-18 / 17960 / 17865-856 / 17800*-760 & 17648-632 could come into play

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout