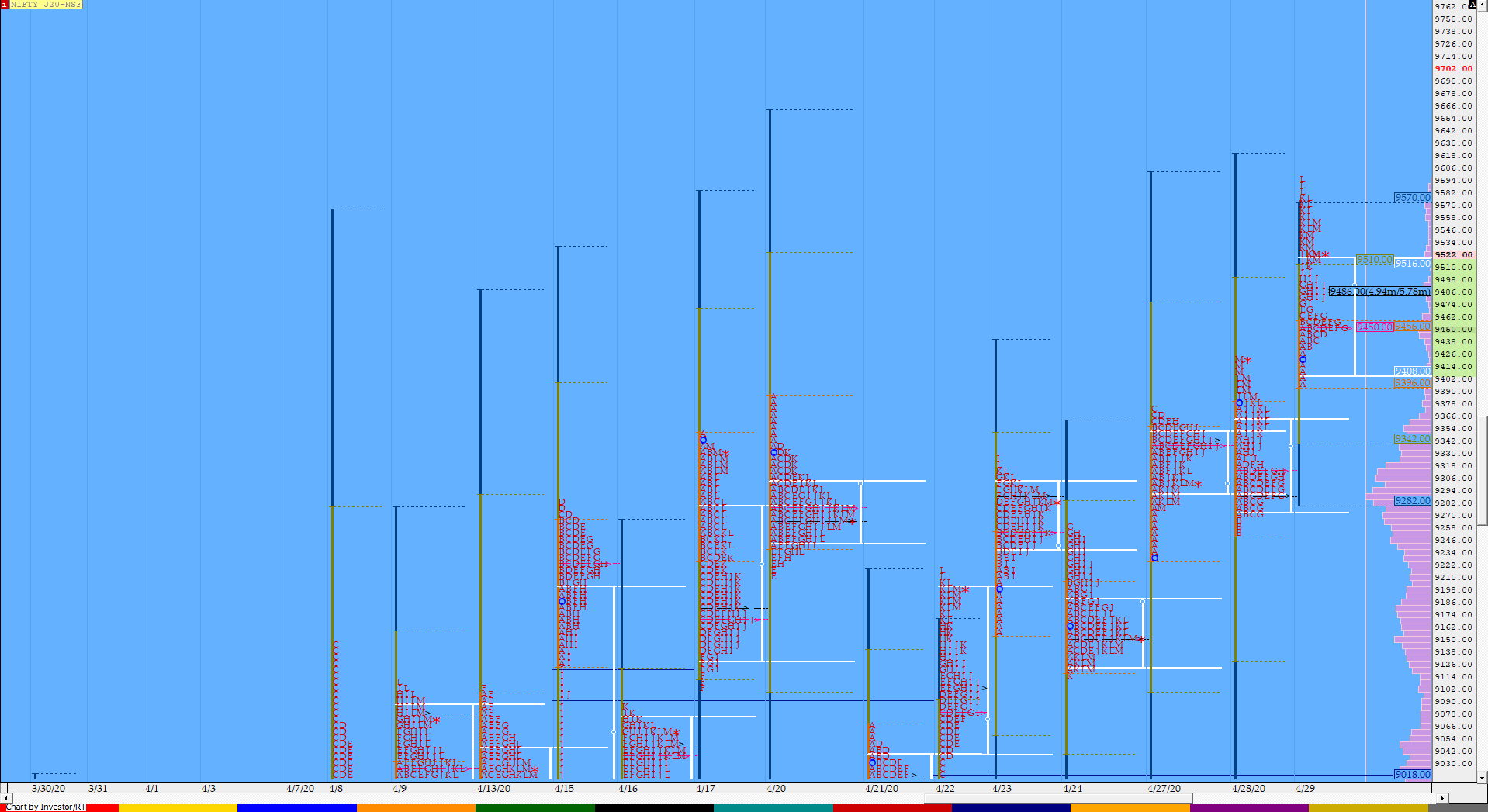

Nifty Apr F: 9549 [ 9595 / 9399 ]

HVNs – (8400) / (8544) / 8928 / 8976 / 9024 / 9216 / 9290 / (9340) / (9455)

Previous day’s report ended with this ‘Spike rules will be in play for the next open & the reference would be 9385 to 9421. The 2-day composite of this week so far is giving a nice 3-1-3 profile so would be interesting to watch if NF gives a move away from here for the expiry or continues to form a balance in between the 2 tails.‘

NF opened in the spike reference but left a buying tail in this zone from 9399 to 9435 in the IB (Initial Balance) as it made new highs for the week at 9458 indicating that it wanted to move away from the 2-day balance with the narrowest IB range for this series of just 59 points hinting at a possibility of multiple IB day. The auction then made a C-side extension and promptly gave a dip to the VWAP but stayed above the morning singles which meant that the PLR (Path of Least Resistance) was still to the upside. NF made another RE (Range Extension) attempt in the ‘E’ period but could only made a marginal new high indicating that supply coming in but once again the dip to VWAP in the ‘F’ period was defended as it left a PBL (Pull Back Low) at 9451 which meant that the demand was overpowering the supply. The ‘G’ period then gave the big move higher as it left an extension handle at 9469 and completed the 1.5 IB objective followed by a higher high in ‘H’ and an outside bar in the ‘I’ period which confirmed a higher PBL of 9476. The auction then made a fresh RE in the ‘J’ period leaving the second extension handle for the day at 9504 confirming that the buyers were still in complete control as it tagged the 2 IB target and did one notch higher in the ‘K’ period where it completed the 3 IB move of 9575. NF continued this imbalance in the ‘L’ period also as it hit 9595 but saw some good profit booking in the last 30 minutes as it closed the day at 9549 leaving a small tail at top from 9577 to 9595. The day’s profile was a trending one though the close was away from the highs but the PLR for the expiry day remains to the upside with today’s POC & VWAP of 9489-9486 being the important level to hold.

- The NF Open was a Open Auction (OA)

- The day type was a Trend Day – Up (TD)

- Largest volume was traded at 9485 F

- Vwap of the session was at 9489 with volumes of 117.9 L and range of 196 points as it made a High-Low of 9595-9399

- NF confirmed a multi-day FA at 9115 on 27/04 and tagged the 1 ATR of 9402 on 28/04. The 2 ATR target comes to 9688.

- NF had confirmed a multi-day FA at 8686 on 09/04 and tagged the 1 ATR objective of 9211 on 15/04. The 2 ATR target comes to 9736. This FA has not been tagged & is now important support.

- NF confirmed a FA at 7521 on 24/03 and tagged the 2 ATR objective of 8595 on 26/03. This FA has not been tagged and is now positional support.

- NF confirmed a FA at 9384 on 17/03 and tagged the 2 ATR move of 8613 on 18/03. This FA has not been tagged and is positional supply point. This FA finally got negated on 28/04 as NF closed above it and is no longer an important reference.

- The Trend Day VWAP of 8620 would be important support level.

- The settlement day Roll Over point (Apr) is 8686

- The VWAP & POC of Mar Series is 9146 & 8592 respectively.

- The VWAP & POC of Feb Series is 11944 & 12125 respectively.

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 9408-9486-9520

Main Hypos for the next session:

a) NF needs to sustain above 9560 for a rise to 9580-9615 / 9650-88 / 9715 / 9736-40 & 9775-90

b) The auction has immediate support at 9528-16 below which it could test 9489-80 / 9460-25 / 9408-9384 / 9360-40 & 9312

Extended Hypos:

c) Above 9790 NF can probe higher to 9850 / 9890 / 9920 & 9951-60

d) Below 9312, the auction can fall further to 9290-68 / 9230-07 / 9179-59 & 9140-24

-Additional Hypos`-

e) Sustaining above 9960` could take NF to 10020 / 10050 / 10090-125 & 10150-175

f) If 9124` is taken out, NF can start a new leg down to 9102*-9085 / 9056-41 / 9017-8986 & 8962-44

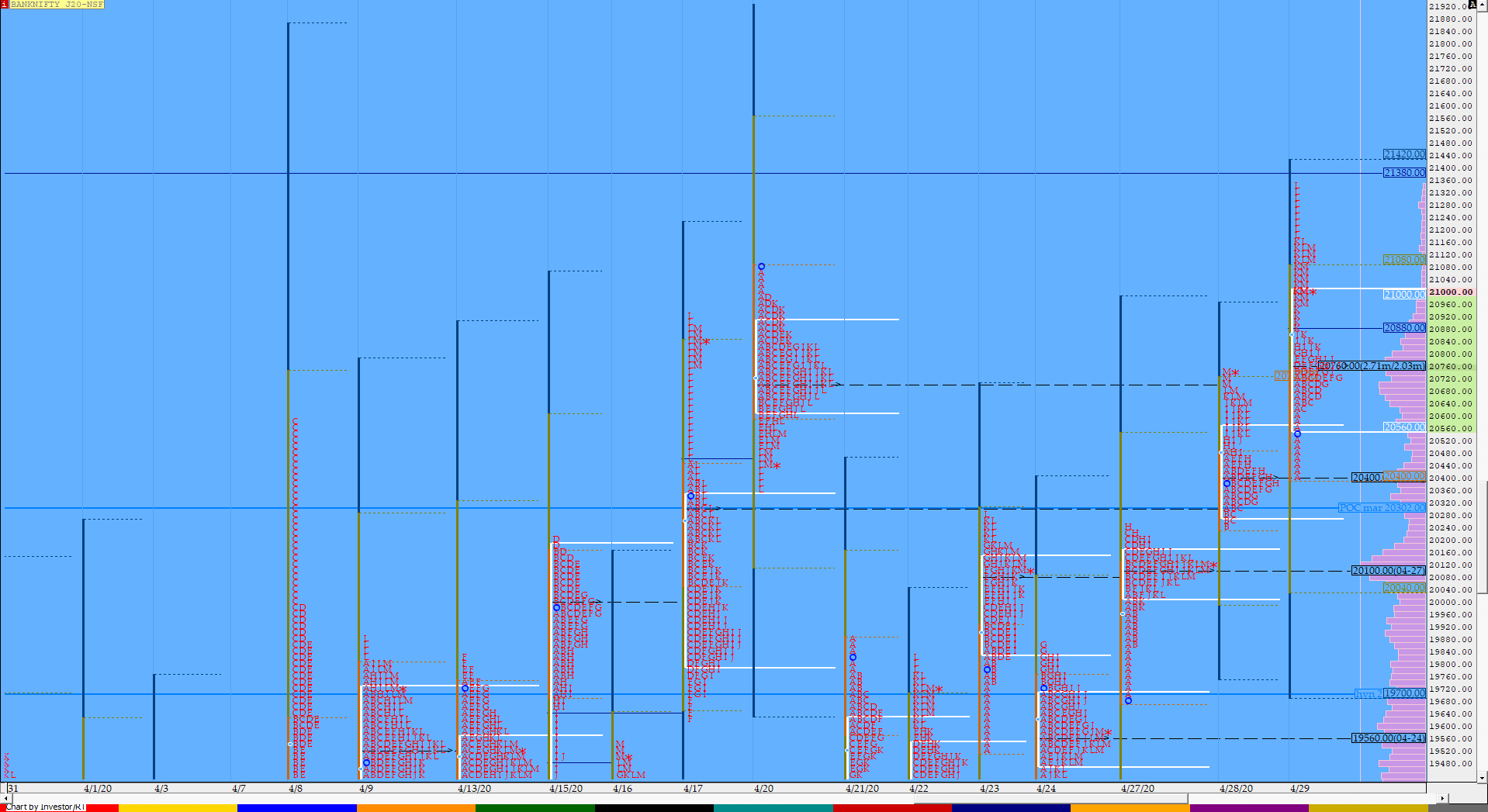

BankNifty Apr F: 21128 [ 21360 / 20401 ]

HVNs – (19248) / 19344-392 / 19536 / (19680) / (20064) / 20130 / (20425) / (20688) / 20760

BNF opened with a gap down at 20540 much below the spike reference of 20685 to 20749 which was a weak signal as it continued to probe lower where it made lows of 20401 stalling right at the yPOC and getting swiftly rejected which was the first important nuance it gave. The auction then went on to get back into the spike zone as it made a high of 20745 in the IB and similar to NF, left a buying tail from 20650 to 20401 which was the next confirmation it gave indicating that the PLR had now changed to the upside. The C period then did give a false move which it is so used to giving as it broke below the VWAP and got into the buying tail but was rejected as it ended up leaving a PBL at 20622 which would be the new reference for the day. BNF then made a slow OTF (One Time Frame) move higher till the ‘J’ period with another higher PBL of 20710 it confirmed in the ‘G’ period but was still not able to tag the 1.5 IB objective of 20917 which was a cause of concern as it suggested that the supply was still persisting. The auction then made a lower low of 20740 in the ‘J’ period and this rejection at the PDH (Previous Day High) got new demand in leading to a monster move over the next 2 periods leaving an extension handle at 20875 as all the sellers were taken to the cleaners with BNF making a high of 21360 almost tagging the 2 ATR target from that FA of 19318 in just 3 days. The closing 30 minutes saw big liquidation happening along with some late trapped longs running for cover as BNF made a retracement to 20974 before closing the day at 21128 leaving an excess from 21163 to 21360. Value for the day was higher and we have an elongated profile so the PLR remains up as long as the extension handle of 20875 & today’s VWAP of 20866 is held.

- The BNF Open was a Open Auction In Range (OAIR)

- The day type was a Trend Day – Up (TD)

- Largest volume was traded at 20760 F

- Vwap of the session was at 20866 with volumes of 51.7 L and range of 959 points as it made a High-Low of 21360-20401

- BNF confirmed a multi-day FA at 19381 on 27/04 and tagged the 1 ATR objective of 20387 on 28/04. The 2 ATR target comes to 21393.

- BNF confirmed a FA at 17921 on 07/04 and tagged the 1 ATR target of 19818 on 08/04. The 2 ATR objective from this FA is at 21715. This FA has not been tagged and is now positional support.

- The settlement day Roll Over point (Apr) is 19380

- The VWAP & POC of Mar Series is 22104 & 20248 respectively.

- The VWAP & POC of Feb Series is 30692 & 30692 respectively.

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 20548-20760-20978

Main Hypos for the next session:

a) BNF needs to sustain above 21100 for a rise to 21160-180 / 21272-294 / 21336-393 / 21460-530 & 21574-634

b) The auction has immediate support at 21030 below which it could test levels of 20988-978 / 20934-865 / 20770-740 / 20664-622 & 20558-526

Extended Hypos:

c) Above 21634, BNF can probe higher to 21715-788 / 21822-842 / 21910 / 22000 & 22110-200

d) Below 20526, lower levels of 20460-425 / 20358-322 / 20248-220 / 20180-100* & 20045 could come into play

-Additional Hypos`-

e) BNF sustaining above 22200` could start a new leg up to 22350-380 / 22423-448 / 22520-560 / 22650 & 22720-780

f) If 20045` is taken out, BNF could fall further to 19995-908 / 19860-814 / 19760-690 / 19600* & 19510-476

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout