Nifty Dec F: 12186 [ 12196/ 12142 ]

HVNs – 11914 / 11954 / 12022 / 12128-143 / 12192

NF could not move away from the prominent POC of previous day which was at 12138 though it stayed above it all day giving yet another narrow range day of just 54 points while forming another balanced profile with higher Value. The last 4-day composite forms a ‘p’ shape profile which can be viewed by clicking on the link given below & it can be seen that we have a high volume zone from 12128 to 12143 from where the auction needs to give a move away on volumes for a trending move in one direction.

(Click here to view the 4-day composite ‘p’ profile in Dec NF)

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 12186 F

- Vwap of the session was at 12166 with volumes of 82.7 L and range of 54 points as it made a High-Low of 12196-12142

- The Trend Day VWAP of 25/11 at 12088 will be important reference on the downside. This was tagged on 26/11 and broken briefly but was swiftly rejected so proves to be support.

- The Trend Day VWAP of 29/10 at 11848 will be important reference on the downside.

- The settlement day Roll Over point (Dec) is 12153

- The VWAP of Nov Series is 11954.

- The VWAP & POC of Oct Series is 11461 & 11365 respectively.

- The VWAP & POC of Sep Series is 11127 & 10960 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 12158-12186-12191

Hypos / Estimates for the next session:

a) NF needs to sustain above 12192 for a move to 12206-215 / 12245 & 12281

b) Immediate support is at 12171 below which the auction could test 12156-143 / 12126*-120 & 12088

c) Above 12281, NF can probe higher to 12310 / 12340 & 12375-384

d) Below 12088, auction becomes weak for 12060-55 / 12040-022* & 12000

e) If 12384 is taken out, the auction go up to to 12407-413 & 12446

f) Break of 12000 can trigger a move lower to 11970-955 & 11930-914*

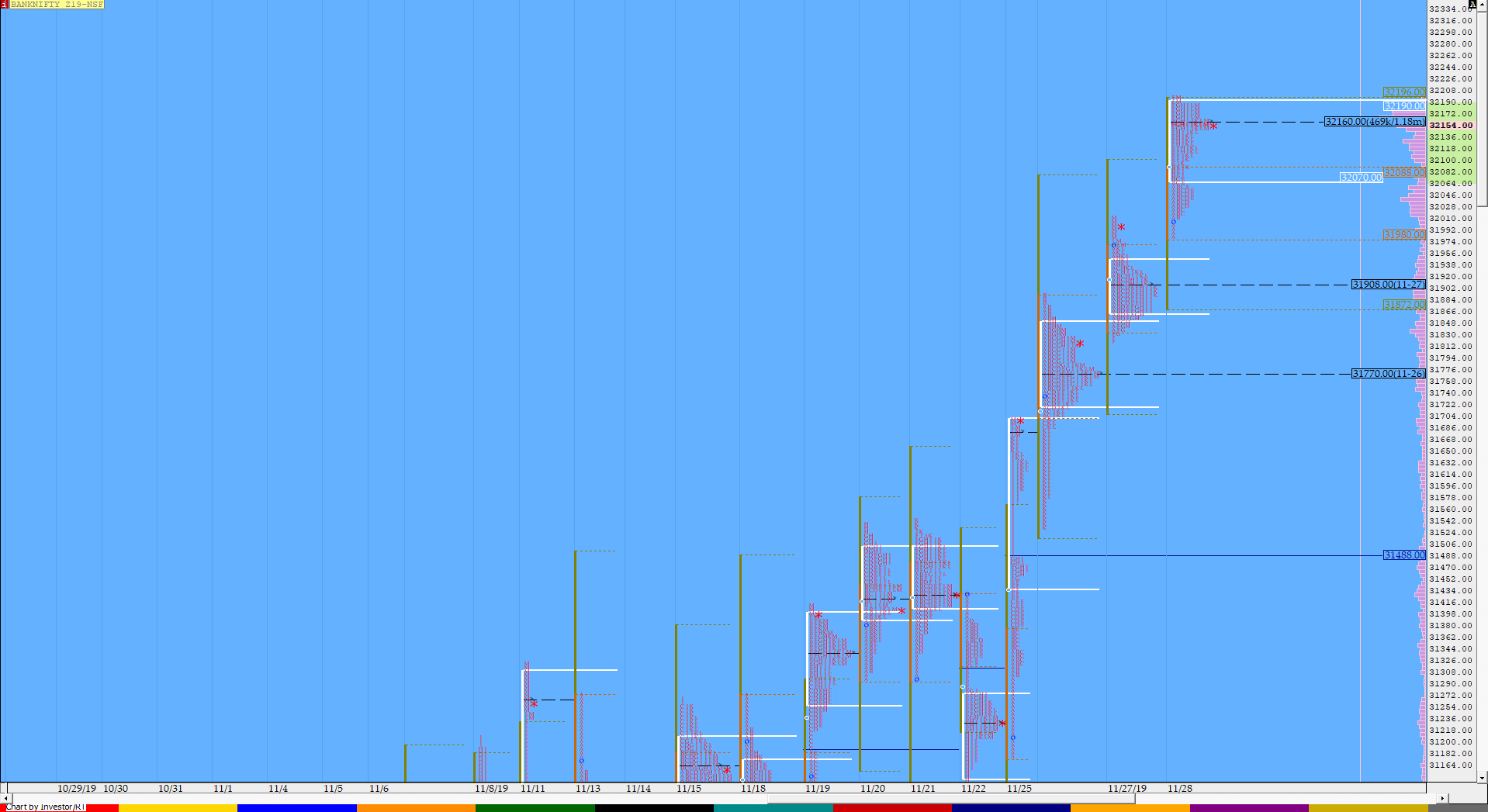

BankNifty Dec F: 31872 [ 31898 / 31705 ]

HVNs – 31426 / 31470 / (31628) / 31680 / 31770 / 31840 / [31885-910] / [32150-160]

BNF made a repeat of the previous day’s auction by opening higher giving a rare follow up post a Neutral Extreme Day but was stuck in a narrow range of just 218 points as it made new highs of 32200 almost tagging the 1 ATR move from the FA of 31820. BNF also has a high volume zone at 32150-32160 which would be the reference to watch in the coming session(s) for a move away on initiative volumes.

- The BNF Open was an Open Auction (OA)

- The day type was a Normal Variation Day – Up (NV)

- Largest volume was traded at 32160 F

- Vwap of the session was at 32111 with volumes of 18.6 L and range of 218 points as it made a High-Low of 32200-31981

- BNF confirmed a FA at 31820 on 27/11 and the 1 ATR target comes to 32218.

- The Trend Day VWAP of 25/11 at 31532 will be important reference on the downside.

- The Trend Day VWAP of 06/11 at 30587 will be important reference on the downside.

- BNF had confirmed a FA at 30175 on 06/11 and tagged the 2 ATR target of 31172. This FA has not been tagged since & hence is now positional support

- The settlement day Roll Over point (Dec) is 32160

- The VWAP of Nov Series is 30699.

- The VWAP & POC of Oct Series is 28784 & 28415 respectively.

- The VWAP & POC of Sep Series is 28416 & 27160 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 32078-32160-32199

Hypos / Estimates for the next session:

a) BNF needs to sustain above 32185-218 for a rise to 32260 / 32326 & 32395-400

b) Immediate support is at 32150 below which the auction could test 32080 / 32020 & 31950

c) Above 32400, BNF can probe higher to 32465 / 32503 & 32577

d) Below 31950, lower levels of 31908* / 31854 & 31770*-758 could be tagged

e) If 32577 is taken out, BNF can give a fresh move up to 32615 / 32660 & 32710-780

f) Below 31758, we could see lower levels of 31700 / 31645 & 31585-532

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout