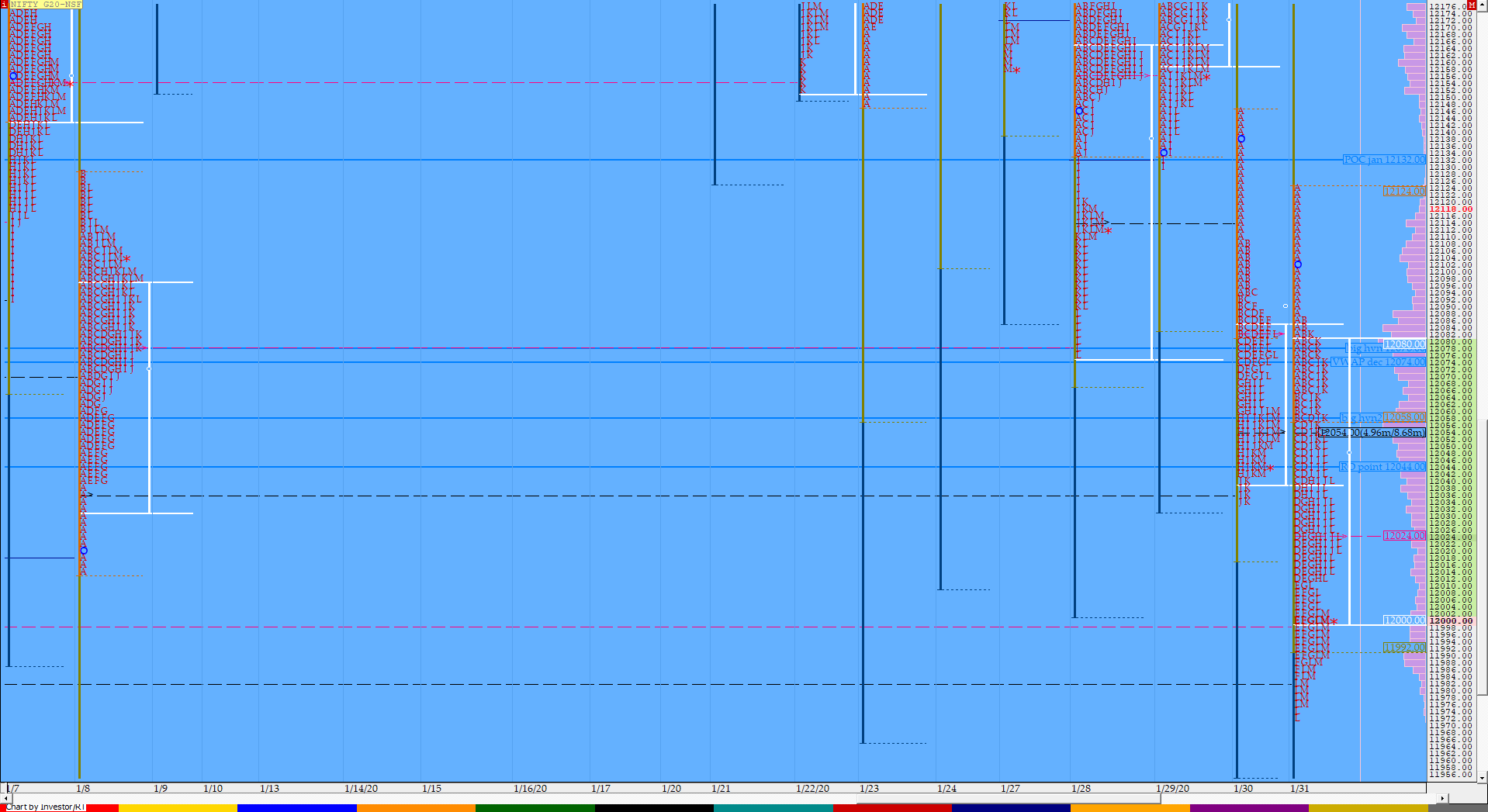

Nifty Feb F: 11703 [ 11747 / 11598 ]

HVNs – 11635 / 11685 / 11820 / 11978 / 12055 / 12078

NF continued the imbalance of 1st Feb at open as it started with a freak OL (Open=Low) tick at 11598 but was rejected from these new lows to leave a small buying tail at lows outside previous day’s range from 11628 to 11598 in the IB (Initial Balance) to form a balanced profile and a Normal Day with a prominent POC at 11688 filling up the low volume area of Saturday’s profile. Acceptance above 11712 in the next session could lead to a test of the Trend Day POC of 11820 above which we have the important supply zone of 11847 to 11867. On the downside, failure to sustain 11685 could lead to more weakness with a probability of new lows being marked in the coming session(s).

Budget Day MP Chart

NF traded in a huge range of 395 points on 1st Feb as it made a high of 12020 where it confirmed a FA after which it went on to make lows of 11625 recording the 5th highest volumes in over 2 years at 229.6 L leaving a Trend Day Down on the very first day of the new calendar month. The extension handle of 11867 & the day’s VWAP of 11847 would remain important references for the series till they get taken out on closing basis.

- The NF Open was an Open Auction In Range (OAIR)

- The day type was a Normal Day (Gaussian Profile)

- Largest volume was traded at 11688 F

- Vwap of the session was at 11685 with volumes of 137.5 L and range of 141 points as it made a High-Low of 11747-11606 if we ignore the freak open tick of 11598

- NF confirmed the first FA of the new series at 12020 on 01/02 and tagged the 2 ATR objective of 11817 on the same day. This FA is currently on ‘T+2‘ Days.

- The 1st Feb Trend Day VWAP of 11847 would be an important reference for this series.

- The 20th Jan Trend Day VWAP of 12336 remains positional supply point.

- The settlement day Roll Over point (Feb) is 12044

- The VWAP & POC of Jan Series is 12178 & 12132 respectively.

- The VWAP & POC of Dec Series is 12087 & 12182 respectively.

- The VWAP & POC of Nov Series is 11954 & 11910 respectively.

You can check the monthly charts & other swing levels for Nifty & NF here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 11660-11688-11715

Hypos / Estimates for the next session:

a) NF needs to sustain above 11712 for a move to 11735-744 / 11765 & 11800-820

b) Immediate support is at 11685 below which the auction could fall to 11665 / 11644-628 & 11606-600

c) Above 11820, NF can probe higher to 11843-846 / 11867 & 11889-900

d) Below 11600 auction gets weak for a test of 11583-580 / 11563-555 & 11535

e) If 11900 is taken out, the auction go up to to 11925-950 / 11970-988 & 12010-20

f) Break of 11535 can trigger a move lower to 11503-496 / 11484 / 11471-765 & 11442

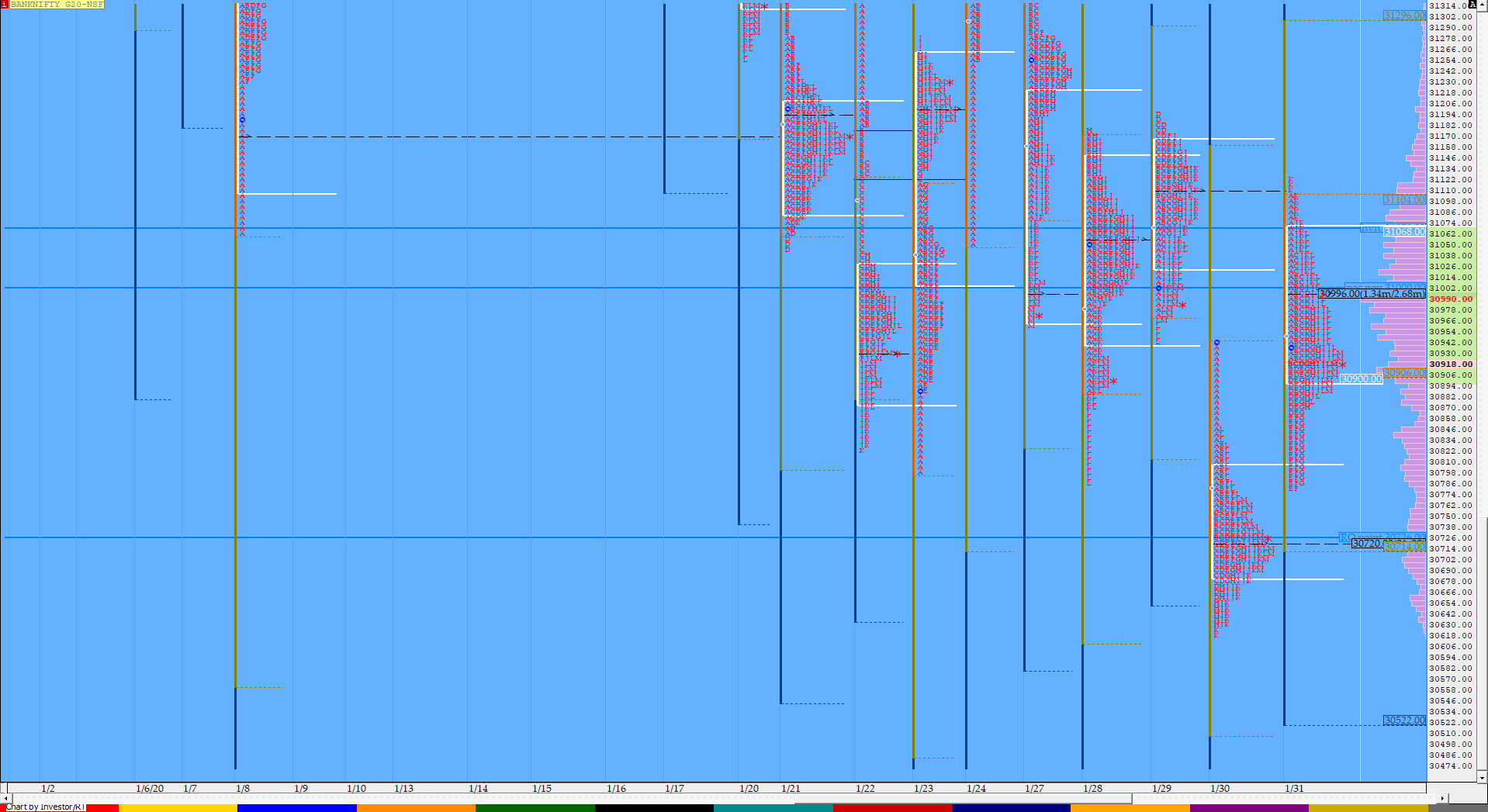

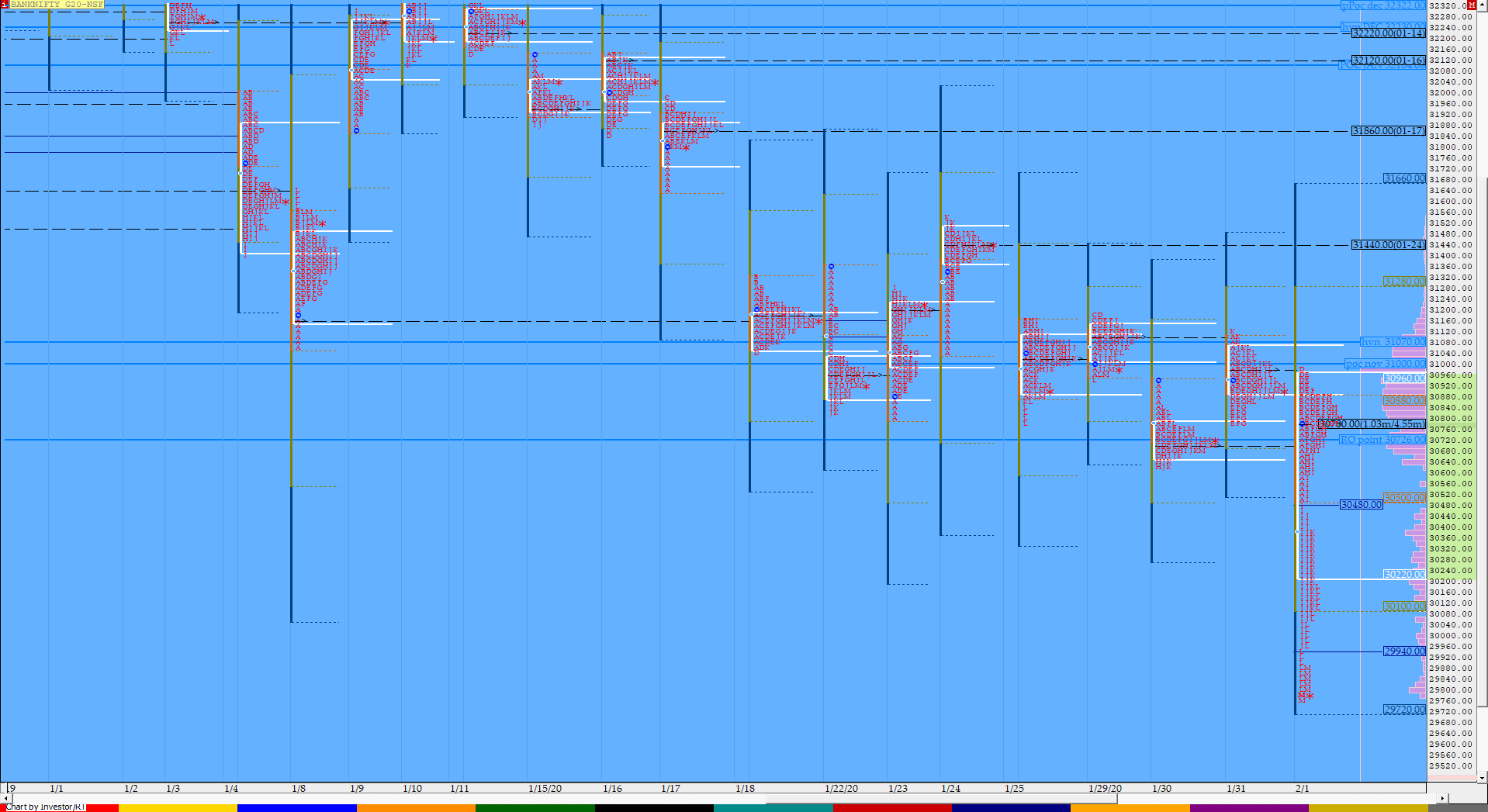

BankNifty Feb F: 30937 [ 31126 / 30780 ]

HVNs – 329900 / (30040) / (30150) / 30355 / 30770 / 30984

Budget Day MP Chart

BNF also traded in a huge range of 1220 points on 1st Feb as it made a high of 30990 where it confirmed a FA after which it went on to make lows of 29770 recording big volumes of 58.3 L confirming a Trend Day Down similar to NF. The extension handle of 30500 & the day’s VWAP of 30387 would remain important references for the series till they get taken out on closing basis.

BNF opened lower well below the lows of Saturday and similar to NF made a freak tick of 29500 at the start but was rejected back into previous day’s range as it left singles from 29500 to 29729 in the IB and went on to form a ‘p’ shape profile suggesting some short covering coming in. The auction got stalled just below the HVN of 30150 today which will be the first reference on the upside if it manages to stay above 30040 and on the downside, today’s POC of 29900 will be the important level to hold failing which BNF could continue its downtrend in the coming session(s).

- The BNF Open was an Open Auction (OA)

- The day type was a Normal Day (‘p’ shape profile)

- Largest volume was traded at 29900 F

- Vwap of the session was at 29935 with volumes of 41.9 L and range of 479 points as it made a High-Low of 30110-29631 if we ignore the freak open tick of 29500

- BNF confirmed the second FA of this series at 30990 on 01/02 and tagged the 2 ATR objective of 30217 on the same day. This FA is currently on ‘T+2‘ Days.

- BNF confirmed the first FA of the new series at 31126 on 31/01 and tagged the 2 ATR objective of 30345 on 01/02. This FA is currently on ‘T+3‘ Days.

- The 1st Feb Trend Day VWAP of 30387 would be an important reference for this series.

- The 20th Jan Trend Day VWAP of 31500 remains positional supply point.

- The settlement day Roll Over point (Feb) is 30726

- The VWAP & POC of Jan Series is 31425 & 32104 respectively.

- The VWAP & POC of Dec Series is 31956 & 32102 respectively.

- The VWAP & POC of Nov Series is 30699 & 31100 respectively.

For the Monthly charts & other swing levels for BankNifty & BNF click here & for the weekly charts & analysis, please click here.

Daily Zones:

- Value zones (volume profile) are at 29862-29900-30060

Hypos / Estimates for the next session:

a) BNF needs to sustain above 30040 for a rise to 30100-150 / 30210-270 & 30352-364

b) The auction gets weak below 29960 for a test of 29890-873 / 29825-770 & 29729

c) Above 30364, BNF can probe higher to 30416-460 / 30500 & 30600-652

d) Below 29729, lower levels of 29635-628 / 29570-537 & 26460-448 could be tagged

e) If 30652 is taken out, BNF can give a fresh move up to 30724 / 30770-780 & 30856-900

f) Break of 29448 could trigger a move down to 29370 / 29296-288 / 29230-200 & 29136

For more tradeable ideas and intraday trading strategies based on MarketProfile and the OrderFlow live charts with OrderFlow analysis Live, subscribe to the trading room. The Vtrender Trading Room hosts India’s largest MarketProfile community live every trading session from 9.15 am to 3.30 pm.

If not a Trading Room member you can get immediate access at – https://in.explara.com/e/vtrender–trading–room/checkout