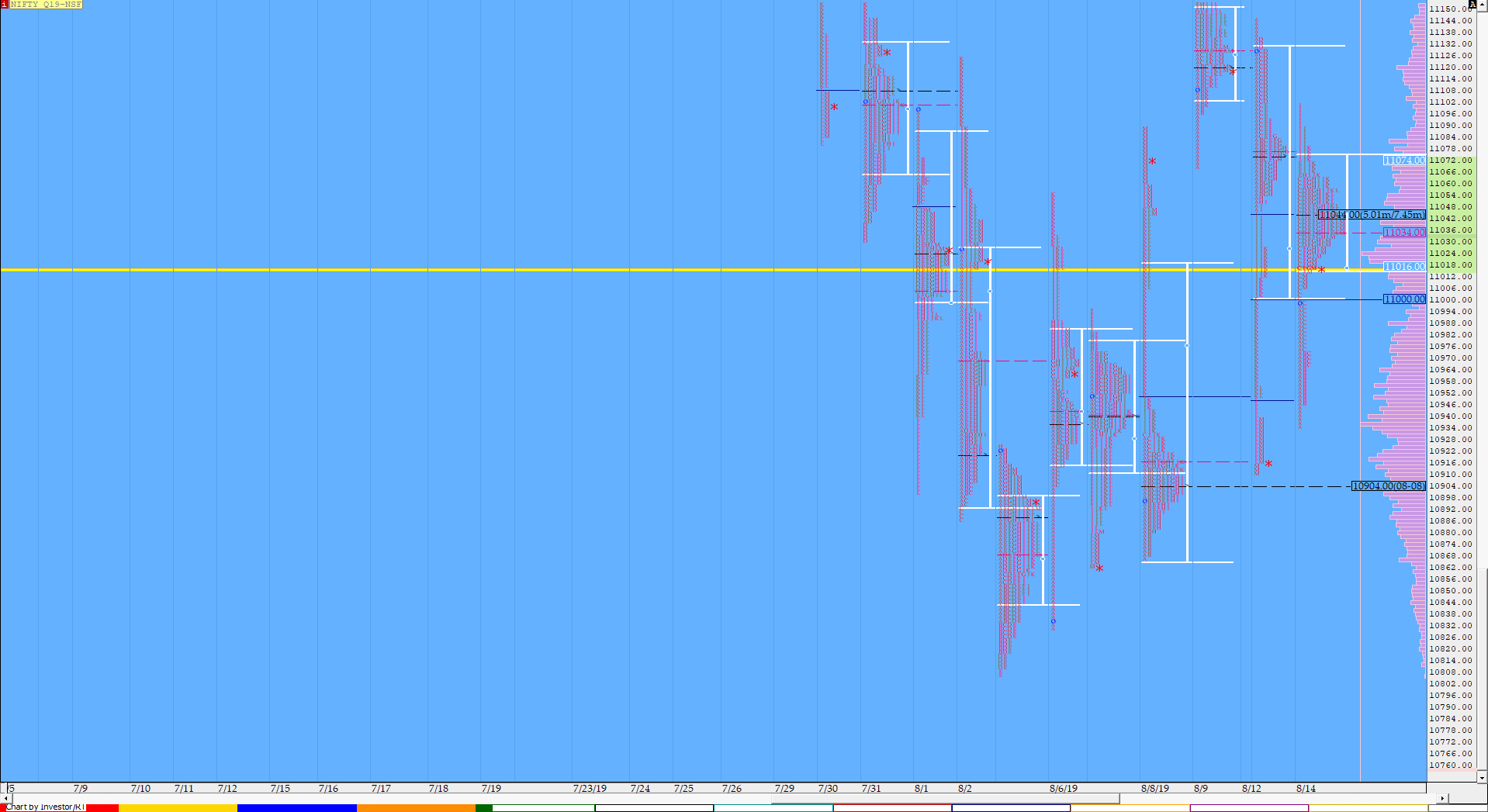

Nifty Sep F: 11002 [ 11079 / 10953 ]

NF had attempted to probe above the composite it was forming in August & was rejected and promptly completed the 80% Rule in the monthly composite as it tagged the VAL of the composite today and in the process confirmed a FA (Failed Auction) at highs rounding off the month to close at the VWAP of the series forming a nice balance. The composite Value for the September Futures is at 10971-11007-11127 and the auction looks good for a trending move away from this balance in the new series.

- The NF Open was an Open Auction (OA)

- The day type was a Normal Variation Day – Down (‘3-1-3’ profile)

- Largest volume was traded at 11010 F

- Vwap of the session was at 11014 with volumes of 165 L and range of 126 points as it made a High-Low of 11079-10953

- NF confirmed a FA at 11079 on 29/08. The 1 ATR objective from this FA is at 10906

- The Trend Day POC & VWAP of 26/08 at 10886 & 10951 would be important references on the downside.

- The Trend Day POC & VWAP of 19/07 at 11478 & 11523 are now positional references on the upside.

- The higher Trend Day VWAP of 05/07 at 11965 is another important reference higher.

- The settlement day Roll Over point is 11010

- The VWAP & POC of Aug Series is 10966 & 10984 respectively.

- The VWAP & POC of Jul Series is 11575 & 11547 respectively.

- The VWAP & POC of Jun Series is 11833 & 11714 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 10994-11010-11038

Hypos / Estimates for the next session:

a) NF needs to sustain above 11010 for further rise to 11038-40 & 11064

b) Immediate support is at 11000 below which auction can test 10970 / 10958-951 & 10930

c) Above 11064, NF can probe higher to 11080-91 / 11105 & 11124-127

d) Below 10930, auction becomes weak for 10907 / 10886 & 10864-851

e) If 11127 is taken out, the auction can rise to 11142-150 / 11175-192 & 11215

f) Break of 10851 can trigger a move lower to 10828-811 & 10780-777

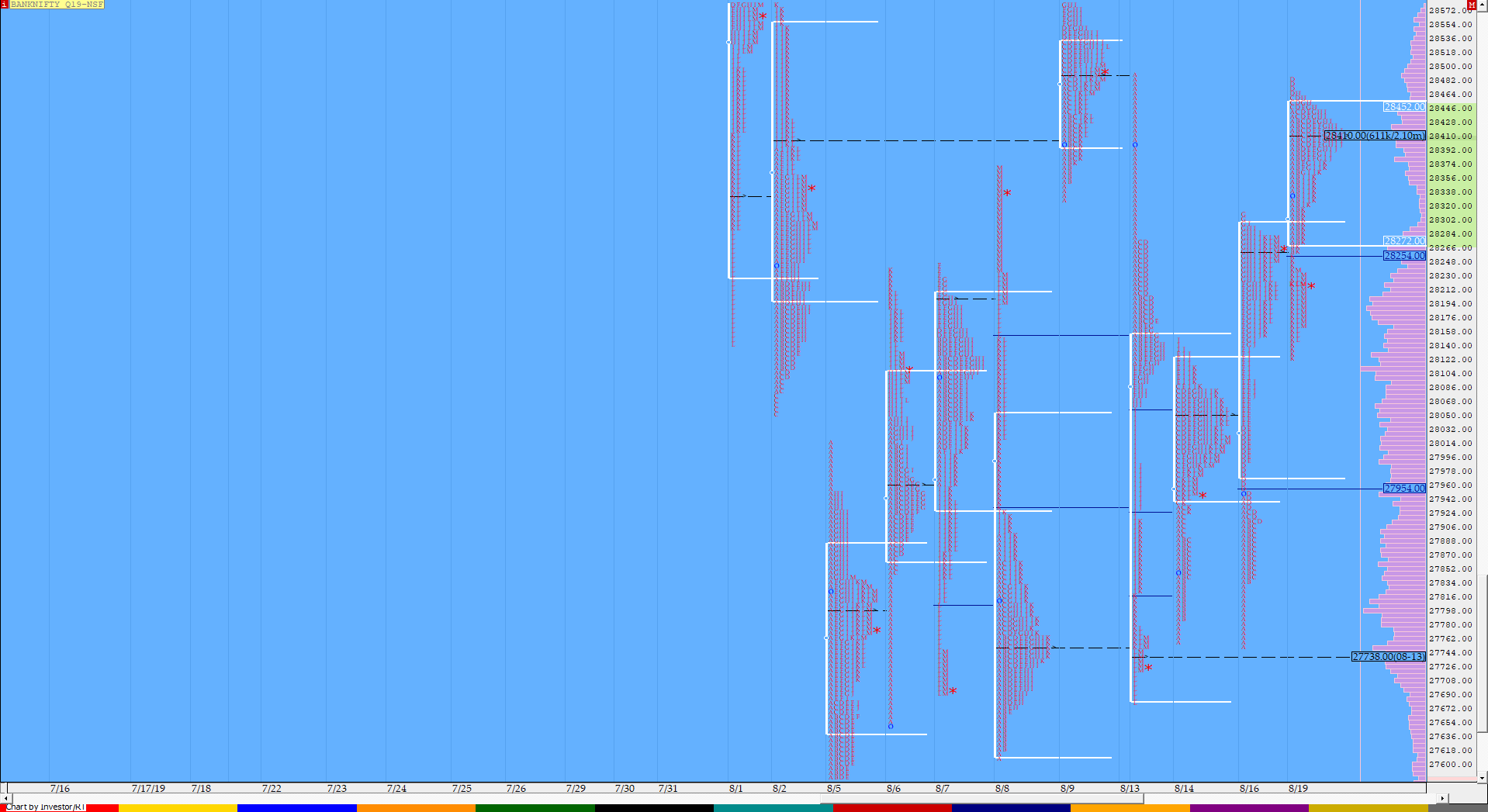

BankNifty Sep F: 27435 [ 27900 / 27328 ]

BNF also made a nice balance for the series & the corresponding Value of the composite for the September Futures is at 27381-27456-28120 and as expected in NF, the auction could give a good move in the new series in BNF also.

- The BNF Open was an Open Auction (OA)

- The day type was a Normal Variation Day – Down (‘b’ shape profile)

- Largest volume was traded at 27450 F

- Vwap of the session was also at 27552 with volumes of 23.2 L in a session which traded in a range of 572 points making a High-Low of 27900-27328

- The Trend Day VWAP of 19/07 at 30085 is now positional supply point.

- The higher Trend Day VWAP of 18/07 & 08/07 at 30598 & 30995 remain important references going forward

- The settlement day Roll Over point is 27450

- The VWAP & POC of August Series 27858 & 27960 respectively

- The VWAP & POC of Jul Series is 30425 & 30586 respectively.

- The VWAP & POC of Jun Series is 30914 & 30961 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 27396-27450-27600

Hypos / Estimates for the next session:

a) BNF has immediate resistance at 27450-475 above which it can rise to 27530-555 & 27610

b) Staying below 27450, the auction can test 27380-375 / 27325-315 & 27240

c) Above 27610, BNF can probe higher to 27655 / 27700-725 & 27800

d) Below 27240, lower levels of 27185-150 / 27090 & 27025 could come into play

e) Sustaining above 27800, BNF can give a fresh move up to 27880-900 & 27956-996

f) Break of 27025 could trigger a move down 26965 / 26905-890 & 26825

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout